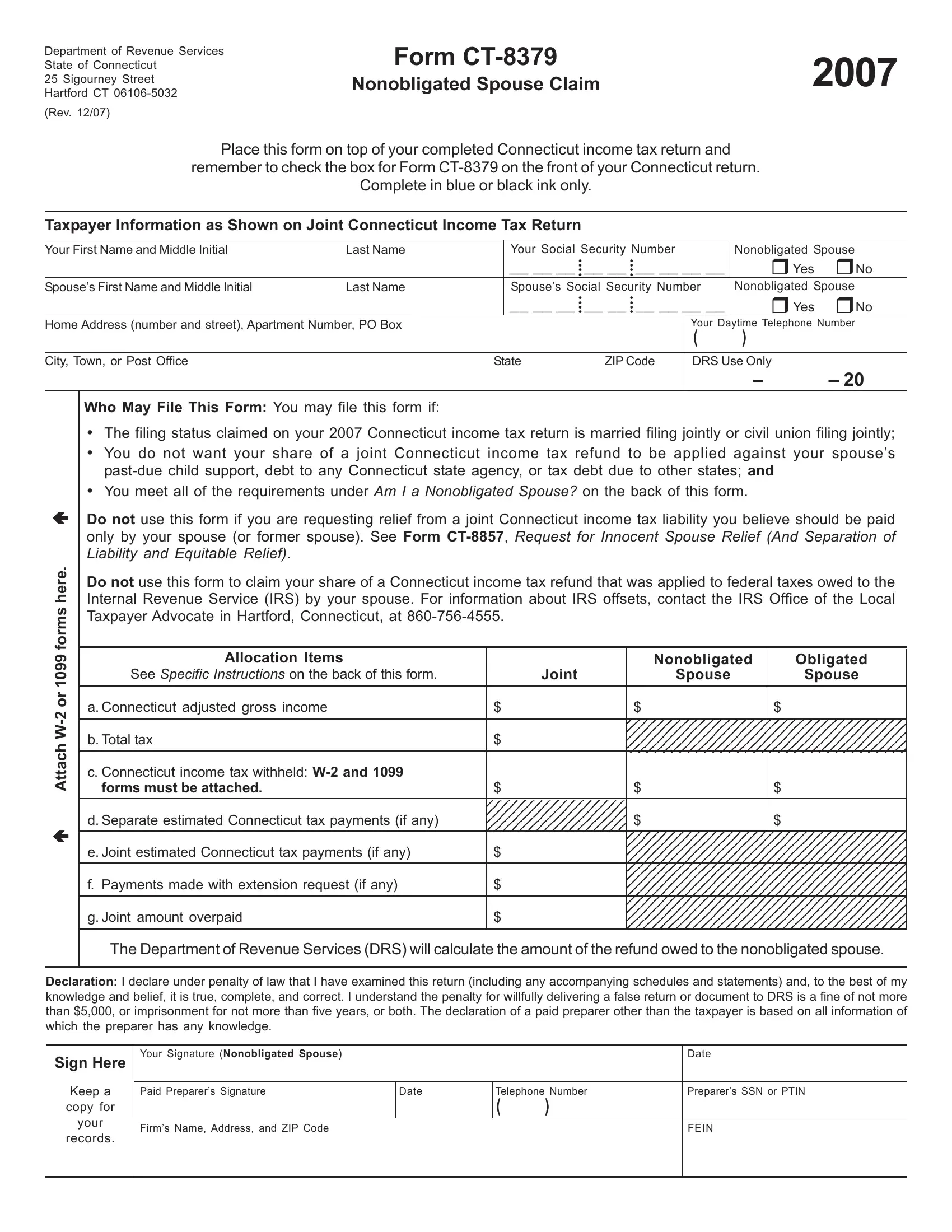

Purpose: Use Form CT-8379, Nonobligated Spouse Claim, if:

•You are a nonobligated spouse and all or part of your overpayment was (or is expected to be) applied against:

•Your spouse’s past due State of Connecticut debt (such as child support, student loan, or any debt to any Connecticut state agency); or

•A tax debt due to other states; and

•You want your share of the joint overpayment refunded to you.

Any reference in this document to a spouse also refers to a party to a civil union recognized under Connecticut law.

General Instructions

Am I a Nonobligated Spouse?

You are a nonobligated spouse, if you meet all of the following requirements:

•You filed a joint Connecticut income tax return with a spouse who owes past-due child support, a debt to any Connecticut state agency, or a tax debt due to other states (the obligated spouse);

•You received income (such as wages, interest, etc.) reported on the joint return;

•You made Connecticut income tax payments (such as withholding or estimated tax payments) reported on the joint return;

•You do not owe past-due child support, a debt to any Connecticut state agency, or a tax debt due to other states; and

•You filed a joint return reporting an overpayment of Connecticut income tax, all or part of which was or is expected to be applied against past-due child support, a debt to any Connecticut state agency, or a tax debt due to other states owed by the obligated spouse.

Filing the Return: You must file Form CT-8379 with Form CT-1040, Form CT-1040EZ, Form CT-1040NR/PY, or Form CT-1040X. Remember to check the box for Form CT-8379 on the front of your Connecticut income tax return.

You must place this form on top of the completed Connecticut income tax return. If you previously filed your 2007 Connecticut income tax return, mail this form separately to: Department of Revenue Services, PO Box 5035, Hartford CT 06102-5035.

Important: Attach copies of all forms W-2 and 1099

showing Connecticut income tax withheld to Form CT- 8379.

Specific Instructions

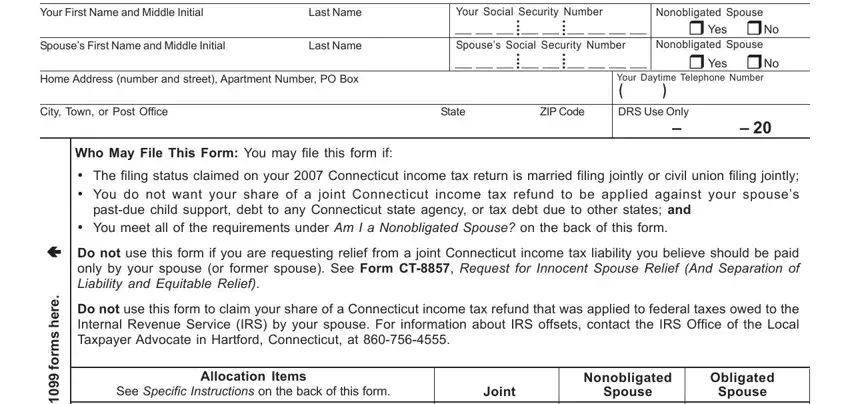

Taxpayer Information: Enter the taxpayer information exactly as it appears on your Connecticut income tax return. The name and Social Security Number (SSN) entered first on the joint tax return must also be entered first on Form CT-8379.

Allocation Items

a.Connecticut adjusted gross income: Enter the joint amount as reported on your joint Connecticut income tax return (Form CT-1040, Line 5; Form CT-1040EZ, Line 3; Connecticut Telefile Tax Return, Line 4 minus Line 5; or Form CT-1040NR/PY, Line 5).Then separately allocate the individual income according to which spouse earned the income. The sum of these must equal the amount reported as joint income.

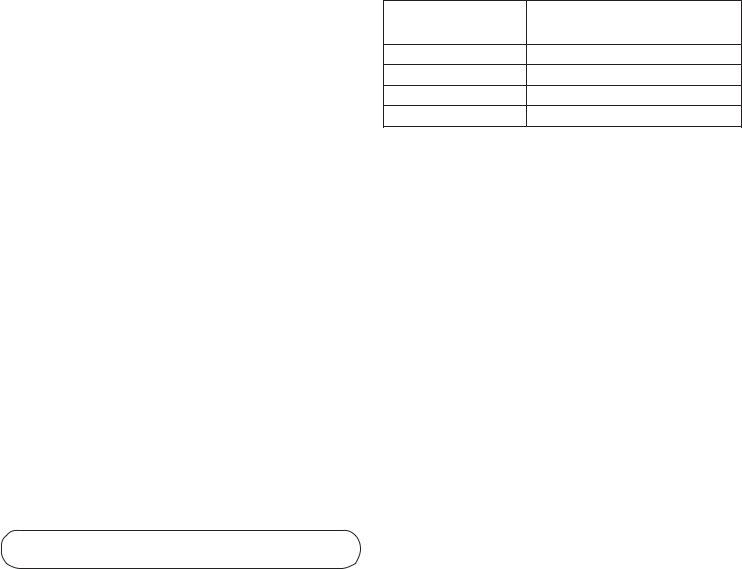

Nonresidents and Part-Year Residents only - Complete the following chart. Enter the joint amount of your Connecticut source income as reported on your Form CT-1040NR/PY. Separately allocate the Connecticut source income according to which spouse earned the income. The sum of these must equal the amount reported as joint Connecticut source income.

|

Nonresidents and |

Connecticut Source Income |

|

Part-Year Residents |

|

(Form CT-1040NR/PY, LINE 6) |

|

Only |

|

|

Allocation Item

Joint

Nonobligated Spouse

Obligated Spouse

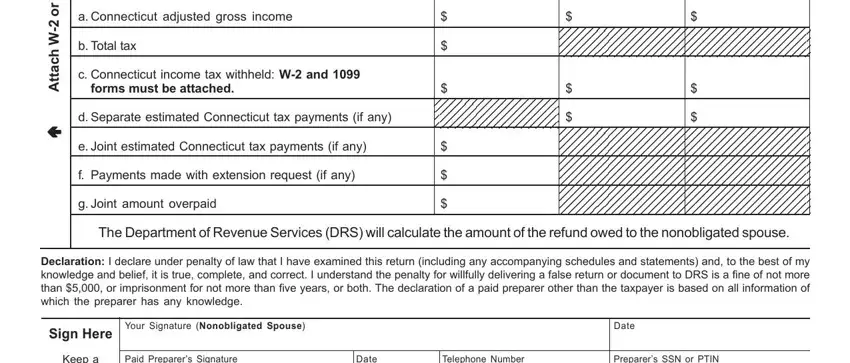

b.Total tax: Enter the joint Connecticut tax liability as reported on your joint Connecticut income tax return (Form CT-1040, Line 16; Form CT-1040EZ, Line 8; Connecticut Telefile Tax Return, Line 12; or Form CT-1040NR/PY, Line 18).

c.Connecticut income tax withheld: Enter the joint Connecticut withholding as reported on your joint Connecticut income tax return (Form CT-1040, Line 18; Form CT-1040EZ, Line 10; Connecticut Telefile Tax Return, Line 13; or Form CT-1040NR/PY, Line 20). List each spouse’s share separately as shown on your individual withholding forms (such as W-2s or 1099s).

d.Separate estimated Connecticut tax payments: Enter any separately paid estimated Connecticut income tax payments in the appropriate spaces.

e.Joint estimated Connecticut tax payments: Enter the total amount of any joint estimated Connecticut income tax payments. Include overpayments applied from a previous year.

f.Payments made with extension request: Enter the joint amount as reported on your joint Connecticut income tax return (Form CT-1040, Line 20; Form CT-1040EZ, Line 12; or Form CT-1040NR/PY, Line 22).

g.Joint amount overpaid: Enter the joint amount overpaid as reported on your joint Connecticut income tax return (Form CT-1040, Line 22; Form CT-1040EZ, Line 14; Connecticut Telefile Tax Return, Line 15; or Form CT-1040NR/PY, Line 24). DRS will compute the separate overpayments for the nonobligated spouse and the obligated spouse.

Nonobligated Spouse Refund: DRS will calculate the amount of the nonobligated spouse’s refund. The nonobligated spouse’s share of the joint Connecticut tax overpayment cannot exceed the joint overpayment.

Signature: The nonobligated spouse must sign this form.

Others Who May Sign for the Nonobligated Spouse: Anyone with a signed Power of Attorney may sign on behalf of the nonobligated spouse. Attach a copy of the Power of Attorney.

Paid Preparer’s Signature: Anyone you pay to prepare your return must sign and date it. Paid preparers must also enter their SSN or Personal Tax Identification Number (PTIN), and their firm’s Federal Employer Identification Number (FEIN) in the spaces provided.