Form Dex 93 can be filled out effortlessly. Simply use FormsPal PDF editing tool to complete the job right away. We at FormsPal are focused on giving you the perfect experience with our editor by regularly presenting new capabilities and improvements. Our tool has become much more intuitive with the latest updates! Now, working with PDF files is a lot easier and faster than ever. Getting underway is effortless! All you have to do is follow the following basic steps directly below:

Step 1: Firstly, access the editor by clicking the "Get Form Button" at the top of this site.

Step 2: With our state-of-the-art PDF file editor, you can actually do more than merely fill out blanks. Try all of the functions and make your documents appear perfect with customized textual content put in, or modify the file's original input to perfection - all comes with the capability to incorporate your own graphics and sign it off.

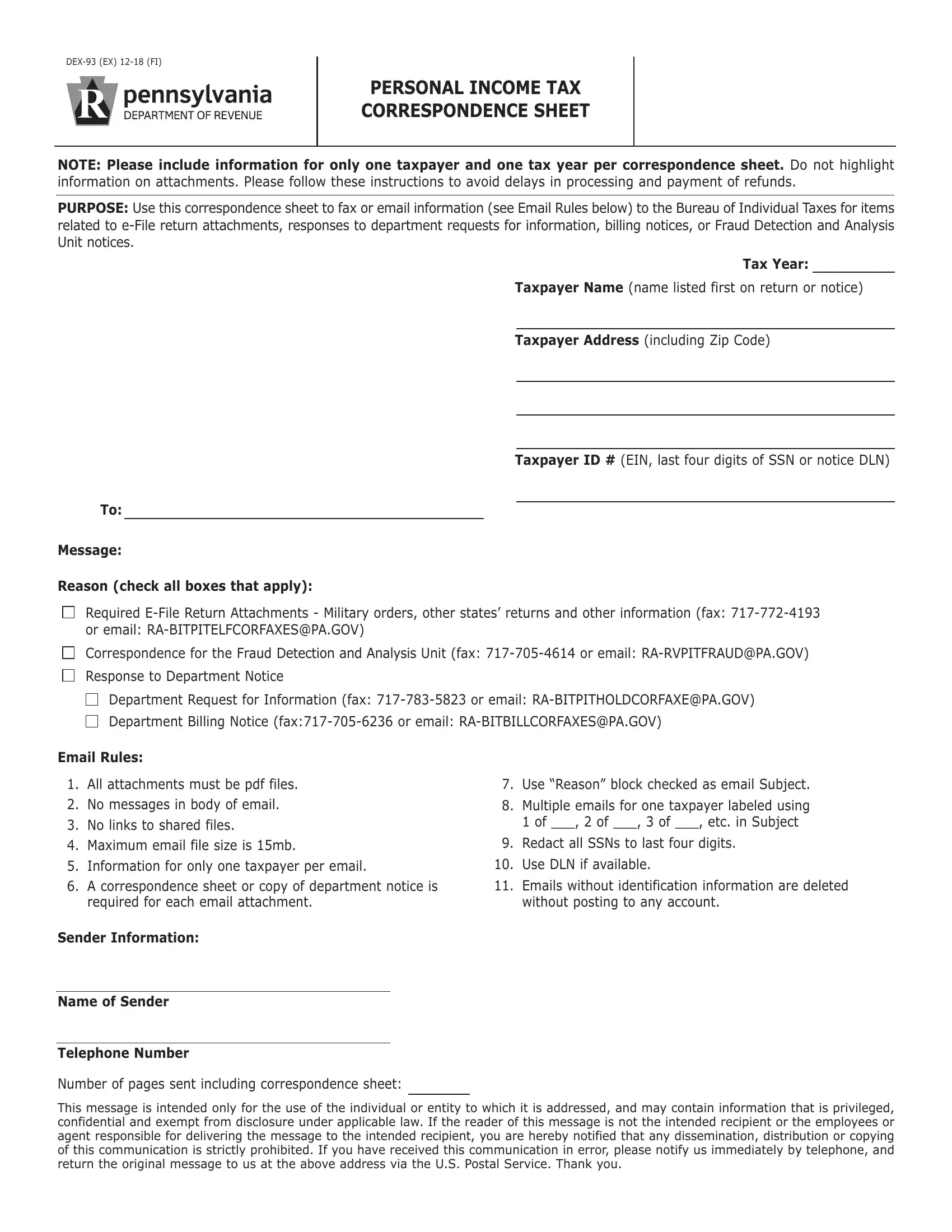

This PDF form will require some specific information; to ensure accuracy, please be sure to take note of the subsequent guidelines:

1. It's vital to fill out the Form Dex 93 correctly, hence be careful while filling in the areas that contain these blank fields:

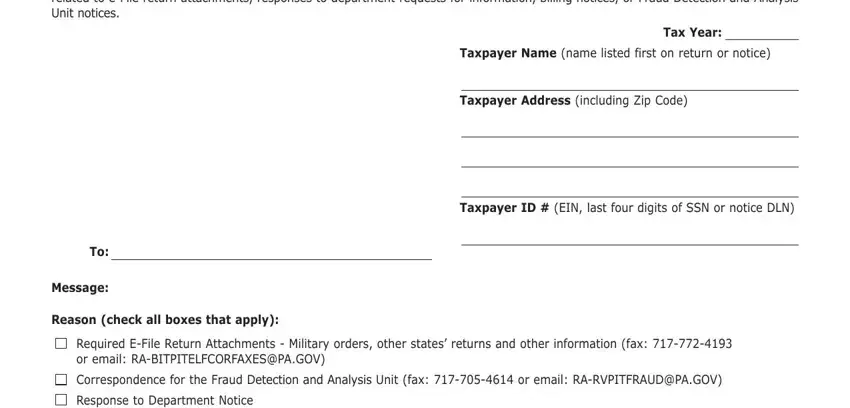

2. Once your current task is complete, take the next step – fill out all of these fields - Response to Department Notice, Department Request for Information, Department Billing Notice fax or, Email Rules, All attachments must be pdf files, No messages in body of email, No links to shared files, Maximum email file size is mb, Use Reason block checked as email, Multiple emails for one taxpayer, Redact all SSNs to last four, Information for only one taxpayer, Use DLN if available, A correspondence sheet or copy of, and Emails without identification with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. In this specific stage, review Number of pages sent including, and This message is intended only for. These should be filled out with highest accuracy.

Be very attentive when filling out This message is intended only for and This message is intended only for, since this is where many people make some mistakes.

Step 3: Proofread the information you have typed into the blanks and then click on the "Done" button. Find your Form Dex 93 when you join for a free trial. Readily use the pdf inside your personal account page, together with any modifications and adjustments being all kept! We don't share any information you provide when filling out forms at our website.