Delaware Form 300 is the state's corporate income tax return. All Delaware corporations are required to file a Form 300, even if they did not earn any taxable income. The deadline to file is April 15th, and late penalties may apply. The form can be filed online or by mail. This guide will provide instructions on how to complete the Delaware Form 300.3' width='32'>4/15/2018) Corporation Income Tax Guide for Delaware»State Corporate Income Tax Filing Requirements & Deadlines in . Learn more about the and how to file your business taxes correctly. Visit our site for more help and information! 3' width='32'>4/15/2018) Corporation Income Tax Guide for Delaware»State Corporate Income Tax Filing

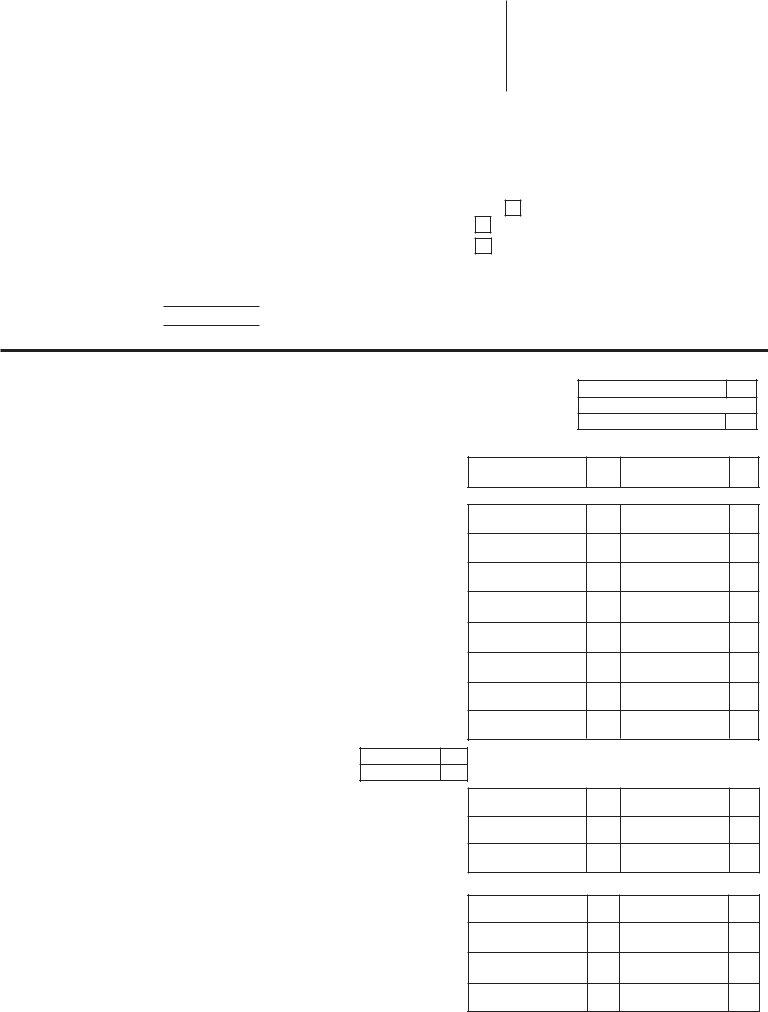

| Question | Answer |

|---|---|

| Form Name | Delaware Form 300 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | PTIN, 12a, 13b, DELAWARE |

DELAWARE

FORM 300

DELAWARE PARTNERSHIP RETURN

TAX YEAR 2006

DO NOT WRITE OR STAPLE IN THIS AREA

FISCAL YEAR _________/_________/__________ To |

__________/__________/__________ |

|

|

|

|

|

REV CODE 006 |

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

EMPLOYER IDENTIFICATION NUMBER |

|||||

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

NATURE OF BUSINESS (SEE INSTRUCTIONS) |

|||||

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. CHECK APPLICABLE BOX: |

|

AMENDED RETURN |

|

PARTNERSHIP DISSOLVED OR INACTIVE |

||

IF THE PARTNERSHIP ADDRESS HAS CHANGED, WHICH ADDRESS IS AFFECTED? |

|

LOCATION |

||||

|

|

|

|

|

|

|

B.DID THE PARTNERSHIP HAVE INCOME DERIVED FROM OR CONNECTED WITH SOURCES IN DELAWARE?

DID THE PARTNERSHIP HAVE DELAWARE RESIDENT PARTNERS? |

|

YES |

|

NO |

|

|

|

|

|

IF THE ANSWER TO EITHER QUESTION ON LINE B IS “YES”, A PARTNERSHIP RETURN IS REQUIRED TO BE FILED.

C.TOTAL NUMBER OF PARTNERS:

D.YEAR PARTNERSHIP FORMED:

ATTACH COMPLETED COPY OF U.S. PARTNERSHIP RETURN OF INCOME FORM 1065 AND ALL SCHEDULES.

CHANGE OF ADDRESS

MAILING |

|

BILLING |

|

|

|

YES |

|

NO |

|

||

|

|

|

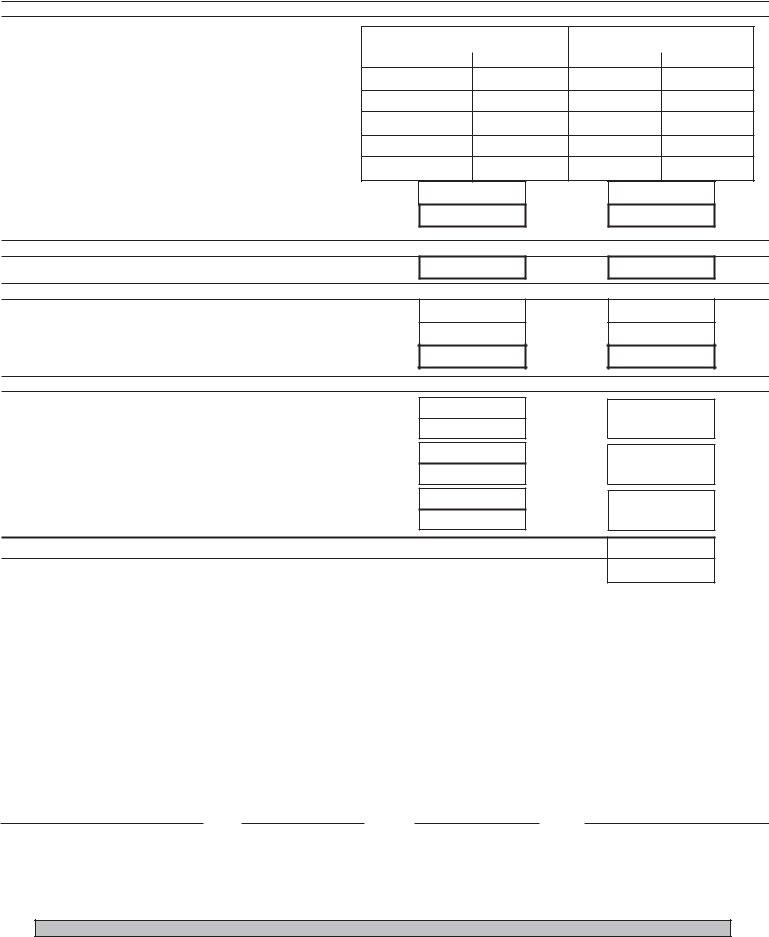

SCHEDULE 1 - PARTNERSHIP SHARE OF INCOME AND DEDUCTIONS WITHINAND WITHOUT DELAWARE

INCOME: |

|

|

1. |

Ordinary income (loss) from Federal Form 1065, Schedule K, Line1 |

1 |

2. |

Apportionment percentage from Delaware Form 300, Schedule 2, Line 16 |

|

|

|

2 |

3. |

Ordinary income apportioned to Delaware. Multiply Line 1 times Line 2 |

|

|

|

3 |

|

|

Column A |

|

|

Total |

00

%

00

Column B

Within Delaware

1

2

3

4. Enter in Column A the amount from Line 1.....................................................................

Enter in Column B the amount from Line 3.....................................................................

4

00

004

5. Net income (loss) from rental real estate activities, |

|

|

5 |

Federal Form 1065, Schedule K, Line 2 |

|

6. Net income (loss) from other rental activities, |

|

|

6 |

Federal Form 1065, Schedule K, Line 3c |

|

7. Guaranteed payments from Federal Form 1065, Schedule K, Line 4 |

|

|

7 |

8. Interest income from Federal Form 1065, Schedule K, Line 5 |

|

|

8 |

9. Dividend income from Federal Form 1065, Schedule K, Line 6(a) |

|

|

9 |

10. Royalty income from Federal Form 1065, Schedule K, Line 7 |

|

|

10 |

11. Net short term capital gain (loss) from |

|

Federal Form 1065, Schedule K, Line 8 |

|

|

11 |

12a. Net long term capital gain (loss) from |

|

Federal Form 1065, Schedule K, Line 9(a) |

12a |

b. Collectible gain (loss) - Fed Form 1065, Sch. K, Line 9b |

|

|

00 |

c. Unrecaptured Section 1250 gain - Fed Form 1065, Sch. K, Line 9c |

|

|

00 |

13. Net gain (loss) under Section 1231 from |

|

Federal Form 1065, Schedule K, Line 10 |

|

|

13 |

14. Other income (loss) (Attach schedule) from |

|

Federal Form 1065, Schedule K, Line 11 |

14 |

15. Total Income (Combine Lines 4 through 12a, Line 13, and Line 14) |

|

|

15 |

DEDUCTIONS: |

|

16.Charitable contributions from

|

Federal Form 1065, Schedule K, Line 13(a) |

16 |

17. |

Section 179 expense deduction from |

|

|

|

17 |

|

Federal Form 1065, Schedule K, Line 12 |

|

18. |

Expenses related to portfolio income (loss) from |

|

|

|

18 |

|

Federal Form 1065, Schedule K, Line 13(b) and 13(c) |

|

19. |

Other deductions from Federal Form 1065, Schedule K, Line 13(d) |

|

|

|

19 |

12b

12c

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

005

006

007

008

009

0010

0011

0012a

0013

0014

0015

0016

0017

0018

0019

SCHEDULE 2 - APPORTIONMENT PERCENTAGE: COMPLETE ONLY IF PARTNERSHIP HAS INCOME DERIVED FROM OR CONNECTED WITH SOURCES IN DELAWARE AND AT LEAST ONE OTHER STATE AND IF IT HAS ONE OR MORE PARTNERS WHO ARE NOT RESIDENTS IN DELAWARE.

SECTION A - GROSS REAL AND TANGIBLE PERSONAL PROPERTY

COLUMN A |

|

COLUMN B |

|

Delaware Sourced |

|

Total Sourced (All Sources) |

|

Beginning of Year |

End of Year |

Beginning of Year |

End of Year |

1.Total real and tangible property owned..............................................................

2.Real tangible property rented (eight times annual rent paid).................................

3.Total (Combine Lines 1 and 2).........................................................................

4.Less: value at original cost of real and tangible property (see instructions)...........

5.Net Values (Subtract Line 4 from Line 3)..........................................................

6. |

Total (Combine Line 5 Beginning and End of Year Totals) |

6 |

7. |

Average values. (Divide Line 6 by 2) |

7 |

1

2

3

4

5

SECTION B - WAGES, SALARIES,AND OTHER COMPENSATION PAID ORACCRUED TO EMPLOYEES

8. Wages, salaries and other compensation of all employees....................................................

8

SECTION C - GROSS RECEIPTS SUBJECT TO APPORTIONMENT

9.Gross receipts from sales of tangible personal property........................................................

10.Gross income from other sources (see attachment)............................................................

11.Total..............................................................................................................................

9

10

11

SECTION D - DETERMINATION OF APPORTIONMENT PERCENTAGES

12a. Enter amount from Column A, Line 7..............................................................................

=

12b. Enter amount from Column B, Line 7..............................................................................

13a. Enter amount from Column A, Line 8..............................................................................

=

13b. Enter amount from Column B. Line 8..............................................................................

14a. Enter amount from Column A, Line 11.............................................................................

=

14b. Enter amount from Column B, Line 11.............................................................................

15.Total (Combine Apportionment Percentages on Lines 12, 13 and 14)

16.Apportionment percentage (see specific instructions)............................................................................................................................................................................................................................

%

%

%

%

12a

12b

13a

13b

14a

14b

15

16

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT, AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THIS DECLARATION IS BASED ON ALL INFORMATION OF WHICH HE/SHE HAS ANY KNOWLEDGE.

SIGNATURE OF PARTNER |

DATE |

|

TELEPHONE NUMBER |

|

||

|

|

|

|

|

|

|

SIGNATURE OF PREPARER |

DATE |

|

TELEPHONE NUMBER |

|

PRINT NAME OF PREPARER |

|

|

|

|

|

|

|

|

PREPARER ADDRESS (STREET, CITY, STATE & ZIP CODE) |

|

|

|

|

PREPARER EIN/SSN/PTIN |

|

MAIL TO: DIVISION OF REVENUE, P.O. BOX 8703, WILMINGTON, DELAWARE

(Revised 01/22/07)