Navigating the complexities of tax refunds for undyed diesel used in off-road or exempt purposes can be daunting, yet the DR-309639 form offers a structured avenue for taxpayers to reclaim their dues. Crafted by the Florida Department of Revenue, this form addresses the specific needs of individuals or entities that have paid taxes on undyed diesel fuel, subsequently used for off-road tasks or other exempted operations. Applicants are required to meticulously complete the form, providing information ranging from personal identification to intricate details of diesel usage, ensuring every red-fielded section is filled to avoid rejection. Alongside the primary application, supporting schedules guide the calculation of the refund amount, demanding an accurate account of diesel purchases, usage, and the tax implications thereof. The form not only caters to direct off-road applications but extends its benefit to activities like operating concrete mixers, compacting solid waste, or powering off-road equipment, provided these tasks comply with the stipulated conditions. Moreover, the DR-309639 form serves as a testament to the state's commitment to acknowledging the diverse utilizations of diesel fuel beyond propulsion, thereby offering a financial reprieve to taxpayers who adhere to the guidelines while contributing towards a more administratively efficient tax system.

| Question | Answer |

|---|---|

| Form Name | Dr 309639 Form |

| Form Length | 10 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 30 sec |

| Other names | form dr 309639 florida, dr 309639, fl dr 309639, dr 309639 refund |

Application for Refund of Tax Paid

on Undyed Diesel Used for

Mail to : Florida Department of Revenue

Refunds

PO Box 6490

Tallahassee FL

Fax:

Handwritten Example

0 1 2 3 4 5 6 7

R. 01/13

Rule

Florida Administrative Code

Effective 01/13

|

|

Typed Example |

8 |

9 |

0123456789 |

Use black ink.

NOTE: Your refund application will be rejected if ields in red are not completed in full.

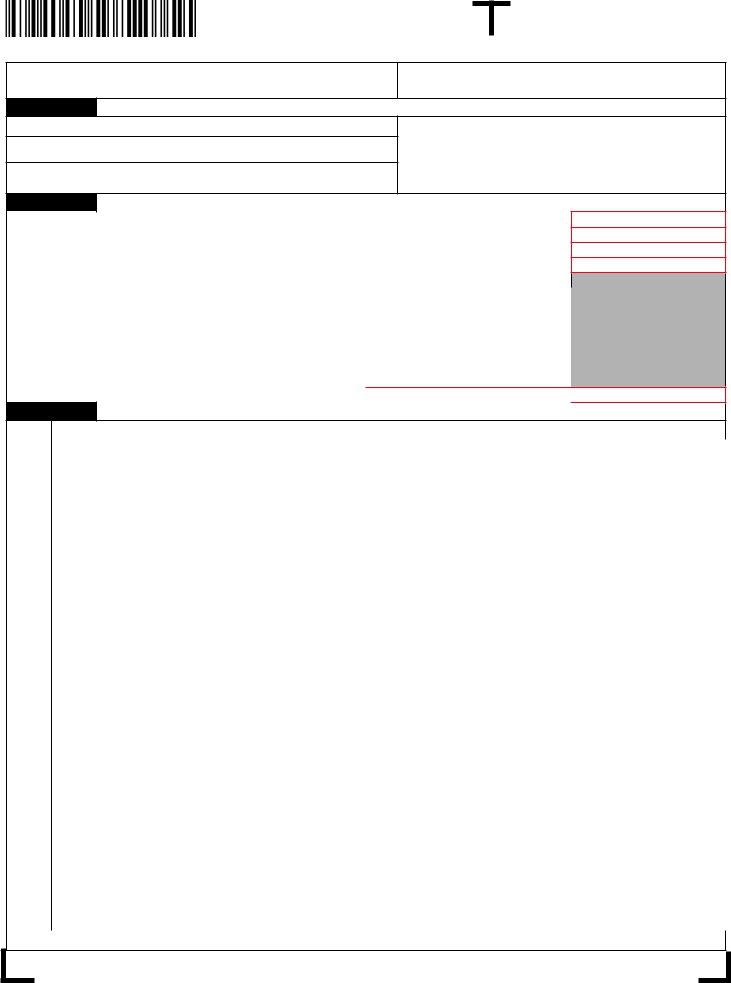

Name of applicant/payee: Mailing street address:

Mailing city, state, ZIP:

Location street address:

Location city, state, ZIP:

Email address:

Sales & Use Tax number:

FEIN:

Business Partner Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

For invoices covering: |

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|||

month |

|

|

|

year through month |

|

|

|

year |

||||||||||||||||||||

Business telephone number (include area code): |

|

|

|

|

|

|

Fax number (include area code): |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

– |

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. Total Net Refund Requested (From Page 2, Part II, Line 13) |

$ |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalty of perjury, I declare that I have read this application and the facts stated in it are true. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Person |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Include area code): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Who May Apply for Refunds?

Any person who purchases undyed,

On this application, you may take a credit for the fuel tax paid against the use tax due on the gallons consumed by a power

Tax Rates: The applicable tax rates are entered by the Department. The state tax rates on fuel, the county fuel tax rates, and the county discretionary sales surtax rates, as provided in sections 206.41, 206.87, 206.9825, 212.05, and 212.055, Florida Statutes (F.S.), are published annually in Taxpayer Information Publications on the Department’s website at www.mylorida.com/dor. The tax rates used to determine the amount of refund due are entered on this application by the Department. When computing use tax due, include the applicable surtax rate where the fuel is delivered.

For help in completing this form, please contact: |

Florida Department of Revenue |

||

|

|

|

Refunds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

R. 01/13

Page 2

FEIN

Category:

Please Check All Applicable Boxes: Note: This application can be used for more than one category of refund.

❑A Fuel used to turn a concrete mixer drum or to compact solid waste.

❑B Fuel used for unloading bulk cargo by pumping.

❑C Fuel used to propel

❑D Fuel used in

Part I:

1) |

Beginning Inventory (Measured on the irst day of the refund period) |

1. |

|||

2) |

Gallons Purchased (From completed Schedule |

2. |

|||

3) |

Ending Inventory (Measured on the last day of the refund period) |

3. |

|||

4) |

Gallons to be Accounted for (Lines 1 plus 2 minus 3) |

4. |

|||

5) |

Gallons Consumed in Trucks (For A and B users only) |

|

|||

|

a. |

Concrete Mixers/Solid Waste Compactors 5a. |

|

gals. |

|

|

|

|

|

|

|

|

b. |

Unloading by Pumping |

|

|

gals. |

|

(From completed Schedule ID, Part II) |

5b. |

|

|

|

6) |

Gallons Consumed for Other Exempt |

|

|||

|

c. |

To Propel |

6c. |

|

gals. |

|

|

|

|

|

|

|

d. |

6d. |

|

gals. |

|

|

|

|

|

|

|

7) |

Gallons Consumed for Highway Use (Line 4 minus Lines 5a, 5b, 6c, and 6d) |

7. |

|||

gals.

gals.

gals.

gals.

gals.

Part II:

Calculation of Refund Due Based on Categories Above:

A. Refund on Undyed Diesel Fuel Consumed by Concrete Mixers/Solid Waste Compactors:

8) |

Gallons Eligible for Refund (35% of Part 1, Line 5a) |

8. |

gals. |

|

|

|

|

9) |

Line 8 multiplied by Average Cost per Gallon (From Schedule 1B, see instructions) |

9. |

$ |

10) |

Fuel Tax Eligible for Refund (Line 8 multiplied by $.316) |

10. |

$ |

11) |

Sales Tax Due [Line 9 multiplied by (6% plus applicable surtax – see Schedule 1C)] 11. |

$ |

|

12) |

Net Refund Due (Line 10 minus Line 11) |

12. |

$ |

B. Refund on Undyed Diesel Fuel Consumed for Unloading Bulk Cargo by Pumping: |

|

|

|

8) |

Gallons Eligible for Refund (Part I, Line 5b) |

8. |

gals. |

|

|

|

|

9) |

Line 8 multiplied by the Average Cost per Gallon (From Schedule 1B, see instructions) 9. |

|

|

|

|

|

|

10) |

Fuel Tax Eligible for Refund (Line 8 multiplied by $.316) |

10. |

$ |

11) |

Sales Tax Due [Line 9 multiplied by (6% plus applicable surtax – see Schedule 1C) |

11. |

$ |

12) |

Net Refund Due (Line 10 minus Line 11) |

12. |

$ |

C. Refund on Undyed Diesel Fuel Used to Propel |

|

|

|

8) |

Gallons Eligible for Refund (Part I, Line 6c) |

8. |

gals. |

|

|

|

|

9) |

Line 8 multiplied by the Average Cost per Gallon (From Schedule 1B, see instructions) 9. |

$ |

|

10) |

Fuel Tax Eligible for Refund (Line 8 multiplied by $.316) |

10. |

$ |

11) |

Sales Tax Due [Line 9 multiplied by (6% plus applicable surtax – see Schedule 1C)] 11. |

$ |

|

12) |

Net Refund Due (Line 10 minus Line 11) |

12. |

$ |

D. Refund on Undyed Diesel Fuel Used in |

|||

8) |

Gallons Eligible for Refund (Part I, Line 6d) |

8. |

gals. |

|

|

|

|

9) |

Line 8 multiplied by the Average Cost per Gallon (From Schedule 1B, see instructions) 9. |

$ |

|

10) |

Fuel Tax Eligible for Refund (Line 8 multiplied by $.316) |

10. |

$ |

11) |

Sales Tax Due [Line 9 multiplied by (6% plus applicable surtax – see Schedule 1C)] 11. |

$ |

|

12) |

Net Refund Due (Line 10 minus Line 11) |

12. |

$ |

13) |

Total Net Refund Requested (Sum of applicable Line 12 totals |

|

|

for Sections A, B, C, D. Carry forward to Page 1, Line 13) |

13. |

$ |

|

Note: Total gallons eligible for refund cannot exceed Part I, Line 4 (Gallons to be Accounted for).

R.01/13 Page 3

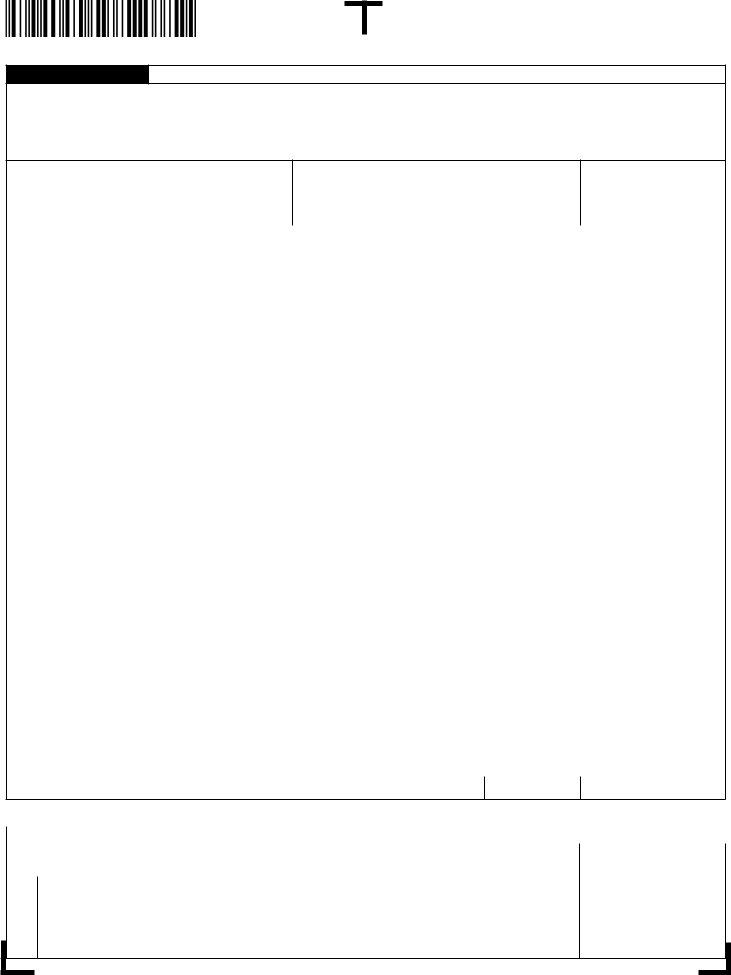

Schedule 1A

Schedule of Purchase of

You must complete and include this schedule with your application to qualify for the refund. In addition, the following information must be made available upon request to validate proof of purchase and taxes paid.

•Invoice from retail station where undyed diesel was purchased and placed directly into the supply tank of a qualifying motor vehicle.

•Invoice from bulk fuel provider. If fuel is placed into qualifying vehicles from bulk storage, you must maintain the original proof of purchase and you must include a daily withdrawal summary of

Applicant Name |

FEIN |

Invoiced Through Date |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

Name of Supplier |

Supplier FEIN/DEP Number |

Date Received |

Invoice Number |

Gallons Invoiced |

Invoiced Price Including Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS

|

Schedule 1B |

Average Cost per Gallon Computation |

|

|

|

|

|

|

|

1 |

|

Total State and Local Option Fuel Tax Paid on Fuel Purchases: |

$ |

|

|

|

(Total of Column 5 from Schedule 1A multiplied by $.316) |

|

|

|

|

|

|

|

2. |

|

Total Cost of Purchased Fuel Less State and Local Option Tax: |

$ |

|

|

|

(Total of Column 6 from Schedule 1A minus Line 1 from Schedule 1B) |

|

|

|

|

|

|

|

3. |

|

Average Cost per Gallon: |

$ |

|

(Total of Line 2 from Schedule 1B divided by Column 5 from Schedule 1A), carried out four decimal

places |