Using PDF files online can be easy using our PDF editor. Anyone can fill out PCS here painlessly. The tool is consistently maintained by us, acquiring cool features and becoming a lot more convenient. Getting underway is effortless! All you need to do is follow the following easy steps down below:

Step 1: First of all, access the editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: The tool offers you the capability to change PDF forms in a variety of ways. Modify it with personalized text, correct existing content, and put in a signature - all doable in no time!

Be attentive while filling out this pdf. Make sure that each blank field is filled out correctly.

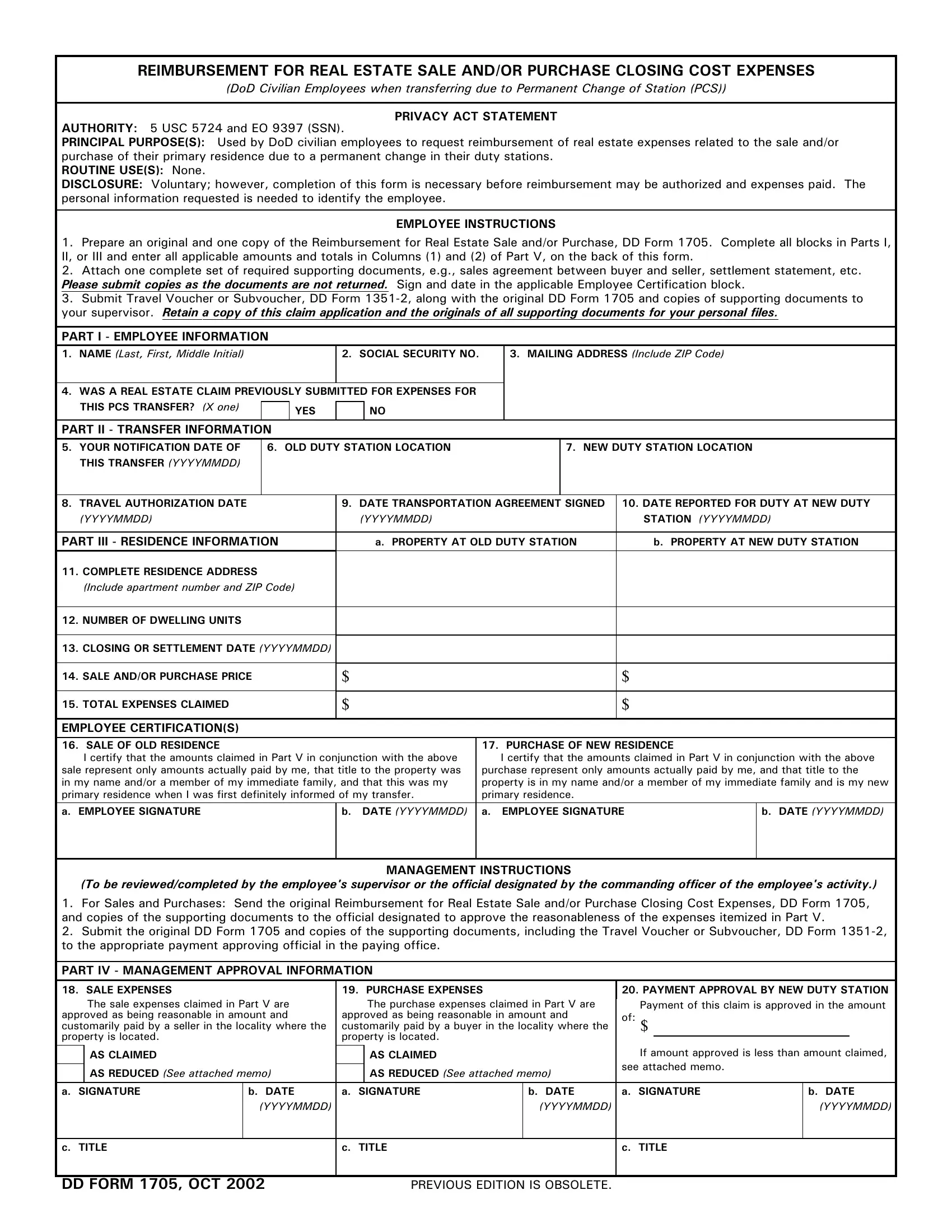

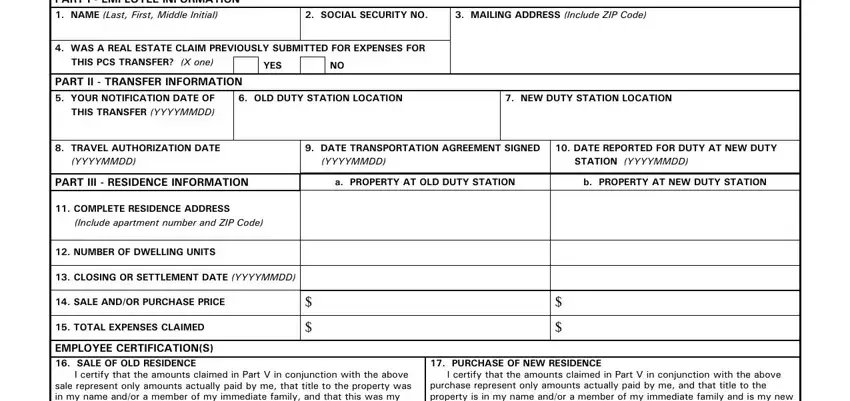

1. The PCS needs certain details to be inserted. Ensure the next blanks are finalized:

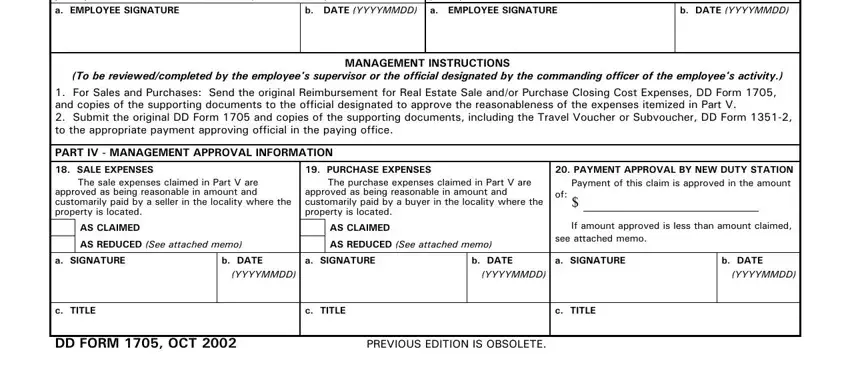

2. Once your current task is complete, take the next step – fill out all of these fields - EMPLOYEE CERTIFICATIONS SALE OF, b DATE YYYYMMDD, PURCHASE OF NEW RESIDENCE I, b DATE YYYYMMDD, To be reviewedcompleted by the, MANAGEMENT INSTRUCTIONS, PART IV MANAGEMENT APPROVAL, PURCHASE EXPENSES The purchase, PAYMENT APPROVAL BY NEW DUTY, If amount approved is less than, a SIGNATURE, b DATE YYYYMMDD, a SIGNATURE, b DATE YYYYMMDD, and a SIGNATURE with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

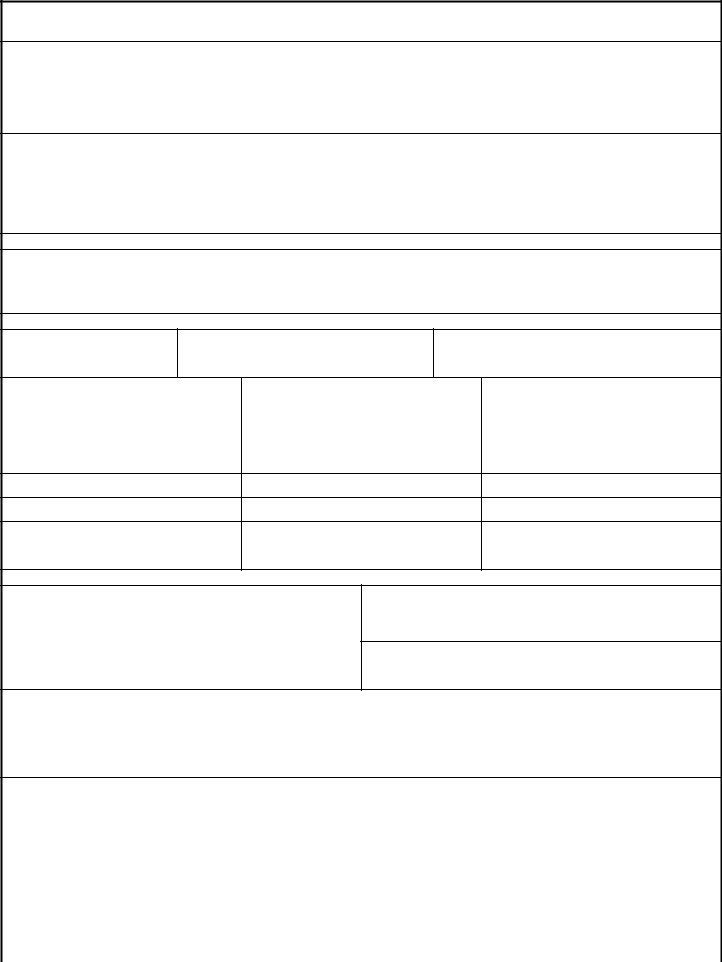

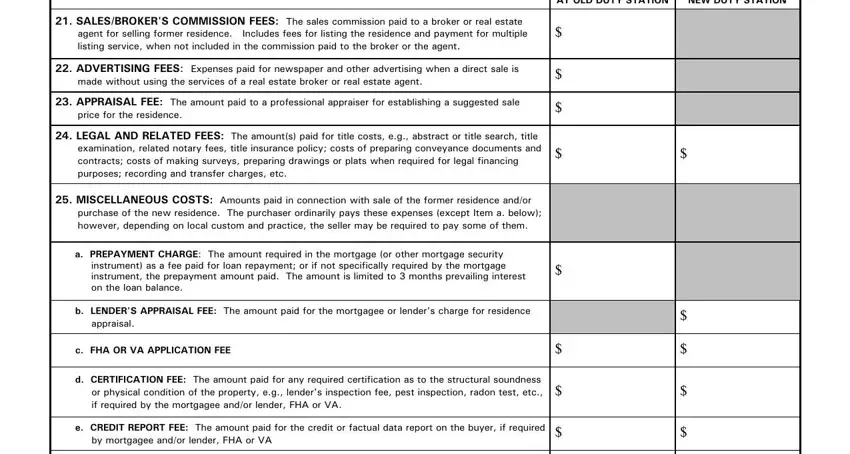

3. The following section is focused on AT OLD DUTY STATION, NEW DUTY STATION, SALESBROKERS COMMISSION FEES The, ADVERTISING FEES Expenses paid, APPRAISAL FEE The amount paid to, LEGAL AND RELATED FEES The, MISCELLANEOUS COSTS Amounts paid, a PREPAYMENT CHARGE The amount, b LENDERS APPRAISAL FEE The amount, c FHA OR VA APPLICATION FEE, d CERTIFICATION FEE The amount, and e CREDIT REPORT FEE The amount - fill in these blank fields.

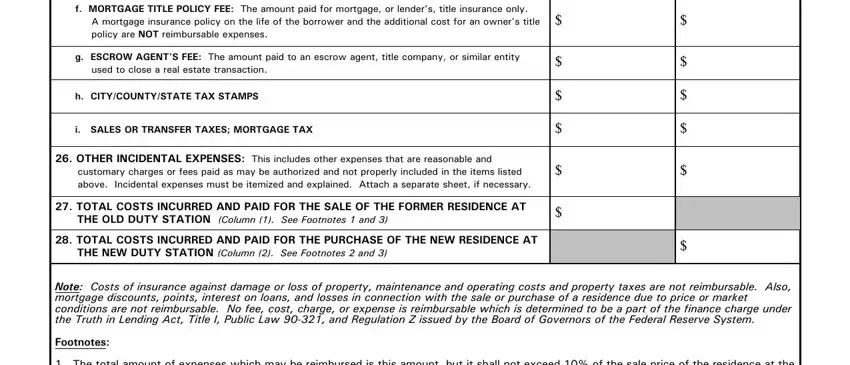

4. Filling out f MORTGAGE TITLE POLICY FEE The, g ESCROW AGENTS FEE The amount, h CITYCOUNTYSTATE TAX STAMPS, i SALES OR TRANSFER TAXES MORTGAGE, OTHER INCIDENTAL EXPENSES This, TOTAL COSTS INCURRED AND PAID FOR, TOTAL COSTS INCURRED AND PAID FOR, Note Costs of insurance against, Footnotes, and The total amount of expenses is vital in the fourth section - you'll want to take the time and fill out every single field!

When it comes to TOTAL COSTS INCURRED AND PAID FOR and TOTAL COSTS INCURRED AND PAID FOR, ensure that you double-check them here. Both of these are surely the most important fields in this PDF.

Step 3: Revise what you have entered into the form fields and then press the "Done" button. Join FormsPal today and instantly get access to PCS, set for downloading. All adjustments made by you are preserved , helping you to modify the pdf later as needed. We do not sell or share any information you use whenever working with documents at our website.