The PDF editor makes it easy to complete the form 104 form. You should be able to generate the form without delay through using these easy steps.

Step 1: Select the button "Get Form Here" on this webpage and select it.

Step 2: Once you have entered your form 104 edit page, you will notice all functions you can use concerning your document within the top menu.

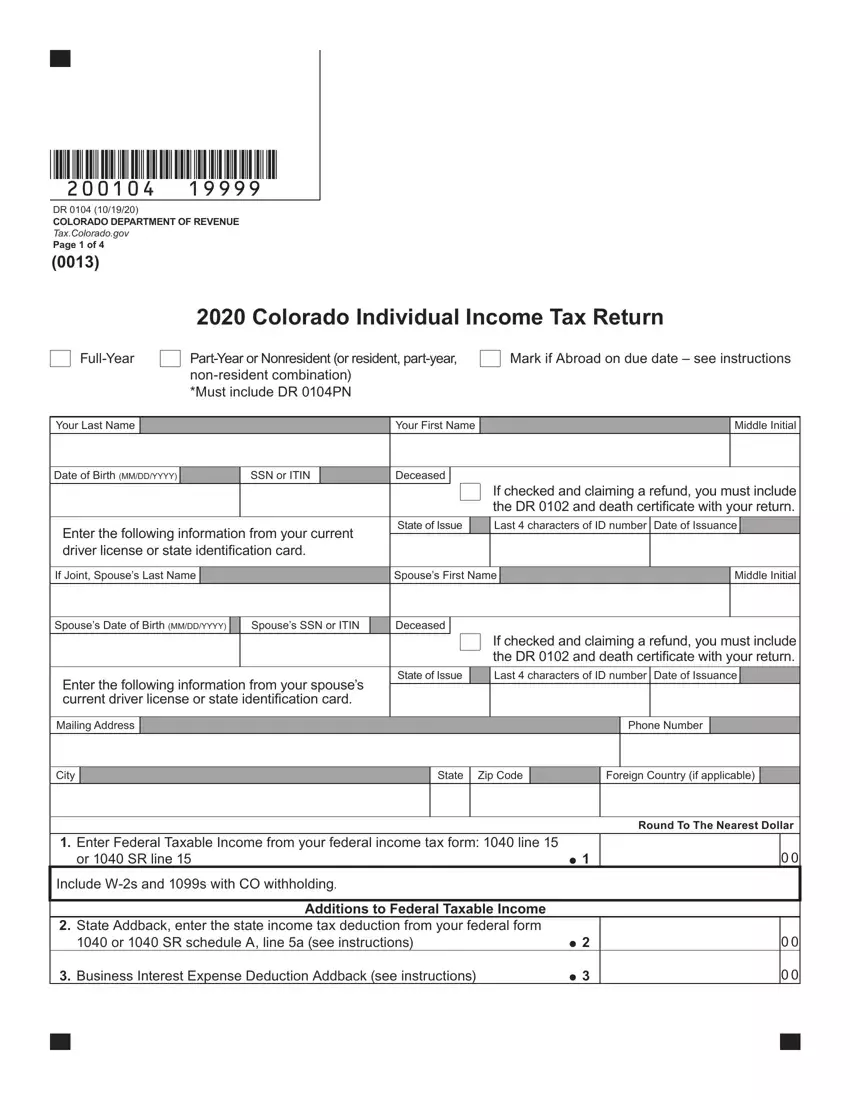

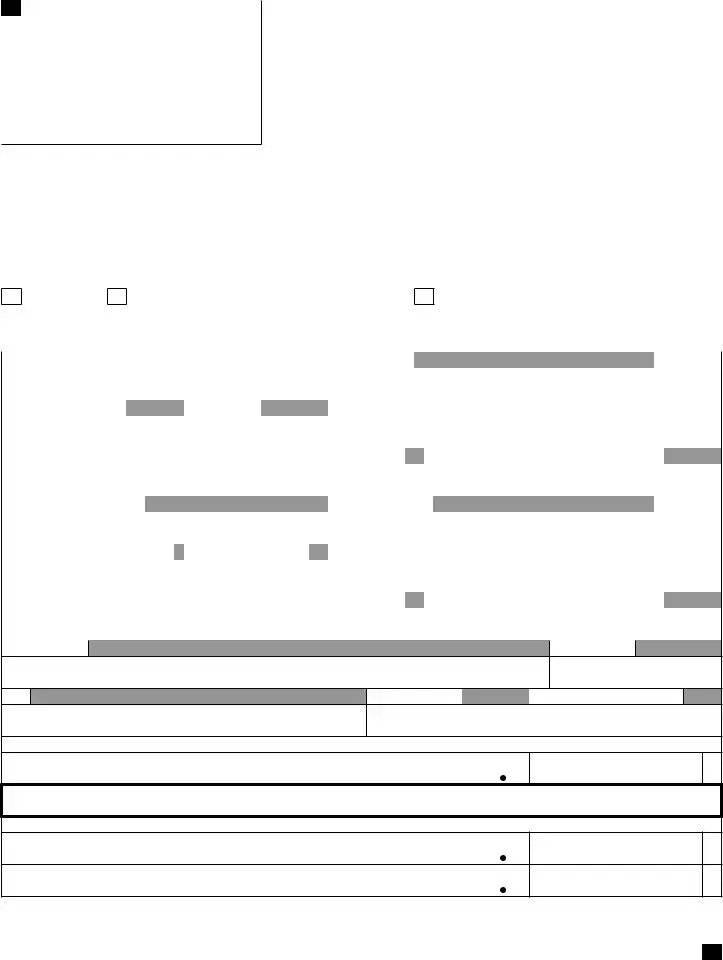

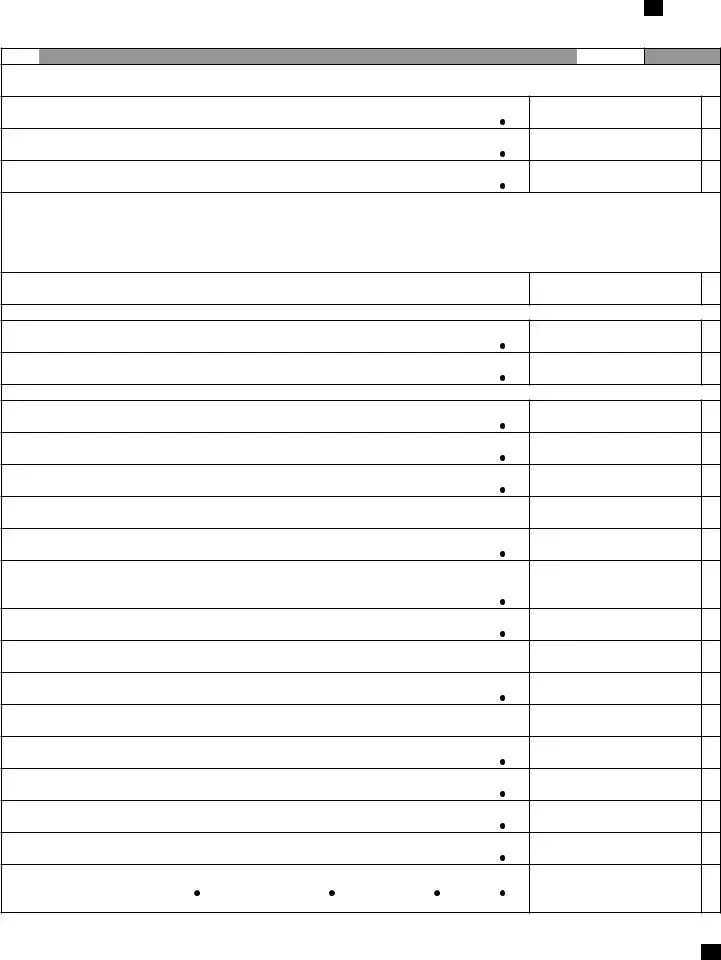

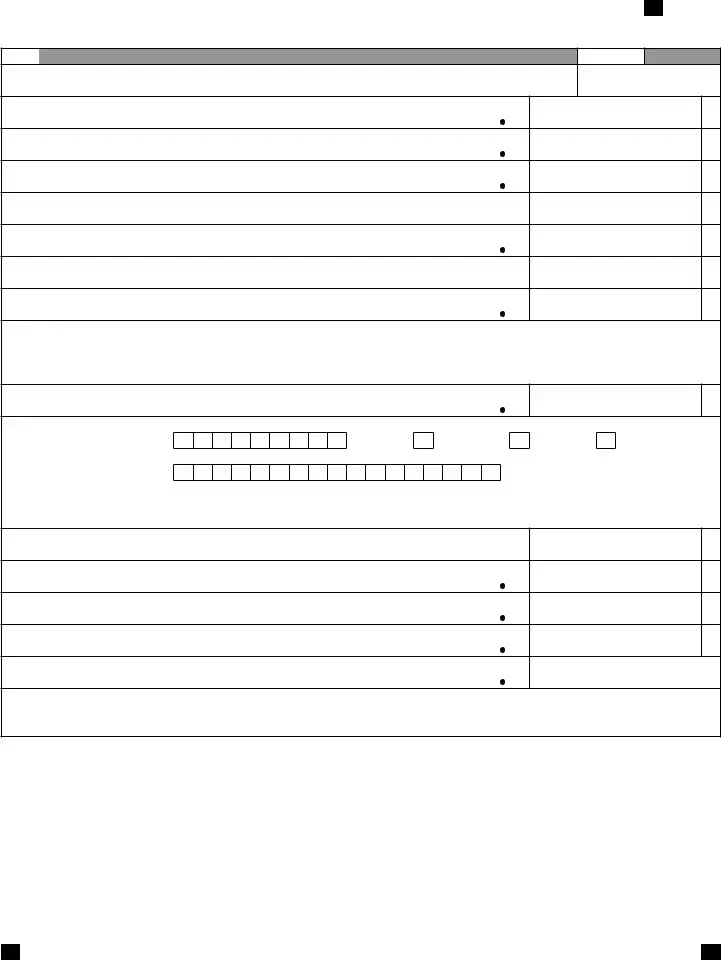

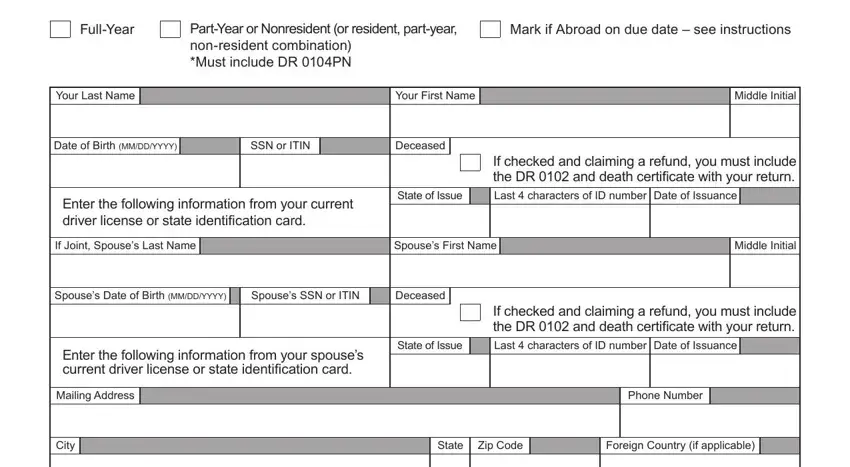

These parts will constitute the PDF document that you'll be completing:

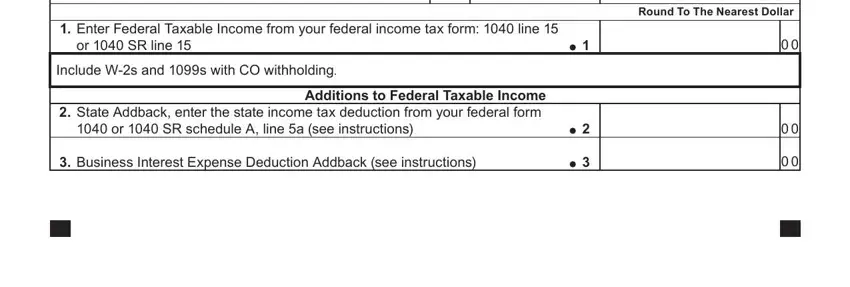

Complete the Enter Federal Taxable Income from, or SR line, Include Ws and s with CO, Additions to Federal Taxable, or SR schedule A line a see, Business Interest Expense, and Round To The Nearest Dollar areas with any information that can be asked by the platform.

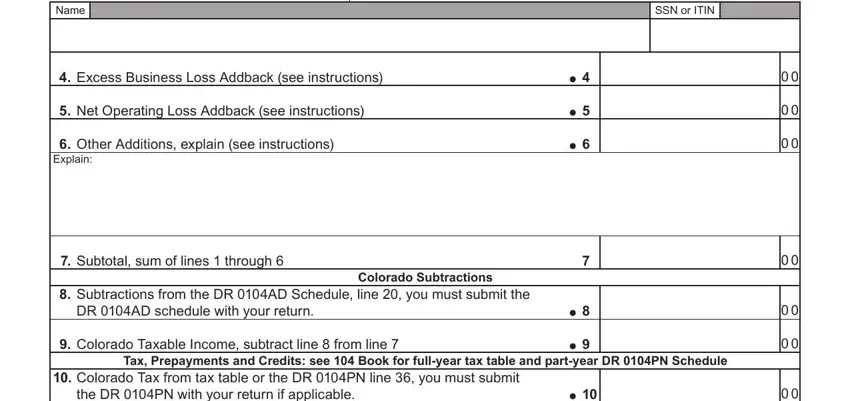

Write down the significant details as you are within the Name, SSN or ITIN, Excess Business Loss Addback see, Net Operating Loss Addback see, Other Additions explain see, Subtotal sum of lines through, Subtractions from the DR AD, DR AD schedule with your return, Colorado Subtractions, Colorado Taxable Income subtract, Tax Prepayments and Credits see, Colorado Tax from tax table or, and the DR PN with your return if segment.

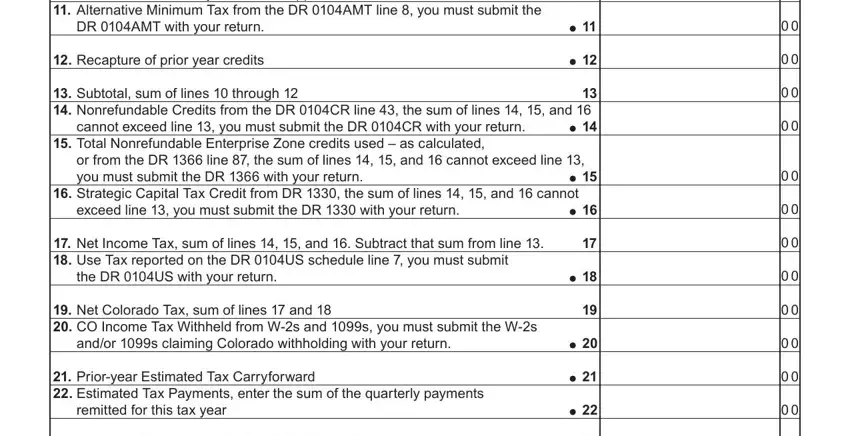

Please make sure to write down the rights and responsibilities of the sides within the the DR PN with your return if, Alternative Minimum Tax from the, DR AMT with your return, Recapture of prior year credits, Subtotal sum of lines through, cannot exceed line you must, Total Nonrefundable Enterprise, or from the DR line the sum of, Strategic Capital Tax Credit from, exceed line you must submit the, Net Income Tax sum of lines and, the DR US with your return, Net Colorado Tax sum of lines, andor s claiming Colorado, and Prioryear Estimated Tax space.

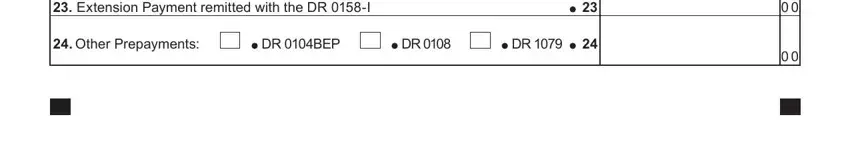

Finalize by checking all of these fields and writing the relevant information: Extension Payment remitted with, Other Prepayments, and DR BEP.

Step 3: Choose the Done button to save the form. Now it is readily available for export to your electronic device.

Step 4: Create duplicates of your file - it can help you remain away from upcoming problems. And fear not - we are not meant to share or see your details.