Any time you would like to fill out section, you won't have to download and install any applications - just try our online PDF editor. To retain our editor on the leading edge of practicality, we strive to implement user-oriented features and enhancements on a regular basis. We are always looking for suggestions - join us in remolding how you work with PDF documents. With just several easy steps, you are able to begin your PDF journey:

Step 1: Access the PDF doc in our editor by clicking the "Get Form Button" above on this page.

Step 2: When you launch the online editor, you will see the document ready to be filled in. Aside from filling out different blank fields, you could also do many other things with the PDF, specifically putting on your own text, modifying the initial text, inserting images, placing your signature to the form, and a lot more.

Be mindful when filling in this pdf. Make sure each blank is filled in properly.

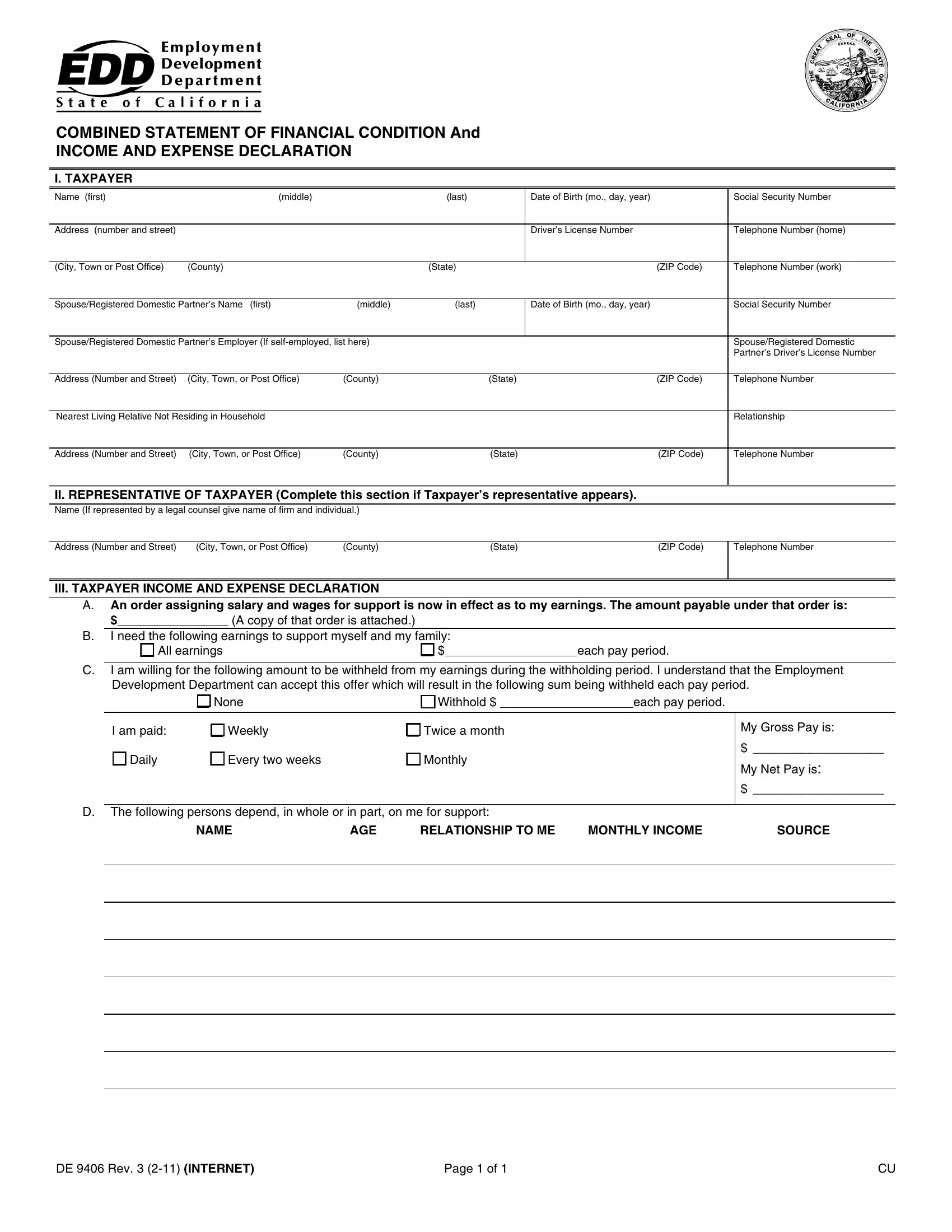

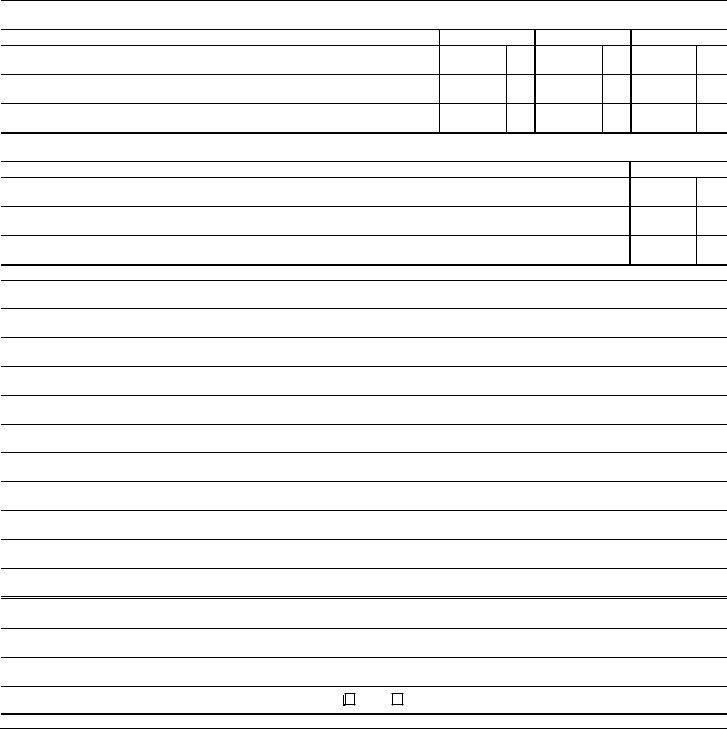

1. Start completing your section with a selection of essential fields. Note all the required information and be sure not a single thing neglected!

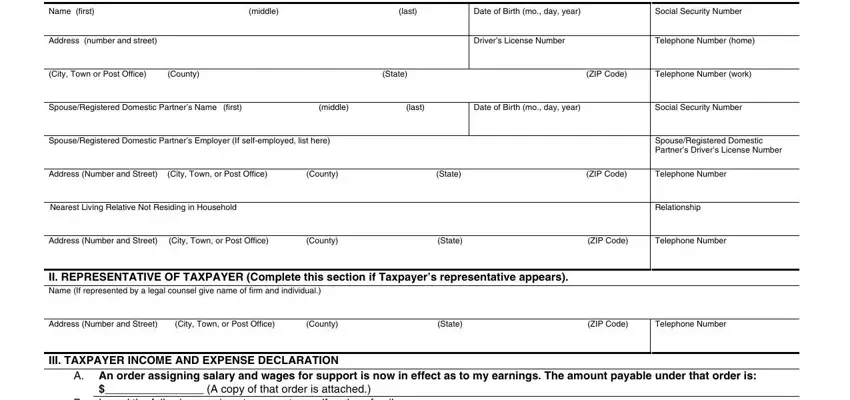

2. Once the last segment is finished, you're ready add the required specifics in A copy of that order is attached, All earnings, each pay period, I am willing for the following, None, Withhold, each pay period, I am paid, Weekly, Twice a month, Daily, Every two weeks, Monthly, My Gross Pay is, and My Net Pay is in order to proceed further.

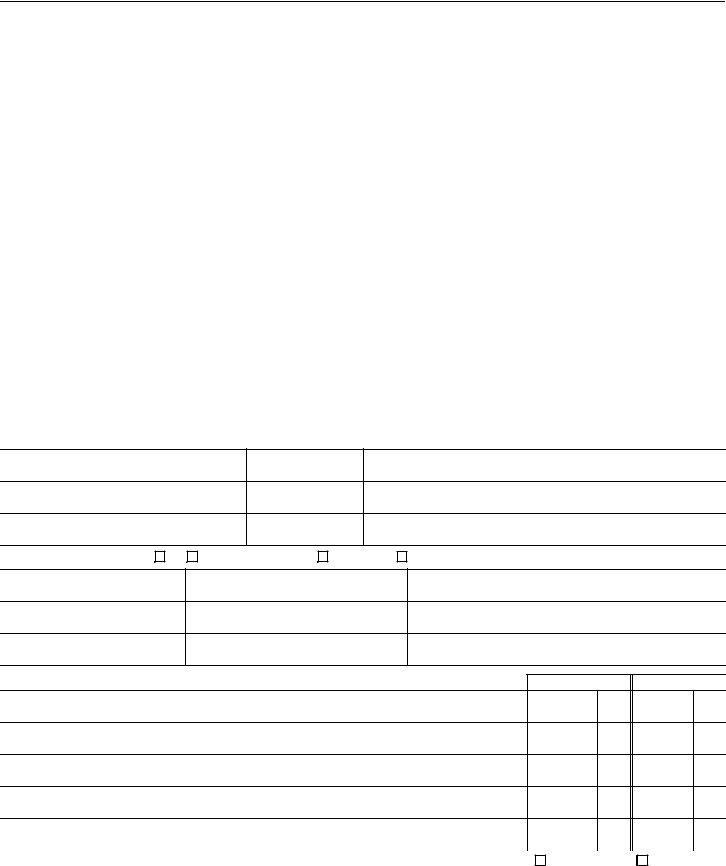

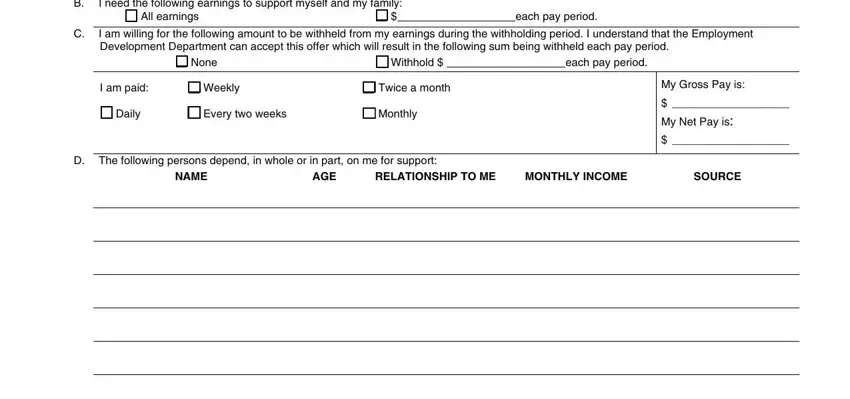

3. The third step is usually hassle-free - fill in all the form fields in State Income Taxes, Federal Income Taxes, Property Taxes Not included in, Social Security OASDI, State Disability Insurance, Medical and Other Insurance, Union and Other Dues, Retirement and Pension Fund, TOTAL REQUIRED DEDUCTIONS, OTHER DEDUCTIONS FROM INCOME, Savings Plan, Total Earnings Include commissions, Pensions and Retirement, Social Security, and Disability andor Unemployment to conclude this part.

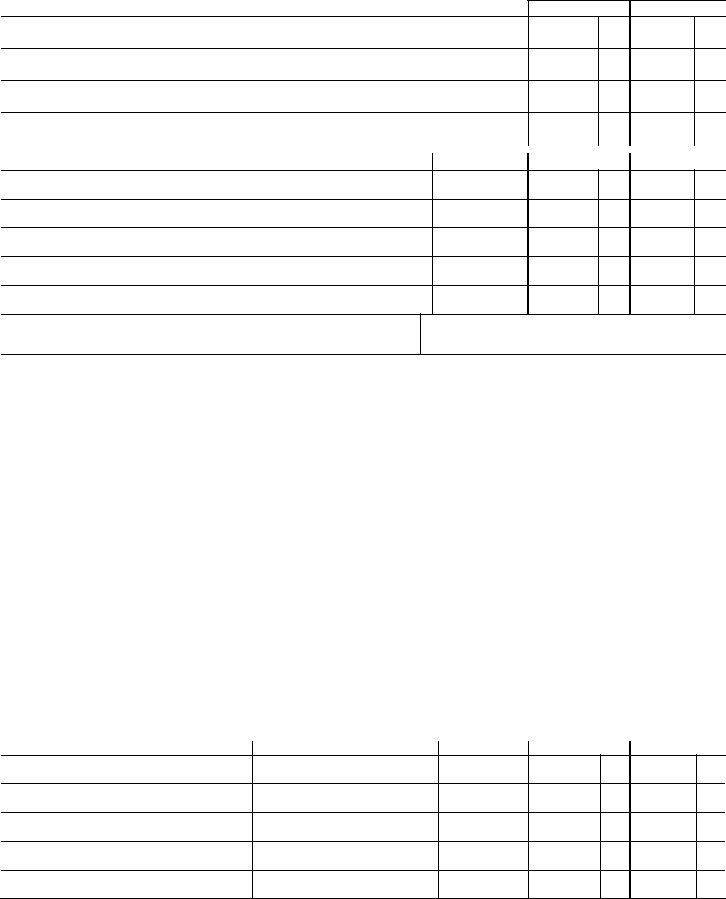

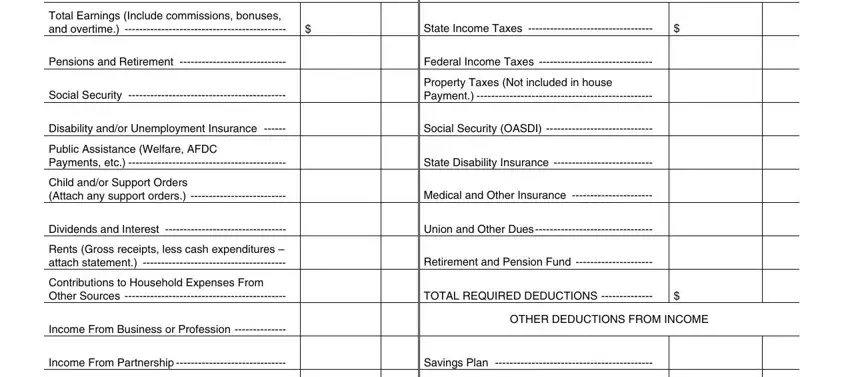

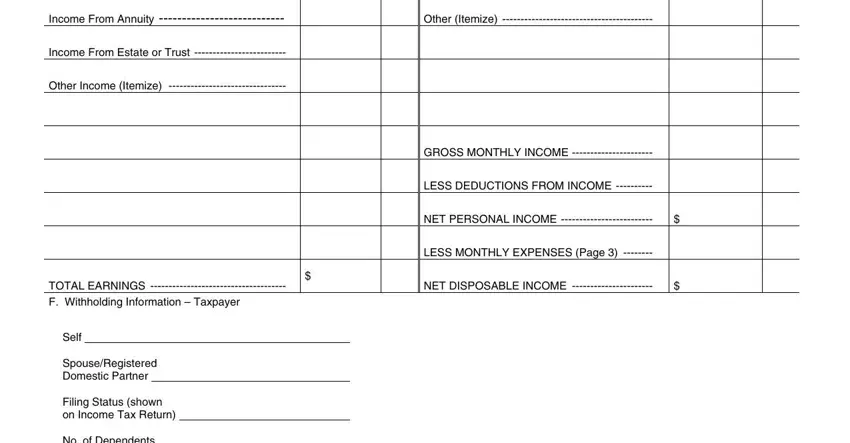

4. The next section will require your involvement in the following parts: Other Itemize, GROSS MONTHLY INCOME, LESS DEDUCTIONS FROM INCOME, NET PERSONAL INCOME, LESS MONTHLY EXPENSES Page, NET DISPOSABLE INCOME, Income From Annuity, Income From Estate or Trust, Other Income Itemize, TOTAL EARNINGS F Withholding, Self SpouseRegistered Domestic, Filing Status shown, and on Income Tax Return No of. Just remember to provide all needed info to move onward.

It is easy to make a mistake when completing the NET DISPOSABLE INCOME, hence make sure you go through it again prior to deciding to send it in.

5. To wrap up your form, the final subsection includes a few additional fields. Typing in on Income Tax Return No of, DE Rev INTERNET, and Page of will conclude everything and you will be done in the blink of an eye!

Step 3: After you've reread the details in the blanks, click on "Done" to conclude your FormsPal process. Sign up with FormsPal now and easily gain access to section, set for downloading. Every last edit you make is handily saved , helping you to customize the form at a later point if necessary. FormsPal is invested in the privacy of our users; we make certain that all personal data going through our system remains protected.