INSTRUCTIONS FOR USE

1.This declaration must be legibly prepared using pen, typewriter, or other permanent method. This declaration is required for all articles which are to be landed by a crew member, including any person traveling on board a vessel, vehicle, or aircraft engaged in international traffic who is returning from a trip on which the person was employed as a crew member.

2.Include serial number with all articles subject to registration, such as cameras, radios, etc. List articles to remain on board separately from those articles to be landed in the United States. List separately articles intended for sale, barter, exchange, or carried by you as an accommodation for someone else.

3.All articles acquired abroad by the particular officer or crew member shall be declared on the declaration, with the exception of articles exclusively for use on the voyage which include only necessary clothing, toiletries, and purely personal effects, and not to exceed 1 open (seal broken) liter container of alcoholic beverages, and 50 cigars, or

300cigarettes, or 2 kilos of smoking tobacco, or a proportionate amount of each, and articles which have been previously cleared through Bureau of Customs and Border Protection and described in a proper CBP receipt release form.

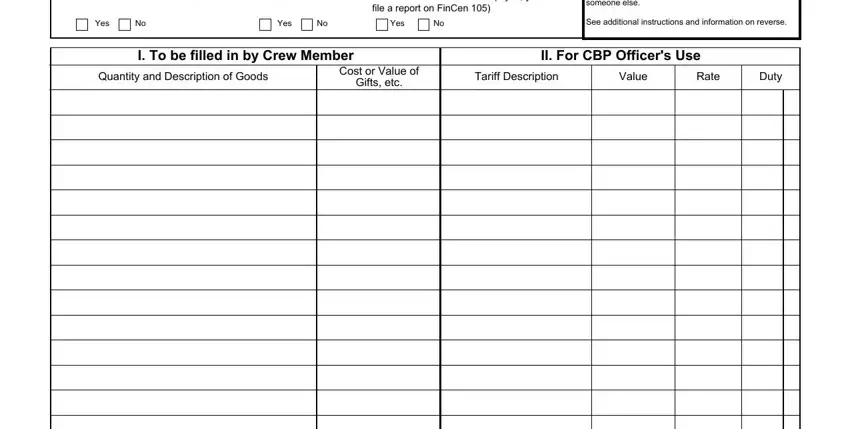

4.Articles in the possession of and exclusively for use by a crew member during the voyage, such as necessary clothing, toiletries, and purely personal effects, may be brought ashore by the crew member on temporary shore or ground leave for use while in a port without a written declaration and entry and without payment of duty or internal revenue tax ONLY if the Port Director of CBP for the port is satisfied that the articles so landed are necessary and appropriate for the crew member's accommodation while on temporary shore or ground leave; that they will be devoted solely to the crew member's bona fide personal use; that the quantities are reasonable, depending upon the circumstances of each particular case; and that, in the case of tobacco products and alcoholic beverages, the container shall have been opened and the total quantity brought ashore while the vessel is in port shall not exceed 50 cigars, 300 cigarettes, or 2 kilos of smoking tobacco, or a proportionate amount of each, and 1 liter of alcoholic beverages. In the case of articles possessing substantial commercial value, such as cameras, watches, razors, and other articles not consumed through use, the CBP officer concerned, before passing the articles free of duty, shall be assured beyond doubt that the article is brought ashore is for the actual bona fide personal use of the crew member while on shore or ground leave and is to be returned to the vessel or aircraft.

5.In the column headed "Cost, Or Value of Gifts, Etc.", state in United States dollars the price actually paid for the articles, or fair value if not acquired by purchase, such as a gift.

6.If additional space is needed to list all articles in column headed "Quantity and Description of Goods", include them in another declaration form obtained from purser. Do not alter the preprinted serial number on the declaration. (If more than one form is needed by a crew member to list articles, all serial numbers of the forms used shall be noted opposite the crew members name on the Crew's Effects Declaration, CBP Form 1304, or the Crew List, Customs and Immigration Form I-418).

7.If insufficient space on "Receipt for Duty and Release Slip" (lower perforated stub) to repeat the listing of all articles to be landed in the United States listed in the column headed "Quantity and Description of Goods", continue on reverse side of stub.

8.This form may be printed by private parties (see footnote) as a 2-part or 3-part set for use as both a vessel's or aircraft's crew purchase manifest and the entry record for articles landed in the United States, when the vessel or aircraft is to clear directly foreign from the first port of arrival.

WARNING-PENALTIES

The transportation of currency or monetary instruments, regardless of the amount, is legal, however, if you take out or bring into (or attempt to take out of or bring into) the United States more than $10,000 (U.S. or foreign equivalent, or a combination of the two) in coin, currency, travelers checks or bearer instruments such as money orders, checks, stocks or bonds, you are required by law to file a report on FinCEN Form 105 (formerly Customs Form 4790). If you have someone else carry the currency or instruments for you, you must also file the report. FAILURE TO FILE THE REQUIRED REPORT OR FALSE STATEMENTS ON THE REPORT MAY LEAD TO SEIZURE OF THE CURRENCY OR INSTRUMENTS AND TO CIVIL PENALTIES AND/OR CRIMINAL PROSECUTION.

A claim for exemption from duty on an article on the false ground that it is not intended for sale and acquired or carried by the declarant as an accommodation for others will subject the articles to forfeiture.

Any article which is required to be manifested and which is not manifested is subject to forfeiture and the master of the vessel is subject to a penalty equal to the forfeiture value (sec. 584, Tariff Act, 1930, as amended). If any article requiring a declaration and entry when brought into the United States is landed without being covered by a release slip or other permit to unlade from the Port Director, Bureau of Customs and Border Protection, the article is subject to forfeiture, the vessel master and any other person associated with the unauthorized removal are subject to penalties equal to the forfeiture value, and if valued at $500 or over, the vessel itself is subject to forfeiture (sect. 453, Tariff Act, 1930).

This form may be printed by private parties, Blocks of serial numbers to be used on such forms will be furnished upon written request to the CBP, Information Services Division, Forms Manager, Washington, DC 20229. Requests should state the quantity of serial numbers needed.

Paperwork Reduction Act Statement: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number and an expiration date. The control number for this collection is 1651-0021. The estimated average time to complete this application is 10 minutes. If you have any comments regarding the burden estimate you can write to U.S. Customs and Border Protection, Office of Regulations and Rulings, 799 9 th Street, NW., Washington DC 20229.