Are you looking to change up your fitness routine? If so, the 48 Form may be perfect for you. This high-intensity workout is a great way to get your heart rate up and burn calories. The 48 Form is a combination of boxing, kickboxing, and Muay Thai that can be modified to fit your needs. Whether you're a beginner or experienced exerciser, this workout is sure to challenge you. So what are you waiting for? Give the 48 Form a try today!

| Question | Answer |

|---|---|

| Form Name | De 48 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | edd poa form, employment development department state of california power of attorney, DBA, SSN |

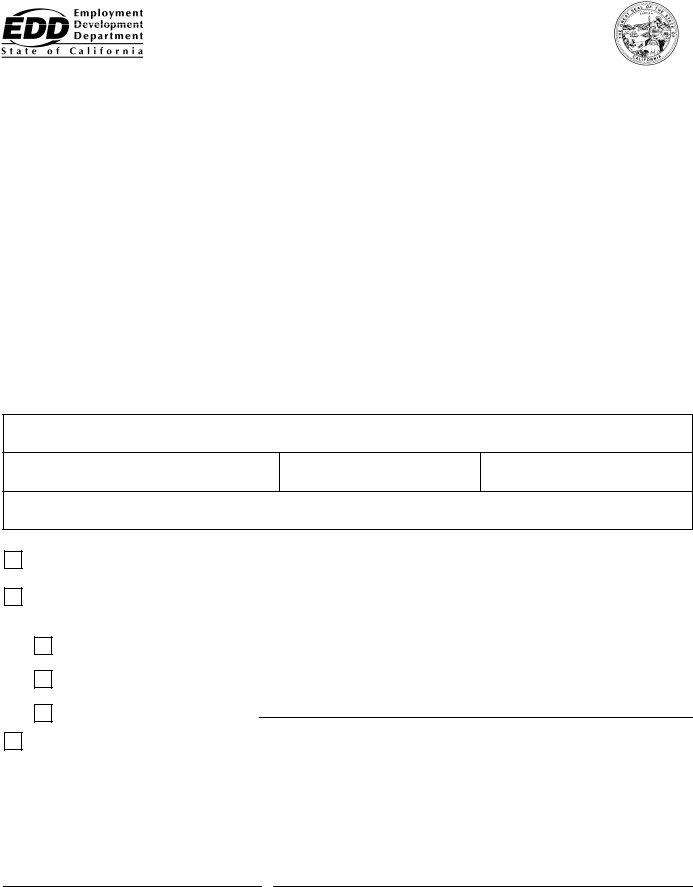

POWER OF ATTORNEY (POA) DECLARATION

SEE INSTRUCTIONS ON THE BACK OF THIS FORM.

I.EMPLOYER/TAXPAYER INFORMATION (please type or print)

California Employer Account Number: |

Taxpayer Identification Number: |

Federal Employer Identification Number: |

||

(if applicable) |

|

|

|

|

|

|

|

|

|

Owner/Corporation Name: |

|

Social Security Number (SSN)/Corporate Identification Number: |

||

|

|

|

|

|

Business Name/Doing Business As (DBA): |

|

|

|

|

|

|

|

|

|

Business Mailing Address: |

|

City: |

State |

ZIP Code |

|

|

|

|

|

Business Phone Number: |

|

Business Fax Number: |

|

|

|

|

|

|

|

Business Location (if different from above): |

|

City: |

State |

ZIP Code |

|

|

|

|

|

II.REPRESENTATIVE DESIGNATION

I hereby appoint the following person to represent the employer/taxpayer for specified tax matters arising under the California Unemployment Insurance Code.

Representative’s Business:

Representative’s Name:

Phone Number:

Fax Number:

Business Mailing Address: |

City: |

State |

ZIP Code |

III.AUTHORIZED ACT(S)

GENERAL AUTHORIZATION: If you want to give the representative general authority to perform all acts on your behalf with regard to your state tax matters.

SPECIFIC DECLARATION: |

If you want to give the representative limited authority with regard to your state |

|||

From |

|

To |

|

tax matters, indicate the specific dates and acts you are authorizing. |

To represent the employer/taxpayer for any and all Tax Reporting Benefit Reporting Both matters relating to the reporting period indicated above.

To represent the employer/taxpayer for changes to their mailing address for any and all Tax Reporting Benefit Reporting Both matters relating to the reporting period indicated above.

Other acts: (describe specifically)

Subject to revocation, the above representative is authorized to receive confidential information.

IV. SIGNATURE AUTHORIZING POWER OF ATTORNEY

Signature of the employer/taxpayer, owner, officer, receiver, administrator, or trustee for the employer/taxpayer: If you are a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, administrator, or trustee on behalf of the employer/taxpayer, you are certifying that you have the authority to execute this form on behalf of the employer/taxpayer by signing this Power of Attorney Declaration.

If this Power of Attorney Declaration is not signed and dated, it will be returned as invalid.

Signature |

Title (Owner, Partner, Corp. Officer: Pres., Vice Pres., CEO or CFO) |

|||

|

|

|

|

|

Print Name |

SSN |

Date |

||

DE 48 Rev. 7 |

|

Page 1 of 2 |

|

CU |

Instructions for Completing the Power of Attorney (POA) Declaration (DE 48)

General Information:

This Power of Attorney (POA) Declaration (DE 48) is your written authorization for an individual or other entity to act on your behalf in tax and/or benefit reporting matters, and will remain in effect until it is rescinded or revoked. When a new POA is filed with the Employment Development Department (EDD), the new POA will automatically revoke any prior declaration(s) on file unless you attach a copy of each POA that you want to remain in effect. In addition, if you need to limit the term of a POA, you must specify the date it will expire as outlined in Section III below. For general information, call the Account Services Group at

I.EMPLOYER/TAXPAYER INFORMATION - Enter your California Employer Account Number (if applicable), Taxpayer Identification Number, Federal Employer Identification Number, Owner or Corporation Name, Owner(s) Social Security Number or Corporate Identification Number, Business Name/Doing Business As (DBA), mailing address, business phone and fax number(s), and business location if different than the mailing address.

II.REPRESENTATIVE DESIGNATION - Enter the representative’s business, representative’s name, phone number, fax number, and address.

III.AUTHORIZED ACT(S) - If you want to authorize your representative to perform any and all acts on your behalf, check the “General Authorization” box. If you want to limit this authorization, check the boxes that apply under “Specific Declaration.” Enter the beginning and ending dates of each interval/period for which you are making the declaration.

IV. SIGNATURE AUTHORIZING POWER OF ATTORNEY - The POA must be signed and dated by the business owner, partner, or corporate officer (i.e., President, Vice President, CEO, or CFO). Please submit an updated list of corporate officers/owners with this document, if applicable. If the declaration is submitted without a signature or with an unauthorized signature, it will be returned.

Please return your completed DE 48 to the EDD representative with whom you are working. If you are not working with a particular representative, send the form to:

Employment Development Department

Account Services Group, MIC 28

P.O. Box 826880

Sacramento, CA

If you have questions or need assistance completing this form, please call:

Department Representative:

Phone Number:

DE 48 Rev. 7 |

Page 2 of 2 |