In the intricate web of financial obligations and recovery, the DD Form 2481 emerges as a pivotal document designed to facilitate the recovery of debts owed to the United States by means of salary offset. Grounded in the principles of the Privacy Act of 1974, this form ensures that an individual's data is handled with the utmost care and confidentiality. Its structured format requires detailed identification of both the paying office and the employee from whom the debt recovery is sought, including personal and contact information which lays the groundwork for a clear and organized process. The form delves into the specifics of the debt, such as the reason, amount, and the terms for recovery, which includes the calculation of any interest, penalties, and administrative costs, cumulatively guiding the amount and schedule of deductions from the employee's salary. Critical to ensuring fairness and compliance with due process, the form outlines the steps taken before salary offset begins, including any hearings or opportunities for the employee to respond. The signatures and certifications from the creditor component serve as a testament to the validity of the debt and the adherence to regulatory parameters. Ultimately, the coordination between the originating agency and the Defense Finance and Accounting Services (DFAS) underscores the meticulous review and routing process integral to the execution of salary offsets, ensuring that each debt recovery is justified and processed with precision.

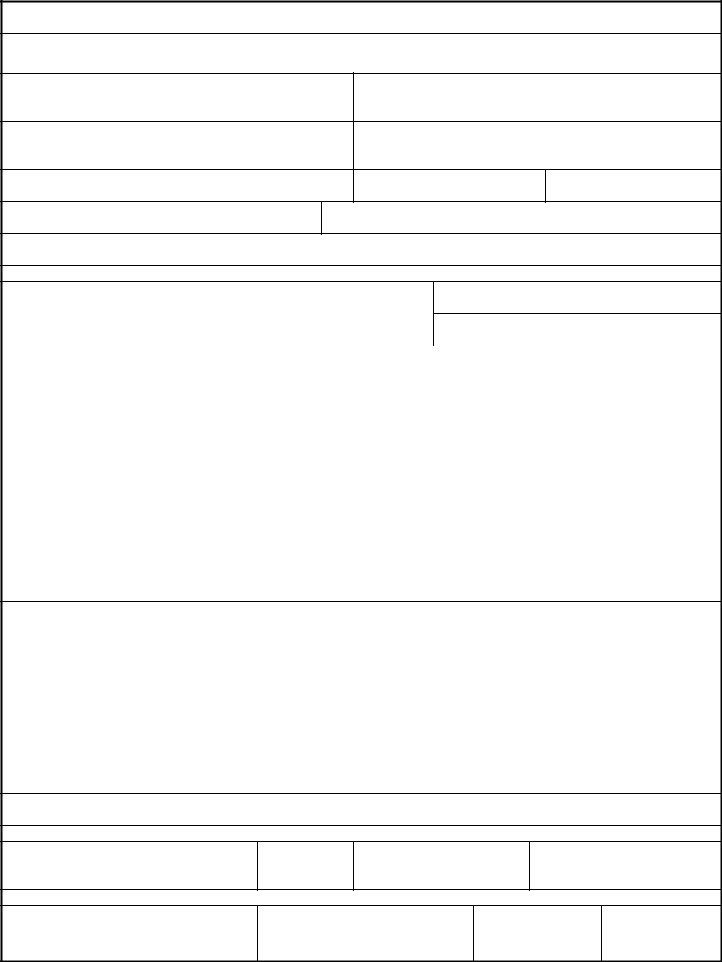

| Question | Answer |

|---|---|

| Form Name | Dd Form 2481 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | dd2481 form, 2481in, dd2481, blank dd2481 |

REQUEST FOR RECOVERY OF DEBT DUE THE UNITED STATES BY SALARY OFFSET

PRIVACY ACT NOTICE

The data on this form is covered by the Privacy Act of 1974, as amended, 5 U.S.C. Section 552a.

1. |

PAYING OFFICE IDENTIFICATION |

2. |

EMPLOYEE IDENTIFICATION |

|

|

|

|

a. |

NAME |

a. |

NAME (Last, First, Middle Initial) |

b.ADDRESS (Street, City, State and Zip Code)

b.ADDRESS (Street, City, State and Zip Code)

c. CONTACT NAME (Last, First, Middle Initial)

c. DATE OF BIRTH (YYYYMMDD)

d. SOCIAL SECURITY NUMBER

d.

e. TELEPHONE NO. (DSN and Commercial)

To liquidate a debt to the United States, the named Creditor Component asks that the debt be collected as shown from the current pay of the employee identified above. Notices and inquiries concerning the debt should be sent to the address shown below.

3.DEBT INFORMATION a. REASON FOR DEBT

b. DATE RIGHT TO COLLECT ACCRUED (YYYYMMDD)

c. DEBT IDENTIFICATION NUMBER, IF ANY

d. ORIGINAL DEBT AMOUNT |

$ |

e. NUMBER OF INSTALLMENTS |

(1) @ |

(2) Amount |

|

|

|

|

|

f. INTEREST DUE (If none, show N/A) |

$ |

|

|

$ |

|

|

|

|

|

g. PENALTY DUE (If none, show N/A) |

$ |

|

|

$ |

|

|

|

|

|

h. ADMINISTRATIVE COST (If none, show N/A) |

$ |

|

|

$ |

|

|

|

|

|

i. TOTAL COLLECTION TO BE MADE |

$ |

j. COMMENCE DEDUCTIONS ON (YYYYMMDD) |

|

|

|

|

|

|

|

4.DUE PROCESS (X applicable items and either enter date action taken in Column (1) or X Column (2) or (3) and attach acknowledgement or consent.)

|

|

(1) Date Action |

(2) Acknow- |

(3) |

|

|

(1) Date Action |

(2) Acknow- |

(3) |

|

|

Taken |

ledgement |

Consent |

|

|

Taken |

ledgement |

Consent |

|

a. CREDITOR COMPONENT 30 |

|

|

|

|

d. HEARING HELD |

|

|

|

|

DAY SALARY OFFSET NOTICE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. EMPLOYEE DID NOT RESPOND |

|

|

|

|

e. DECISION FOR CREDITOR |

|

|

|

|

(Consent assumed) |

|

|

|

|

COMPONENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. EMPLOYEE REQUESTED A |

|

|

|

|

f. OTHER (Specify) |

|

|

|

|

HEARING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify the following:

(1)The debt identified above is properly due the United States from the named employee in the amount shown;

(2)This Agency's regulations implementing 5 U.S.C. 5514 have been approved by the Office of Personnel Management; and

(3)The information concerning this Component's and the employee's actions is correct as stated.

5.CREDITOR COMPONENT INFORMATION

a. NAME |

|

b. ADDRESS (Street, City, State and Zip Code) |

|

|

|

|

|

c. CONTACT NAME (Last, First, Middle Initial) |

d. |

|

e. TELEPHONE NO. (DSN and Commercial) |

|

|

|

|

f. ACCOUNTING CLASSIFICATION (Line of Accounting) |

|

|

|

g.DOCUMENT NUMBER

h.CERTIFYING OFFICIAL

(1) Signature |

(2) Date Signed |

(3) Title |

(4) Telephone No. (DSN and Commercial) |

(YYYYMMDD)

6. DFAS ACCOUNTING OFFICE

a. OFFICE, SYMBOL, AND PROCESSOR'S NAME b.

c.TELEPHONE NO.

(DSN and Commercial)

d.DATE (YYYYMMDD)

DD FORM 2481, APR 2006 |

PREVIOUS EDITION IS OBSOLETE. |

Adobe Professional 7.0 |

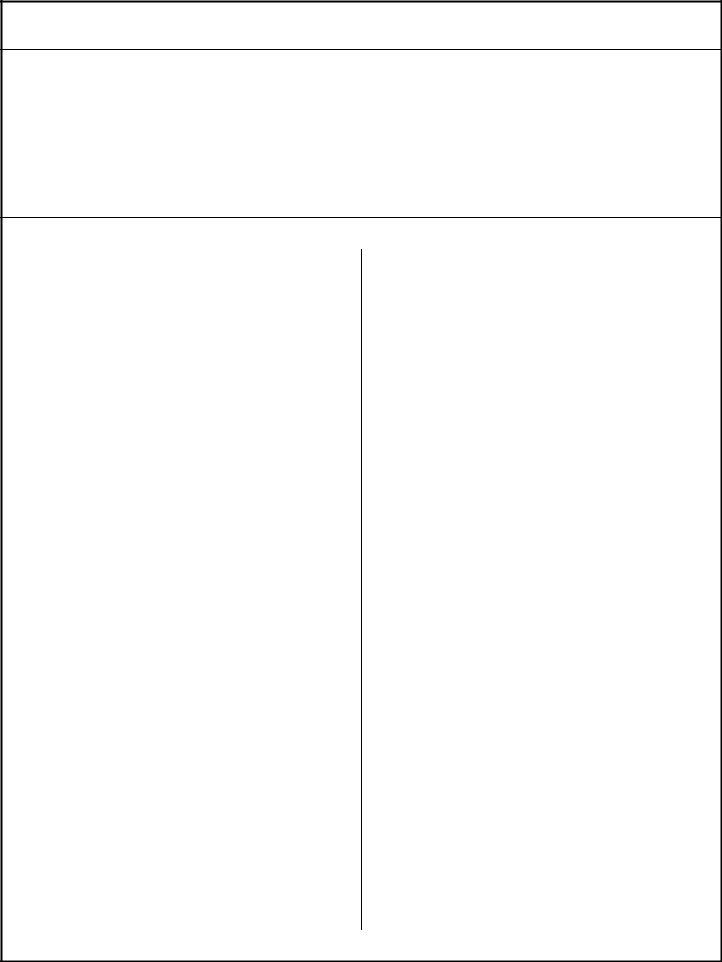

INSTRUCTIONS

1. PURPOSE OF THIS FORM:

Used primarily for requesting recovery of a debt by salary offset and certifying that due process has been completed when debtor has not responded to a demand for payment, requested a hearing, or refuted the creditor component's proposed installment deductions.

2. ROUTING AND REVIEW PROCESS:

a.The installation or originating activity, identified in Item 5, Creditor Component Information, will complete Items 1 - 5 of DD Form 2481 and forward it to the appropriate supporting DFAS accounting office.

b.The DFAS accounting office will review the accounting data located in Item 5 of DD Form 2481 to verify that the Line of Accounting (LOA) is correct and then complete Item 6. If the LOA is not in the proper format or appears to be invalid, the accounting office will coordinate with the installation or originating activity to ensure correct accounting data.

c.The DFAS accounting office will ensure the LOA and document number is clearly readable and properly formatted for the current Defense Civilian Pay System (DCPS) accounting screens. The DFAS accounting office will record an accounts receivable (if none exist) and will transmit the original DD Form 2481 to the correct payroll office for entry into DCPS.

d.The DFAS accounting office will maintain a copy of the DD Form 2481in accordance with the DFAS

e.The payroll office will not accept DD Form 2481 or other collection documents from any source other than a DFAS accounting office.

f.The payroll office will process all DD Form 2481s received from a DFAS accounting office upon receipt.

3. COMPLETING THIS FORM:

a.Items 1 - 5 will be completed by the creditor.

(1)Item 1 - Name and address of the DFAS Paying Office responsible for the processing of the salary offset. Include a contact person and

(2)Item 2 - Name, address, date of birth and social security number of the individual for whom a salary offset is requested.

(3)Item 3 - Specific information and justification of debt.

(4)Item 4 - Annotate the appropriate Due Process given to the individual for whom a salary offset is requested.

(5)Item 5 - Name and address of organization initiating collection. Include contact name,

b.Item 6 - This item is completed by the DFAS accounting office. Indicate office with symbol,

DD FORM 2481, APR 2006