Navigating the complexities of tax and insurance deductions can often feel like a maze, and the Edd De form, officially known as the Claim for Refund of Excess California State Disability Insurance Deductions, serves as a beacon for individuals who find themselves overpaying on their state disability insurance (SDI). Exclusively applicable to those exempt from California State Income Tax, this form provides a streamlined process for claiming a refund on excess SDI deductions. To initiate a claim, individuals must provide detailed personal information, include their employment and earnings history, and attach pertinent documents such as copies of their Form(s) W-2. It's essential to carefully document wages from multiple employers, ensuring that the total SDI deductions do not exceed the statutory threshold established for the given tax year. The guidelines stipulate that claims must be based on calendar year wages only and must be filed within a three-year period following the calendar year in which the excess deductions occurred. Moreover, clear instructions are provided regarding the specific conditions under which wages are eligible for consideration within a claim. The intricacies of the DE 1964 form highlight the importance of meticulousness and accuracy in pursuing a refund, emphasizing its role as a critical tool for those eligible to navigate their way to reclaiming excess deductions rightfully theirs.

| Question | Answer |

|---|---|

| Form Name | Edd Form De 1964 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | de1964 edd 1964 form |

CLAIM FOR REFUND OF EXCESS CALIFORNIA STATE

DISABILITY INSURANCE DEDUCTIONS

DO NOT FILE THIS CLAIM FOR REFUND UNLESS YOU ARE EXEMPT FROM CALIFORNIA STATE INCOME TAX. PLEASE COMPLETE A SEPARATE FORM FOR EACH INDIVIDUAL.

1.

PLEASE

TYPE

OR

First Name and Middle Initial |

Last Name |

Social Security Number |

||

|

|

|

|

|

|

|

|

|

|

Current Home Address (Number and Street, including apartment number, or rural route) |

For Tax Year: |

|||

|

|

|

|

|

City, Town or Post Office, State, and ZIP Code |

|

Date Filed |

||

|

|

|

|

|

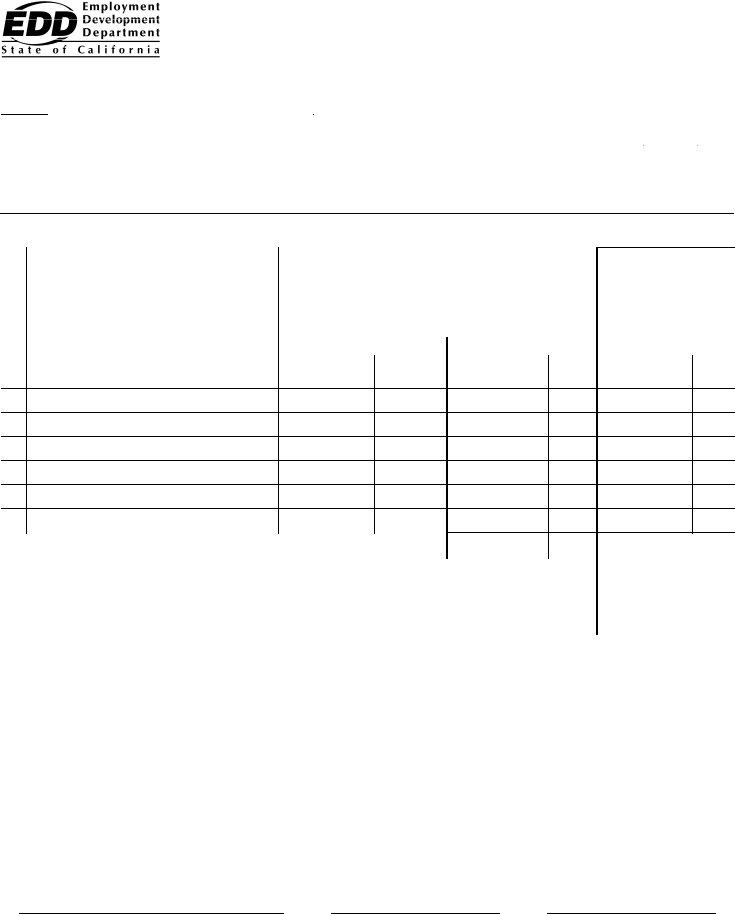

Complete schedule below if you worked for two or more employers and deductions for California State Disability Insurance (SDI) exceeded the amount shown in Column 7(D) below.

|

|

|

|

WAGES PAID TO YOU |

ACTUAL DEDUCTION FOR |

||

|

WAGE SUMMARY |

|

|

SDI, NOT TO EXCEED |

|||

|

DATES EMPLOYED |

DURING |

________ |

||||

|

|

PERCENTAGE RATE |

|||||

|

|

DO NOT SHOW MORE |

|||||

|

|

DURING CALENDAR |

|||||

|

EMPLOYER’S BUSINESS NAME AND CITY |

SHOWN IN COLUMN 7(B) |

|||||

|

THAN THE AMOUNT |

||||||

|

YEAR |

_______ |

|||||

|

AS SHOWN ON FORM |

OF WAGES SHOWN IN |

|||||

|

SHOWN IN COLUMN 7(C) |

||||||

|

|

|

|||||

|

(List in Alphabetical Order) |

|

|

COLUMN (C). DO NOT |

|||

|

|

|

FOR ANY ONE EMPLOYER |

||||

|

*Copies of Form(s) |

|

|

LIST FICA DEDUCTIONS |

|||

|

|

|

|

|

|||

|

COLUMN (A) |

COLUMN (B) |

COLUMN (C) |

COLUMN (D) |

|

||

|

|

|

|

|

|

|

|

NAME |

LOCATION |

FROM (MONTH) |

TO (MONTH) |

DOLLARS |

CENTS |

DOLLARS |

CENTS |

2.

|

3. |

Total DI taxable wages paid |

|

|

|

|

|

4. |

Total actual deductions for SDI (includes Paid Family Leave amount) |

|

|

||

|

5. |

Enter amount shown in Column 7(D) for tax year |

|

|

||

|

6. |

Refund claimed (line 4 less line 5) |

|

|

|

|

7. |

|

TABLE OF MAXIMUM WAGES AND REQUIRED CONTRIBUTIONS |

|

|

||

(A) Tax Year |

|

(B) Percentage Rate |

(C) Maximum Wages |

(D) Maximum Contributions |

||

2009 |

|

1.1% |

90,669 |

997.36 |

|

|

2010 |

|

1.1% |

93,316 |

1026.48 |

|

|

2011 |

|

1.2% |

93,316 |

1119.79 |

|

|

2012 |

|

1.0% |

95,585 |

955.85 |

|

|

2013 |

|

1.0% |

100,880 |

1008.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.I hereby declare that I am exempt from California State Income Tax and, therefore, am filing this claim directly with the Employment Development Department.

I further declare under penalty of perjury that the statement of wages paid to me and contributions deducted, as shown hereon, are true and correct to the best of my knowledge and belief.

SIGNATURE |

PHONE NUMBER |

DATE |

*This request cannot be processed without copies of Form(s)

DE 1964 Rev. 29 |

Page 1 of 2 |

CU |

INSTRUCTIONS

CLAIM FOR REFUND OF EXCESS CALIFORNIA STATE

DISABILITY INSURANCE DEDUCTIONS

CLAIM MUST BE BASED ON CALENDAR YEAR WAGES

A valid SDI refund claim filed directly with the Employment Development Department on this form must meet ALL of the following conditions:

1.Claimant worked for two or more employers subject to withholding California SDI.

2.Deductions for California SDI were made from calendar year wages.

3.Such deductions exceed the statutory limits.

4.Claimant declares by signature to exemption from California State Income Tax.

WHERE TO FILE CLAIM:

Employment Development Department, P.O. Box 826880, Special Processes Group MIC 13, Sacramento, CA

WHEN TO FILE CLAIM:

Claims for credit or refund of California SDI overpayment must be filed within three years after the end of the calendar year in which the excess deductions were made. The claim must be based on the calendar year in which the wages were received.

AMENDED CLAIMS:

Amended claims must be so marked (if not, they will be returned to claimant) and forwarded to the Employment Development Department, P.O. Box 826880, Special Processes Group MIC 13, Sacramento, CA

INFORMATION FOR COMPLETING WAGE SUMMARY SCHEDULE:

1.The SDI deductions are shown on Forms

2.Most federal, state, and local government agencies are not required to deduct California SDI. Do not include these wages in your claim unless disability insurance deductions were actually made.

3.Do not include in your claim:

a.Deductions made from your wages for Social Security and Medicare (FICA), or federal and state income tax withheld from your wages.

b.Deductions made from wages earned in states other than California, unless such wages were reported to the State of California.

c.Seaman's wages that come under the jurisdiction of states other than California.

4.

INSTRUCTIONS FOR COMPLETING DE 1964

1.Enter all information requested in section 1.

2.Enter employer information:

Column (A) – All employers and location of job sites, attach Form(s)

Column (C) – Wages up to annual maximum shown in Section 7(C) paid to you by individual Column (A) employers. Column (D) – Enter actual amount of SDI withheld. Do not exceed the percentage rate shown in Section 7(B) of wages in

Column (C).

3.Enter total SDI taxable wages paid.

4.Enter total of all SDI deductions withheld by each employer in Column (D). This amount must be verified by attached Form

5.Enter maximum contribution for tax year (see Column 7D).

6.Enter amount of refund claimed (line 4 less line 5).

7.Table of Maximum Wages and Required Contributions (reference table only).

8.Read and sign this declaration which states you are exempt from California State Income Tax. Without your signature, your claim will be rejected.

9.Enter your phone number and date.

ASSISTANCE:

If you need assistance in completing this claim, contact the Excess State Disability Insurance Unit of the Employment Development Department, P.O. Box 826880, Special Processes Group MIC 13, Sacramento, CA

DE 1964 Rev. 29 |

Page 2 of 2 |