In the realm of navigating the intricacies of public assistance, the DHS 20 form stands as a vital document meant to streamline the process of verifying an individual's assets for eligibility determination. Operating under the authority of P.A., 280 of 1939, its completion is not merely a formality but a mandatory step in ensuring that those in need receive the support they merit, without discrimination. By authorizing the release of financial information, the form facilitates a crucial exchange between individuals—or their representatives—and financial institutions. This exchange is not limited to current asset statuses but extends to accounts closed within the past 36 months, ensuring a comprehensive view of one's financial history. The form pays deep respect to the diversity and needs of its constituents, clearly stating its adherence to the Americans with Disabilities Act by offering assistance to those who struggle with reading, writing, hearing, and more. This emblem of administrative diligence and inclusivity does more than merely gather data; it embodies the Department of Human Services' commitment to fairness and accessibility. With sections meticulously designed for both the applicant and the financial institution, it ensures clarity and completeness in the documentation of assets, from savings accounts to safety deposit boxes, all while upholding the privacy and dignity of all individuals.

| Question | Answer |

|---|---|

| Form Name | DHS-20 Form |

| Form Length | 1 pages |

| Fillable? | Yes |

| Fillable fields | 41 |

| Avg. time to fill out | 8 min 31 sec |

| Other names | dhs 20 verification of assets, michigan dhs 20 verification of assests form, dhs verification of assets form, dhs 20 |

Training Office

7109 West Saginaw Hwy

Lansing, MI 48917

Fifth Third

(EASTERN MICHIGAN)

P.O. BOX 630900 CINCINNATI OH

Case Name: Susan Sharp

Case Number: see your Case Data Sheet

Date: Last Month

DHS Office:

Specialist: A. Specialist

Phone:

Fax:

Specialist ID:

Department of Human Services (DHS) will not discriminate against any individual or group because of race, religion, age, national origin, color, height, weight, marital status, sex, sexual orientation, gender identity or expression, political beliefs or disability. If you need help with reading, writing, hearing, etc., under the Americans with Disabilities Act, you are invited to make your needs known to a DHS office in your area.

AUTHORITY: P.A., 280 of 1939

COMPLETION: Required

PENALTY: Inability to determine eligibility for public assistance

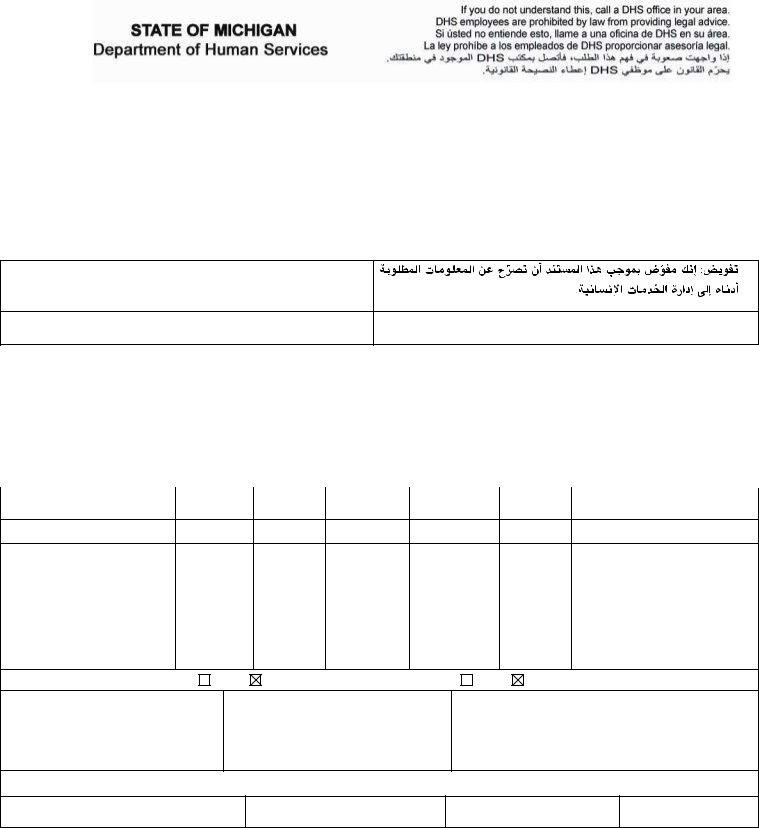

VERIFICATION OF ASSETS

AUTHORIZATION: You are hereby authorized to release the information requested below to the Department of Human Services.

AUTORIZACION: Usted está autorizado a dar la información pedida más abajo a Department of Human Services.

Signature of Client or Client’s Representative |

Date |

|

Susan Sharp |

Last Month |

|

To determine eligibility for assistance it is necessary to verify assets owned by the person named below, either alone or jointly with other persons. If the account is joint, please list the names of the account members.

Please provide current information on the person indicated below. Also, please report on accounts closed within the past 36 months. A stamped, addressed envelope is enclosed for return of the completed form. Thank you.

THIS SECTION IS TO BE COMPLETED BY THE SPECIALIST

Name (Type or Print) |

|

|

|

|

Social Security Number |

|

|

Susan Sharp |

|

|

|

|

|

||

THIS SECTION IS TO BE COMPLETED BY FINANCIAL INSTITUTION |

|

|

|||||

NOTE: Please Report on Closed |

Savings/Share Certificate of |

Checking/Draft |

Prepaid |

Other |

|||

Accounts if Closed Within Past |

Patient Trust |

Burial |

|||||

Account |

Deposit |

Account |

(Explain) |

||||

36 Months |

Fund |

Account |

|||||

|

|

|

|||||

|

|

|

|

||||

1.Account Number(s): 7007942

2. |

Date Last Withdrawal |

MM/DD/YY |

|

|

|

3. |

Amount Last Withdrawal |

$910.00 |

|

|

|

4. |

Current Balance |

$50.00 |

|

|

|

5. |

Highest Balance |

$960.00 |

|

For Month of ______________ |

|

6. |

Lowest Balance |

$50.00 |

|

For Month of |

|

7. Is There a Safety Deposit Box?

Yes |

No |

8. Is There a Trust Fund? |

Yes |

No If Yes, Attach a Copy of the Trust. |

9.For Each Joint Account List Account Number:

Account Members:

10.For Each Joint Account List Account Number:

Account Members:

11. For Each Loan Application Within Past 36 Months List:

Account Number ___________/______________

Type (e.g., Auto, Home) ___________/ ____________

Current Balance ____________/_ ____________

If collateral was used attach a copy of the loan application

12. Remarks:

13. Signature

Teller

14. Title

Teller, Fifth Third

15. Telephone No.

()

16.Date

LAST MONTH