The completing the cf 1040 pv is pretty simple. Our experts made sure our PDF editor is not hard to use and helps complete any form in a short time. Have a look at some of the steps you'll want to take:

Step 1: Initially, choose the orange button "Get Form Now".

Step 2: It's now possible to update your cf 1040 pv. The multifunctional toolbar enables you to add, eliminate, improve, and highlight content or perhaps carry out several other commands.

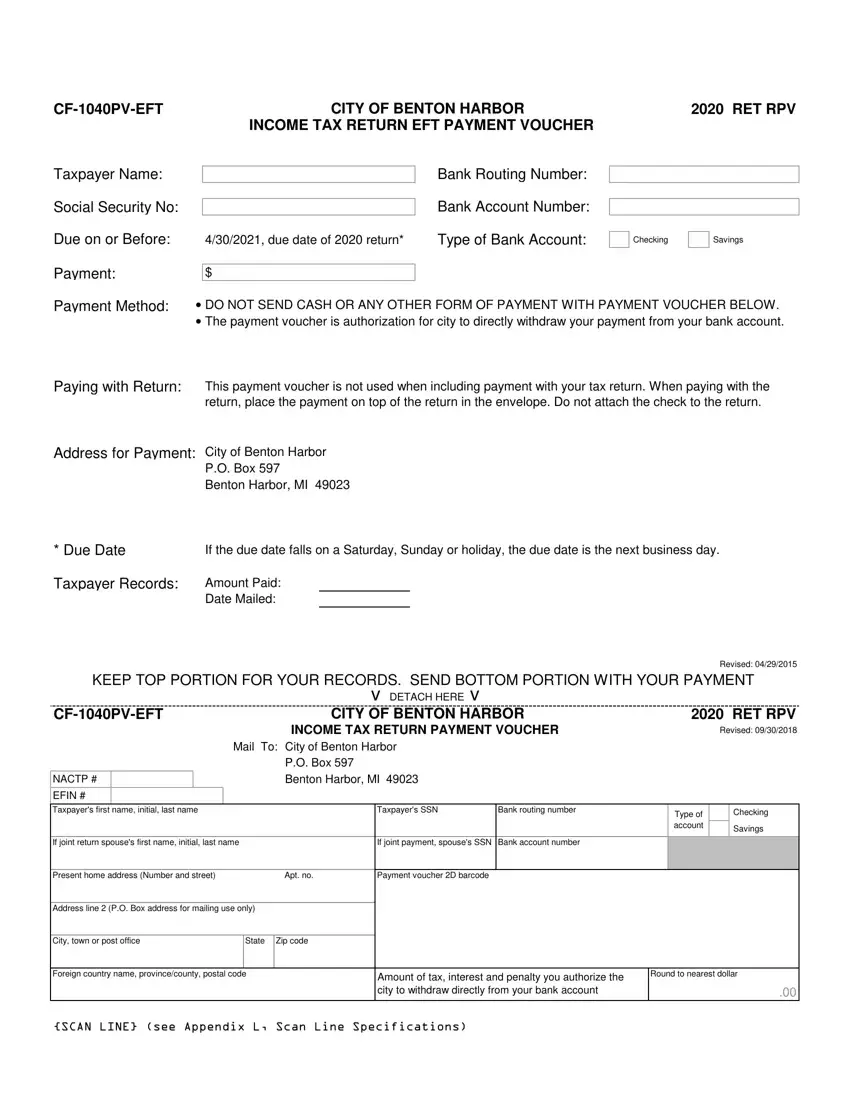

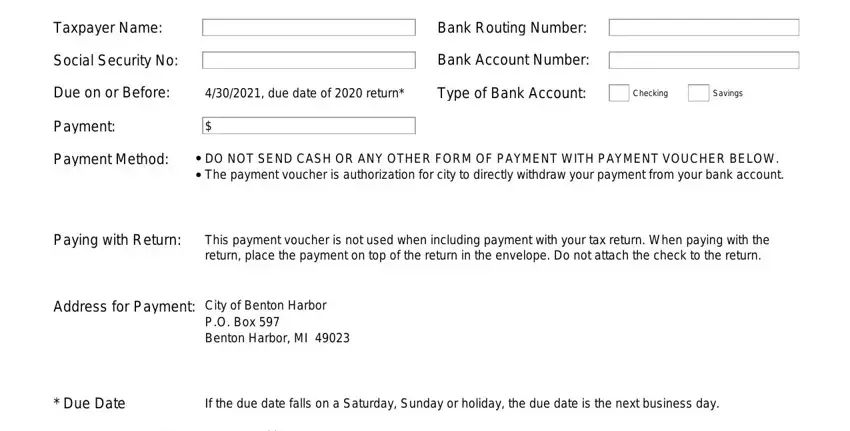

The PDF template you decide to fill in will include the next parts:

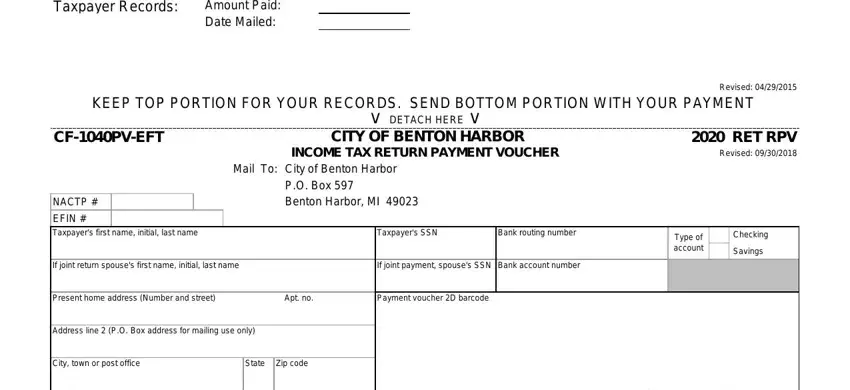

In the Taxpayer Records, Amount Paid Date Mailed, Revised, KEEP TOP PORTION FOR YOUR RECORDS, RET RPV Revised, CFPVEFT, NACTP, EFIN Taxpayers first name initial, Mail To City of Benton Harbor PO, Taxpayers SSN, Bank routing number, Type of account, Checking, Savings, and If joint return spouses first name field, put in writing your data.

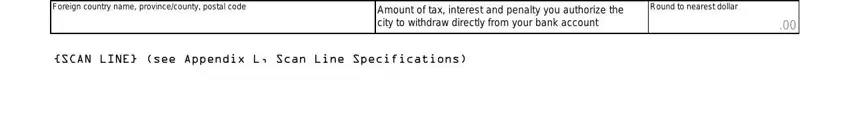

In the Foreign country name, Amount of tax interest and penalty, Round to nearest dollar, and SCAN LINE see Appendix L Scan Line section, focus on the relevant details.

Step 3: Once you select the Done button, your prepared form can be simply exported to all of your gadgets or to email specified by you.

Step 4: Come up with a copy of every file. It should save you some time and assist you to refrain from difficulties in the future. By the way, the information you have will not be used or analyzed by us.