Should you wish to fill out summit county conveyance form, it's not necessary to download any sort of programs - simply make use of our online tool. The editor is continually updated by our staff, receiving useful features and growing to be greater. Here's what you'll want to do to get going:

Step 1: Open the PDF file in our tool by hitting the "Get Form Button" above on this webpage.

Step 2: This editor will give you the capability to customize your PDF in various ways. Enhance it by including any text, correct what's originally in the file, and add a signature - all possible within minutes!

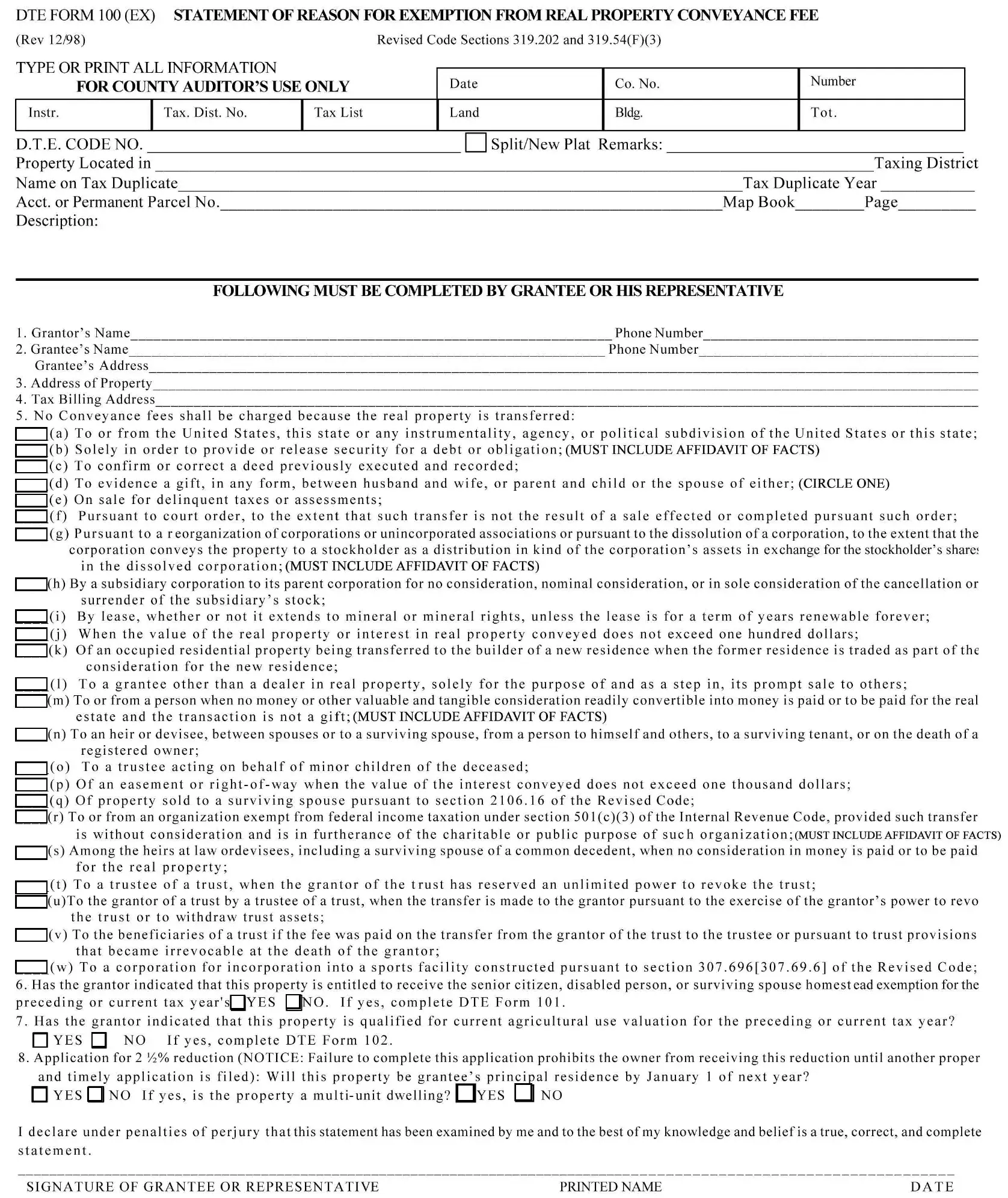

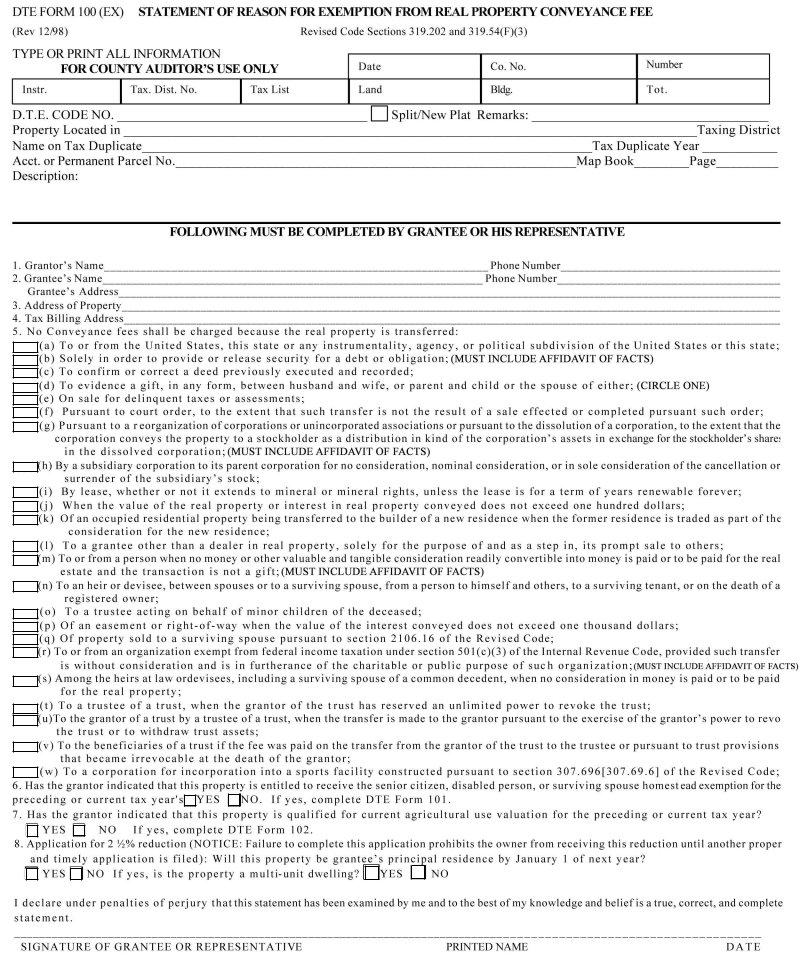

This PDF will require particular details to be typed in, hence you need to take whatever time to enter exactly what is expected:

1. The summit county conveyance form needs specific details to be typed in. Ensure that the subsequent blank fields are completed:

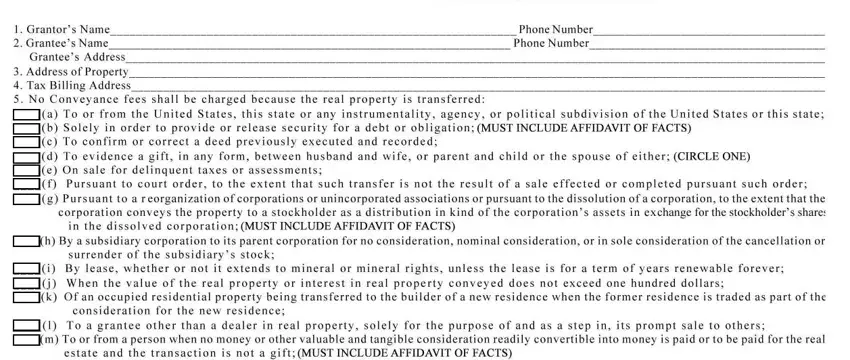

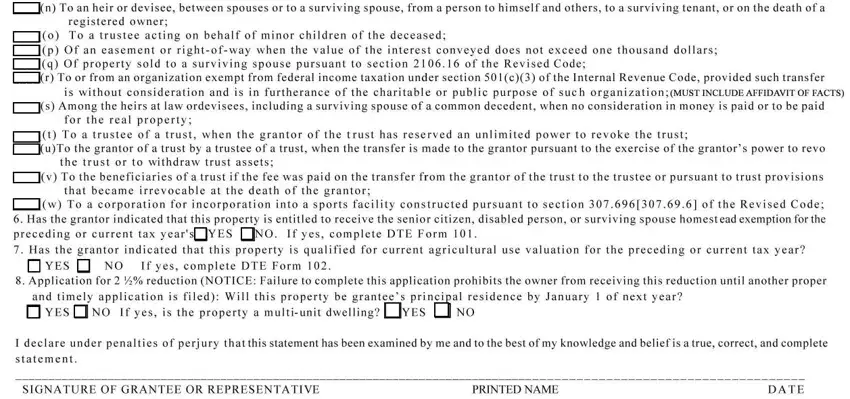

2. Your next part is to fill out these particular blanks: .

People who work with this document often make mistakes when completing this field in this section. You need to revise everything you type in right here.

Step 3: Before finishing your document, you should make sure that all blank fields are filled out right. As soon as you think it is all good, click on “Done." After registering afree trial account here, it will be possible to download summit county conveyance form or email it without delay. The PDF file will also be readily accessible in your personal account page with all of your adjustments. Here at FormsPal, we do our utmost to make sure that all of your details are kept secure.