When working in the online PDF editor by FormsPal, it is easy to fill out or edit new jersey form cri 200 right here. In order to make our editor better and less complicated to utilize, we consistently design new features, taking into consideration feedback from our users. To get started on your journey, consider these basic steps:

Step 1: Simply hit the "Get Form Button" at the top of this page to open our pdf form editor. There you will find everything that is needed to fill out your document.

Step 2: As soon as you start the online editor, you will get the document all set to be filled in. Apart from filling out various blank fields, you might also perform some other actions with the PDF, specifically putting on custom text, editing the initial textual content, inserting illustrations or photos, placing your signature to the document, and much more.

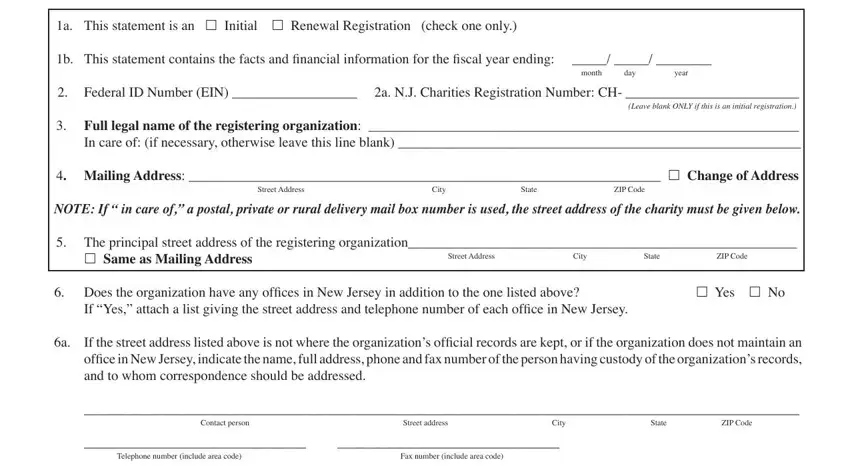

This document requires particular info to be entered, therefore be sure to take the time to enter what's expected:

1. It is important to complete the new jersey form cri 200 accurately, thus be mindful when filling out the sections containing all of these blanks:

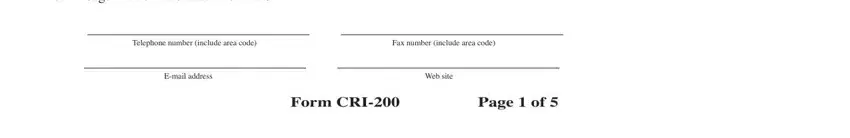

2. Soon after completing the previous step, go to the next step and complete the essential details in all these blank fields - Organizations contact information, Telephone number include area, Fax number include area code, Email address, Web site, and Form CRI Page of.

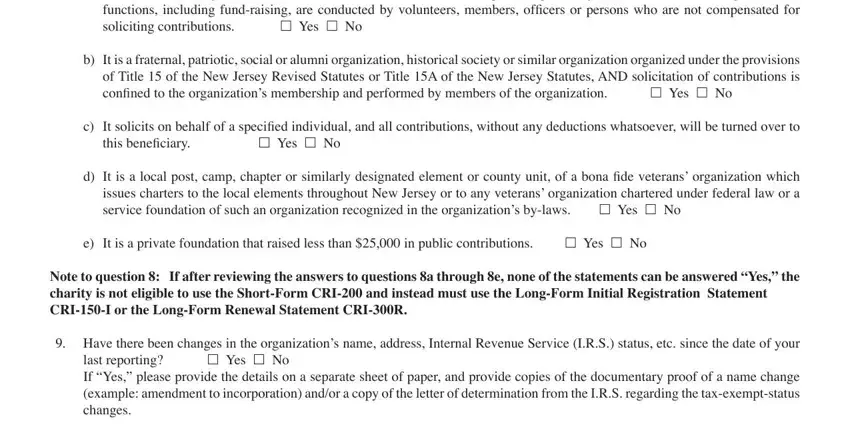

3. Your next stage is going to be straightforward - fill out all of the form fields in a It did not receive gross, The organization is eligible to, b It is a fraternal patriotic, this beneiciary, Yes No, Yes No, Yes No, e It is a private foundation that, Have there been changes in the, last reporting If Yes please, and Yes No to conclude this segment.

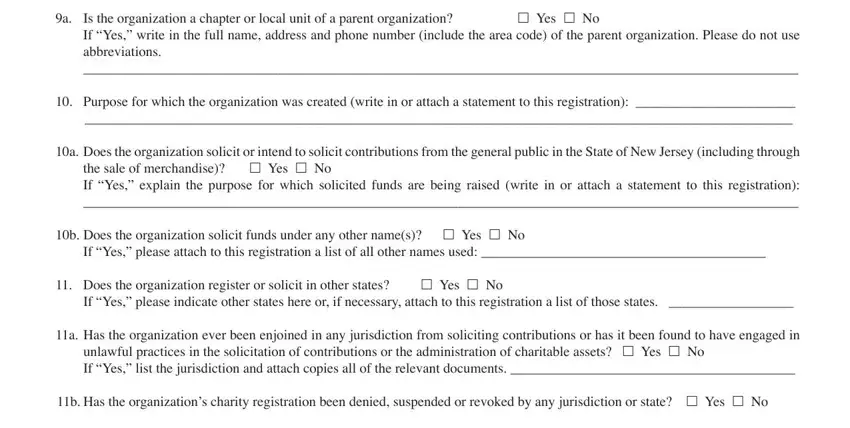

4. Filling out a Is the organization a chapter or, Yes No, If Yes please attach to this, the sale of merchandise Yes No, and a Does the organization solicit or is essential in this part - make sure you don't rush and be mindful with each and every empty field!

Be really careful while filling out If Yes please attach to this and a Is the organization a chapter or, as this is the part in which many people make some mistakes.

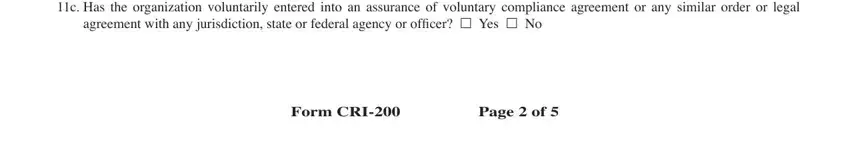

5. The last section to submit this PDF form is crucial. Be sure you fill out the mandatory form fields, consisting of a Does the organization solicit or, agreement with any jurisdiction, and Form CRI Page of, prior to finalizing. Failing to do this might give you an incomplete and probably invalid paper!

Step 3: Before getting to the next stage, it's a good idea to ensure that form fields have been filled in right. As soon as you’re satisfied with it, press “Done." Sign up with us today and immediately use new jersey form cri 200, available for download. All changes you make are kept , which means you can change the file at a later stage as needed. We do not share the information you provide whenever completing documents at FormsPal.