In the complex landscape of conducting business affairs, especially in scenarios involving financial distress or restructuring, the Client Questionnaire Business form emerges as a vital document. At its core, this comprehensive form serves to collect essential information regarding the business in question, spanning from basic identification details to the nuanced aspects of its financial health and legal standings. By meticulously requiring details such as the business's name, previous names, contact information, the nature of the business, details of authorized signers, and past or pending bankruptcy cases, it lays the groundwork for an accurate assessment of the business's current situation. Moreover, it delves into the specifics of property ownership, both real and personal, asking for information on existing assets, their value, and any liabilities associated with them. By doing so, the form not only aids legal professionals in advising their clients with precision but also ensures that businesses navigating through bankruptcy or restructuring processes are prepared with the necessary documentation to facilitate a smooth proceeding. This initial gathering of detailed and structured information via the Client Questionnaire Business form is a crucial step in the process, enabling a focused and efficient approach to addressing the challenges the business may face.

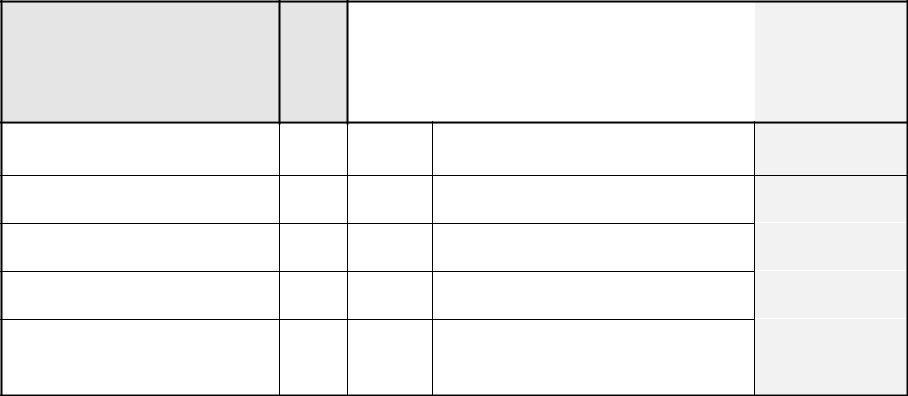

| Question | Answer |

|---|---|

| Form Name | Client Questionnaire Business Form |

| Form Length | 25 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 6 min 15 sec |

| Other names | schedule c 2018 questionner for client, questionnaire for wedding client questionnaire, questionaire for clients, assessment questionnaire client bookkeeping |

Client Questionnaire For Business Debtor

Section 1 Basic Information

Part A. Name and Address

Name of business: _________________________________________________________________

Contact Person’s name: _______________________________________________________________

Telephone Number: _______________ ext.:______Alternative Number: _______________________

Has the business gone by any other names in the past eight years? No |

Yes |

If yes, list other names: |

|

__________________________________________________________________________________ |

|||

Federal Tax ID or Social Security Number: |

_____________________________________________ |

||

Address: ___________________________________________________________________________

City: ___________________________ |

State: _______ Zip: ________________ |

|

County: |

____________________ |

Has the business been at this address for at least 180 days? No Yes |

If there is a different mailing address, please list:

Mailing Address: __________________________________________________________

City: ___________________________ State: _______ Zip: ________________

Part B. Nature of Business

1.Location of principal assets, if different from address above:

______________________________________________________________________________

City: ________________________ State: __________ Zip:__________________________

2.Please describe the nature of your business: _____________________________________________

______________________________________________________________________________

3. |

Who is the authorized signer? _____________________ His/Her title?_____________________ |

|

4. |

Do any of the following describe your business?Railroad |

Stockbroker Commodity Broker Clearing bank |

|

Health Care Business Single Asset Real Estate |

501(c)(3) |

Part C. Prior/Pending Bankruptcy Cases

1. Has a bankruptcy case been filed by your company or against your company in the last 8 years? No Yes If yes, in which district of which state was the case filed? _______________________________

Case Number: ____________________ Date filed: _____________

2.Are there currently any bankruptcy cases pending involving you, your business, your business partner, or any of your

affiliates? No Yes

If yes, name of debtor: _______________________________ Relationship to you: __________________

Case Number: _______________ Date filed: _____________ Judge: ______________________

District in which the case was filed: _______________________________

Exhibit "C" to the Voluntary Petition

Does your company own or have possession of any property that poses or is alleged to pose a threat of imminent and identifiable harm to public health or safety? No Yes

Client Questionnaire:

Page 1

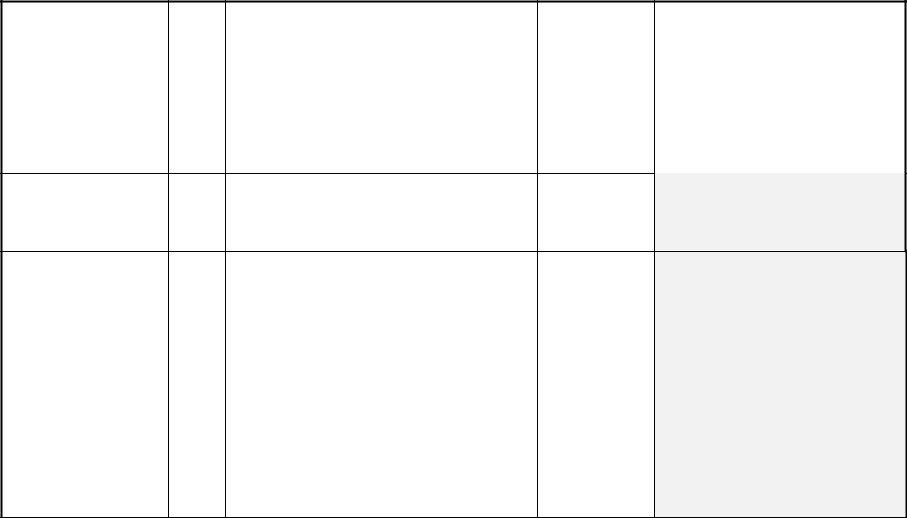

Section 2 Property

Part A. Real Estate (Schedule A)

List all real estate which the business owns or is a joint owner of, even if the business still owes money on the property.

Address and description of property

Value

|

The |

|

List all mortgages and liens |

|

|

business’s % |

|

|

|

|

ownership, or |

|

|

|

|

$ amount of |

|

What is the $ |

|

|

equity, if your |

|

value of the |

Who issued the lien, loan or mortgage? (name |

|

business is not |

|

loan, lien, or |

and address of institution) |

|

the sole |

|

mortgage? |

|

|

owner. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Office Use Only

Notes

Client Questionnaire: |

Page 2 |

Part B. Personal Property (Schedule B)

For each type of property listed below, indicate whether the business owns any property of that category, and, if so, fill in the remaining information. You can think of the value as the resale value. Attach additional pages if necessary.

|

|

|

|

|

|

Office Use Only |

|

|

Type of Property |

Yes/No |

Description & Location |

Value |

Notes |

|

|

|

1. |

Cash on hand |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Checking/Savings |

|

|

|

|

|

|

Account, Certificates of |

|

|

|

|

|

|

|

deposit, other bank |

|

|

|

|

|

|

|

accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.Security deposits held by utility companies, landlord

4.Household goods,

furniture, including audio, video, and computer equipment

Client Questionnaire: |

Page 3 |

|

|

|

|

|

|

Office Use Only |

Type of Property |

|

Yes/No |

Description & Location |

Value |

Notes |

|

5. |

Books, pictures, art |

|

|

|

|

|

objects, records, compact |

|

|

|

|

||

discs, collectibles |

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Clothing |

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Furs and jewelry |

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Sports, photographic, |

|

|

|

|

|

hobby equipment, firearms |

|

|

|

|

||

|

|

|

|

|

|

|

9. |

Interest in insurance |

|

|

|

|

|

|

|

|

|

|||

cancellation value |

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Annuities |

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Interests in an |

|

|

|

|

|

education IRA, as defined |

|

|

|

|

||

in 26 USC § 530(b)(1) |

|

|

|

|

||

|

|

|

|

|

||

12. Interests in pension or |

|

|

|

|

||

profit sharing plans |

|

|

|

|

|

|

|

|

|

|

|

||

13. Stock and interests in |

|

|

|

|

||

incorporated/ |

|

|

|

|

|

|

unincorporated business |

|

|

|

|

||

|

|

|

|

|

|

|

Client Questionnaire: |

|

Page 4 |

||||

|

|

|

|

|

Office Use Only |

Type of Property |

Yes/No |

Description & Location |

Value |

Notes |

|

14. |

Interests in |

|

|

|

|

partnerships/joint ventures |

|

|

|

|

|

|

|

|

|

|

|

15. |

Bonds |

|

|

|

|

|

|

|

|

|

|

16. |

Accounts receivable |

|

|

|

|

|

|

|

|

|

|

17. |

Alimony/family |

|

|

|

|

support to which you are |

|

|

|

|

|

entitled |

|

|

|

|

|

|

|

|

|

|

|

18. |

Other liquidated debts |

|

|

|

|

owed to you, including tax |

|

|

|

|

|

refunds |

|

|

|

|

|

|

|

|

|

|

|

19. |

Equitable or future |

|

|

|

|

interests or life estates |

|

|

|

|

|

|

|

|

|

|

|

20. |

Interests in estate of |

|

|

|

|

decedent or life insurance |

|

|

|

|

|

plan or trust |

|

|

|

|

|

|

|

|

|

|

|

21. |

Other contigent/ |

|

|

|

|

unliquidated claims, |

|

|

|

|

|

including tax refunds, |

|

|

|

|

|

counterclaims |

|

|

|

|

|

|

|

|

|

|

|

22. |

Patents, copyrights, |

|

|

|

|

other intellectual property |

|

|

|

|

|

|

|

|

|

|

|

23. |

Licenses, franchises |

|

|

|

|

|

|

|

|

|

|

Client Questionnaire: |

Page 5 |