In the USA, those employees who, out of non-work reasons, have lost their wages partially or entirely can participate in the Disability Insurance benefits program. The program is based on the workers’ funding. Commonly named SDI, the California program was initiated by the EDD, the Employment Disability Insurance. In the periods of the worker’s disability to perform their job-related duties, the insurance deals with their wages. Among the cases when such measures are commonly applied are injuries—mental and physical— or certain wellbeing conditions.

Who Can Benefit From the SDI

According to recent research, the majority of Californian employees are under coverage by the SDI. This means the workers are able to get particular benefits implied by the program once the applicant is found eligible for the matter. There are also certain limitations as to the range of employees who have the opportunity to claim the insurance. Among them there are election campaign employees and those individuals working on school projects.

It is advisable that one should inquire from their management whether the employer takes part in the SDI insurance program.

Requirements for Getting the SDI Benefits

If a disability of the applicant has been proven, they can qualify for receiving the benefits granted by the SDI program in California. Besides that, one should be currently undergoing health-care treatment at a certified clinic headed by a licensed professional or a religious trustee with due authorization. The amount of your income during the period called the “base period” must be significant. It is recommended that the application be made as quickly as possible, as soon as the injury has been received.

There is also a timeframe required for the claimers to fit in with the application process: 41 days starting from the very date of the start of the disability that reduced your working capacity so that you stopped being able to work or attending job interviews and conduct the overall search for the new job. It should be noted that one does not ultimately lose the chance to be found eligible for the SDI even if they miss the deadline. It can be possible if one can provide a valid reason for their inability to meet the required timeframe requirements. One of such reasons can be misunderstanding o the order of the application and related procedures as a result of an unclear conversation with the EDD specialist, for example.

How to Apply

There are two ways one can apply for the SDI program benefits:

- Official EDD web page

In any case, one has to complete the application and fill out the required form. To embrace the accuracy and legitimacy of the form, it is advised that it should be carefully filled out. You can do it safely with the help of our form-building software located on our website.

What are the Benefits?

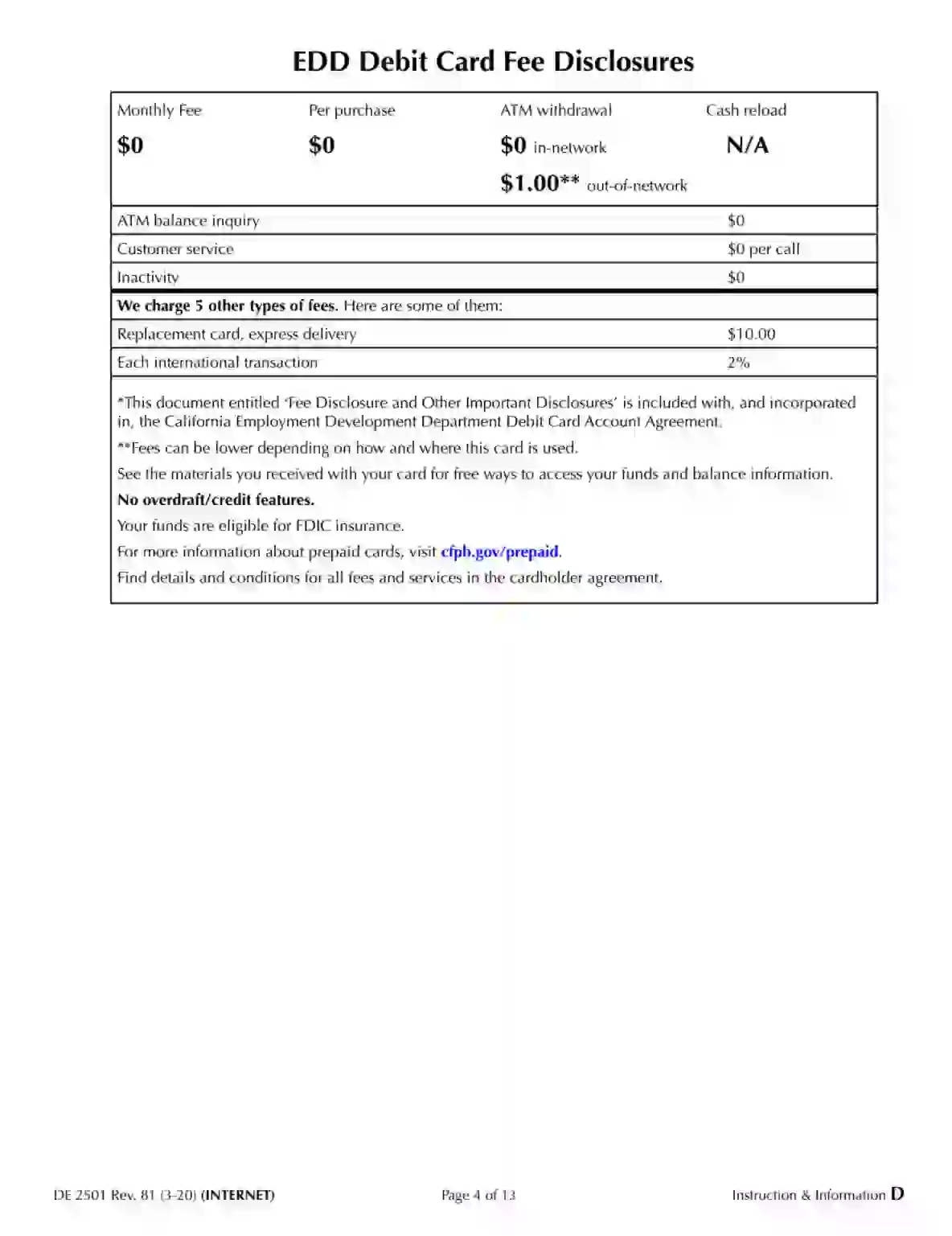

It depends. Largely, on the amount of money, you earned during the quarter of the topmost earnings. In this case, the benefits will amount to 60—70% of the norm. Sometimes, the benefit can be up to $1,216 weekly while being distributed twice a month.

During the entire time of your disability that prevents you from your job responsibilities, one can continue receiving the SDI benefits. The maximum is 52 weeks, but there are situations when the account of the applicant has insufficient funds, there is no guarantee they will receive full-year SDI benefits. The information concerning the number of earnings available on your reserve account can be found in a statement from the EDD you get during the application process.

If a disability period exceeds 52 weeks, the person who has it can qualify eligible for receiving SSDI or SSI benefits. The kind of benefit largely depends on the kind of disability preventing the person from working. The severity of the disability is a serious factor in the benefit distribution.

Besides that, there are private kinds of insurance provided in some companies. Named Long Term Disability Insurance, the insurance is aimed to cover cases of prolonged disability periods. There are certain limitations as to the range of individuals subject to benefits. You can clarify the issue by asking your employer.

As to individuals who qualify as self-employed, the SDI coverage is provided to them in case they participate in Disability Insurance Elective Coverage. The fee should be paid, too.

If You Get Injured at Work

If one gets an injury during their work activities, the SDI benefits can be received in two specific cases:

- The sum of money you get from the Workers’ Compensation payment is less than the plausible SDI one.

- In case of a delay occurring in a Worker Compensation application procedure.

In all other cases, when you get injured at work, the order of actions you should take differs: claim for temporary income replacement.

In cases when an employer provides short-term benefits to temporarily disabled employees, they can also apply for receiving the SDI benefits too. The benefits must be integrated. In this case, you will receive the money from the EDD.

As to the seven-day waiting period, one can utilize their sick or vacation payment as coverage.

In the following part of the piece, we will walk you through the major steps one should take to apply for the SDI benefits.

Other California Forms

There are more fillable California forms accessible with our editor. Just below, we selected several of the more popular PDFs under this category. Moreover, keep in mind that you can easily upload, fill out, and edit any PDF document at FormsPal.

Instructions to Fill Out The Form

Here are certain recommendations to all applicants for the SDI benefits:

- You should fill out the form using black ink exclusively.

- The information should be put accurately within the designated boxes in the form.

- Your social security number must be put on each page of the form.

- Faxing the form is not allowed.

- After the form is completed, you should mail it to the EDD within the designated envelope. In case the claim is late, you can be rejected.

The Essential Requirements

- All the items in part A should be completed, and Box A40 SIgned. Be careful filling out the form for any mistakes you make will entail a return of the claim or postpone the payment. Mind to put “PMB” initials on your private mailbox to ensure the Postal Service of America delivers the paper.

- A physician or a practitioner (a licensed specialist is required) should have Part B completed and signed. The physician must have the authority to verify and certify the claimer’s medical condition and the extent of its severity.

- The date when your claim should start must be chosen carefully. Remember that the amount of benefit you get depends on the choice of the date.

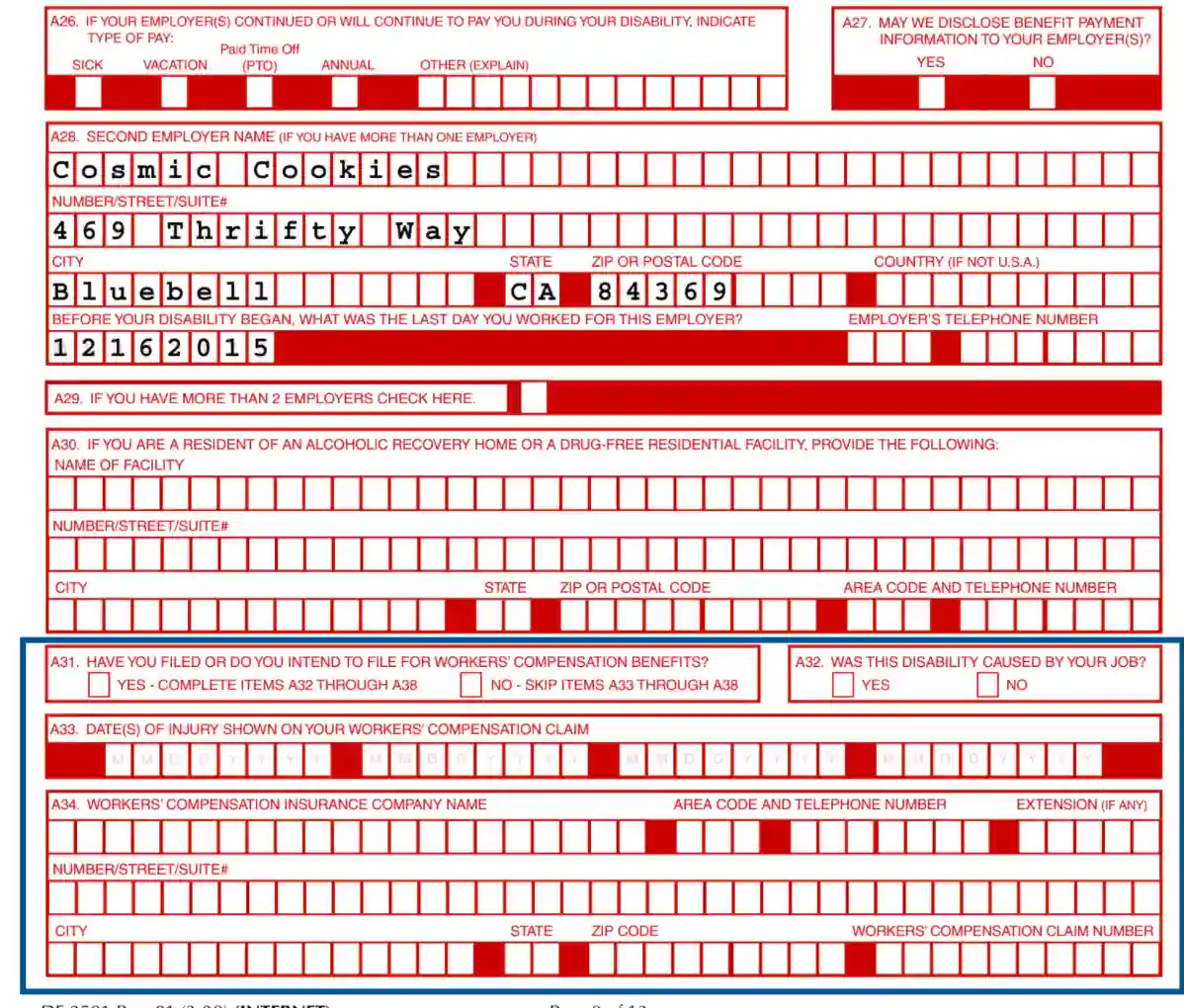

- In case your injury is job-related, fill out A31—A38. The status letter should be attached if your claims have been previously accepted, rejected, or postponed.

- Complete the form, put the signs, and put it in the envelope which is given to you. The time taken to process a claim is around 14 days. Both parts A and B must be completed.

Essential Eligibility

The claim will not be successful unless the following requirements are heeded:

- The claimer’s inability to work for at minimum eight days running.

- The claimer should be currently working or in the search for the job.

- The loss of your wages must be motivated.

- The claimer should have at minimum $300 in wages earned in a particular period.

- A licensed doctor should be in charge of you.

- The claim form should be submitted in a 49-day period since the start of the severe medical condition that brought about the disability.

- For your particular case, check out such conditions as ineligibility, rights and responsibilities of the claimer, the amount of benefits provided, information regarding disqualification, reduction of benefits, and special circumstances.

To accelerate the process of filling out the form, you can turn to the services of a professional lawyer to embrace accuracy, legitimacy, and overall success. As well, you can use the form-building constructor located on our website.

How to Fill out the Form

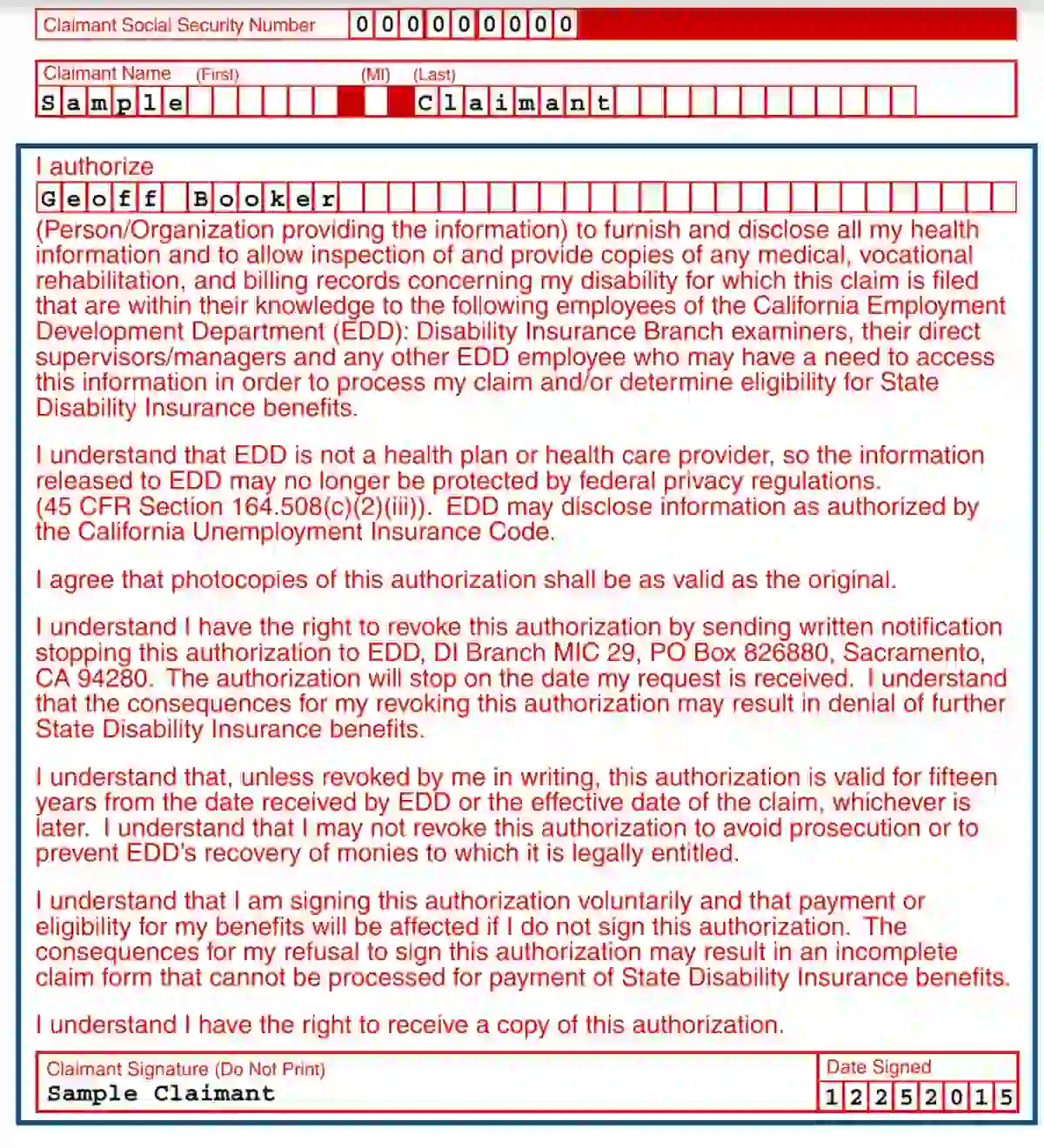

Following the California Code of Regulations, Title 22, sections 1085, 1088, and 1326, the Social Security details must be disclosed. Read the data on the collection and maintenance of the data.

Here is a list of steps to fill out EDD Form DE 2501 required by law:

1. Put in the name and the Social Security number.

Identify the claimer’s Social Security number and input the legal name.

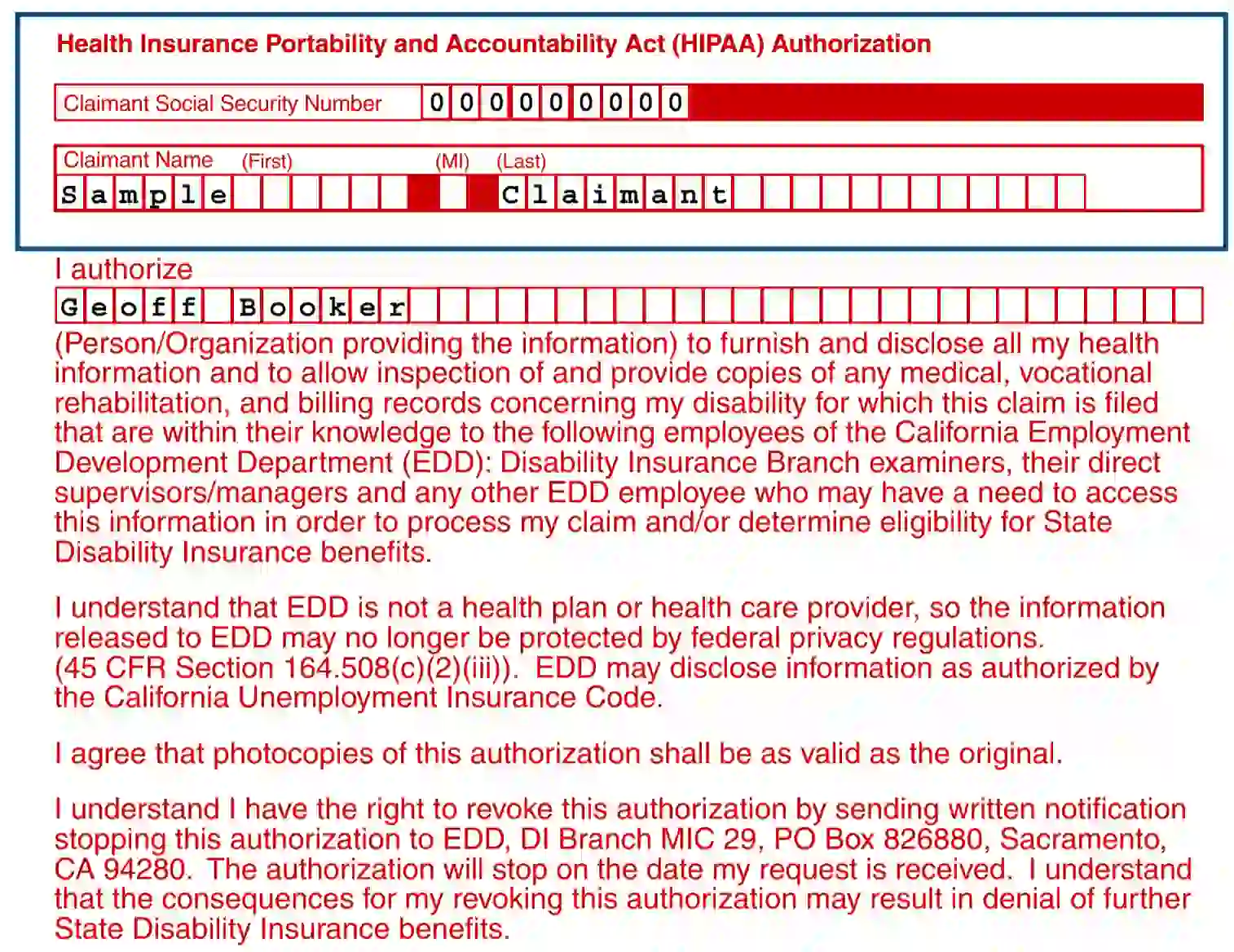

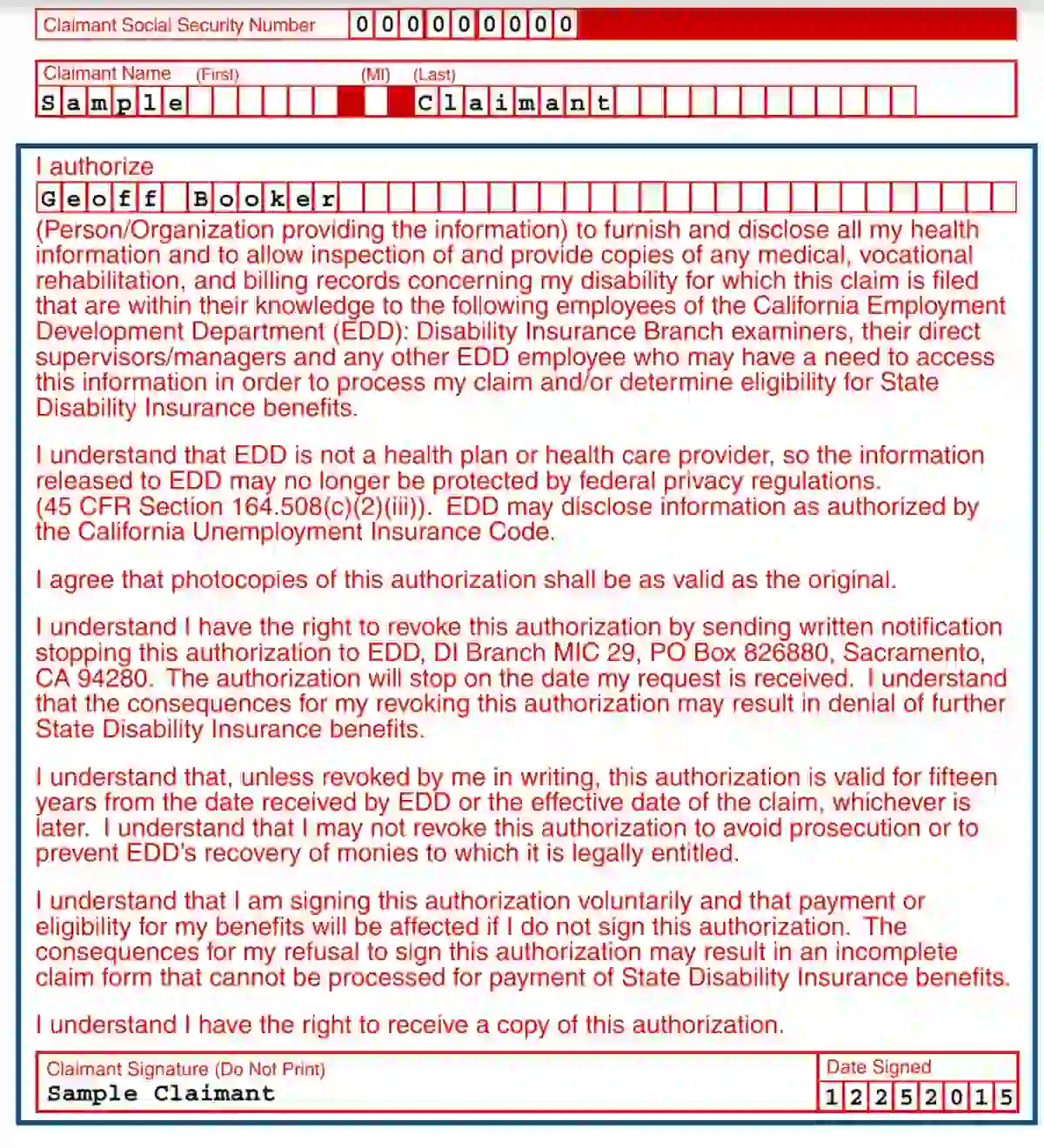

2. Authorize the person in charge

Input the info regarding the person to deal with any health-related data regarding the disability concerned. Ensure to read the following text in the body of the form to fully understand the procedure and the viable results.

3. Put a sign and date

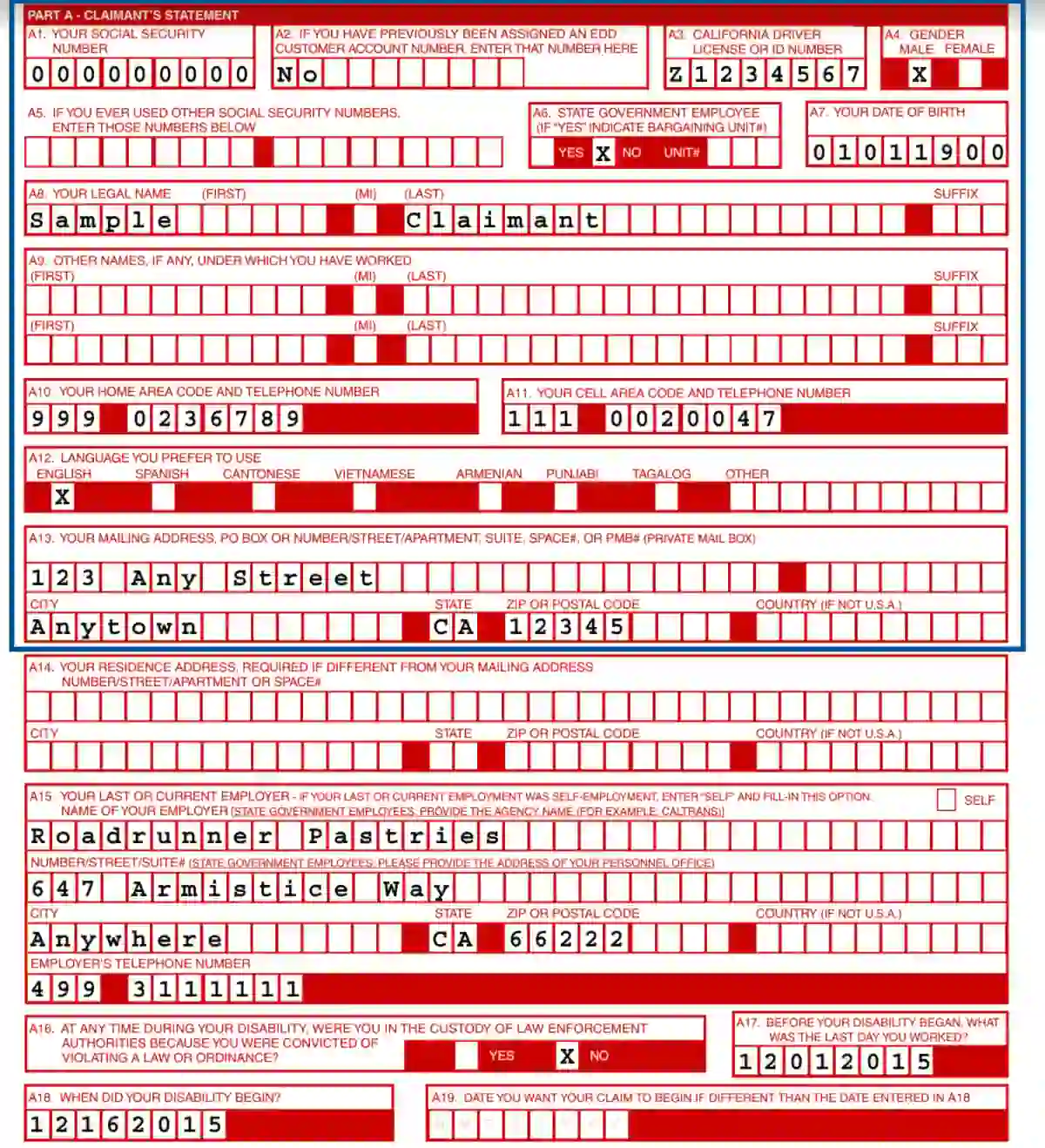

4. Fill out Part A

Fill out boxes A1—A13:

- Social Security number

- Legal name

- Residence

- Telephone number (cell area code and phone number)

- Preferred language to use

5. Identify the employer

Input information about the actual or previous employer

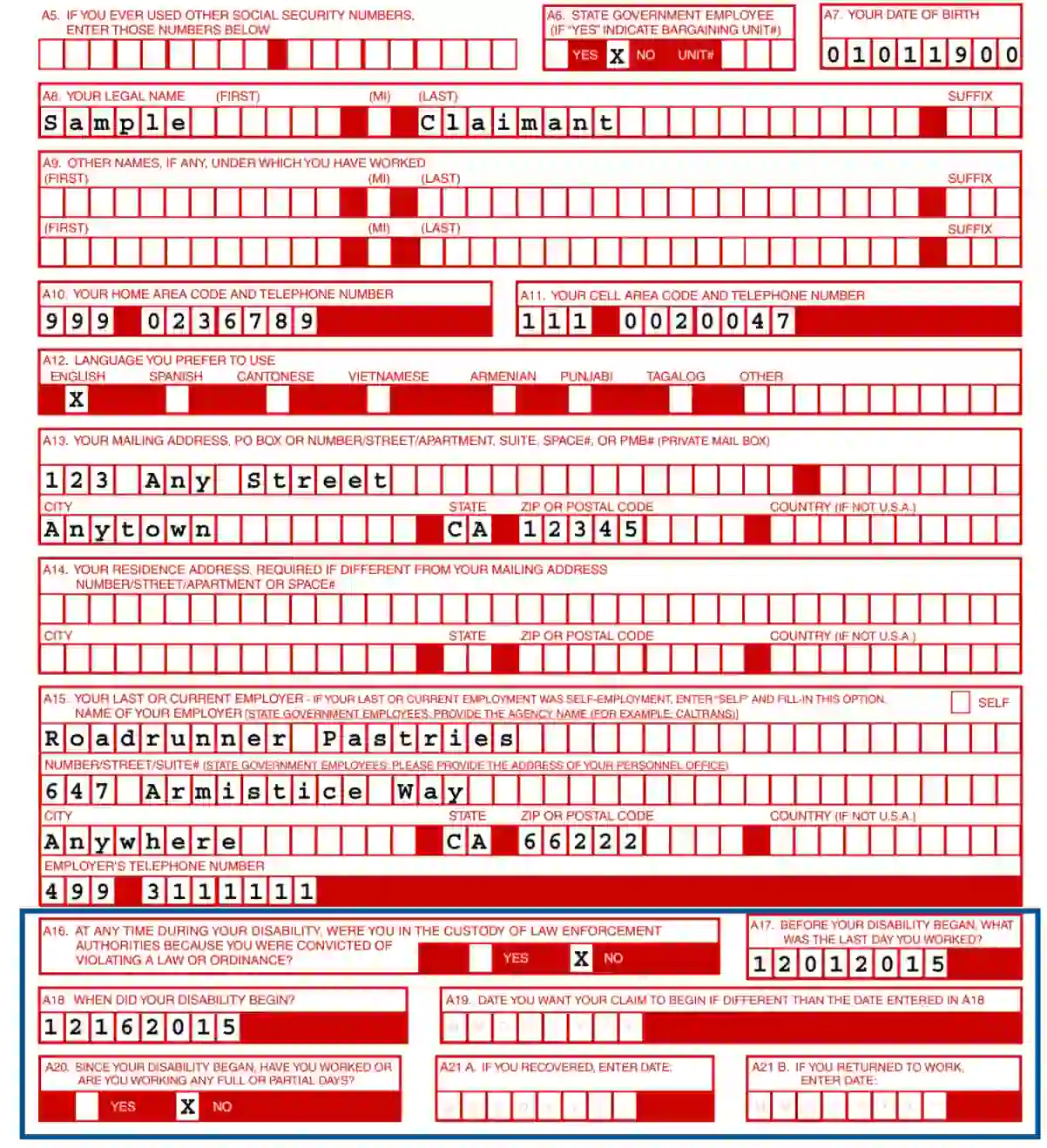

6. Provide more info

In A 16—A 21, put the date of the start of the illness, the last day you worked before the injury, the preferable date of the claim, information about full or partial shifts since the start of the disability, and the date of your return to work.

7. Reenter the Social Security code. Also, in sections A22— A27 provide the info about:

- Regular or temporary job

- The reason you stopped working

- Your job classification

- The payments by the employer during and after your disability

- The opportunity for the employer to receive the info about the benefit payment

8. Provide info about the second employer and check the required box in A29

9. Provide the info about your residentship in a facility for alcohol and drug addiction recovery

10. Indicate if you have dealt with the claims before and verify if the disability is job-related; put in the date of injury and the insurance company title.

11. Input the Adjuster’s name

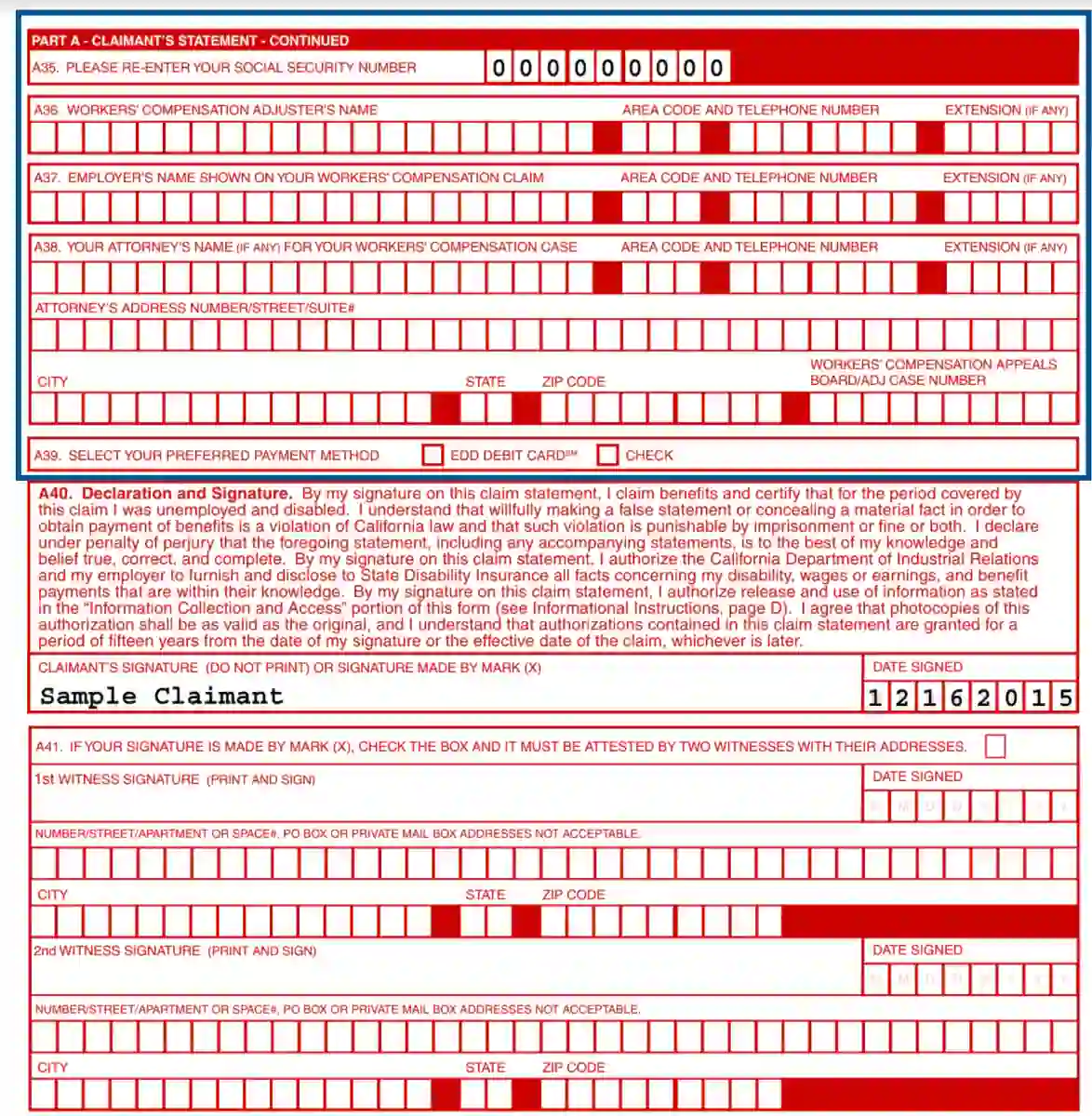

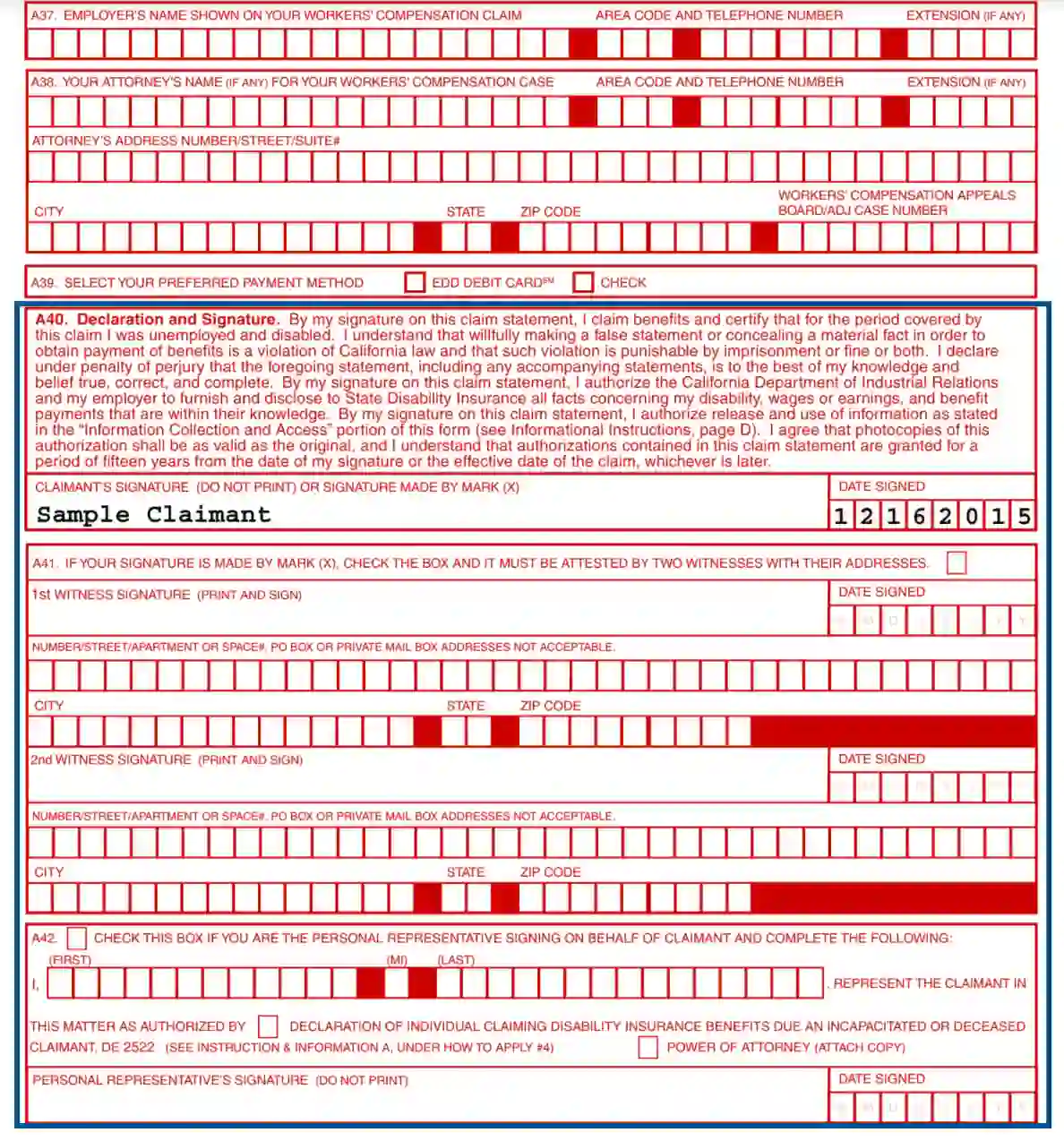

Do it after reentering your Social Security number and provide the info about the employer and attorney. All that and payment method is indicated in sections A35— A39.

12. In sections A40— A 42, provide your and the witnesses’ signatures.

13. Have Part B filled out and signed by a physician.

In sections B1—B11, you should fill out the information about the name, address, and phone number of the practitioner in charge of the injury.

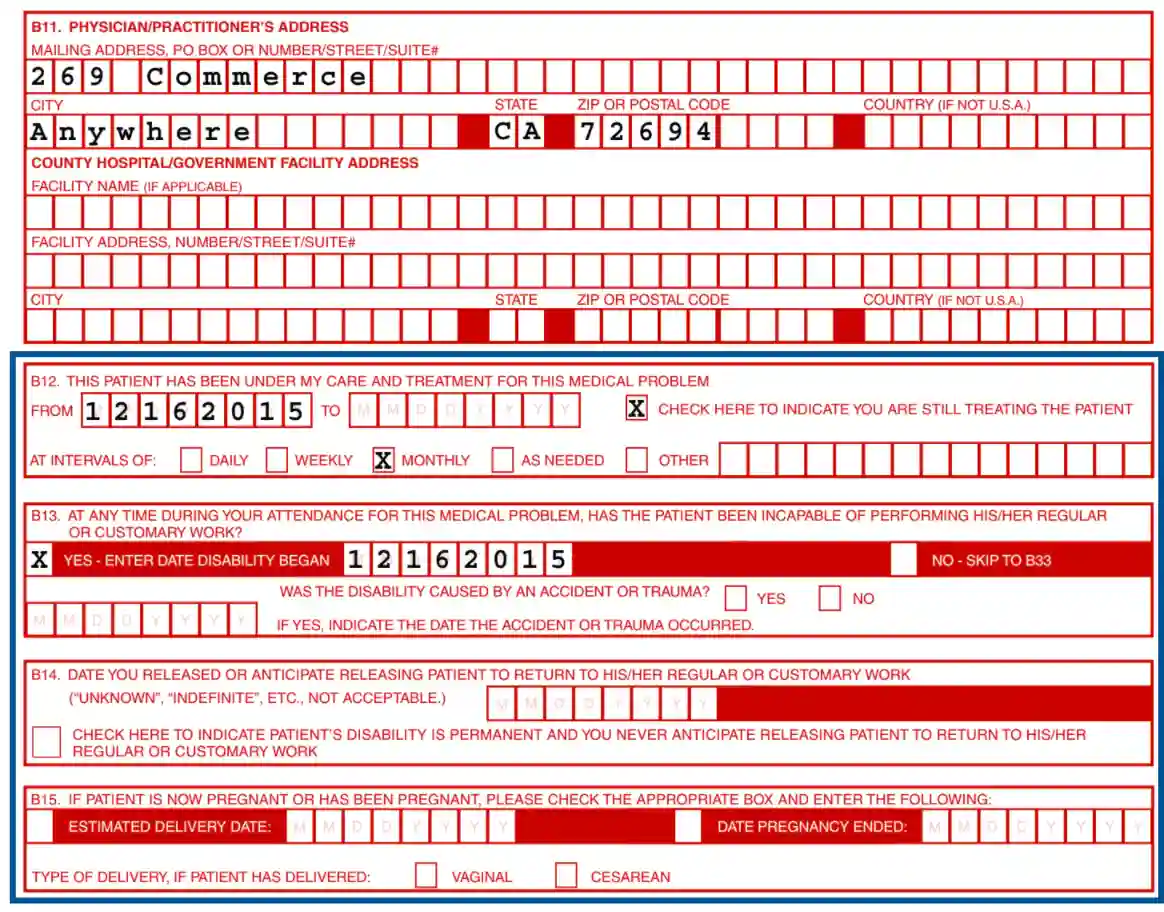

14. Provide the time of the treatment, release, pregnancy details in B12—B15

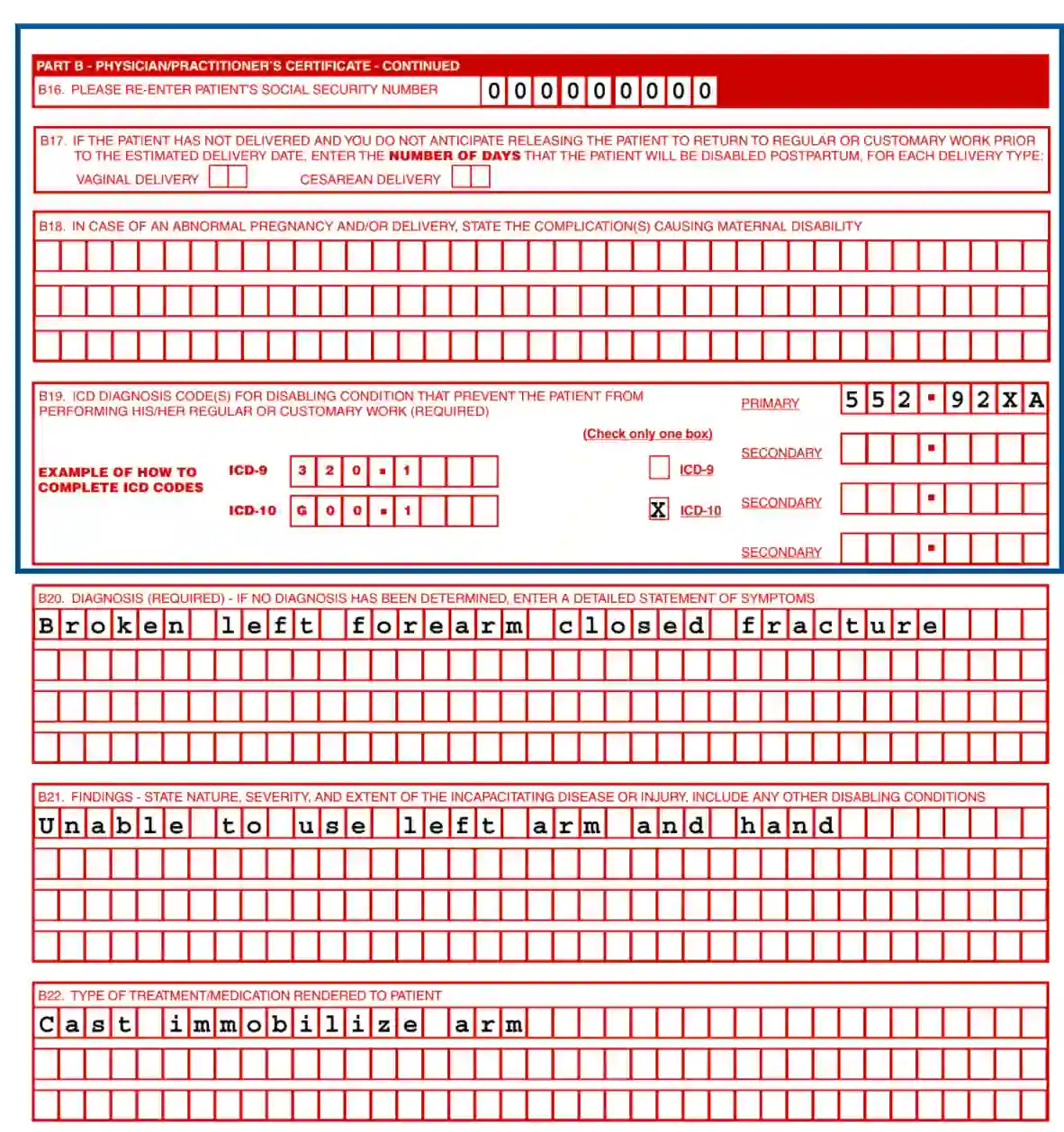

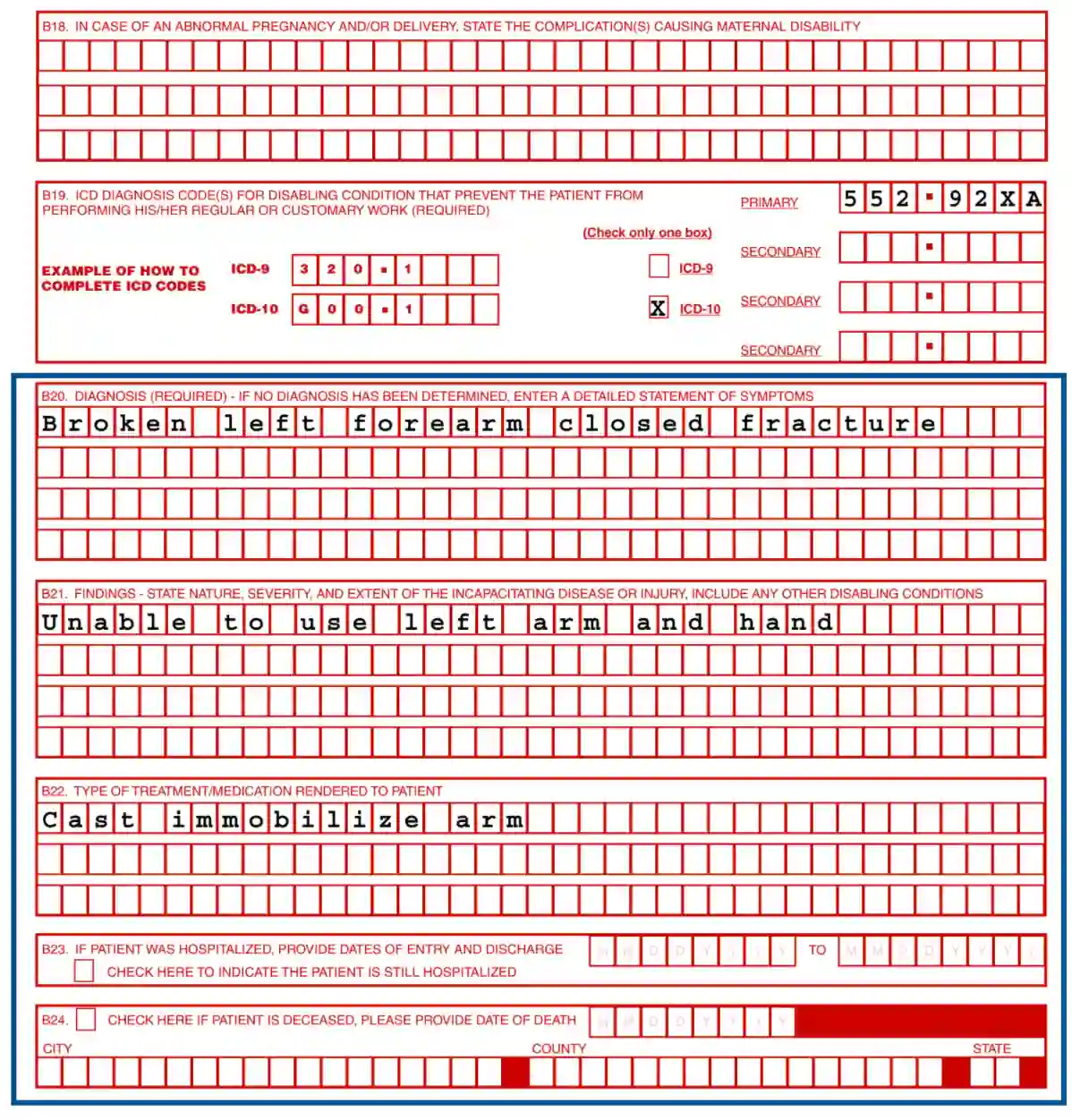

15. In sections B16—B19, provide information about the patient’s release, abnormal pregnancy, and ICD diagnosis.

16. Input information about a diagnosis, findings, and treatment information

Also, add the date of the hospital entry and release or death of the patient in boxes B 20—B24.

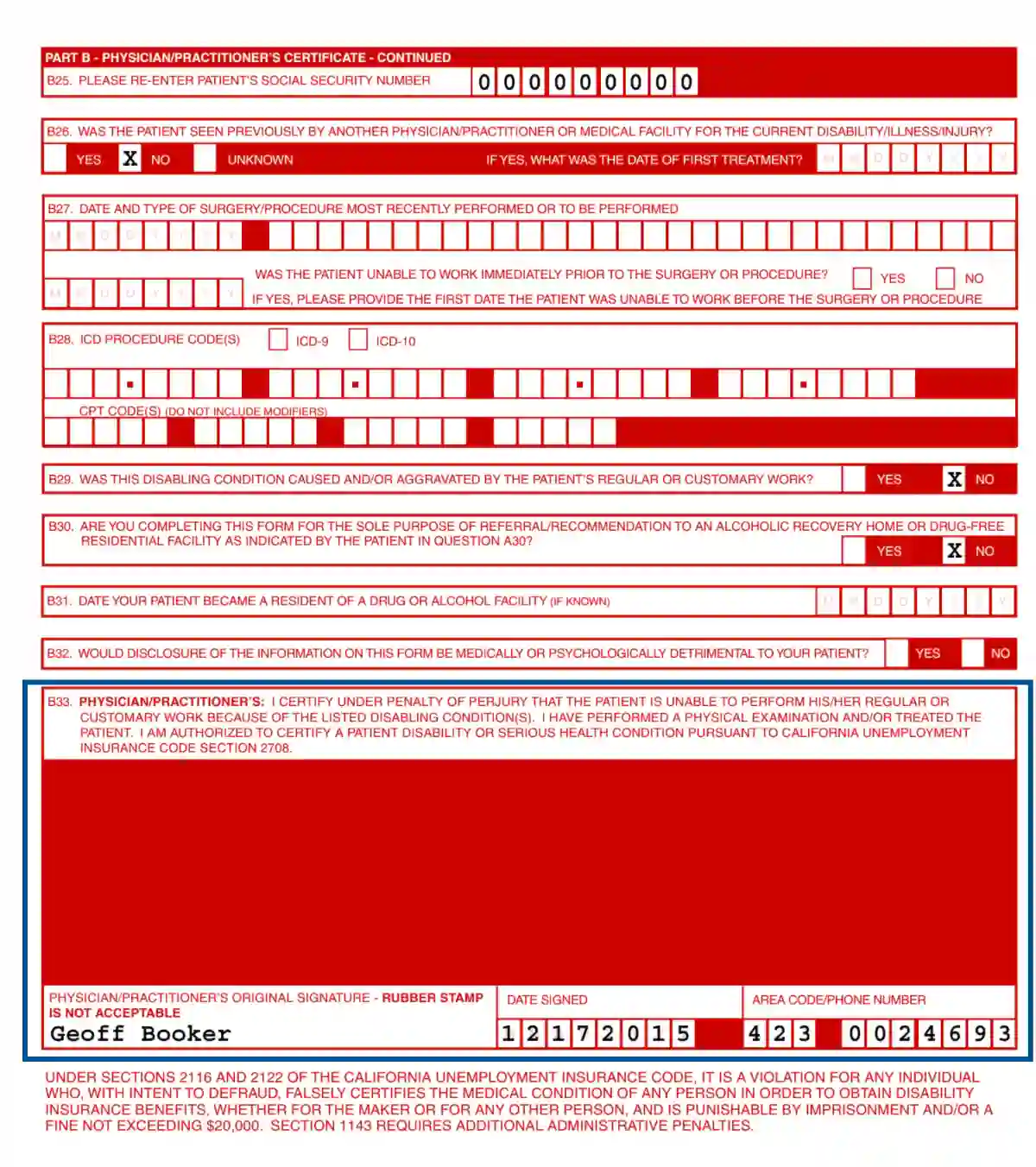

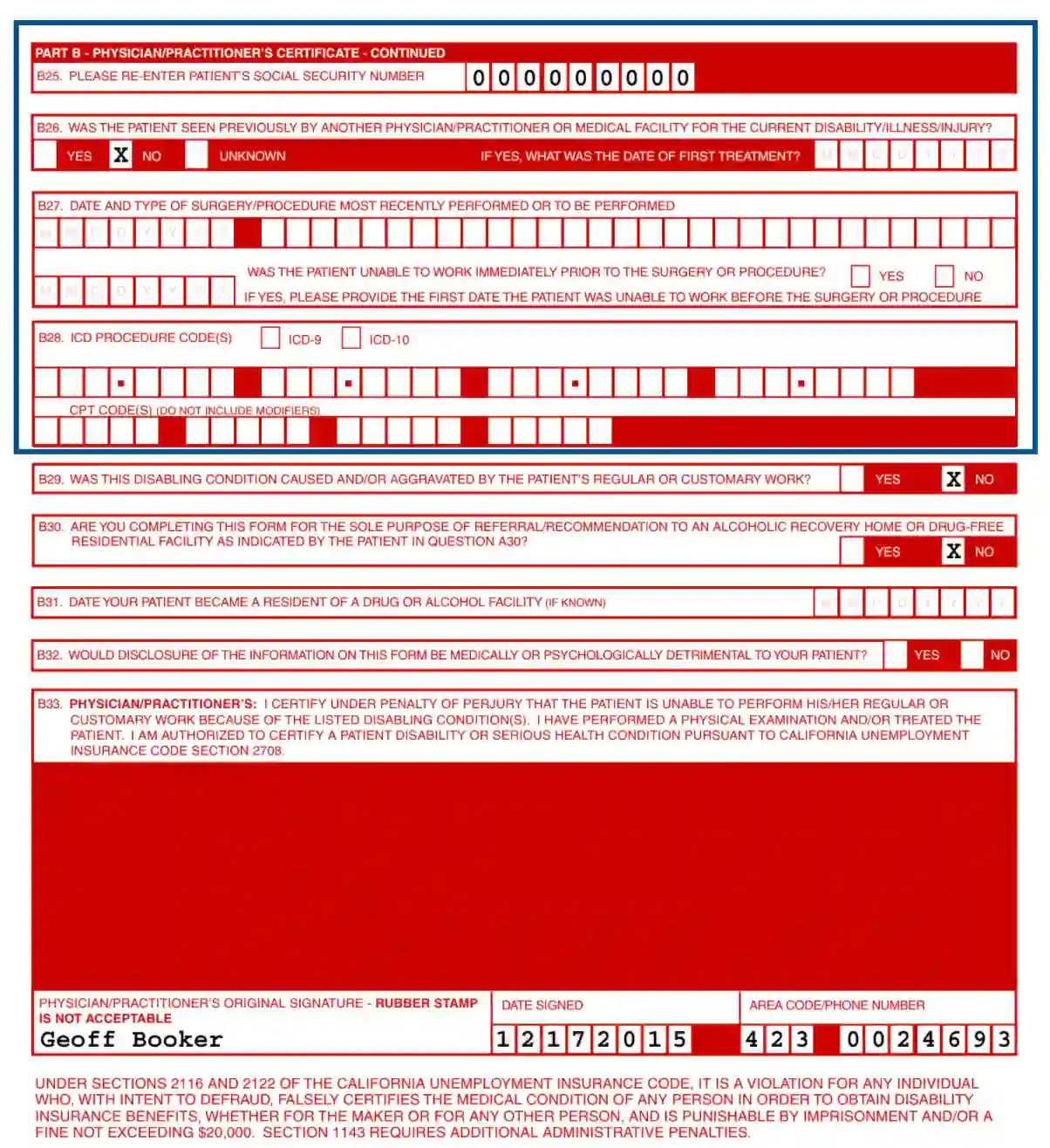

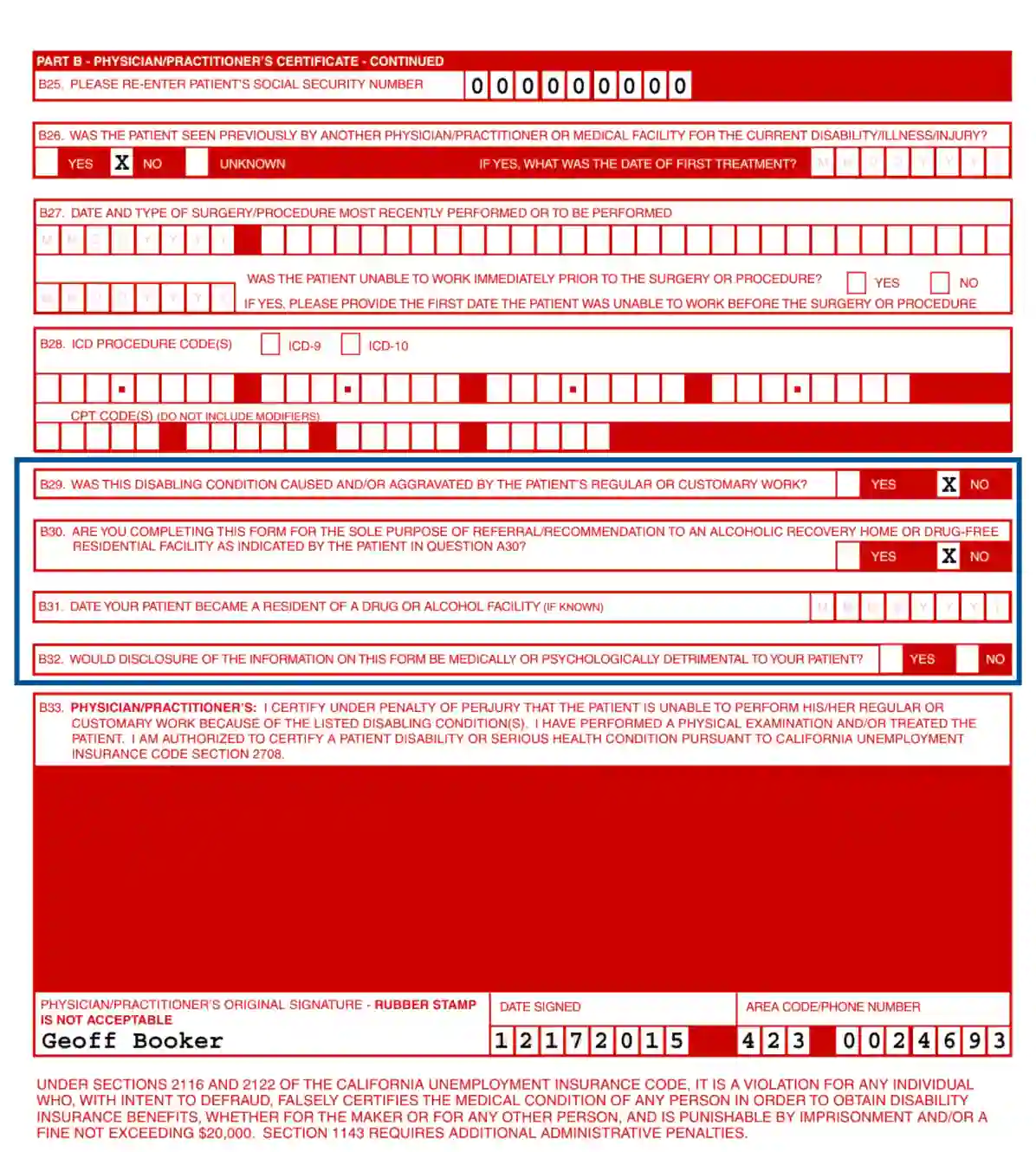

17. In boxes B25— B28, input the Social Security number of the patient, info of the previous appointments with physicians, recent surgery, and ICD procedures.

18. Check the boxes in B29— B32:

- If the injury is job-related

- If you fill the form for the purpose of referral to a recovery facility

- Date of the patient’s start being a resident of such a facility

- If you would disclose the info to the patient

19. Certify the patient’s disability, put a sign and a date