In today's healthcare and childcare benefits landscape, the Claim Medcom form emerges as a crucial document for employees seeking reimbursement under Flexible Spending Accounts (FSA) and Dependent Care Assistance Programs (DCAP). This comprehensive form, designed for submission to Medcom—a provider of benefit solutions—entails a detailed process for mailing or electronically submitting claims. Located in Jacksonville, FL, with options for fax and email submissions, the form facilitates the reimbursement of medical expenses and dependent daycare costs to eligible employees. It precisely outlines the necessity for attaching substantiating documents such as insurance Explanation of Benefits (EOB), medical provider invoices, and day care provider invoices, which are indispensable for the processing of any claim. Additionally, the form mandates the disclosure of the employee's personal information, including any changes to their name or address, thus ensuring accurate identification and processing. The explicit instructions regarding the substantiation of claims underscore the importance of compliance with IRS regulations, emphasizing the need for detailed documentation to justify the reimbursement of claimed expenses. Furthermore, the form includes a certification section where employees attest to the legitimacy of their claims, acknowledge the regulations surrounding ineligible reimbursements, and understand the implications of seeking funds for unsubstantiated expenses. This meticulous requirement not only safeguards against fraudulent claims but also aligns with the legal standards set by tax and healthcare policies.

| Question | Answer |

|---|---|

| Form Name | Claim Form Medcom |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | medcom form, claim form medcomreceipts download, claim emedcom print printable, medcom box email |

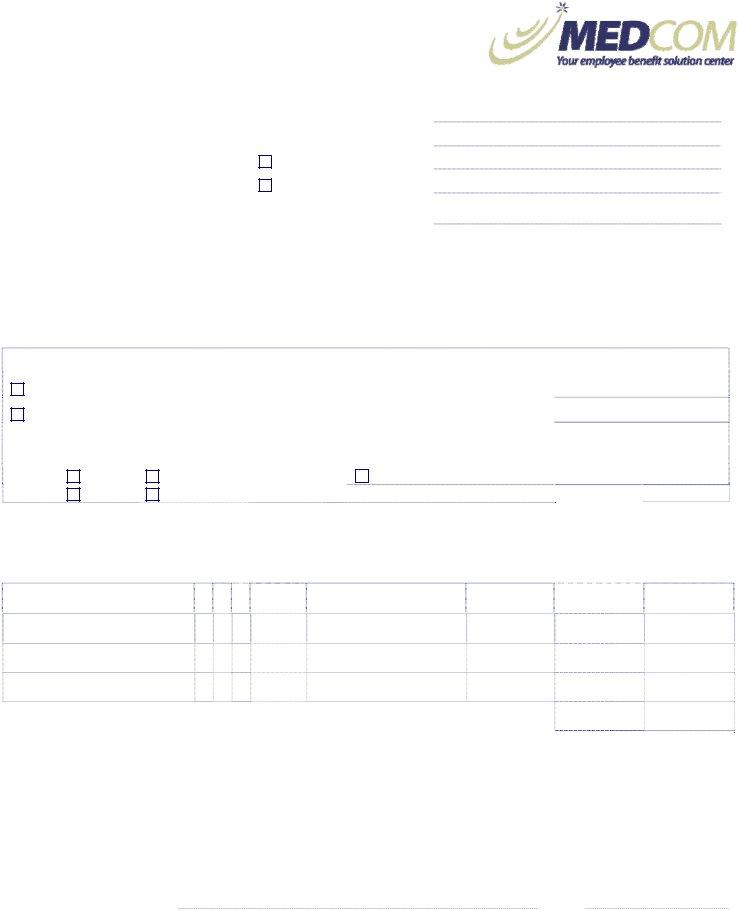

FLEX CLAIM FORM

MAIL TO MEDCOMP.O. BOX 10269 JACKSONVILLE, FL

FAX TO 877.723.0149

EMAIL TO MedcomReceipts@emedcom.net

|

EMPLOYEE NAME (Print) |

|

|

SOCIAL SECURITY NUMBER |

|

FLEXIBLE BENEFIT PLAN |

FORMER NAME, IF CHANGED |

|

NEW ADDRESS, IF CHANGED |

||

|

Street

City |

State |

Zip |

YOUR CLAIM CAN NOT BE PROCESSED IF THE FOLLOWING SUBSTANTIATION IS NOT ATTACHED

Medical Claims: Insurance Explanation of Benefits (EOB); Medical Provider invoice containing diagnosis; Prescription for treatment, etc.

Dependent Day Care Claims: Invoices itemized by Payment Frequency* and with the name of the Day Care Provider, Tax- ID Number, dates of service and the name of person receiving the service.

Please reimburse me for: |

|

Medical Expenses Totaling (FSA) |

$ |

|

|

Dependent Day Care Expenses (DCAP) Totaling |

$ |

|

DCAP CLAIMS WILL NOT BE CONSIDERED FOR PAYMENT UNLESS THE TWO QUESTIONS BELOW ARE ANSWERED

1.*Payment Frequency of DCAP expenses

Daily |

Monthly |

|

|

||

Weekly |

Other Describe: |

|

|

||

|

|

|

|

DAY |

|

|

|

Check CARE |

|||

EXPENSES INCURRED BY |

Self Spouse |

Child |

Child’s |

||

Date of |

|||||

|

|

||||

|

|

|

|

||

(NAME) |

|

|

|

Birth |

|

2.Did you work all days during the DCAP claim period?

Yes (if "NO" please enter total number business days not worked)

Total number days not worked: |

|

|

days |

|

|

|

|

|

|

PROVIDER |

|

ITEMIZE & TOTAL |

||

OF |

|

|

EXPENSES |

|

SERVICE |

|

|

|

|

|

INCURRED |

|

|

|

Include Tax ID if for Day Care |

DATE |

FSA |

|

DCAP |

TOTAL SUBMITED

I hereby certify that the above requested reimbursement is for eligible services received by either myself or eligible tax dependents (if any). The above expenses are not payable to me or any eligible tax dependent(s) from any other source, nor will I seek reimbursement under any other plan or source covering health benefits. If the expense(s) is for Day Care, the dependent(s) is an eligible tax dependent. I may not claim the Dependent Care Tax Credit for any reimbursement I receive for this claim.

I further certify that I understand that I must immediately repay ineligible reimbursements. If I have a debit card, it will be deactivated until the full amount of any ineligible expenses is repaid; and, future claims may be

EMPLOYEE SIGNATURE |

DATE |

MEDCOM CUSTOMER SERVICE 800.523.7542 or 904.596.4500

If you have questions, refer to the Plan Document and Summary Plan Description for complete details regarding your benefits

CLAIM FORM