Handling PDF documents online is actually super easy with this PDF editor. You can fill in dr 1094w here effortlessly. We at FormsPal are devoted to making sure you have the perfect experience with our editor by consistently adding new functions and improvements. With these improvements, working with our tool becomes easier than ever before! With some basic steps, you may begin your PDF journey:

Step 1: Access the form in our editor by clicking on the "Get Form Button" above on this page.

Step 2: Using our online PDF tool, you may do more than merely complete blank fields. Edit away and make your documents seem professional with customized textual content added, or adjust the file's original content to perfection - all comes with the capability to add stunning images and sign the PDF off.

This form will need specific details; to ensure correctness, remember to take heed of the recommendations directly below:

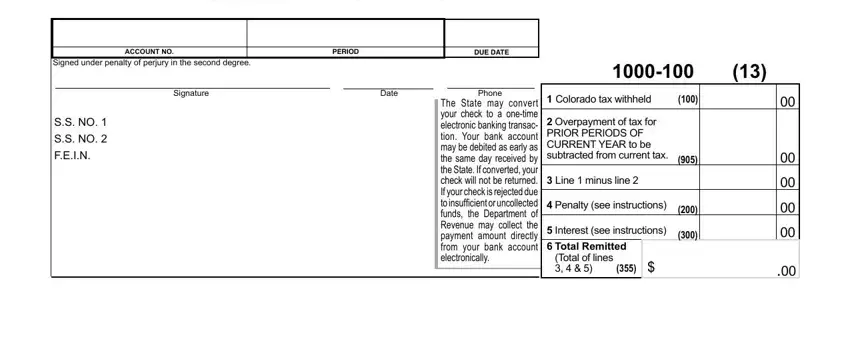

1. While submitting the dr 1094w, ensure to include all of the essential fields within the associated section. This will help to hasten the process, making it possible for your details to be handled promptly and accurately.

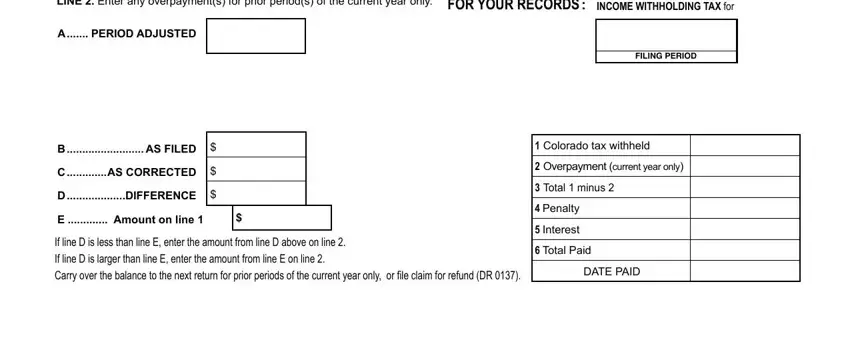

2. Once your current task is complete, take the next step – fill out all of these fields - LiNE Enter any overpayments for, FOR YOUR RECORDS, INCOME WITHHOLDING TAX for, A PERiOD ADJUSTED, B AS FiLED, C AS CORRECTED, D DiFFERENCE, E Amount on line, If line D is less than line E, FiLiNG Period, Colorado tax withheld, Total minus, Penalty, Interest, and Total Paid with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

You can potentially make errors when filling out your INCOME WITHHOLDING TAX for, therefore be sure to reread it before you'll submit it.

Step 3: Be certain that your information is correct and then click on "Done" to proceed further. Try a 7-day free trial option with us and gain immediate access to dr 1094w - available from your personal account page. FormsPal is invested in the personal privacy of all our users; we always make sure that all information entered into our system is confidential.