Should you wish to fill out ct child support forms, there's no need to install any kind of applications - simply try using our PDF tool. FormsPal team is always working to improve the tool and ensure it is much better for people with its handy functions. Unlock an ceaselessly innovative experience today - take a look at and uncover new possibilities along the way! With just several basic steps, you can start your PDF journey:

Step 1: Simply click the "Get Form Button" at the top of this page to access our pdf form editor. There you will find everything that is required to work with your document.

Step 2: After you start the editor, you'll see the form all set to be completed. Apart from filling out various blank fields, you might also perform various other things with the form, specifically writing custom words, editing the initial textual content, adding illustrations or photos, putting your signature on the document, and more.

This form will require particular data to be entered, so make sure to take some time to enter what is expected:

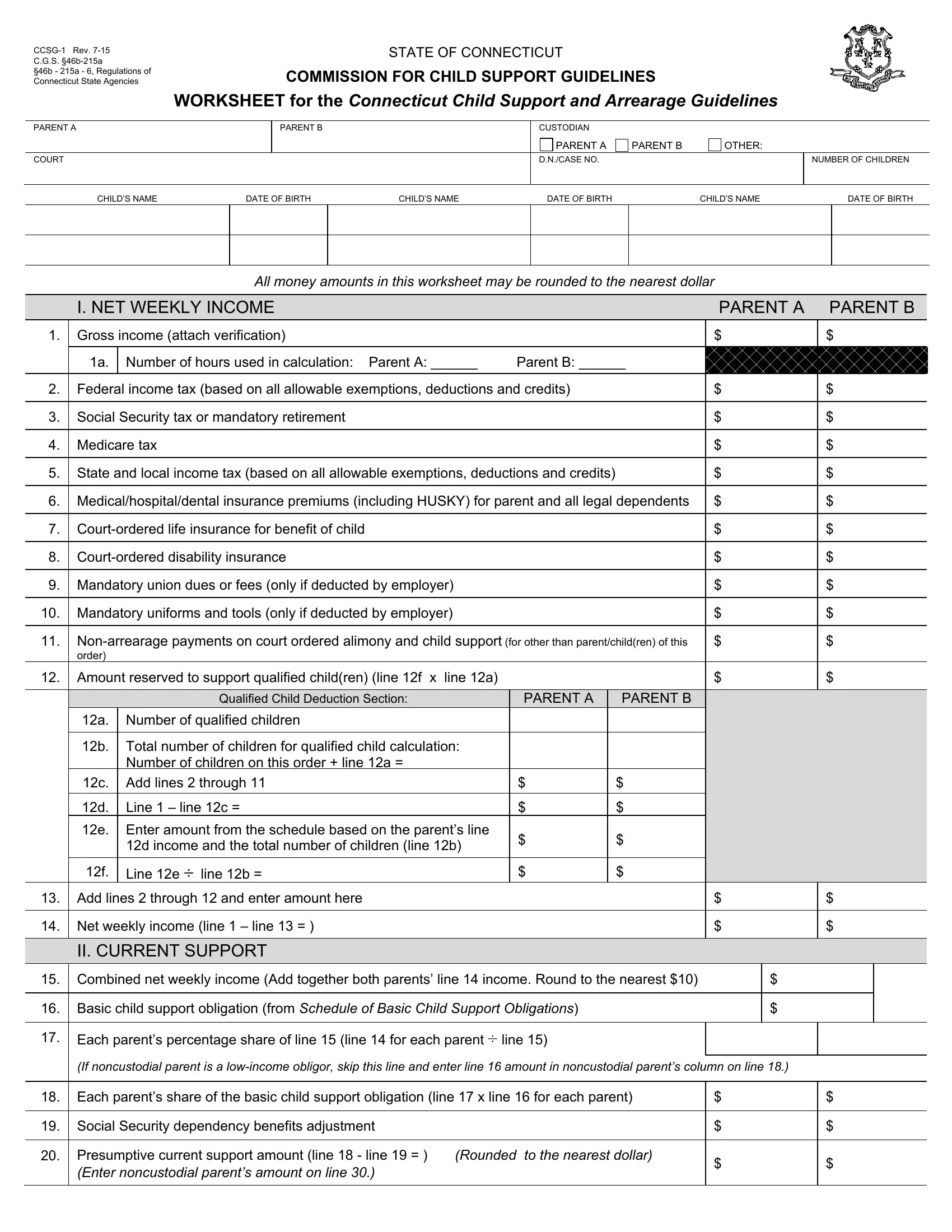

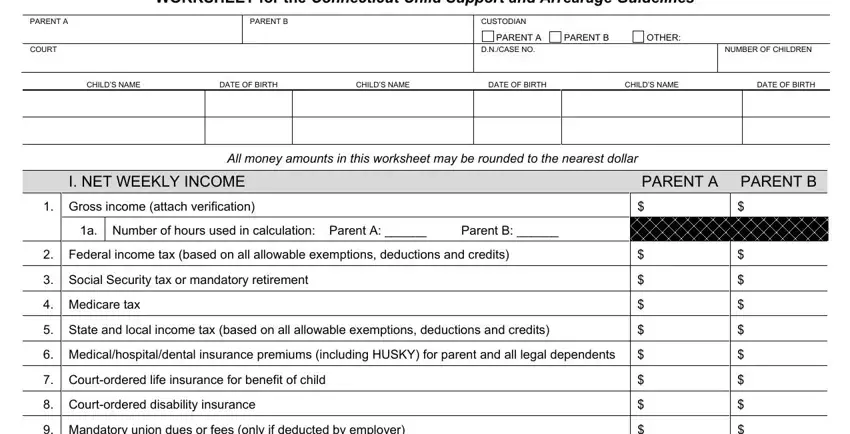

1. You will want to fill out the ct child support forms properly, thus be mindful when working with the parts containing these blank fields:

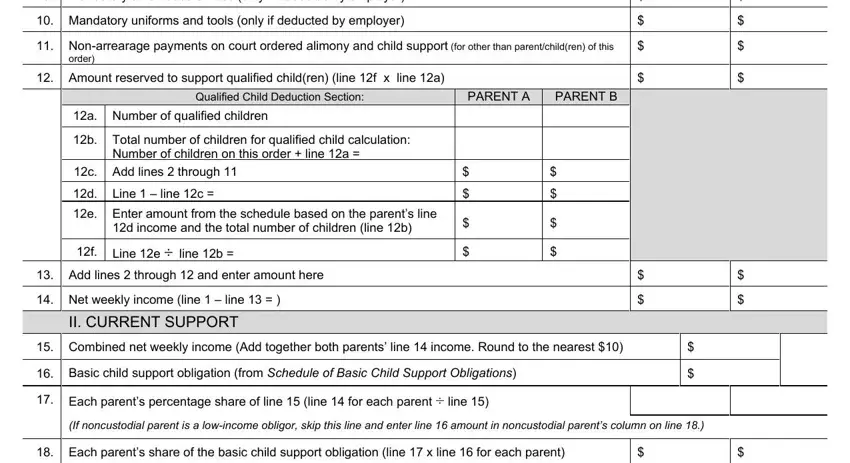

2. After the previous segment is completed, you'll want to add the essential particulars in Mandatory union dues or fees only, Mandatory uniforms and tools only, Nonarrearage payments on court, order, Amount reserved to support, Qualified Child Deduction Section, PARENT A, PARENT B, a Number of qualified children, b Total number of children for, Number of children on this order, c Add lines through, Line line c, e Enter amount from the schedule, and d income and the total number of in order to move on to the 3rd stage.

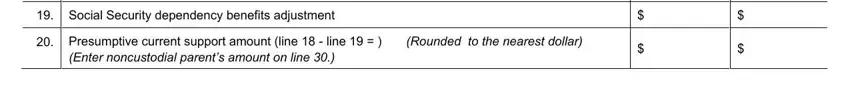

3. The third stage is generally hassle-free - fill out all of the form fields in Social Security dependency, Presumptive current support, and Enter noncustodial parents amount to conclude this process.

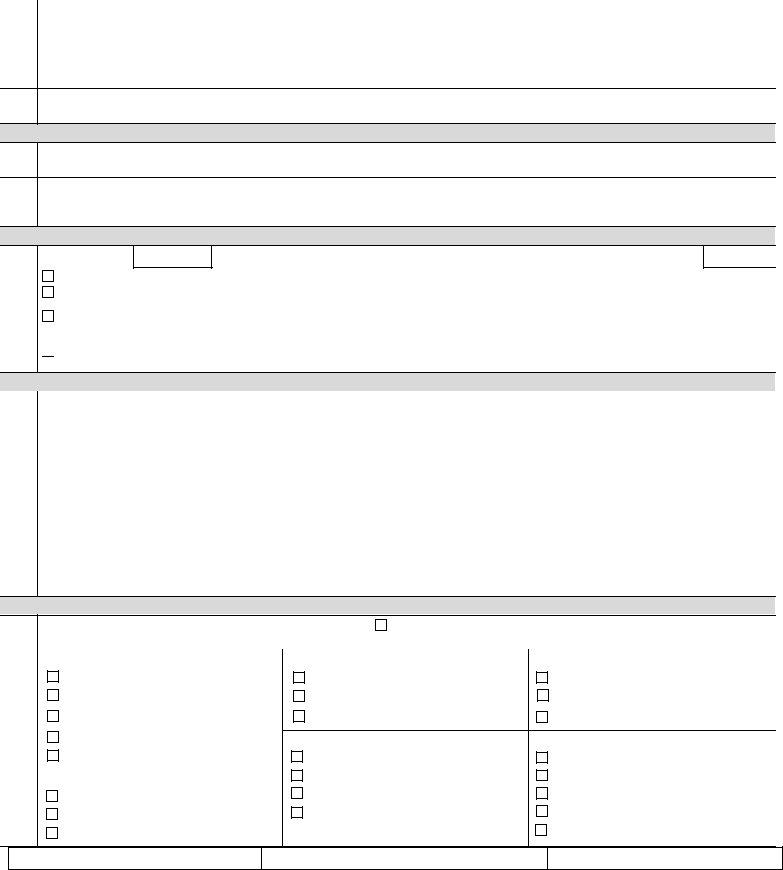

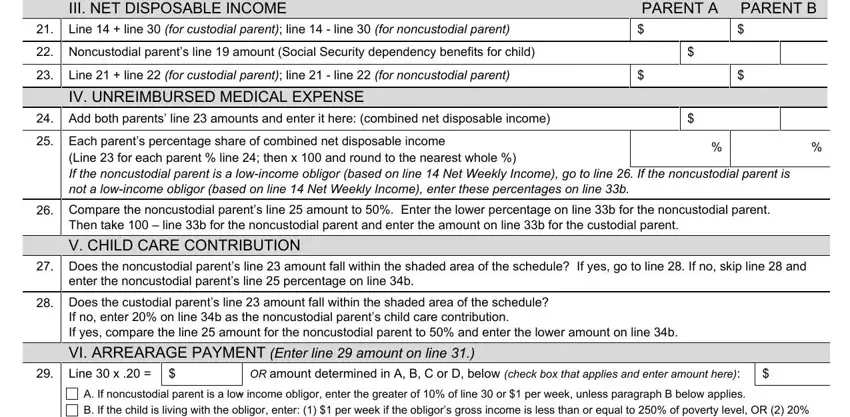

4. Filling out III NET DISPOSABLE INCOME, Line line for custodial parent, Noncustodial parents line amount, PARENT A, PARENT B, Line line for custodial parent, IV UNREIMBURSED MEDICAL EXPENSE, Add both parents line amounts, Each parents percentage share of, Line for each parent line then, Compare the noncustodial parents, Then take line b for the, Does the noncustodial parents, enter the noncustodial parents, and Does the custodial parents line is key in the next form section - make certain that you be patient and be mindful with each empty field!

It's simple to get it wrong when filling in the Line line for custodial parent, therefore be sure you reread it before you decide to finalize the form.

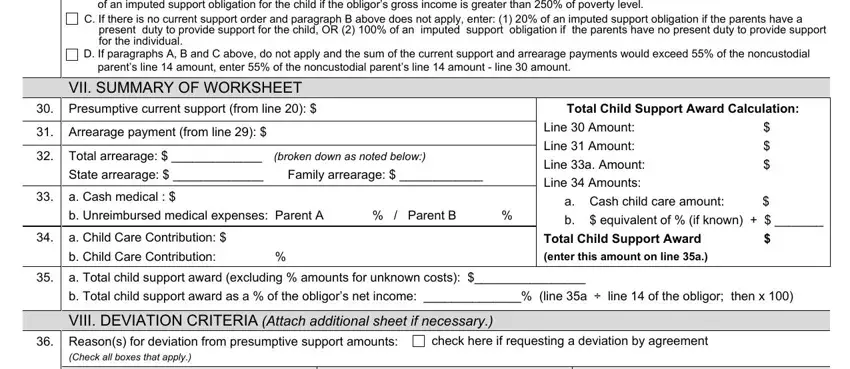

5. This pdf needs to be finalized with this area. Further one can find a comprehensive set of form fields that require correct information in order for your form submission to be accomplished: of an imputed support obligation, C If there is no current support, present duty to provide support, D If paragraphs A B and C above do, parents line amount enter of the, VII SUMMARY OF WORKSHEET, Presumptive current support from, Arrearage payment from line, Total arrearage, broken down as noted below, State arrearage Family arrearage, a Cash medical, Total Child Support Award, Line Amount Line Amount, and Line a Amount Line Amounts.

Step 3: Just after going through the fields and details, press "Done" and you're all set! Download your ct child support forms as soon as you join for a 7-day free trial. Immediately get access to the form in your personal account page, with any edits and changes being all preserved! We do not sell or share the details that you type in whenever dealing with documents at our website.