overwithheld can be filled out without any problem. Simply try FormsPal PDF tool to accomplish the job right away. Our editor is continually evolving to give the best user experience attainable, and that is due to our resolve for continuous development and listening closely to testimonials. With just a couple of easy steps, you'll be able to begin your PDF journey:

Step 1: Click on the orange "Get Form" button above. It's going to open our pdf editor so you can start completing your form.

Step 2: The tool will allow you to change your PDF file in many different ways. Transform it by writing personalized text, adjust existing content, and add a signature - all possible within a few minutes!

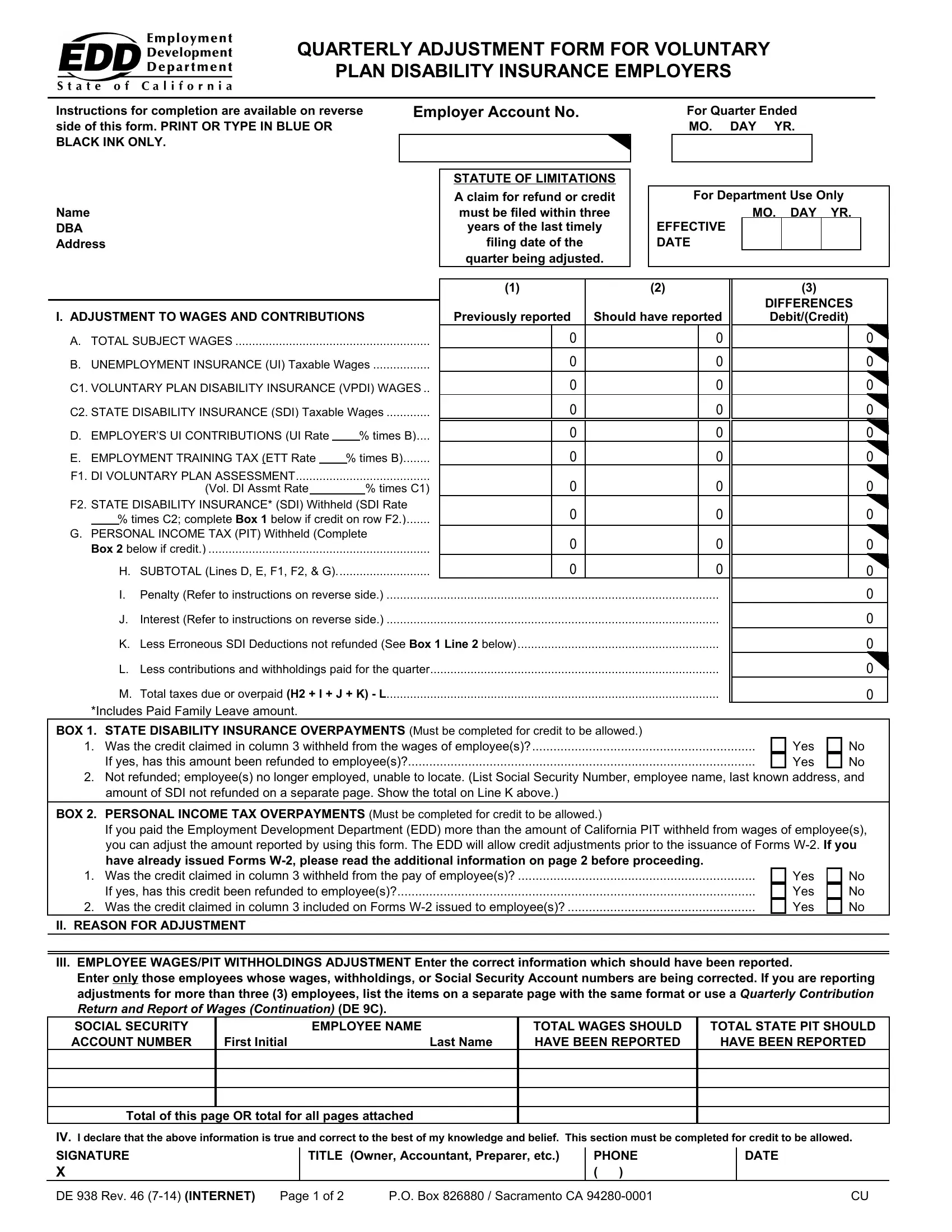

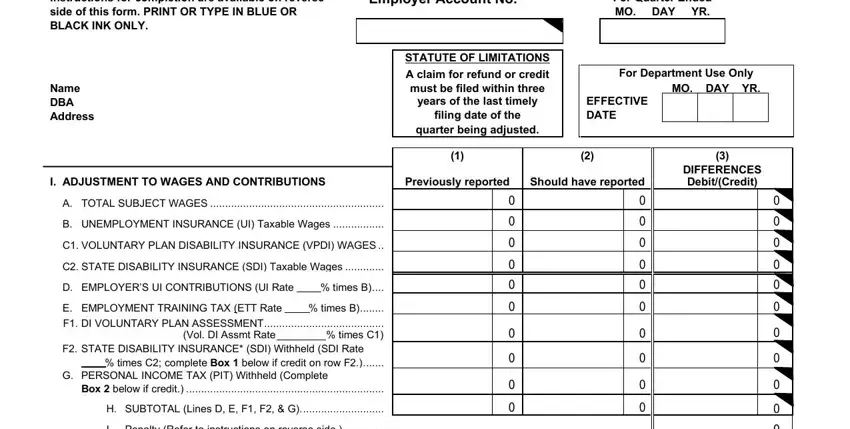

This PDF form will need specific details to be filled out, therefore you need to take your time to enter what's asked:

1. While filling in the overwithheld, ensure to incorporate all of the necessary fields within its associated form section. This will help facilitate the work, making it possible for your details to be processed efficiently and properly.

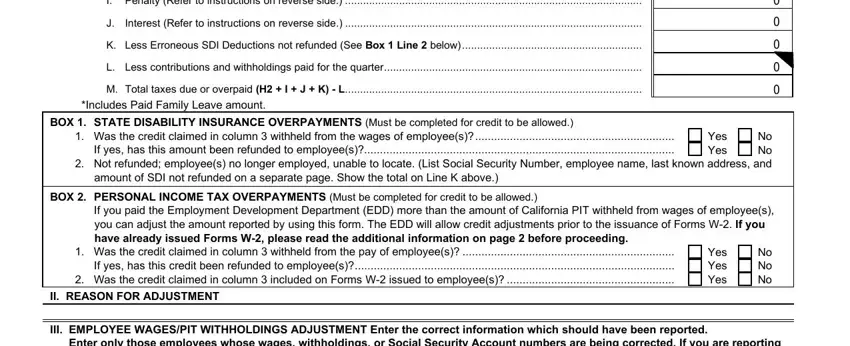

2. The third step is usually to fill out all of the following blank fields: I Penalty Refer to instructions on, Interest Refer to instructions on, K Less Erroneous SDI Deductions, L Less contributions and, M Total taxes due or overpaid H I, Includes Paid Family Leave amount, BOX STATE DISABILITY INSURANCE, Was the credit claimed in column, No No Not refunded employees no, Yes Yes, amount of SDI not refunded on a, BOX PERSONAL INCOME TAX, If you paid the Employment, you can adjust the amount reported, and Was the credit claimed in column.

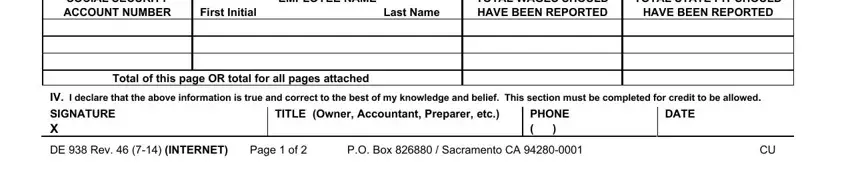

3. This next part is considered rather easy, Enter only those employees whose, TOTAL WAGES SHOULD HAVE BEEN, EMPLOYEE NAME, TOTAL STATE PIT SHOULD, HAVE BEEN REPORTED, First Initial, Last Name, Total of this page OR total for, IV I declare that the above, SIGNATURE X DE Rev INTERNET, TITLE Owner Accountant Preparer etc, PHONE, DATE, Page of, and PO Box Sacramento CA - each one of these form fields is required to be filled out here.

It is easy to make an error while filling in your HAVE BEEN REPORTED, for that reason make sure to go through it again prior to deciding to send it in.

Step 3: As soon as you have looked over the information in the document, press "Done" to finalize your document generation. Join us now and easily use overwithheld, ready for download. All modifications made by you are saved , making it possible to change the file at a later time as required. We do not share the information that you use while dealing with forms at FormsPal.