The PDF editor that you can benefit from was made by our top software engineers. One could submit the mo dor form 126 form fast and efficiently with this software. Merely stick to this procedure to get started.

Step 1: On the webpage, press the orange "Get form now" button.

Step 2: As soon as you access our mo dor form 126 editing page, there'll be each of the options you can take about your file within the upper menu.

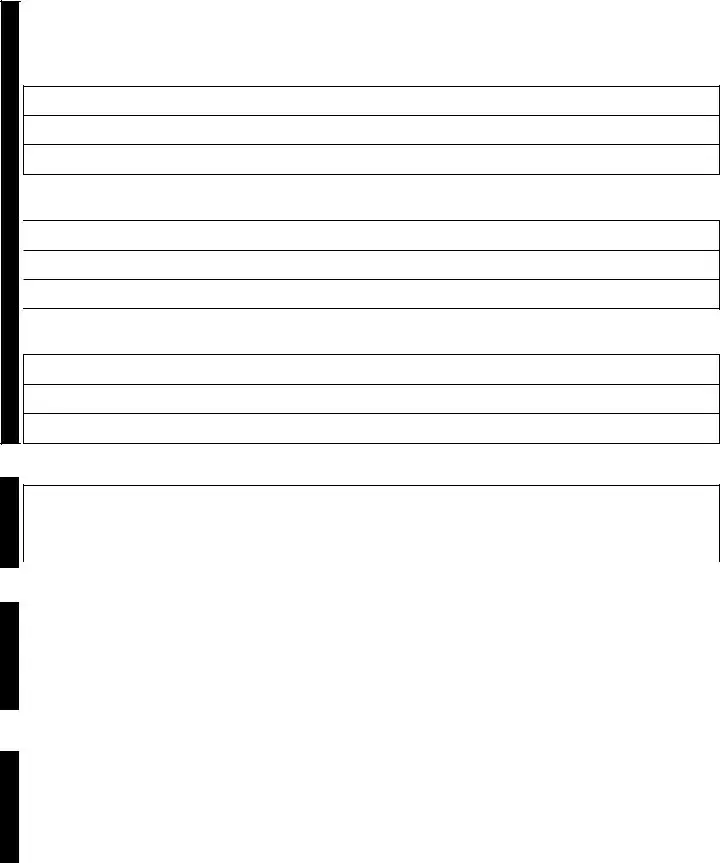

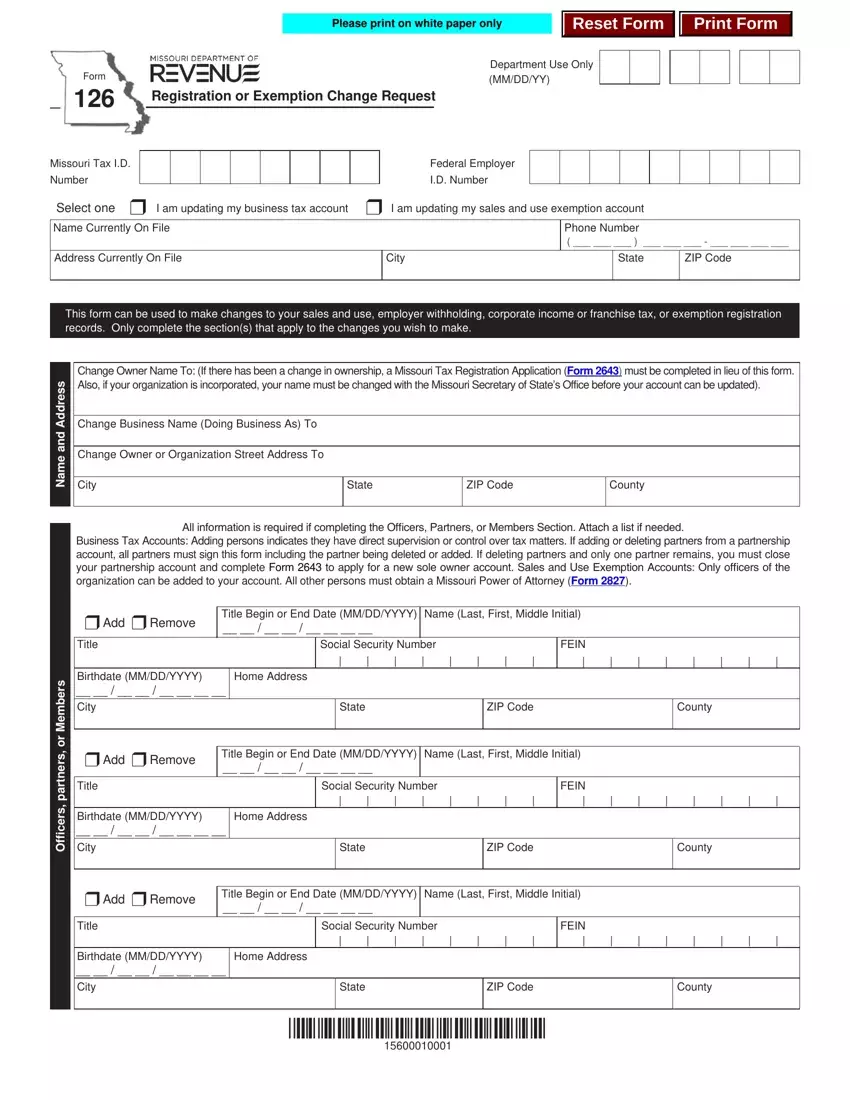

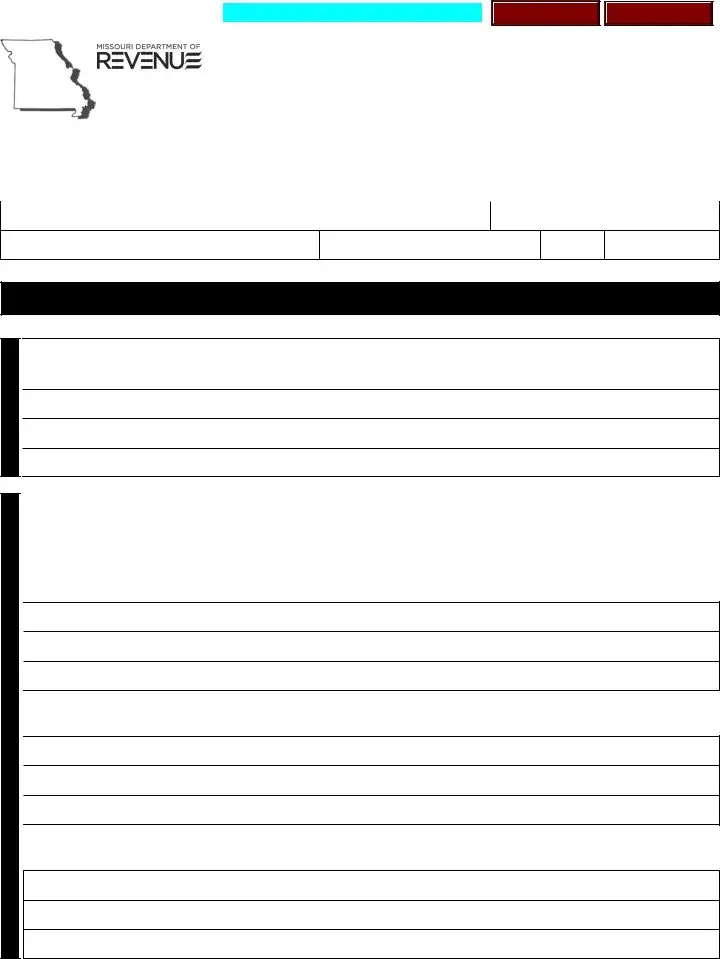

These segments will constitute the PDF form that you'll be filling out:

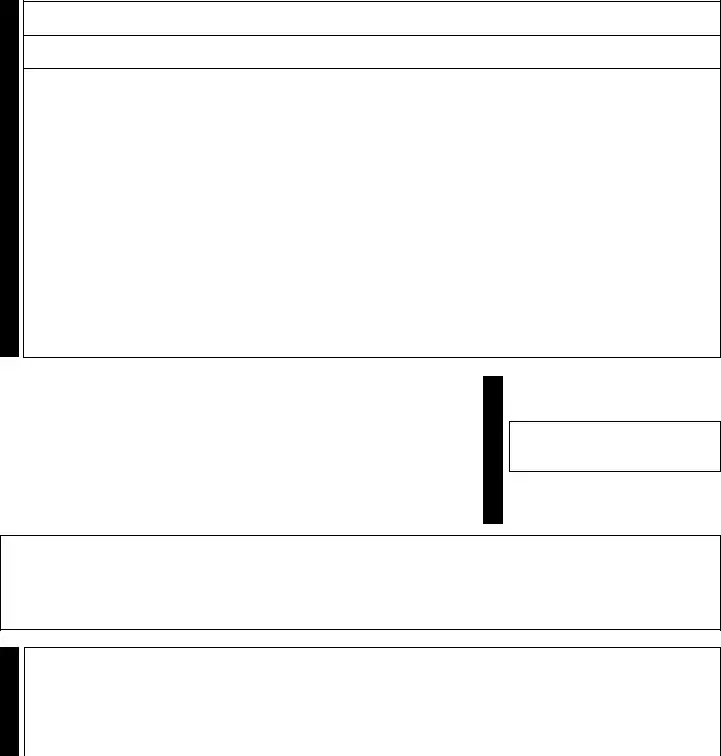

Inside the box s s e r d d A d n a, e m a N, s r e b m e M, r o, s r e n t r a p, s r e c i f f, Change Owner Name To If there has, Change Business Name Doing, Change Owner or Organization, City, State, ZIP Code, County, All information is required if, and r Add r Remove write down the particulars that the platform asks you to do.

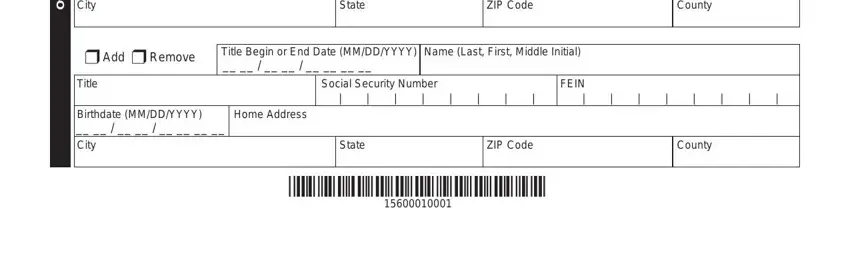

Be sure to identify the relevant data within the s r e c i f f, Birthdate MMDDYYYY City, State, ZIP Code, County, r Add r Remove, Title Begin or End Date MMDDYYYY, Title, Social Security Number, FEIN, Birthdate MMDDYYYY City, Home Address, State, ZIP Code, and County field.

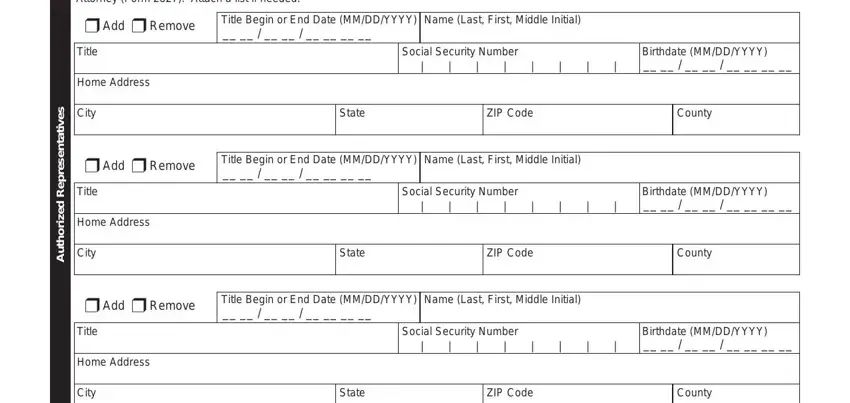

Describe the rights and obligations of the sides in the space All information is required if, r Add r Remove, Title Begin or End Date MMDDYYYY, Title, Home Address, City, Social Security Number, Birthdate MMDDYYYY, State, ZIP Code, County, r Add r Remove, Title Begin or End Date MMDDYYYY, Title, and Home Address.

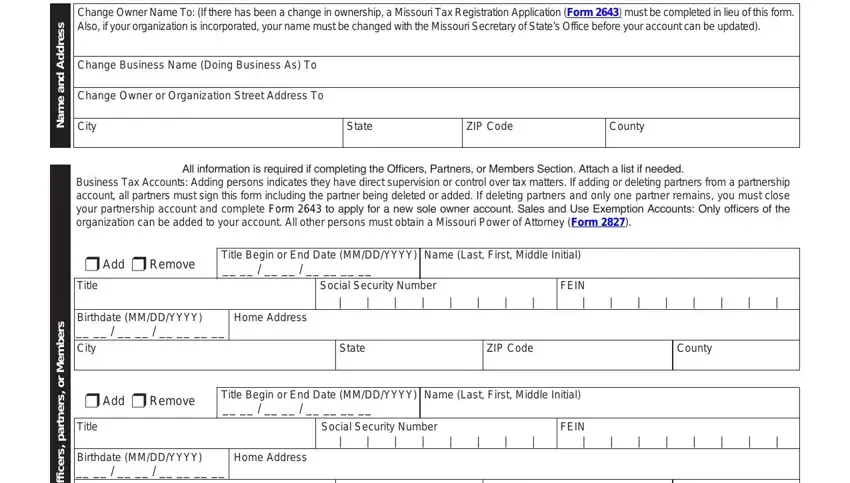

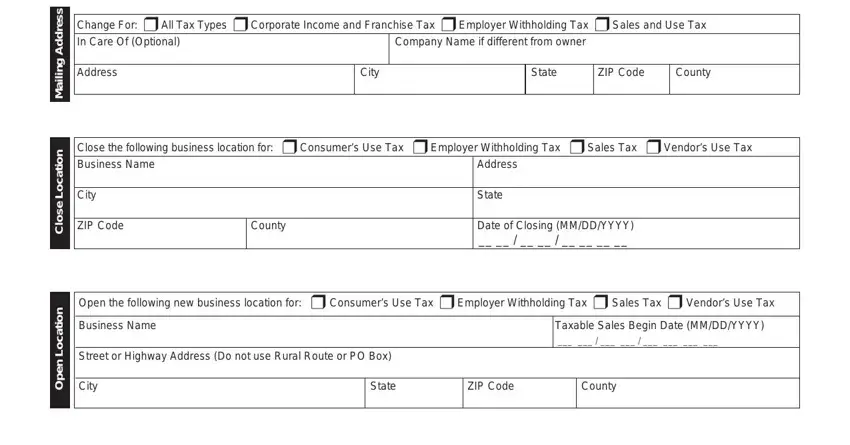

End by checking the next areas and filling them out as required: Change For r All Tax Types r, Company Name if different from, Address, City, State, ZIP Code, County, Close the following business, Address, City, ZIP Code, County, State, Date of Closing MMDDYYYY, and Open the following new business.

Step 3: Click "Done". Now you may export your PDF file.

Step 4: Ensure that you remain away from possible complications by creating at least 2 copies of the file.

Officers, partners, or Members

Officers, partners, or Members