For many who invest in real estate in Canada, navigating the tax implications associated with rental properties is a critical aspect of managing investments successfully. This is where the Canada T776 form comes into play. Officially titled "Statement of Real Estate Rentals," the form is an essential tool for anyone who owns and rents real estate or other types of property, including farmland. It serves a key function by helping property owners determine their gross rental income, pinpoint deductible expenses, and ultimately calculate their net rental income or loss for the fiscal year. The form is comprehensive, covering scenarios where rental income is considered either property income or business income, based on the services provided to tenants. It also includes sections for co-owners to outline their share of income or losses and account for their percentage of ownership. For accurate completion, the form delves into specifics such as the accrual method for calculating rental income, various deductible expenses, capital cost allowance, and equipment or building additions and dispositions. This thorough approach ensures property owners can accurately report their rental income and expenses, potentially optimizing their tax situation. In addition, the T776 form includes guidance to distinguish between different types of rental income, assisting owners in navigating the complex terrain of tax obligations and benefits associated with real estate rentals in Canada.

| Question | Answer |

|---|---|

| Form Name | Canada Form T776 |

| Form Length | 4 pages |

| Fillable? | Yes |

| Fillable fields | 194 |

| Avg. time to fill out | 39 min 52 sec |

| Other names | t776 form pdf, t776 rental income, cra form t776, statement of real estate rentals |

Protected B when completed

•Use this form if you own and rent real estate or other property. It relates mainly to renting real estate but also covers some other types of rental

property such as farmland. This form will help you determine your gross rental income, the expenses you can deduct, and your net rental income or loss for the year.

•To determine whether your rental income is from property or a business, consider the number and types of services you provide for your tenants:

–If you rent space and only provide basic services such as heating, lighting, parking, laundry facilities, you are earning an income from renting property.

–If you provide additional services such as cleaning, security, and meals, you may be conducting a business.

•For more information about how to determine if your rental income comes from property or a business, see Interpretation Bulletin

•If you are a

•For information on how to fill out this form, see Guide T4036, Rental Income.

Part 1 – Identification

Your name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Social Insurance Number |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

PROV./TERR. |

Postal code |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal period |

Date (YYYYMMDD) |

|

to |

|

|

|

Year |

|

|

|

Month Day |

Was this the final year of your rental operation? |

|

|

|

Yes |

|

|

|

|

No |

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

3 |

|

1 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Your percentage of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax shelter identification number (8 characters) |

|

|

Partnership business number |

|||||||||||||||||||||||||||||||

the partnership |

|

|

|

% |

Industry code |

|

5 |

|

3 |

1 |

|

|

1 |

|

1 |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Name of person or firm preparing this form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business number/Account number |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of person or firm preparing this form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

PROV./TERR. |

Postal code |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2 – Details of other

Share of net |

$ |

Percentage |

% |

||

name and address |

income (loss) |

of ownership |

|||

|

|||||

|

|

|

|

|

|

Share of net |

$ |

Percentage |

% |

||

name and address |

income (loss) |

of ownership |

|||

|

|||||

|

|

|

|

|

|

Share of net |

$ |

Percentage |

% |

||

name and address |

income (loss) |

of ownership |

|||

|

|||||

|

|

|

|

|

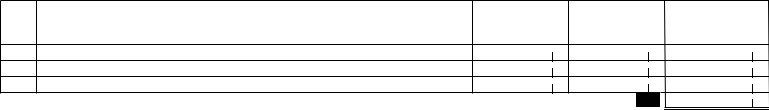

Part 3 – Income

In most cases, you calculate your rental income using the accrual method. If you have no amounts receivable and no expenses outstanding at the end of the year, you can use the cash method.

List the addresses of your rental propertiesNumber of unitsGross rents

1

2

3

Enter the total of your gross rents in the year you receive them (amount 1 plus amount 2 plus amount 3). . . . . . . . . . . . . . . . . . . 8141

Other income (for example, premiums and leases, sharecropping) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8230

Total gross rental income – Enter this amount on your Income Tax and Benefit Return on line 12599 (line 8141 plus line 8230) |

8299 |

|

T776 E (19) |

(Ce formulaire est disponible en français.) |

Page 1 of 4 |

Protected B when completed

Part 4 – Expenses

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest and bank charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Office expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Professional fees (includes legal and accounting fees) . . . . . . . . . . . . . .

Management and administration fees . . . . . . . . . . . . . . . . . . . . . . . . . . .

Repairs and maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Salaries, wages, and benefits (including employer's contributions) . . . . .

Property taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Travel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Motor vehicle expenses (not including capital cost allowance) . . . . . . . . .

Other expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total expenses (add the lines listed under "Total expenses") . . . . . .

Total expenses |

|

Personal portion |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A

Total for personal portion (add the lines listed under "Personal portion") |

9949 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deductible expenses (total expenses from amount A minus total personal portion on line 9949) |

|

|

|

|

|

|

|

4 |

. . . . . |

. . . . . . . . . . . . . . . . |

. . . . . |

|

|||||

|

|

|

|

|

||||

Net income (loss) before adjustments (total gross rental income from line 8299 minus deductible expenses from amount 4) |

|

9369 |

|

|

|

|||

. . . . . . . . . . . . . . . . |

. . . . . |

|||||||

|

|

|

|

|

|

|

|

|

Other expenses of the |

|

9945 |

|

|

|

|||

|

|

|

|

|

||||

Subtotal (amount 5 minus line 9945)

Recaptured capital cost allowance

Subtotal (amount 6 plus line 9947)

|

9948 |

Terminal loss |

|

Subtotal (amount 7 minus line 9948)

Total capital cost allowance claim for the year (amount i from Area A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9936

Net income (loss) (amount 8 minus line 9936) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If you are a sole proprietor or a

Partnerships |

|

Partners – your share of amount 9, or the amount from your T5013 slip, Statement of Partnership Income |

. . . . |

|

9974 |

Partners – GST/HST rebate for partners received in the year |

|

Partners – other expenses of the partner . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9943

Your net income (loss) – For sole proprietors or

on line 12600. For partnerships, enter the result of amount 10 plus line 9974 minus line 9943. Enter this amount on your Income Tax and Benefit Return on line 12600 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9946

6

7

8

9

10

Page 2 of 4

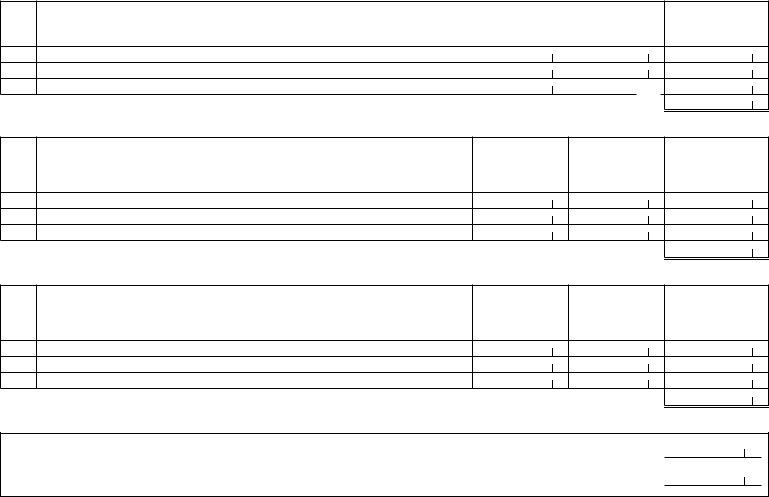

The capital cost allowance (CCA) you can claim depends on the type of rental property you own and the date you acquired it. Group the depreciable property you |

Protected B when completed |

own into the appropriate classes. A specific rate of CCA generally applies to each class. |

|

Area A – Calculation of capital cost allowance (CCA) claim

1 |

2 |

|

3 |

|

4 |

|

5 |

|

6* |

|

7 |

|

8 |

|

9 |

|

10 |

|

11 |

12 |

|

13 |

|

Class |

Undepreciated |

Cost of additions |

Cost of additions |

Proceeds of |

UCC after additions |

Proceeds of |

UCC adjustment |

Adjustment for |

Base amount |

CCA |

CCA for the year |

UCC at the end of |

|||||||||||

number |

capital cost (UCC) |

in the year |

from column 3 |

dispositions |

and dispositions |

dispositions |

for |

for CCA |

Rate |

(col. 10 multiplied |

the year |

||||||||||||

|

at the start of the |

(see Area B and C |

which are for AIIP |

in the year (see |

(col. 2 plus col. 3 |

available to reduce |

additions of AIIP |

additions subject to |

(col. 6 plus col. 8 |

% |

by col. 11 or a |

(col. 6 minus col. |

|||||||||||

|

year |

below) |

or one or more |

Area D and E |

minus col. 5) |

additions of AIIP |

and ZEV (col. 4 |

the half |

minus col. 9) |

|

lower amount) |

12) |

|

||||||||||

|

|

|

|

|

below) |

|

|

and ZEV (col. 5 |

minus col. 7) |

1/2 multiplied by |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

vehicles (ZEV) |

|

|

|

|

minus col. 3, plus |

multiplied by the |

(col. 3 minus col. 4 |

|

|

|

|

|

|

|

||||

|

|

|

|

|

(new property must |

|

|

|

|

col. 4). If negative, |

relevant factor. If |

minus col. 5). If |

|

|

|

|

|

|

|

||||

|

|

|

|

|

be available for |

|

|

|

|

enter "0" |

negative, enter "0" |

negative, enter "0" |

|

|

|

|

|

|

|

||||

|

|

|

|

|

use in the year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note 1 |

|

|

|

|

Note 2 |

Note 3 |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total CCA claim for the year**: Total of column 12 (enter the amount on line 9936 of Part 4, |

► |

|

|

i |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

amount i minus any personal part and any CCA for |

|

|

|

|

|

|||||||||

*If you have a negative amount in column 6, add it to income as a recapture under 'Recaptured capital cost allowance' on line 9947. If no property is left in the class and there is a positive amount in the column, deduct the amount from your income as a terminal loss under 'Terminal loss' on line 9948. For more information, read Chapter 3 of Guide T4036.

**For information on CCA for "Calculation of

***Sole proprietors and partnerships - enter the total CCA claim for the year from amount i on line 9936.

Note 1: Columns 4, 7, and 8 apply only to accelerated investment incentive properties (AIIPs) (see Regulation 1104(4) of the Income Tax Regulations for the definition),

Note 2: The proceeds of disposition of a

Note 3: The relevant factors for properties available for use before 2024 are 2 1/3 (classes 43.1 and 54), 1 1/2 (class 55), 1 (classes 43.2 and 53), 0 (classes 12 and 13), and 1/2 for the remaining accelerated investment incentive properties.

For more information on AIIP and ZEV, see Guide T4036 or go to

List all equipment or other property you acquired or improved in the current tax year, and group them into the appropriate classes. Equipment includes appliances such as a washer and dryer; maintenance equipment such as a lawn mower or a snow blower; and other property such as furniture and some fixtures you acquired to use in your rental operation.

Area B – Equipment additions in the year

1

Class

number

2

Property details

3

Total cost

4

Personal portion

(if applicable)

5

Rental portion (col. 3 minus col. 4)

Total equipment additions in the year (total of column 5) 9925

List all building or leasehold interest additions you acquired or improved in the current tax year. Group the depreciable property you own into the appropriate classes.

Page 3 of 4

Area C – Building additions in the year

Protected B when completed

1

Class

number

2 |

3 |

4 |

|

5 |

Property details |

Total cost |

Personal portion |

Rental portion |

|

|

|

(if applicable) |

(col. 3 minus |

|

|

|

|

|

col. 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total building additions in the year (total of column 5) 9927

Area D – Equipment dispositions in the year

1

Class

number

2

Property details

3

Proceeds of

disposition (should not

be more than the

capital cost)

4

Personal portion (if applicable)

5

Rental portion (col. 3 minus col. 4)

Total equipment dispositions in the year (total of column 5) 9926

Area E – Building dispositions in the year

1

Class

number

2

Property details

3

Proceeds of

disposition (should not

be more than the

capital cost)

4 Personal portion

(if applicable)

5

Rental portion (col. 3 minus col. 4)

|

Total building dispositions in the year (total of column 5) 9928 |

Area F – Land additions and dispositions in the year |

|

|

9923 |

Total cost of all land additions in the year |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

Total proceeds from all land dispositions in the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9924

See the privacy notice on your return.

Page 4 of 4