|

Power of Attorney - Post Retirement |

STATE OF CONNECTICUT |

|

State Employees Retirement System |

|

OFFICE OF THE STATE COMPTROLLER |

|

CO-1049A Rev. 8/2015 |

|

RETIREMENT SERVICES DIVISION |

|

Page 1 of 2 |

|

|

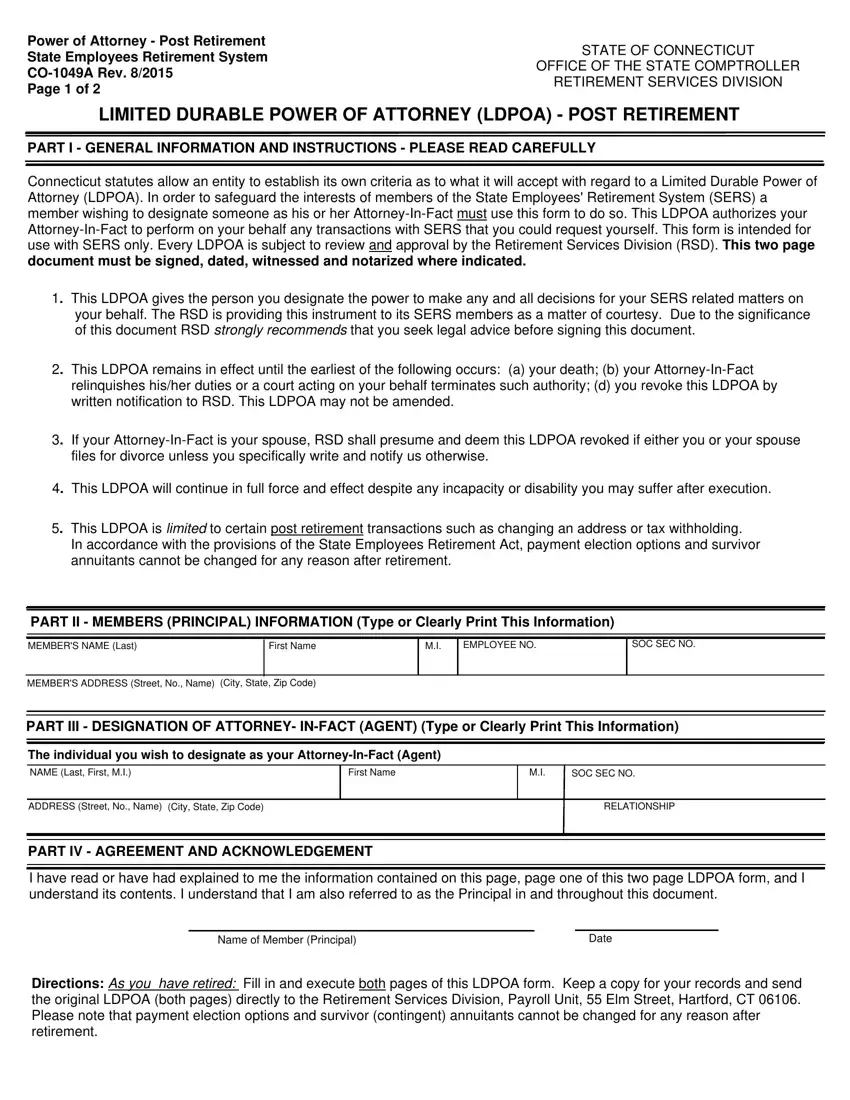

LIMITED DURABLE POWER OF ATTORNEY (LDPOA) - POST RETIREMENT

PART I - GENERAL INFORMATION AND INSTRUCTIONS - PLEASE READ CAREFULLY

Connecticut statutes allow an entity to establish its own criteria as to what it will accept with regard to a Limited Durable Power of Attorney (LDPOA). In order to safeguard the interests of members of the State Employees' Retirement System (SERS) a member wishing to designate someone as his or her Attorney-In-Fact must use this form to do so. This LDPOA authorizes your Attorney-In-Fact to perform on your behalf any transactions with SERS that you could request yourself. This form is intended for use with SERS only. Every LDPOA is subject to review and approval by the Retirement Services Division (RSD). This two page document must be signed, dated, witnessed and notarized where indicated.

1. This LDPOA gives the person you designate the power to make any and all decisions for your SERS related matters on your behalf. The RSD is providing this instrument to its SERS members as a matter of courtesy. Due to the significance of this document RSD strongly recommends that you seek legal advice before signing this document.

2. This LDPOA remains in effect until the earliest of the following occurs: (a) your death; (b) your Attorney-In-Fact relinquishes his/her duties or a court acting on your behalf terminates such authority; (d) you revoke this LDPOA by written notification to RSD. This LDPOA may not be amended.

3. If your Attorney-In-Fact is your spouse, RSD shall presume and deem this LDPOA revoked if either you or your spouse files for divorce unless you specifically write and notify us otherwise.

4. This LDPOA will continue in full force and effect despite any incapacity or disability you may suffer after execution.

5. This LDPOA is limited to certain post retirement transactions such as changing an address or tax withholding.

In accordance with the provisions of the State Employees Retirement Act, payment election options and survivor annuitants cannot be changed for any reason after retirement.

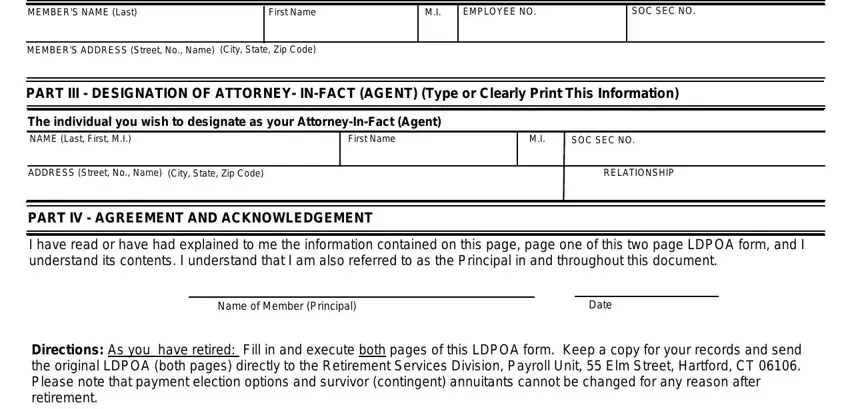

PART II - MEMBERS (PRINCIPAL) INFORMATION (Type or Clearly Print This Information)

MEMBER'S ADDRESS (Street, No., Name) (City, State, Zip Code)

PART III - DESIGNATION OF ATTORNEY- IN-FACT (AGENT) (Type or Clearly Print This Information)

The individual you wish to designate as your Attorney-In-Fact (Agent)

ADDRESS (Street, No., Name) (City, State, Zip Code) |

RELATIONSHIP |

PART IV - AGREEMENT AND ACKNOWLEDGEMENT

I have read or have had explained to me the information contained on this page, page one of this two page LDPOA form, and I understand its contents. I understand that I am also referred to as the Principal in and throughout this document.

Name of Member (Principal) |

Date |

Directions: As you have retired: Fill in and execute both pages of this LDPOA form. Keep a copy for your records and send the original LDPOA (both pages) directly to the Retirement Services Division, Payroll Unit, 55 Elm Street, Hartford, CT 06106. Please note that payment election options and survivor (contingent) annuitants cannot be changed for any reason after retirement.

|

Power of Attorney - Post-Retirement |

STATE OF CONNECTICUT |

|

OFFICE OF THE STATE COMPTROLLER |

|

State Employees Retirement System |

|

RETIREMENT SERVICES DIVISION |

|

CO-1049A Rev. 8-2015 |

|

|

|

Page 2 of 2 |

|

|

|

LIMITED DURABLE POWER OF ATTORNEY (LDPOA) - POST RETIREMENT |

|

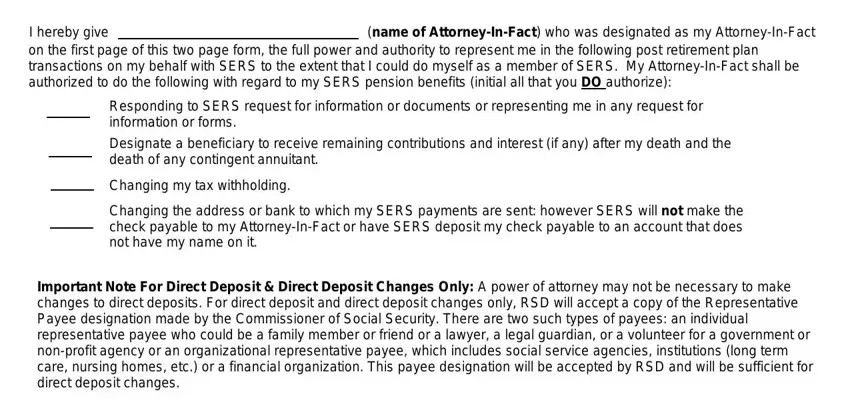

I hereby give |

|

(name of Attorney-In-Fact) who was designated as my Attorney-In-Fact |

on the first page of this two page form, the full power and authority to represent me in the following post retirement plan transactions on my behalf with SERS to the extent that I could do myself as a member of SERS. My Attorney-In-Fact shall be authorized to do the following with regard to my SERS pension benefits (initial all that you DO authorize):

Responding to SERS request for information or documents or representing me in any request for information or forms.

Designate a beneficiary to receive remaining contributions and interest (if any) after my death and the death of any contingent annuitant.

Changing my tax withholding.

Changing the address or bank to which my SERS payments are sent: however SERS will not make the check payable to my Attorney-In-Fact or have SERS deposit my check payable to an account that does not have my name on it.

Important Note For Direct Deposit & Direct Deposit Changes Only: A power of attorney may not be necessary to make changes to direct deposits. For direct deposit and direct deposit changes only, RSD will accept a copy of the Representative Payee designation made by the Commissioner of Social Security. There are two such types of payees: an individual representative payee who could be a family member or friend or a lawyer, a legal guardian, or a volunteer for a government or non-profit agency or an organizational representative payee, which includes social service agencies, institutions (long term care, nursing homes, etc.) or a financial organization. This payee designation will be accepted by RSD and will be sufficient for direct deposit changes.

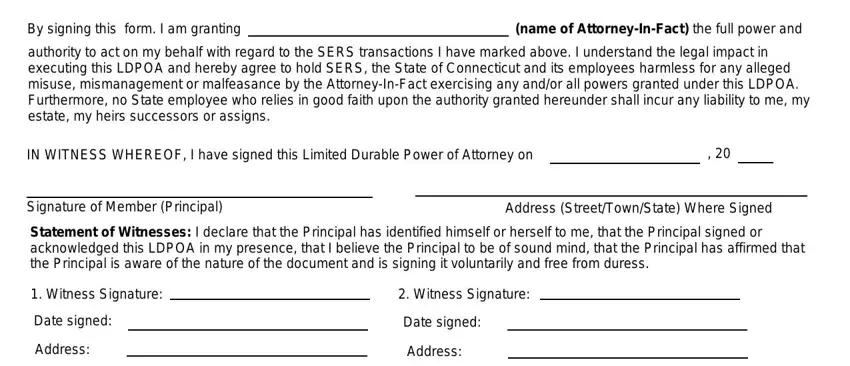

By signing this form. I am granting(name of Attorney-In-Fact) the full power and

authority to act on my behalf with regard to the SERS transactions I have marked above. I understand the legal impact in executing this LDPOA and hereby agree to hold SERS, the State of Connecticut and its employees harmless for any alleged misuse, mismanagement or malfeasance by the Attorney-In-Fact exercising any and/or all powers granted under this LDPOA. Furthermore, no State employee who relies in good faith upon the authority granted hereunder shall incur any liability to me, my estate, my heirs successors or assigns.

IN WITNESS WHEREOF, I have signed this Limited Durable Power of Attorney on |

, 20 |

|

|

|

|

|

|

|

|

|

Signature of Member (Principal) |

|

Address (Street/Town/State) Where Signed |

|

Statement of Witnesses: I declare that the Principal has identified himself or herself to me, that the Principal signed or acknowledged this LDPOA in my presence, that I believe the Principal to be of sound mind, that the Principal has affirmed that the Principal is aware of the nature of the document and is signing it voluntarily and free from duress.

|

|

|

|

|

|

|

|

1. Witness Signature: |

|

|

2. Witness Signature: |

|

|

Date signed: |

|

|

Date signed: |

|

Address: |

|

|

|

Address: |

|

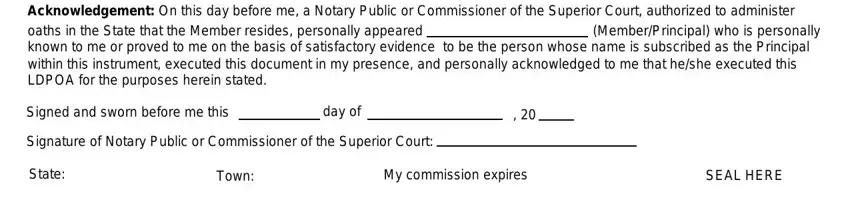

Acknowledgement: On this day before me, a Notary Public or Commissioner of the Superior Court, authorized to administer

oaths in the State that the Member resides, personally appeared |

|

|

(Member/Principal) who is personally |

known to me or proved to me on the basis of satisfactory evidence |

to be the person whose name is subscribed as the Principal |

within this instrument, executed this document in my presence, and personally acknowledged to me that he/she executed this LDPOA for the purposes herein stated.

|

|

|

|

|

|

|

|

|

|

Signed and sworn before me this |

|

day of |

|

, 20 |

|

|

|

Signature of Notary Public or Commissioner of the Superior Court: |

|

|

|

|

|

State: |

Town: |

|

My commission expires |

|

|

SEAL HERE |