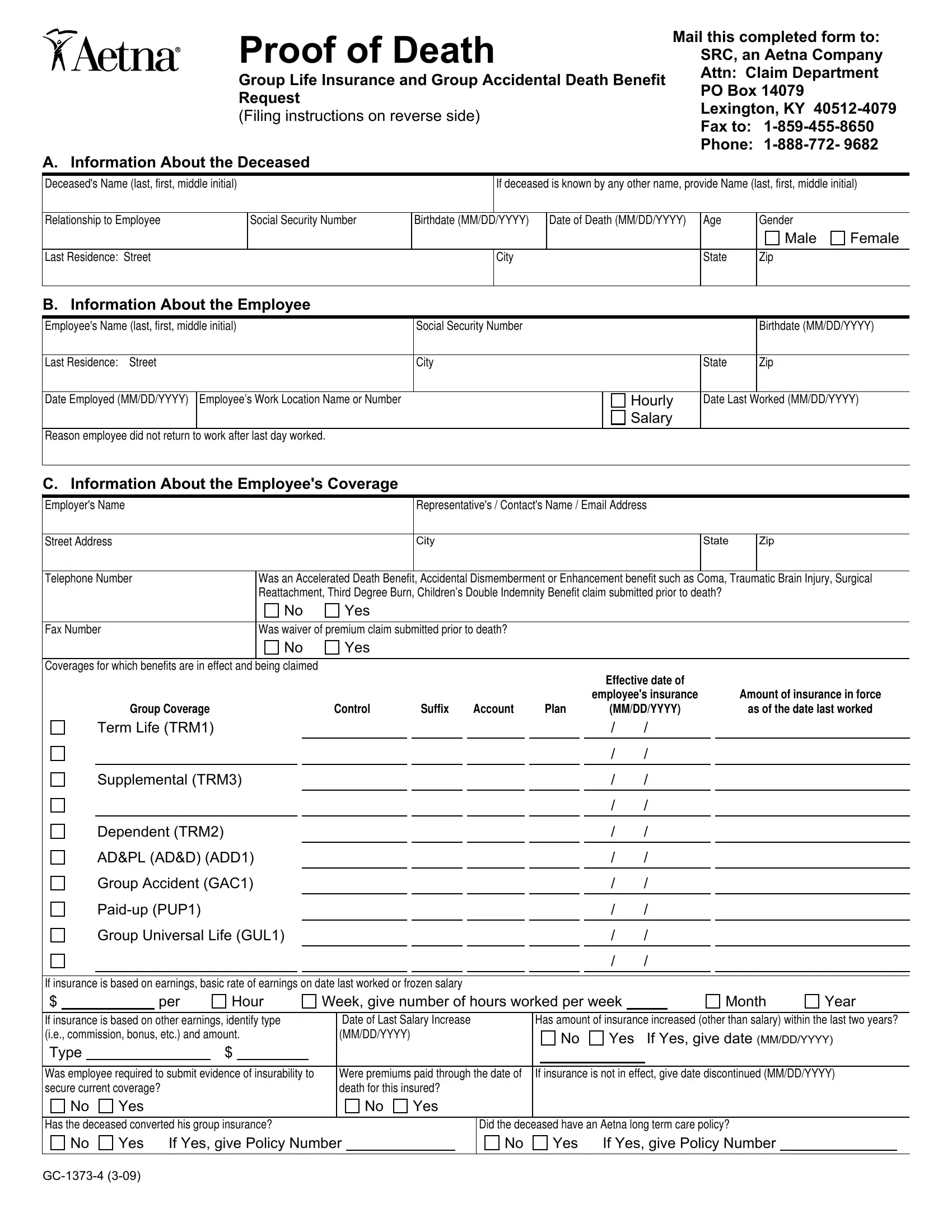

Proof of Death

Group Life Insurance and Group Accidental Death Benefit

Request

(Filing instructions on reverse side)

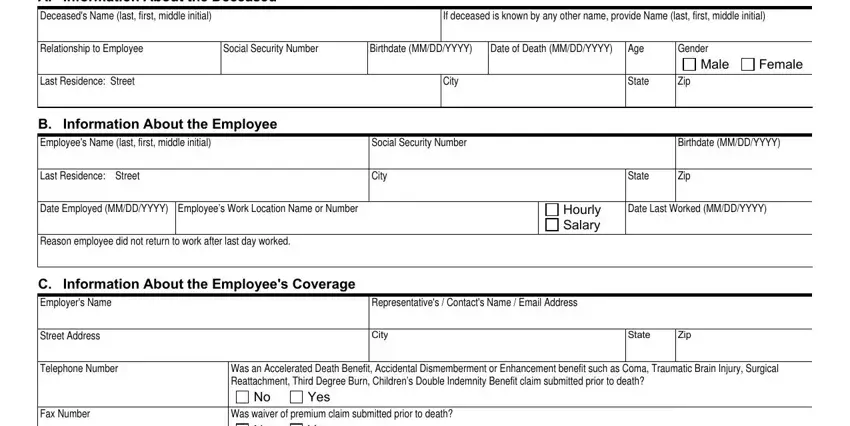

A. Information About the Deceased

Mail this completed form to: SRC, an Aetna Company Attn: Claim Department PO Box 14079 Lexington, KY 40512-4079 Fax to: 1-859-455-8650 Phone: 1-888-772- 9682

Deceased's Name (last, first, middle initial)

If deceased is known by any other name, provide Name (last, first, middle initial)

Relationship to Employee |

Social Security Number |

Birthdate (MM/DD/YYYY) |

Date of Death (MM/DD/YYYY) |

Age |

Gender |

|

|

|

|

|

|

|

Male |

Female |

|

|

|

|

|

|

|

|

Last Residence: Street |

|

|

City |

|

State |

Zip |

|

|

|

|

|

|

|

|

|

B. Information About the Employee

Employee's Name (last, first, middle initial) |

Social Security Number |

|

|

Birthdate (MM/DD/YYYY) |

|

|

|

|

|

|

Last Residence: Street |

City |

|

State |

Zip |

|

|

|

|

|

|

Date Employed (MM/DD/YYYY) |

Employee’s Work Location Name or Number |

|

Hourly |

Date Last Worked (MM/DD/YYYY) |

|

|

|

Salary |

|

|

|

|

|

|

|

|

Reason employee did not return to work after last day worked. |

|

|

|

|

|

|

|

|

|

|

C. Information About the Employee's Coverage

Representative's / Contact's Name / Email Address

Telephone Number |

Was an Accelerated Death Benefit, Accidental Dismemberment or Enhancement benefit such as Coma, Traumatic Brain Injury, Surgical |

|

Reattachment, Third Degree Burn, Children’s Double Indemnity Benefit claim submitted prior to death? |

|

|

No |

Yes |

|

|

|

|

|

|

|

|

|

|

Fax Number |

Was waiver of premium claim submitted prior to death? |

|

|

|

|

No |

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

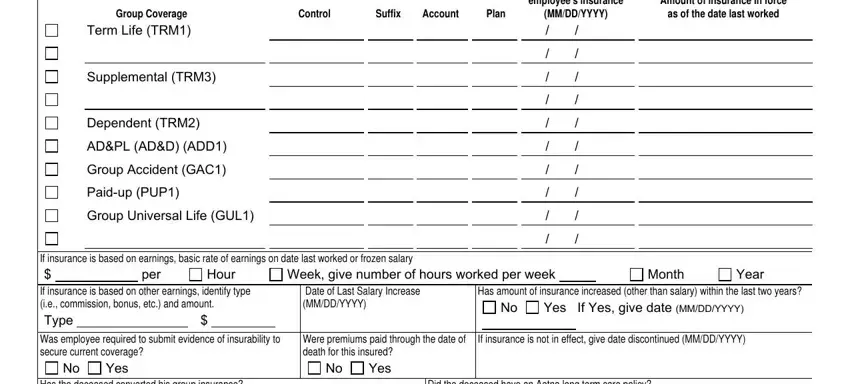

Coverages for which benefits are in effect and being claimed |

|

|

|

|

|

|

|

|

|

|

|

|

Effective date of |

|

|

|

|

|

|

|

employee's insurance |

Amount of insurance in force |

Group Coverage |

|

Control |

Suffix |

Account |

Plan |

(MM/DD/YYYY) |

as of the date last worked |

Term Life (TRM1)

Supplemental (TRM3)

Dependent (TRM2)

AD&PL (AD&D) (ADD1)

Group Accident (GAC1)

Paid-up (PUP1)

Group Universal Life (GUL1)

/ |

/ |

/ |

/ |

|

|

/ |

/ |

|

|

/ |

/ |

|

|

/ |

/ |

/ |

/ |

|

|

/ |

/ |

|

|

/ |

/ |

|

|

/ |

/ |

/ |

/ |

If insurance is based on earnings, basic rate of earnings on date last worked or frozen salary

Week, give number of hours worked per week

If insurance is based on other earnings, identify type |

Date of Last Salary Increase |

Has amount of insurance increased (other than salary) within the last two years? |

(i.e., commission, bonus, etc.) and amount. |

(MM/DD/YYYY) |

|

|

|

|

No |

Yes If Yes, give date (MM/DD/YYYY) |

Type |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Was employee required to submit evidence of insurability to |

Were premiums paid through the date of |

If insurance is not in effect, give date discontinued (MM/DD/YYYY) |

secure current coverage? |

|

|

|

|

death for this insured? |

|

|

|

|

|

|

No |

Yes |

|

|

|

|

|

No |

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Has the deceased converted his group insurance? |

|

|

|

|

Did the deceased have an Aetna long term care policy? |

No |

Yes |

If Yes, give Policy Number |

|

|

No |

|

Yes |

If Yes, give Policy Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GC-1373-4 (3-09) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

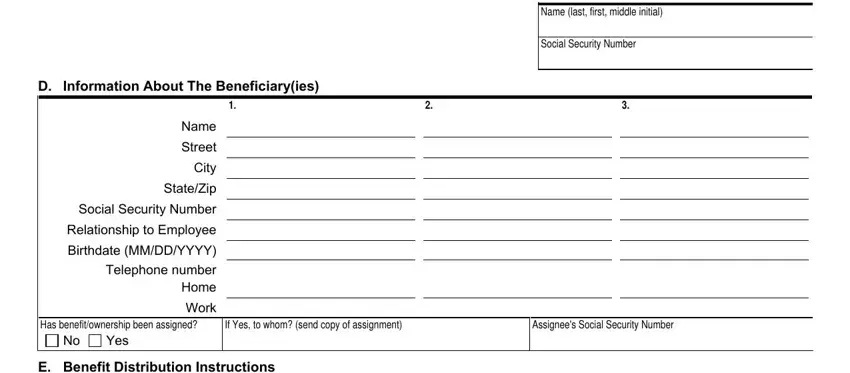

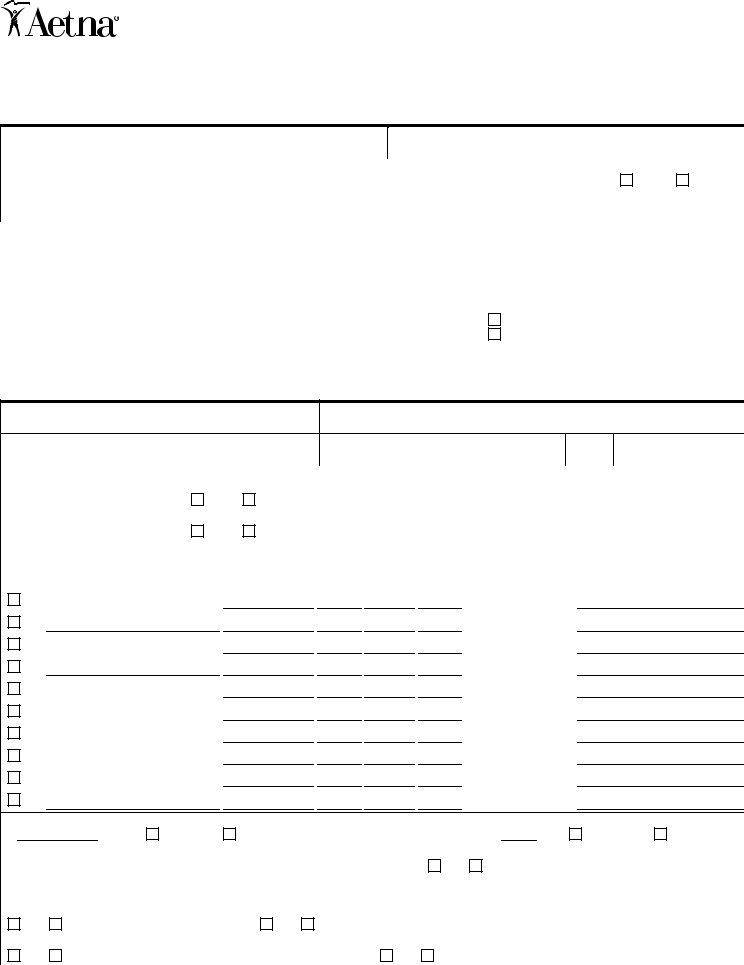

Page 2

Deceased Information

Name (last, first, middle initial)

Social Security Number

D. Information About The Beneficiary(ies)

Name

Street

City

State/Zip

Social Security Number

Relationship to Employee

Birthdate (MM/DD/YYYY)

Telephone number

Home

Work

Has benefit/ownership been assigned?

No Yes

If Yes, to whom? (send copy of assignment)

Assignee's Social Security Number

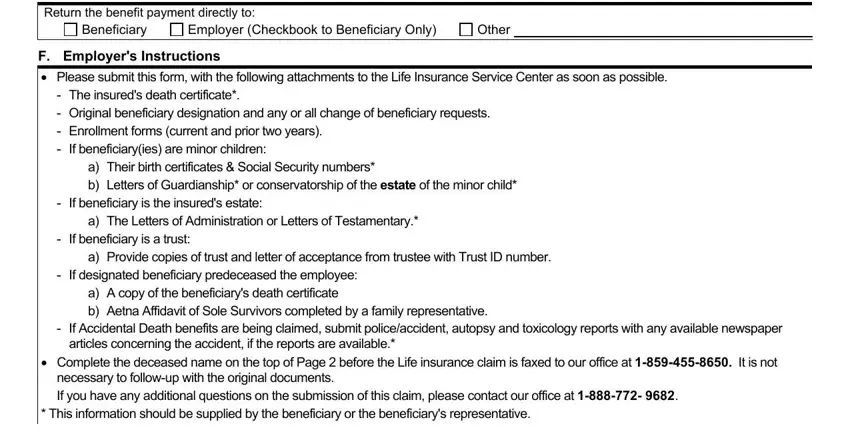

E.Benefit Distribution Instructions

Return the benefit payment directly to:

Employer (Checkbook to Beneficiary Only)

F. Employer's Instructions

•Please submit this form, with the following attachments to the Life Insurance Service Center as soon as possible.

-The insured's death certificate*.

-Original beneficiary designation and any or all change of beneficiary requests.

-Enrollment forms (current and prior two years).

-If beneficiary(ies) are minor children:

a)Their birth certificates & Social Security numbers*

b)Letters of Guardianship* or conservatorship of the estate of the minor child*

-If beneficiary is the insured's estate:

a)The Letters of Administration or Letters of Testamentary.*

-If beneficiary is a trust:

a)Provide copies of trust and letter of acceptance from trustee with Trust ID number.

-If designated beneficiary predeceased the employee:

a)A copy of the beneficiary's death certificate

b)Aetna Affidavit of Sole Survivors completed by a family representative.

-If Accidental Death benefits are being claimed, submit police/accident, autopsy and toxicology reports with any available newspaper articles concerning the accident, if the reports are available.*

•Complete the deceased name on the top of Page 2 before the Life insurance claim is faxed to our office at 1-859-455-8650. It is not necessary to follow-up with the original documents.

If you have any additional questions on the submission of this claim, please contact our office at 1-888-772- 9682.

* This information should be supplied by the beneficiary or the beneficiary's representative.

GC-1373-4 (3-09)

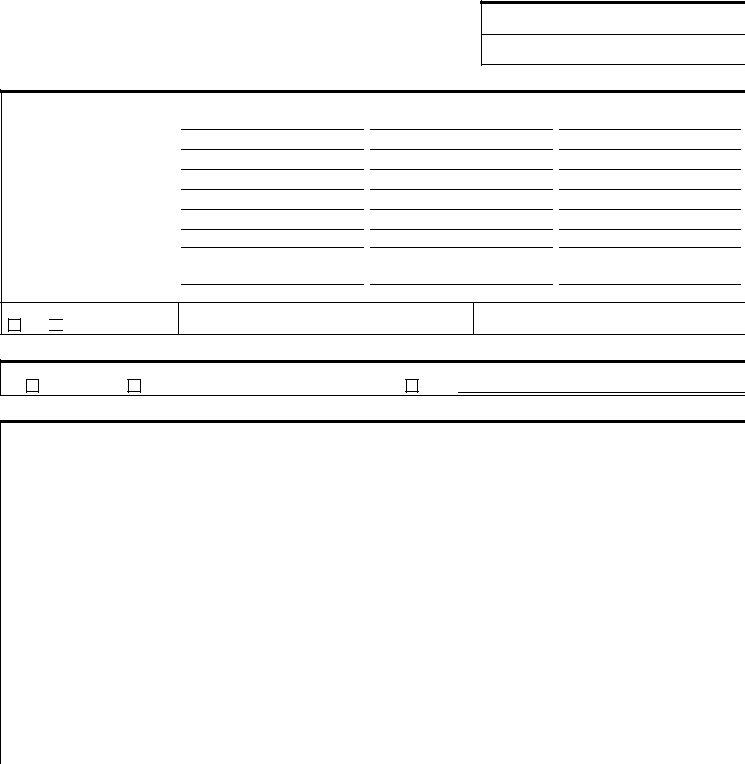

Page 3

Deceased Information

Name (last, first, middle initial)

Social Security Number

G. Employer's Authorized Representative

Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Attention Arkansas, Louisiana and West Virginia Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. Attention California Residents: For your protection California law requires the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Attention Colorado Residents: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies.

Attention Florida Residents: Any person who knowingly and with intent to injure, defraud, or deceive any insurer, files a statement of claim or an application containing any false, incomplete or misleading information is guilty of a felony of the third degree.

Attention Kansas Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person submits an enrollment form for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto may have violated state law.

Attention Kentucky Residents: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and may subject such person to criminal and civil penalties.

Attention Maine and Tennessee Residents: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or denial of insurance benefits.

Attention Maryland Residents: Any person who knowingly and willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly and willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison. Attention New Jersey Residents: Any person who includes any false or misleading information on an application for an insurance policy or knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

Attention North Carolina Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which may be a crime and subjects such person to criminal and civil penalties. Attention Ohio and Pennsylvania Residents: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Attention Oklahoma Residents: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Attention Oregon Residents: Any person who with intent to injure, defraud or deceive any insurance company or other person submits an enrollment form for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto may have violated state law.

Attention Puerto Rico Residents: Any person who knowingly and with the intention to defraud includes false information in an application for insurance or file, assist or abet in the filing of a fraudulent claim to obtain payment of a loss or other benefit, or files more than one claim for the same loss or damage, commits a felony and if found guilty shall be punished for each violation with a fine of no less than five thousand dollars ($5,000), not to exceed ten thousand dollars ($10,000); or imprisoned for a fixed term of three (3) years, or both. If aggravating circumstances exist, the fixed jail term may be increased to a maximum of five (5) years; and if mitigating circumstances are present, the jail term may be reduced to a minimum of two (2) years.

Attention Vermont Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which may be a crime and may subject such person to criminal and civil penalties.

Attention Virginia Residents: Any person who knowingly and with intent to injure, defraud or deceive any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent act, which is a crime and subjects such person to criminal and civil penalties.

Attention Washington Residents: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines, and denial of insurance benefits.

|

|

|

|

|

|

|

|

Name |

|

|

Signature |

|

|

Date (MM/DD/YYYY) |

|

at (city, state, zip) |

|

|

|

|

|

|

|

GC-1373-4 (3-09) |

|

|

|

|

|