hcs can be filled out online easily. Simply use FormsPal PDF editor to do the job quickly. We are focused on providing you with the ideal experience with our editor by continuously introducing new features and improvements. Our tool has become a lot more useful with the newest updates! Currently, working with PDF forms is easier and faster than ever. Here is what you'd want to do to begin:

Step 1: Click the orange "Get Form" button above. It will open up our editor so that you can begin filling out your form.

Step 2: This tool will let you change most PDF documents in various ways. Change it by writing personalized text, adjust original content, and place in a signature - all doable in minutes!

This PDF doc will involve some specific information; in order to guarantee consistency, please be sure to adhere to the recommendations hereunder:

1. The hcs requires specific information to be inserted. Make certain the next blank fields are filled out:

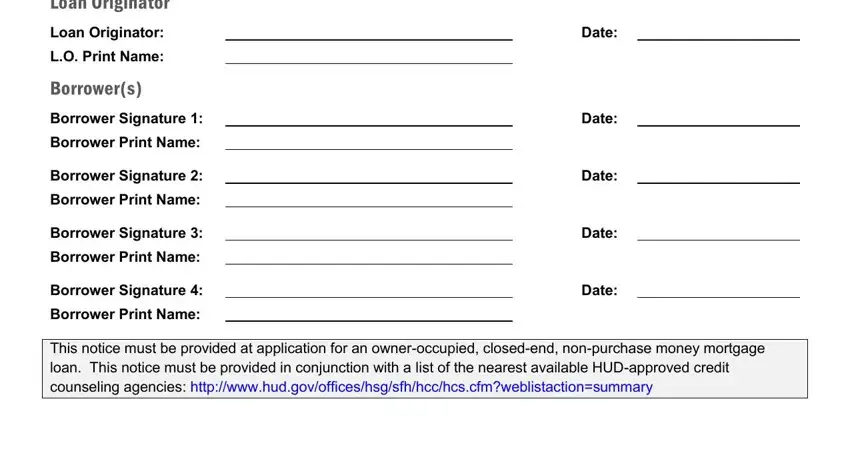

2. Once your current task is complete, take the next step – fill out all of these fields - Loan Originator, Loan Originator, LO Print Name, Borrowers, Borrower Signature, Borrower Print Name Borrower, Borrower Print Name Borrower, Borrower Print Name Borrower, Date, Date, Date, Date, Date, and Borrower Print Name This notice with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be really mindful when filling in LO Print Name and Borrower Print Name Borrower, because this is where a lot of people make some mistakes.

Step 3: Prior to finishing the form, make sure that blanks were filled in the proper way. When you verify that it's correct, click “Done." Create a free trial subscription with us and gain direct access to hcs - available inside your FormsPal account page. FormsPal is invested in the confidentiality of all our users; we ensure that all personal information processed by our editor is kept secure.