|

|

|

|

|

|

|

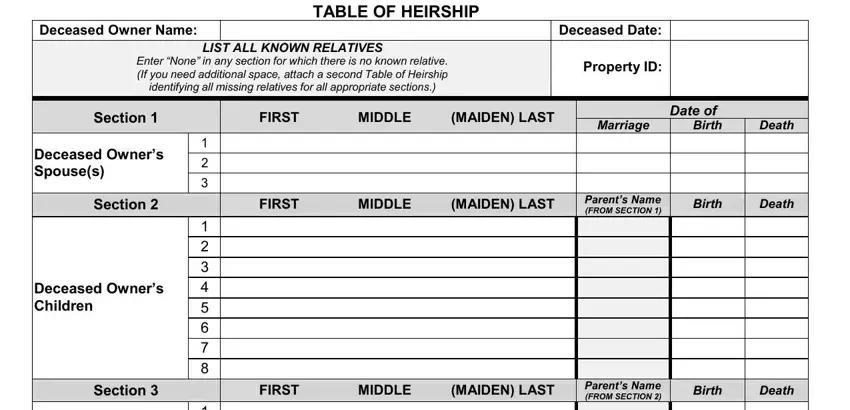

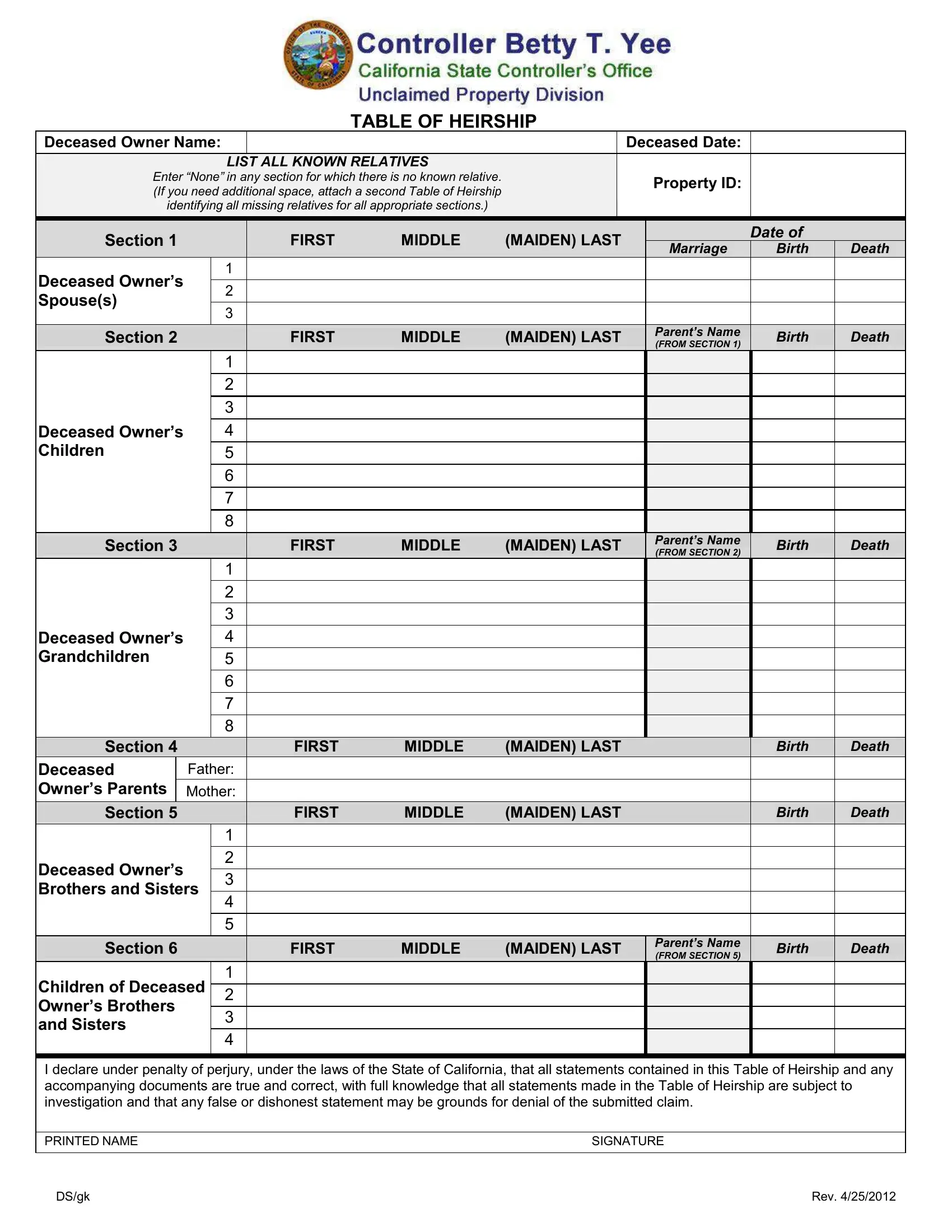

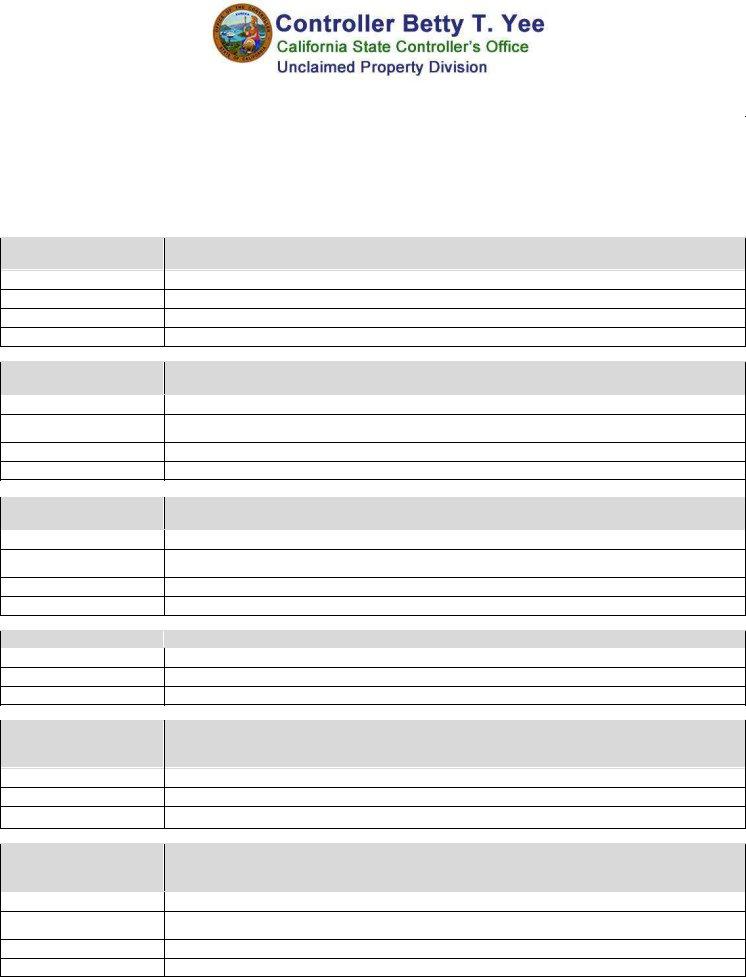

TABLE OF HEIRSHIP |

|

|

|

|

|

|

|

Deceased Owner Name: |

|

|

|

|

|

|

Deceased Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIST ALL KNOWN RELATIVES |

|

|

|

|

|

|

|

|

|

Enter “None” in any section for which there is no known relative. |

|

|

|

Property ID: |

|

|

|

|

(If you need additional space, attach a second Table of Heirship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

identifying all missing relatives for all appropriate sections.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 1 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

|

Date of |

|

|

|

|

|

|

|

|

Marriage |

|

Birth |

|

Death |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deceased Owner’s |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

Spouse(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 2 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

Parent’s Name |

|

Birth |

|

Death |

|

|

|

|

|

|

(FROM SECTION 1) |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

Deceased Owner’s |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

Children |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

Section 3 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

Parent’s Name |

|

Birth |

|

Death |

|

|

|

|

|

|

(FROM SECTION 2) |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

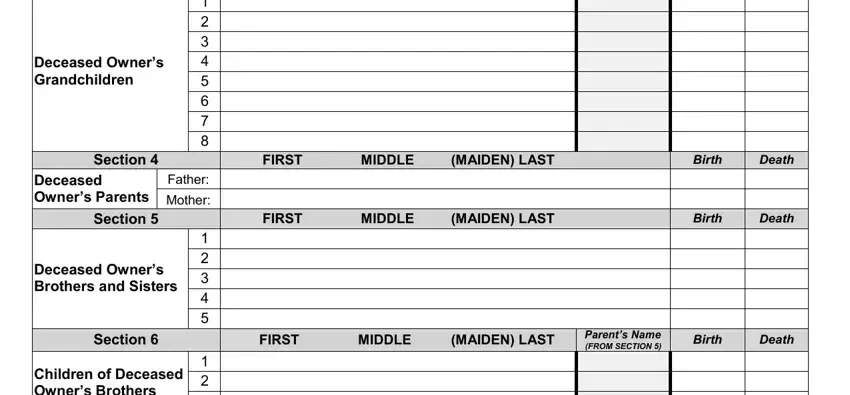

Deceased Owner’s |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

Grandchildren |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

Section 4 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

|

|

Birth |

|

Death |

Deceased |

|

Father: |

|

|

|

|

|

|

|

|

|

|

|

Owner’s Parents |

|

Mother: |

|

|

|

|

|

|

|

|

|

|

|

Section 5 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

|

|

Birth |

|

Death |

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

Deceased Owner’s |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

Brothers and Sisters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 6 |

|

|

|

|

FIRST |

MIDDLE |

(MAIDEN) LAST |

|

|

Parent’s Name |

|

Birth |

|

Death |

|

|

|

|

|

|

(FROM SECTION 5) |

|

|

Children of Deceased |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

Owner’s Brothers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

and Sisters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

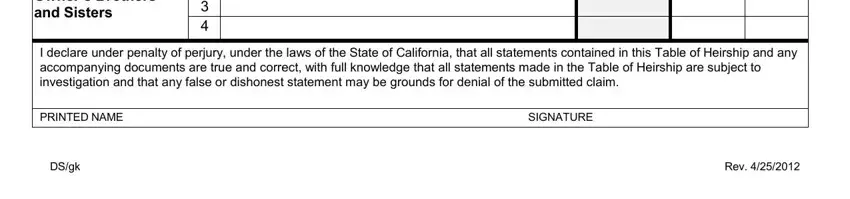

I declare under penalty of perjury, under the laws of the State of California, that all statements contained in this Table of Heirship and any accompanying documents are true and correct, with full knowledge that all statements made in the Table of Heirship are subject to investigation and that any false or dishonest statement may be grounds for denial of the submitted claim.

PRINTED NAME |

SIGNATURE |

|

|

DS/gk |

Rev. 4/25/2012 |

Name

Date of Birth

Date of Death

Section 6

Name

Parent’s Name

(FROM SECTION 5)

Date of Birth

Date of Death

Section 5

Section 4

Name

Date of Birth

Date of Death

Name

Parent’s Name

(FROM SECTION 2)

Date of Birth

Date of Death

Section 3

Name

Parent’s Name

(FROM SECTION 1)

Date of Birth

Date of Death

Section 2

Name

Date of Marriage

Date of Birth

Date of Death

Section 1

|

TABLE OF HEIRSHIP |

|

INSTRUCTIONS |

Deceased Owner Name |

Enter the name of the deceased person whose property you are claiming. |

|

|

Deceased Date |

Enter the date the deceased property owner died. |

|

|

Property ID |

Enter the Property ID found on the claim details page printed with your claim form. |

|

|

To ensure you receive the funds to which you are entitled, enter the requested information for yourself and all of the deceased property owner’s known relatives, both living and dead. In addition, provide a copy of all pages of the certified death certificate for all deceased relatives listed in all Sections above your name to whom you are directly related (such as, your grandmother/grandfather, mother/father, and/or son/daughter).

Include in this section all of the deceased property owner’s current or former spouses. Enter one spouse per line (living or dead). If the deceased owner never married, enter “None.”

Enter the spouse’s first, middle, (maiden name, if applicable) and last name.

Enter the spouse’s date of marriage to the deceased property owner.

Enter the spouse’s date of birth.

If the spouse is deceased, enter the spouse’s date of death.

Include in this section all of the deceased property owner’s children. Enter one child per line (living or dead). If the deceased owner did not have any children, enter “None.”

Enter the child’s first, middle, (maiden name, if applicable) and last name.

Enter the first name of the child’s parent, as listed in Section 1.

Enter the child’s date of birth.

If the child is deceased, enter the child’s date of death.

Include in this section all of the deceased property owner’s grandchildren. Enter one grandchild per line (living or dead). If the deceased owner did not have any grandchildren, enter “None.”

Enter the grandchild’s first, middle, (maiden name, if applicable) and last name.

Enter the first name of grandchild’s parent, as listed in Section 2.

Enter the grandchild’s date of birth.

If the grandchild is deceased, enter the grandchild’s date of death.

Include in this section both of the deceased property owner’s parents (living or dead).

Enter the parent’s first, middle, (maiden name, if applicable) and last name.

Enter the parent’s date of birth.

If the parent is deceased, enter the parent’s date of death.

Include in this section all of the deceased property owner’s brothers and sisters. Enter one brother or sister per line (living or dead). If the deceased owner did not have any brothers or sisters, enter “None.”

Enter the brother or sister’s first, middle, (maiden name, if applicable) and last name.

Enter the brother or sister’s date of birth.

If the brother or sister is deceased, enter the brother or sister’s date of death.

Include in this section all of the deceased property owner’s nieces and nephews. Enter one niece or nephew per line (living or dead). If the deceased owner did not have any nieces or nephews, enter “None.”

Enter the niece or nephew’s first, middle, (maiden name, if applicable) and last name.

Enter the first name of the niece or nephew’s parent, as listed in Section 5.

Enter the niece or nephew’s date of birth.

If the niece or nephew is deceased, enter the niece or nephew’s date of death.