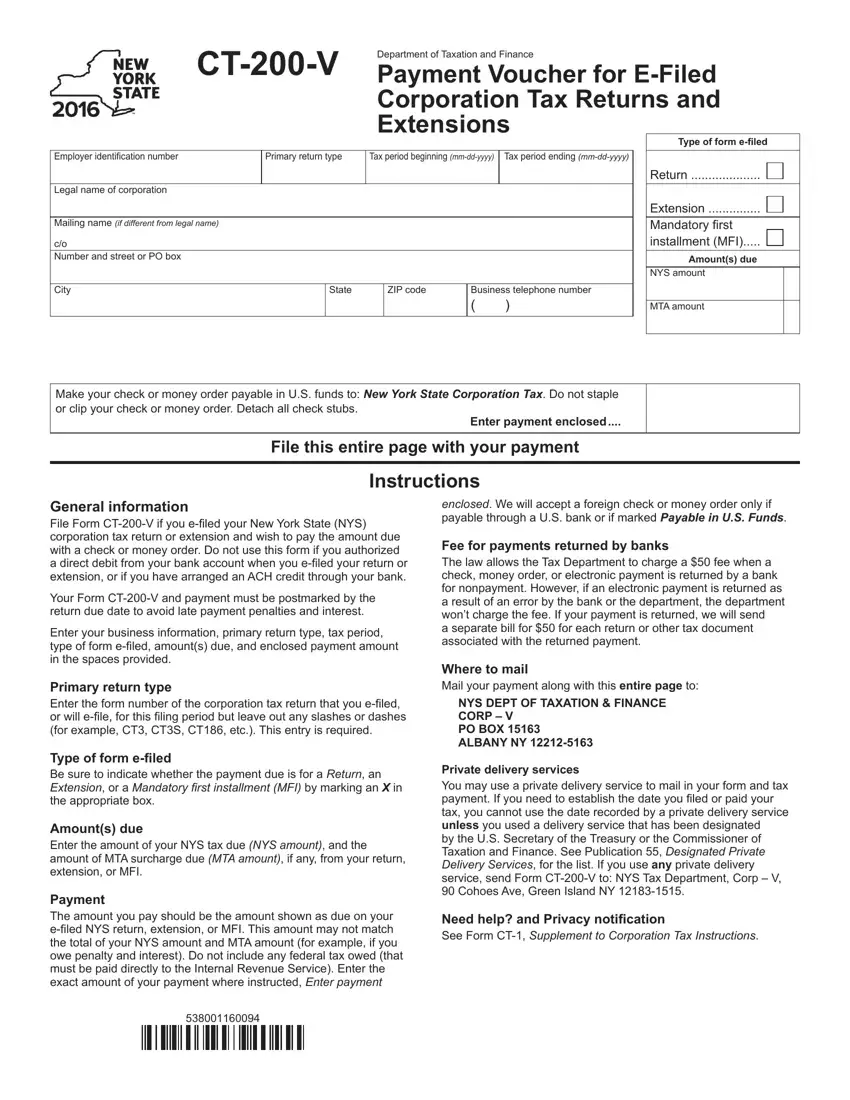

General information

File Form CT-200-V if you e-iled your New York State (NYS) corporation tax return or extension and wish to pay the amount due with a check or money order. Do not use this form if you authorized a direct debit from your bank account when you e-iled your return or extension, or if you have arranged an ACH credit through your bank.

Your Form CT-200-V and payment must be postmarked by the return due date to avoid late payment penalties and interest.

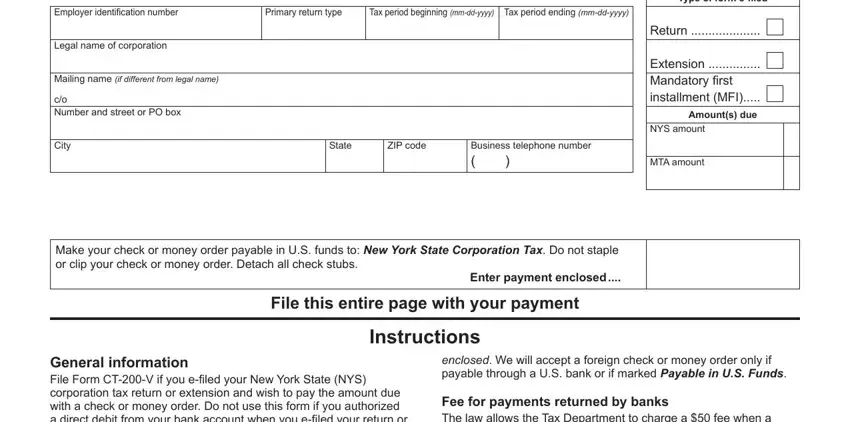

Enter your business information, primary return type, tax period, type of form e-iled, amount(s) due, and enclosed payment amount in the spaces provided.

Primary return type

Enter the form number of the corporation tax return that you e-iled, or will e-ile, for this iling period but leave out any slashes or dashes (for example, CT3, CT3S, CT186, etc.). This entry is required.

Type of form e-iled

Be sure to indicate whether the payment due is for a RETURN, an EXTENSION, or a Mandatory irst installment (MFI) by marking an X in the appropriate box.

Amount(s) due

Enter the amount of your NYS tax due (NYS amount), and the amount of MTA surcharge due (MTA amount), if any, from your return, extension, or MFI.

Payment

The amount you pay should be the amount shown as due on your e-iled NYS return, extension, or MFI. This amount may not match the total of your NYS amount and MTA amount (for example, if you owe penalty and interest). Do not include any federal tax owed (that must be paid directly to the Internal Revenue Service). Enter the exact amount of your payment where instructed, Enter payment

enclosed. We will accept a foreign check or money order only if payable through a U.S. bank or if marked Payable in U.S. Funds.

Fee for payments returned by banks

The law allows the Tax Department to charge a $50 fee when a check, money order, or electronic payment is returned by a bank for nonpayment. However, if an electronic payment is returned as a result of an error by the bank or the department, the department won’t charge the fee. If your payment is returned, we will send

a separate bill for $50 for each return or other tax document associated with the returned payment.

Where to mail

Mail your payment along with this entire page to:

NYS DEPT OF TAXATION & FINANCE

CORP – V

PO BOX 15163

ALBANY NY 12212-5163

Private delivery services

You may use a private delivery service to mail in your form and tax payment. If you need to establish the date you iled or paid your tax, you cannot use the date recorded by a private delivery service unless you used a delivery service that has been designated

by the U.S. Secretary of the Treasury or the Commissioner of Taxation and Finance. See Publication 55, Designated Private Delivery Services, for the list. If you use any private delivery service, send Form CT-200-V to: NYS Tax Department, Corp – V, 90 Cohoes Ave, Green Island NY 12183-1515.

Need help? and Privacy notiication

See Form CT-1, Supplement to Corporation Tax Instructions.