Any time you need to fill out eic table earned income credit, you won't have to download and install any kind of programs - simply try using our online PDF editor. Our team is ceaselessly endeavoring to develop the tool and enable it to be much faster for people with its many functions. Uncover an endlessly innovative experience today - check out and discover new opportunities as you go! Here is what you'd want to do to get going:

Step 1: Click on the "Get Form" button in the top part of this webpage to get into our PDF editor.

Step 2: As you open the editor, you'll see the document prepared to be filled out. Besides filling out different fields, you can also do several other things with the PDF, such as adding your own text, modifying the initial textual content, adding images, placing your signature to the PDF, and a lot more.

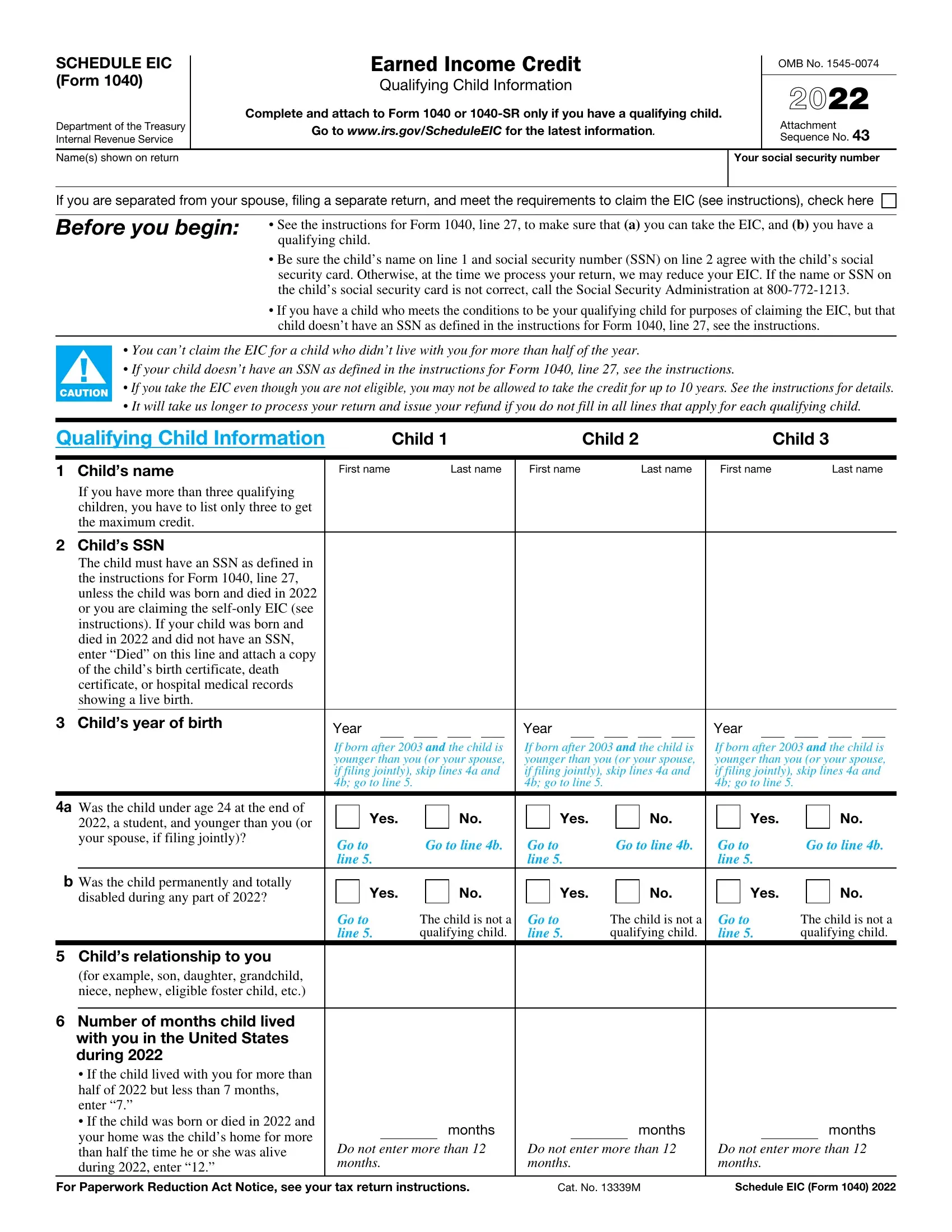

As for the blank fields of this precise PDF, here's what you need to do:

1. You need to fill out the eic table earned income credit correctly, so be attentive when filling in the areas containing all these blanks:

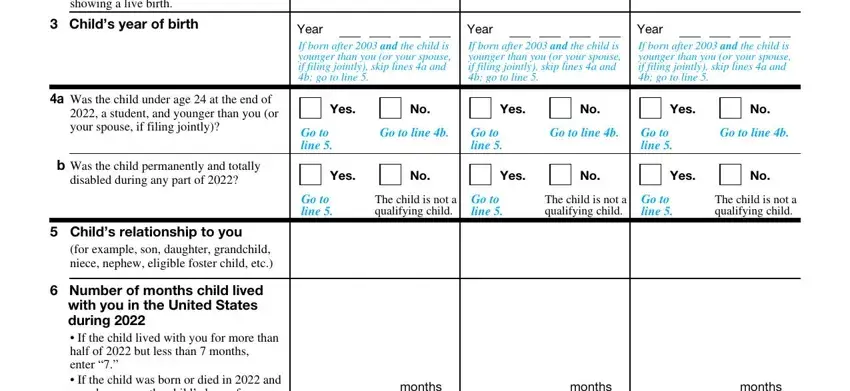

2. The third step is usually to submit these particular blanks: The child must have an SSN as, Childs year of birth, a Was the child under age at the, a student and younger than you or, b Was the child permanently and, disabled during any part of, Childs relationship to you, for example son daughter, Number of months child lived with, Year If born after and the child, Year If born after and the child, Year If born after and the child, Yes, Yes, and Yes.

Many people generally make mistakes while filling out Year If born after and the child in this part. Make sure you double-check what you enter here.

Step 3: Spell-check everything you've inserted in the blanks and hit the "Done" button. Join us today and immediately get access to eic table earned income credit, ready for download. All modifications made by you are preserved , so that you can edit the pdf further if required. FormsPal ensures your data privacy via a protected system that never saves or distributes any kind of private data used. Be confident knowing your documents are kept protected when you work with our tools!