Working with PDF files online is actually surprisingly easy with our PDF editor. Anyone can fill out mn w4 form printable here within minutes. To make our editor better and more convenient to use, we continuously design new features, with our users' feedback in mind. For anyone who is looking to start, here is what you will need to do:

Step 1: Hit the "Get Form" button at the top of this page to access our PDF tool.

Step 2: This tool will allow you to work with your PDF document in many different ways. Enhance it with customized text, adjust original content, and put in a signature - all manageable within minutes!

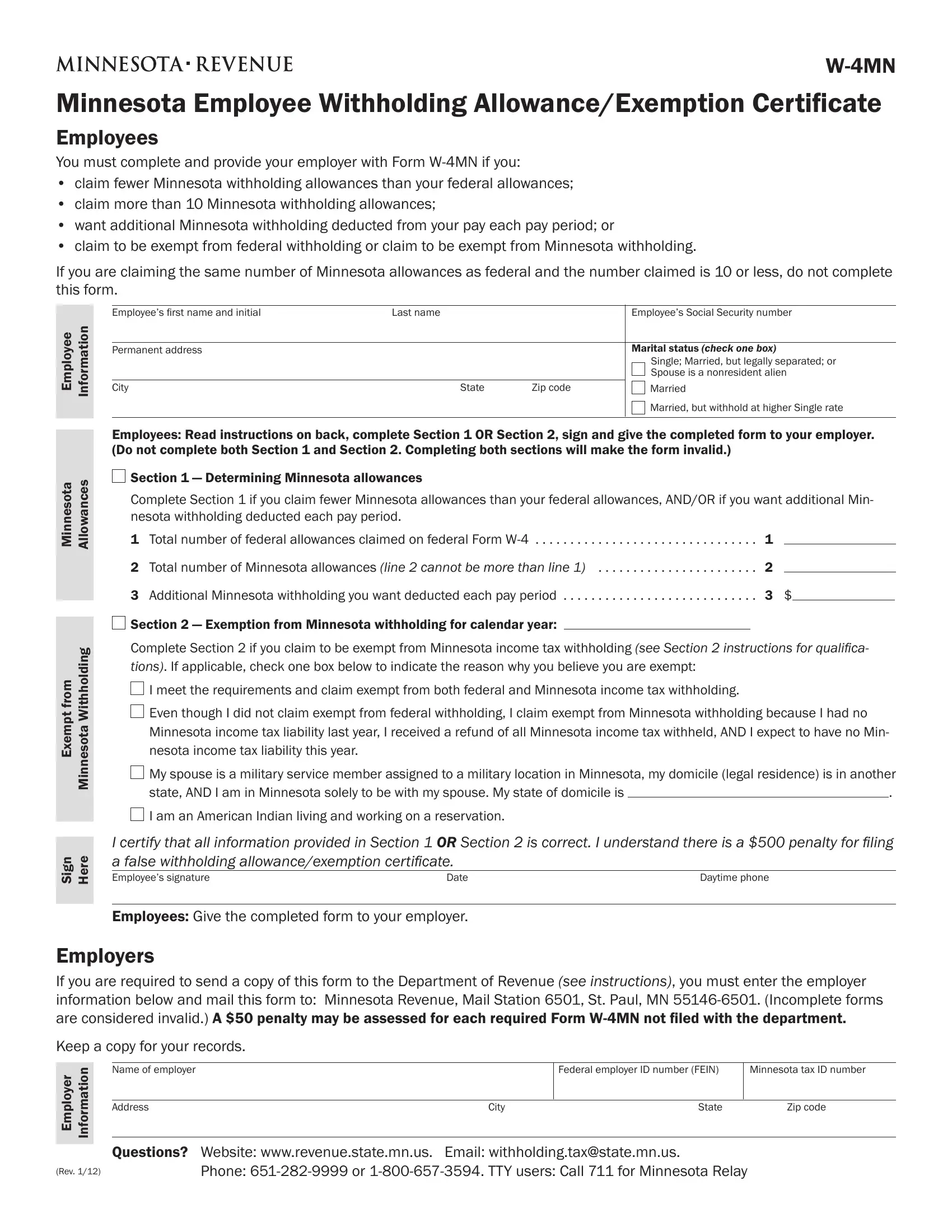

This form requires particular details to be filled in, thus you should definitely take the time to enter what's expected:

1. The mn w4 form printable will require specific details to be inserted. Make sure the subsequent fields are completed:

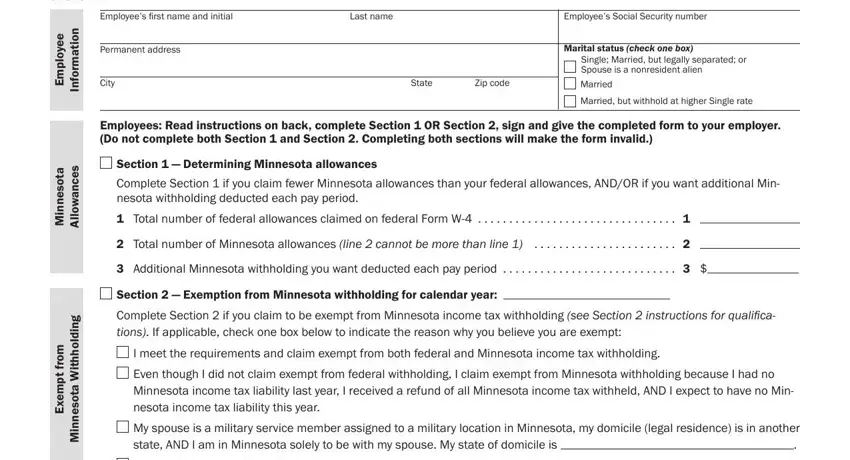

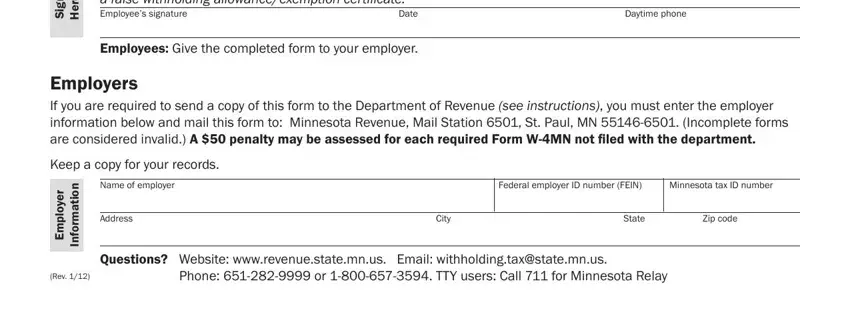

2. Once your current task is complete, take the next step – fill out all of these fields - I certify that all information, Daytime phone, Date, n g S, e r e H, Employees Give the completed form, Employers If you are required to, Keep a copy for your records, Name of employer, Address, r e y o p m E, n o i t a m r o f n I, Federal employer ID number FEIN, Minnesota tax ID number, and City with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Regarding Daytime phone and Employees Give the completed form, make certain you take another look in this current part. These are the most significant ones in the PDF.

Step 3: Before finalizing this form, ensure that blanks were filled in as intended. As soon as you believe it is all fine, press “Done." Sign up with us now and easily obtain mn w4 form printable, prepared for downloading. Every edit made is conveniently preserved , making it possible to edit the document at a later time when required. FormsPal is invested in the confidentiality of our users; we ensure that all personal data put into our system is secure.