Understanding the intricacies of the Form 414 is essential for businesses operating within Maharashtra, India, especially when looking to ensure compliance with the Maharashtra Value Added Tax Act, 2002. This form serves as an application for a clearance certificate, a document that is crucial for companies seeking to affirm their tax affairs are in order. Specifically, it is required under clause (a) of subsection (8) of section 32 of the said Act. The applicant must provide comprehensive details including the name of the dealer, the registration certificate number under the M.V.A.T Act, 2002, the business address, and the specific period for which the tax clearance certificate is requested. This process illustrates the government's effort to streamline tax compliance and ensure businesses are transparent about their financial dealings. For companies like RUSHABH INFOSOFT LTD., applying for such a certificate is a step towards maintaining financial propriety and establishing trust with the tax authorities, thereby facilitating smoother operations and potentially safeguarding against any legal complications related to tax matters.

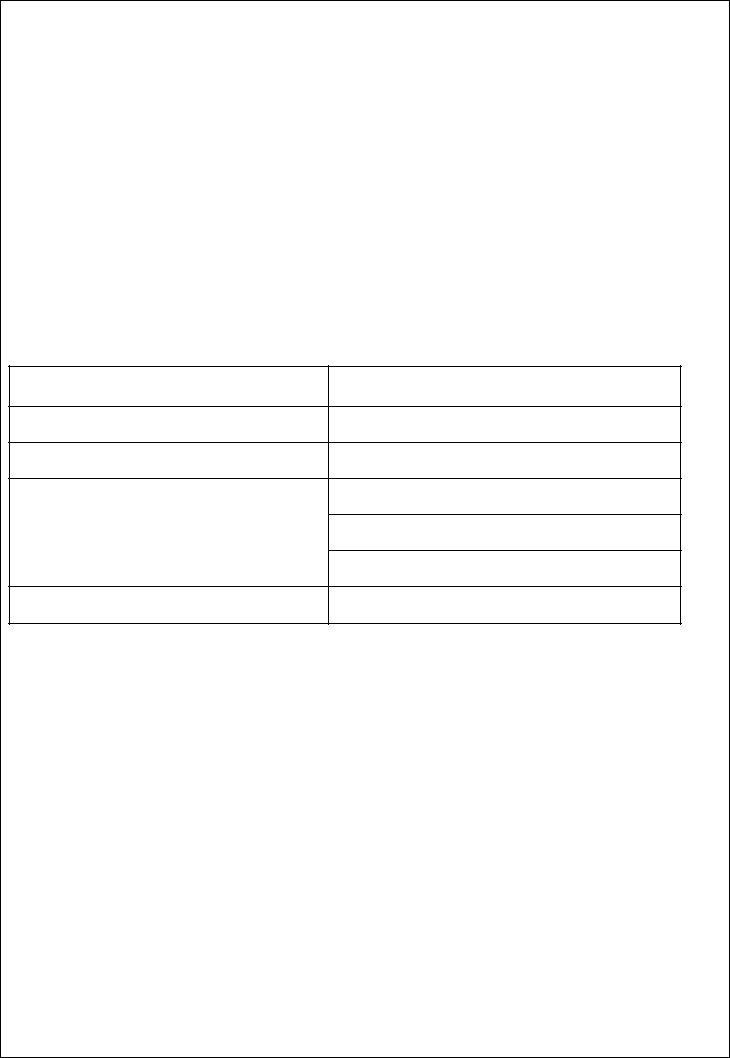

| Question | Answer |

|---|---|

| Form Name | Form 414 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | fort mccoy form 414, direction for form 414, form 414 gst, form 414 sales tax |

(See rule 42)

Application for clearance certificate under clause (a) of sub section (8) of section 32 of the Maharashtra Value Added Tax Act, 2002

To

__________________________________________

__________________________________________

__________________________________________

Subject: Application for clearance certificate under clause (a) of sub section (8) of section 32 of the Maharashtra Value Added Tax Act, 2002

Sir

I request that a Tax Clearance Certificate be granted to me. I give below the necessary particulars

Name of the dealer

R.C. No under M.V.A.T Act, 2002

Address of the place of business

Period for which tax clearance certificate is required

Thanking you |

Yours faithfully |

Date ___________________ |

Signature ________________________ |

Place ____________________ |

Name and Status ______________________ |

RUSHABH INFOSOFT LTD.