We used the top computer programmers to build our PDF editor. This application will enable you to complete the uitr form file easily and won't eat up a lot of your time. This straightforward instruction will help you learn how to start.

Step 1: The first task is to select the orange "Get Form Now" button.

Step 2: Once you have accessed the editing page uitr form, you should be able to notice each of the functions readily available for your document within the top menu.

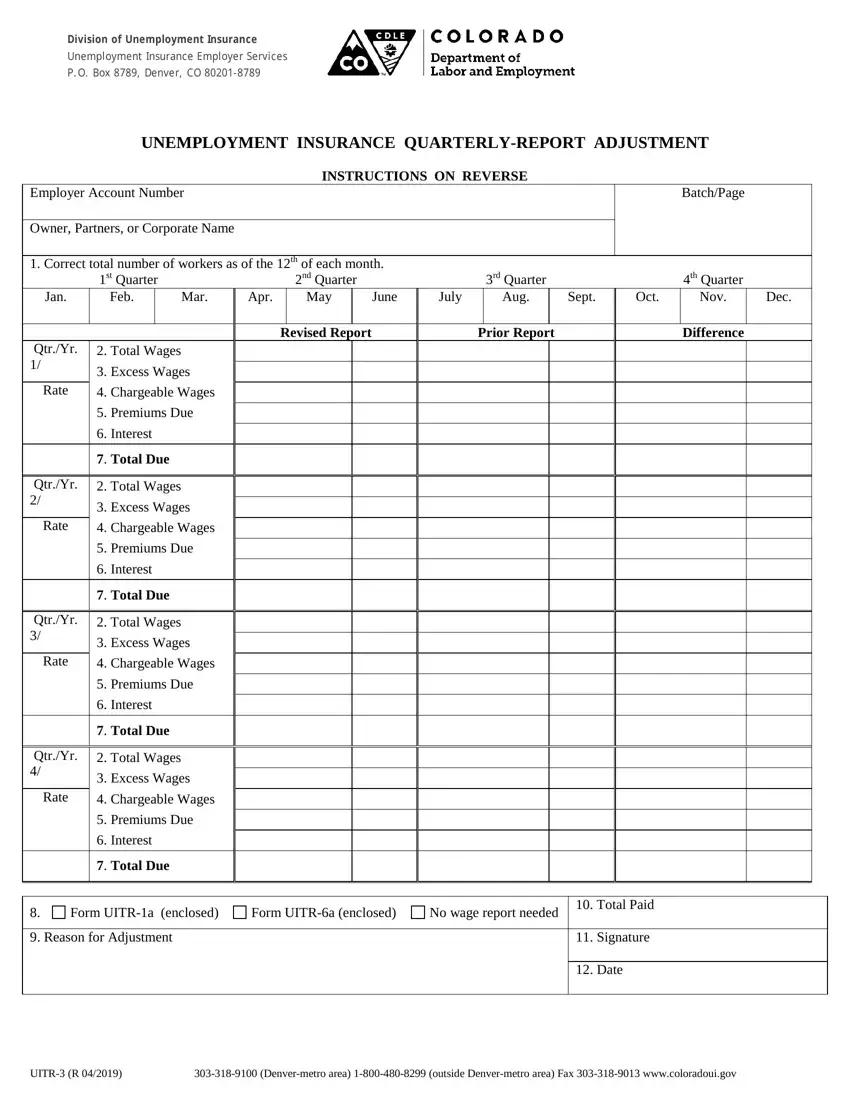

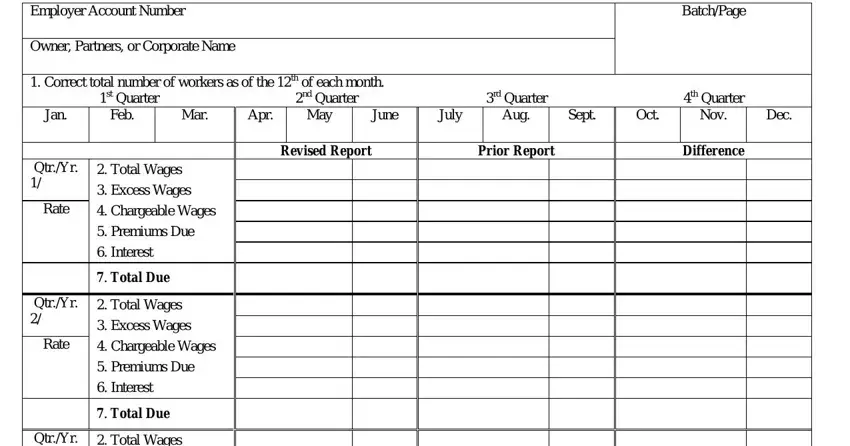

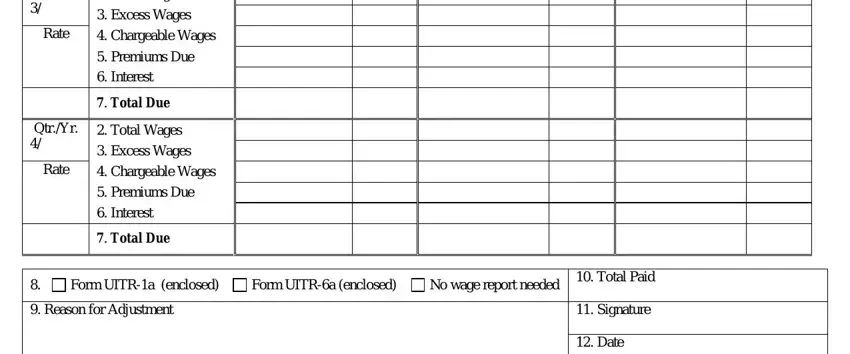

It is essential to type in the next data if you need to prepare the template:

Within the part QtrYr, Rate, Total Wages Excess Wages, QtrYr, Rate, Premiums Due Interest, Total Due, Total Wages, Excess Wages Chargeable Wages, Total Due, Form UITRa enclosed, Form UITRa enclosed, No wage report needed, Reason for Adjustment, and Total Paid enter the details that the application demands you to do.

Step 3: Click "Done". You can now transfer your PDF file.

Step 4: Generate copies of the document - it will help you prevent potential future complications. And fear not - we do not publish or watch the information you have.