The DTF-719-MN form, issued by the New York Department of Taxation and Finance, plays a crucial role for retail dealers and vending machine operators in the state. It serves as the renewal application for registration to sell cigarettes and tobacco products for the period from January 1, 2018, through December 31, 2018. This document outlines the necessary steps owners must take to comply with legal requirements, including detailing the legal name of the business, DBA/trade name, sales tax vendor identification number, and mailing address. The form further breaks down into parts, specifying the number of certificates needed for retail operations and vending machines, along with the associated costs. Importantly, it stipulates the deadlines for submission and payment methods. Completing and submitting this form on time ensures that retail dealers and vending operators can continue their sales without interruption, adhering to state regulations. The form also accommodates businesses looking to report changes such as adding new locations or ceasing sales of cigarettes while remaining open for other types of sales, making it a comprehensive tool for managing sales tax compliance in the tobacco retail sector.

| Question | Answer |

|---|---|

| Form Name | Dtf 719 Mn Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | dtf 719 form, atividade para escuta fala pensamento e imaginacao di das crianças, dtf 719 i, renewal application for registration of retail dealers and vending machines for salas of cigarettes and tobacco products dtf 719 mn |

Department of Taxation and Finance

Renewal Application for Registration of Retail Dealers and Vending Machines for Sales of Cigarettes and Tobacco Products

(6/17)

C18

Use this form to renew registration for all or any portion of the period from

January 1, 2018, through December 31, 2018.

Print or type

Legal name of business |

Date |

|

|

DBA (doing business as)/trade name |

Sales tax vendor identification number |

|

|

Mailing address; c/o name |

|

|

|

Number and street |

|

|

|

City, state, ZIP code |

|

|

|

Read the instructions (Form

Use this form to renew the registration for retail dealer certificates and vending machine certificates only if you are

currently registered for 2017. If registering for the first time, use Form

|

|

A |

B |

C |

D |

|

|

Number of |

Amount due |

Code |

|

|

|

Cost of each |

|||

|

|

certificates |

(A x B) |

|

|

|

|

|

|

|

|

1. |

Certificates of registration for retail operations |

|

$300 |

$ |

7030 |

|

(from Part A; see instructions) |

|

|||

|

|

|

|

|

|

2. |

Vending machine registration certificates |

|

$100 |

$ |

7040 |

|

(from Part B; see instructions) |

|

|||

|

|

|

|

|

|

3. |

Total amount due (add lines 1 and 2, column C) |

|

$ |

|

|

. . . . . . . . . . . . |

|

|

|||

Note: Vending machine registration certificates and certificates of registration for the period January 1, 2018, through December 31, 2018, will not be issued before December 1, 2017.

–Attach check or money order for the amount on line 3 payable to : New York State Sales Tax.

–W rite your sales tax vendor identification number, Form

–Mail your application and remittance on or before September 20, 2017.

–Do not mail this application in the envelope with your sales tax return.

Signature of applicant

Title

Daytime telephone number |

Date |

|

( |

) |

|

|

|

|

72000106170094

For office use only

Mail to:

NYS TAX DEPARTMENT

PO BOX 15175

ALBANY NY

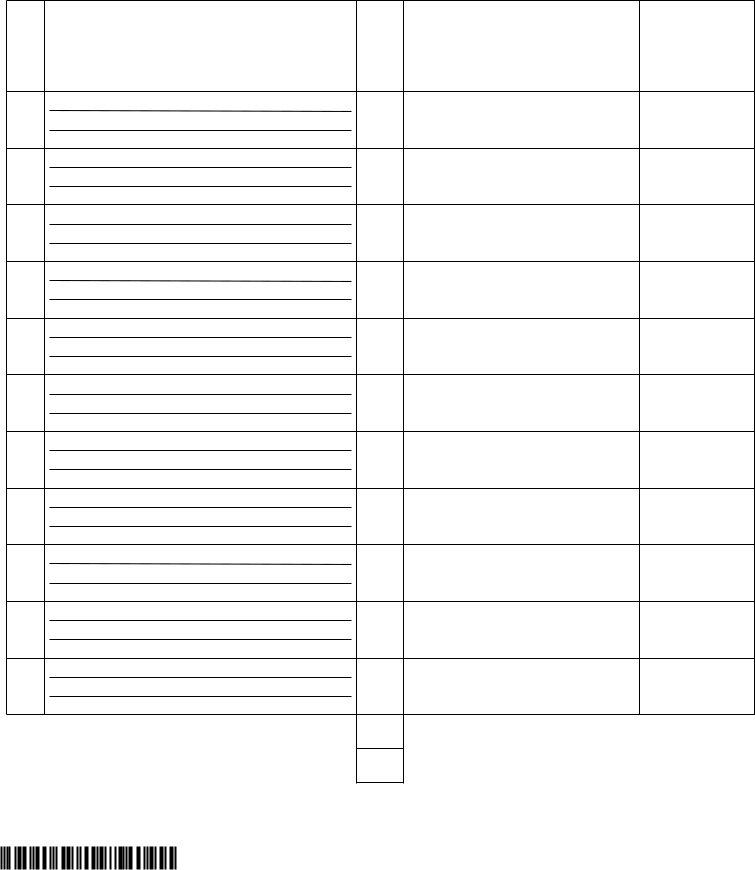

Part A - Certificates of registration for retail operations ($300 each)

The Seq. no. box is for office use only. In column A, enter your business name [trade name, DBA (doing business as) name, or assumed name if different from your legal name] and physical address for each business location. In column B, indicate whether you are currently making retail sales of cigarettes and/or tobacco products for each location listed. In column C, mark an X if the business is no longer selling cigarettes, but is open for other types of sales. In column D, enter the date you stopped all business activity at the location listed. In column E, enter the date you plan on beginning business if you are adding a new location for 2018 (attach Form

Seq.

no.

A

Business name and physical address

B

Y = yes

N = no

C |

D |

Location no longer selling |

Location closed for all |

cigarettes, but open for |

business; enter |

other types of sales |

|

|

(mm/dd/yy) |

|

|

E

Adding new location;

enter beginning

business date (Form

Totals from additional copies of page (if attached) . . . . . . . . . .

Total number of certificates of registration required . . . . . .

Enter this total on page 1, line 1, column A, as applicable.

72000206170094

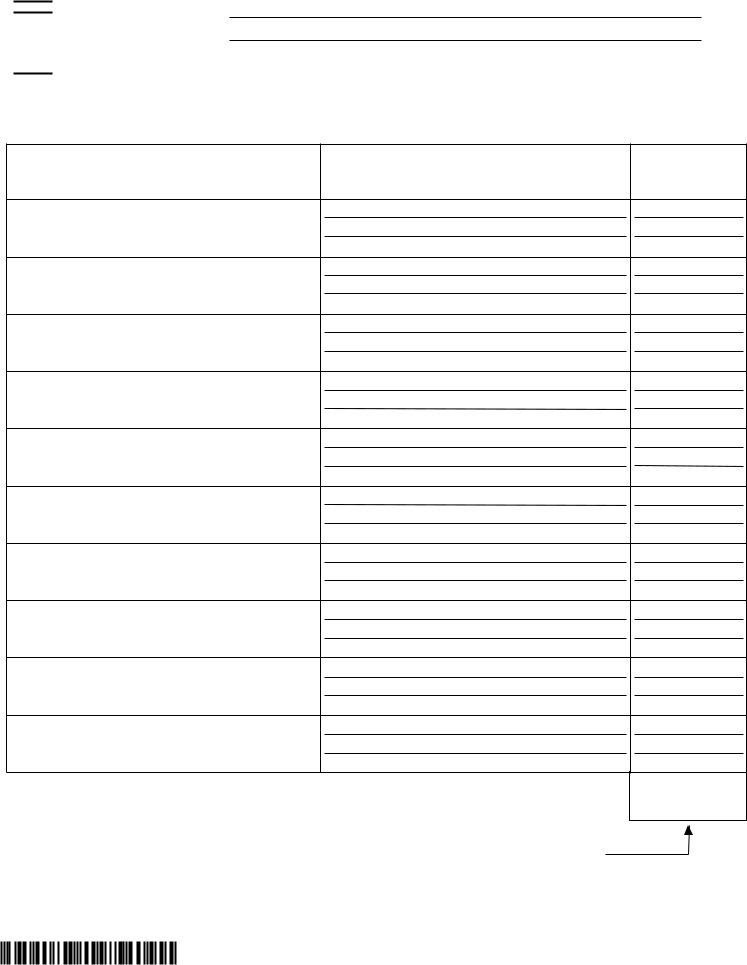

Part B - Vending machine registration certificates ($100 each)

Vendor name:

Vendor ID:

Period designator: C18

In columns A through C, list the business name and physical address where each of your vending machines is located and each machine's serial number. If you have several machines at one location, enter the physical address only once, but enter the serial numbers of every machine at the location. Attach additional copies of this page if necessary.

A

Business name

B

Physical address where vending machine is located

(report each machine separately in column C)

C

Serial number of each

vending machine

Total number of vending machine registration certificates required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Carry forward to next page or, if last page of Part B, enter this total on page 1, line 2, column A, as applicable.

72000306170094 |

|

|

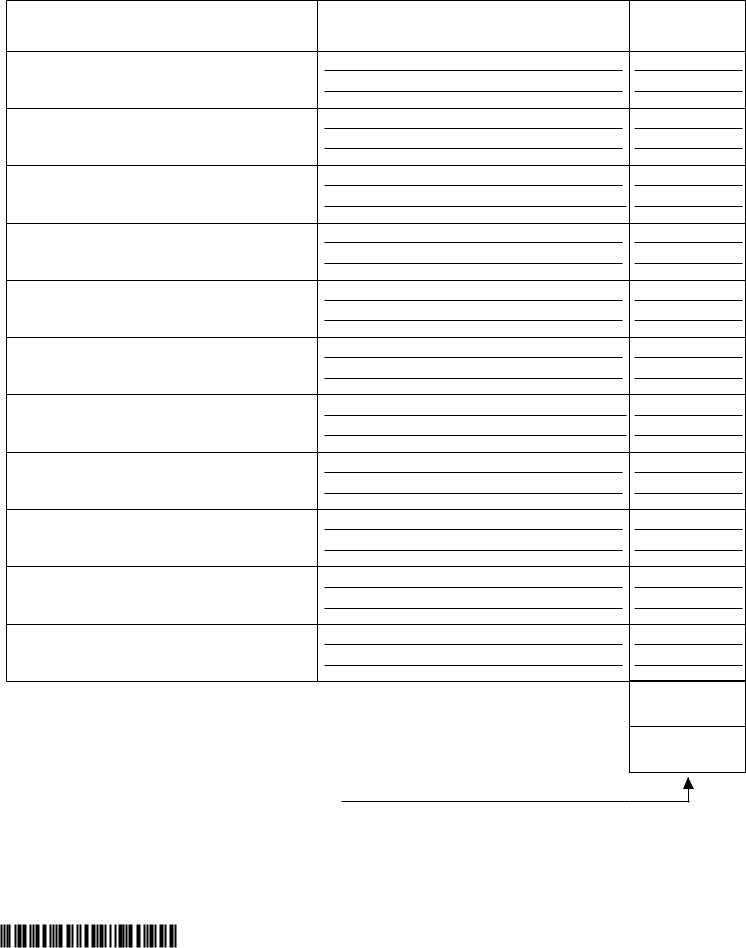

Part B - Vending machine registration certificates (continued)

A

Business name

B

Physical address where vending machine is located

(report each machine separately in column C)

C

Serial number of each

vending machine

Number of vending machine registration certificates from previous page (if last page, include totals from additional copies, if attached) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total number of vending machine registration certificates required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter this total on page 1, line 2, column A, as applicable.

72000406170094