It's straightforward to prepare the certified payroll report form. Our tool was made to be easy-to-use and help you complete any PDF quickly. These are the four actions to take:

Step 1: To begin the process, click the orange button "Get Form Now".

Step 2: You'll notice all of the functions which you can take on the template once you've entered the certified payroll report form editing page.

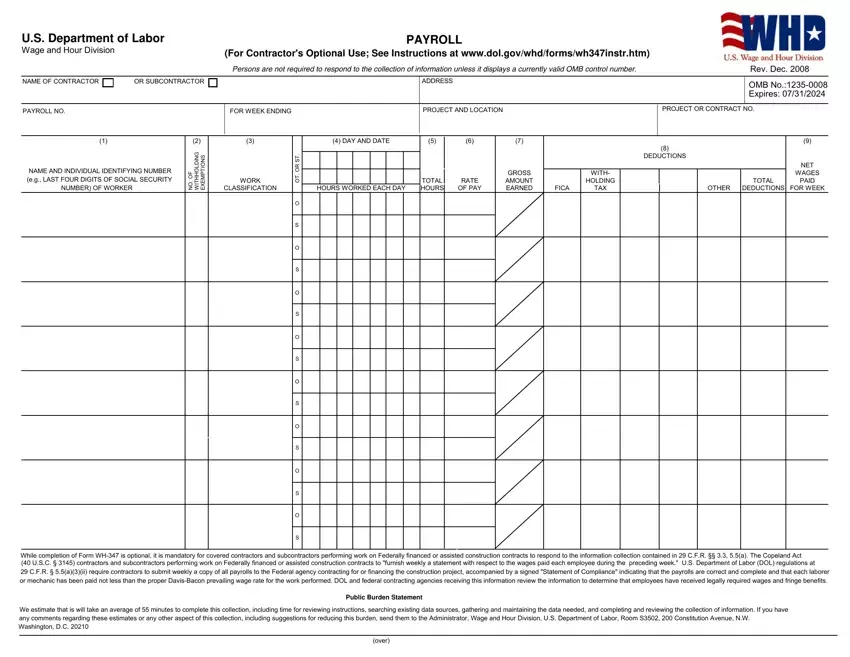

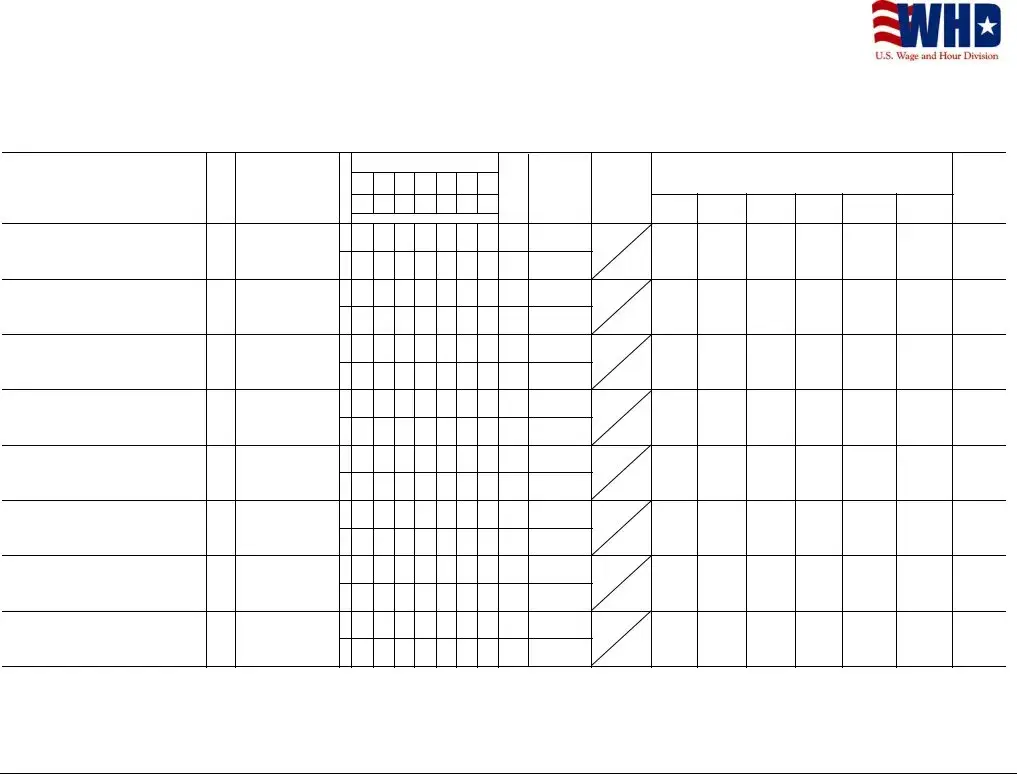

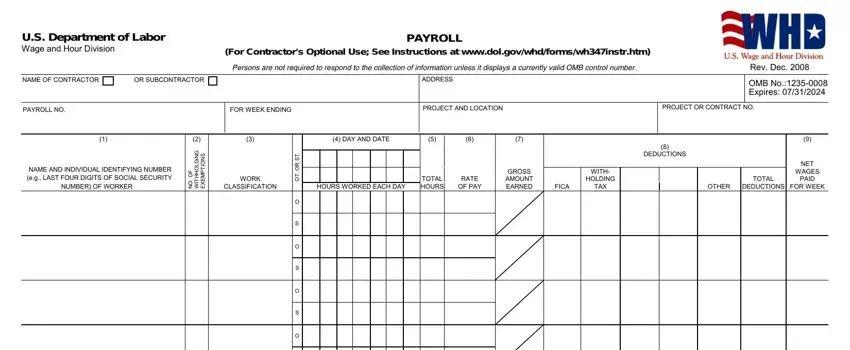

Fill out the particular segments to create the document:

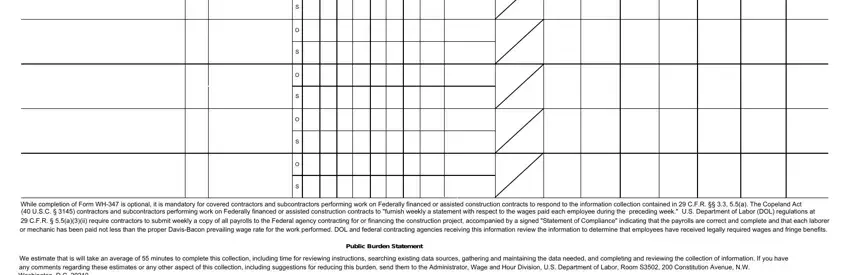

Write down the appropriate details in the area While completion of Form WH is, We estimate that is will take an, and Public Burden Statement.

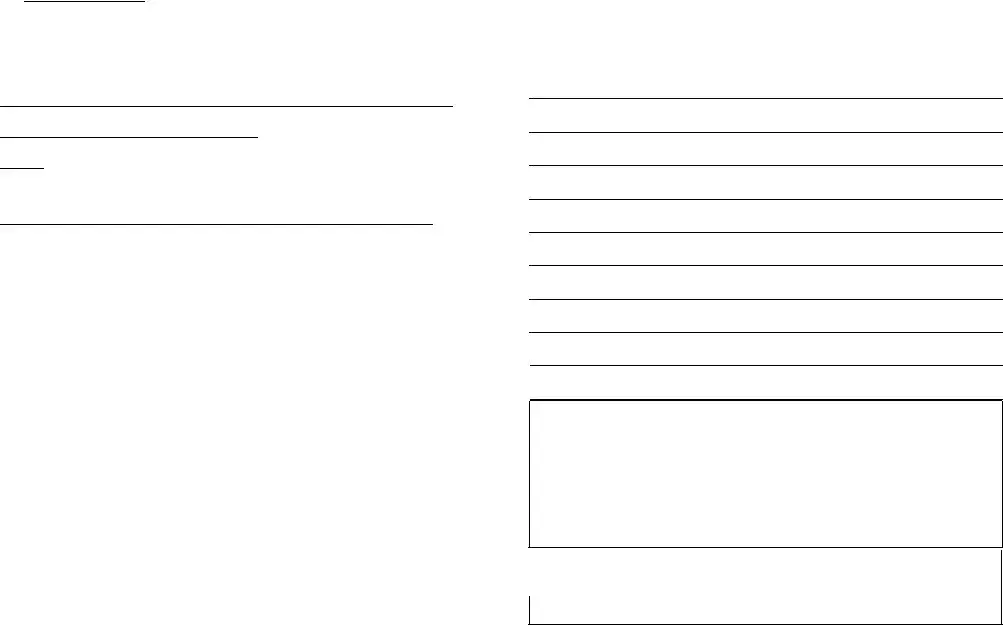

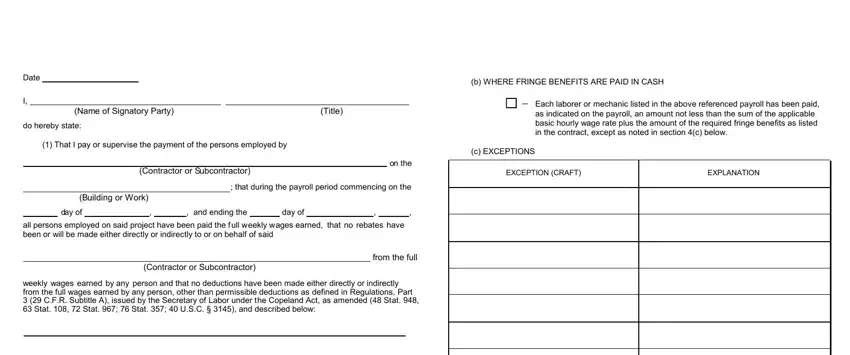

Write down the crucial particulars in Date, Name of Signatory Party, Title, do hereby state, That I pay or supervise the, Contractor or Subcontractor, b WHERE FRINGE BENEFITS ARE PAID, Each laborer or mechanic listed, on the, c EXCEPTIONS, EXCEPTION CRAFT, EXPLANATION, Building or Work, that during the payroll period, and day of section.

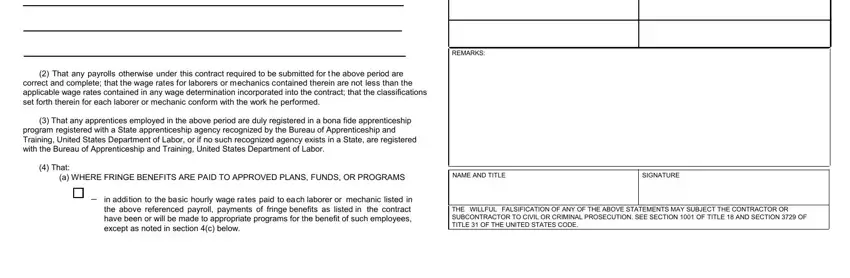

The Contractor or Subcontractor, weekly wages earned by any person, That any payrolls otherwise under, That any apprentices employed in, program registered with a State, REMARKS, That, a WHERE FRINGE BENEFITS ARE PAID, NAME AND TITLE, SIGNATURE, in addition to the basic hourly, and THE WILLFUL FALSIFICATION OF ANY section will be the place to insert the rights and obligations of each party.

Step 3: Click "Done". Now you can transfer your PDF form.

Step 4: It could be better to have copies of the file. There is no doubt that we will not publish or read your data.