Filling in files using our PDF editor is easier in comparison with nearly anything. To enhance brokers market analysis form erc the form, there isn't anything you need to do - just stick to the steps below:

Step 1: Press the orange "Get Form Now" button on this webpage.

Step 2: Now, you're on the file editing page. You may add information, edit existing data, highlight particular words or phrases, insert crosses or checks, insert images, sign the document, erase needless fields, etc.

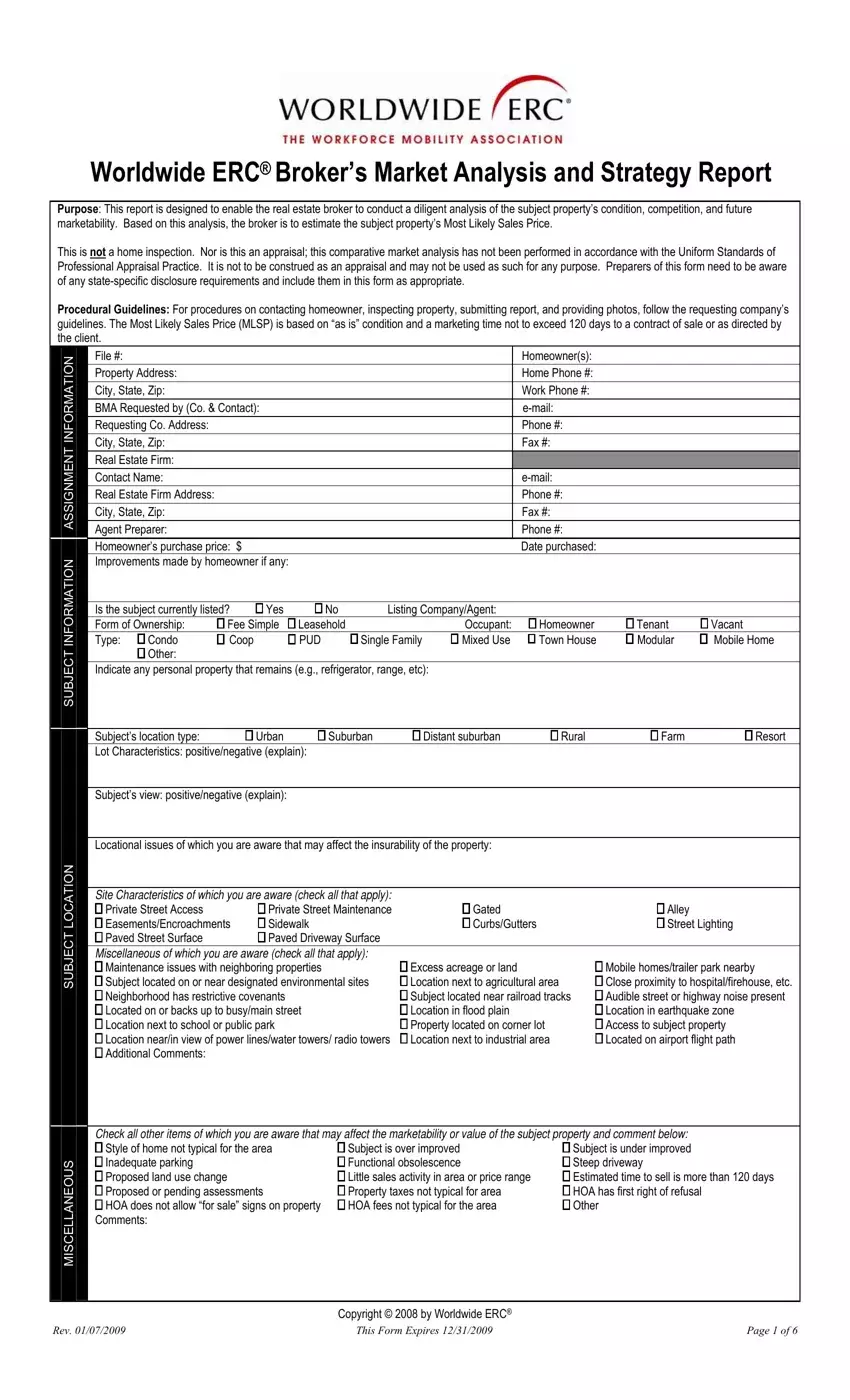

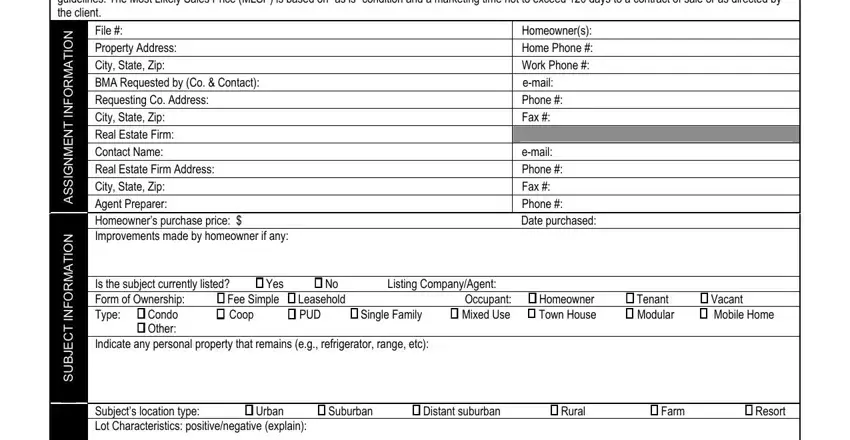

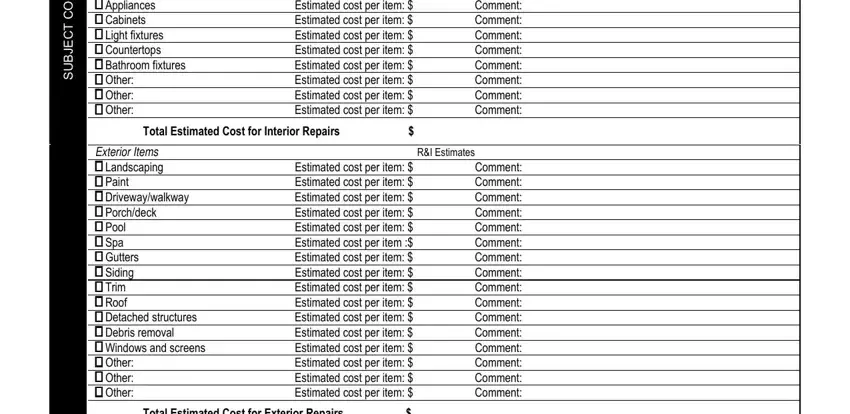

Please type in the following details to create the brokers market analysis form er, c PDF:

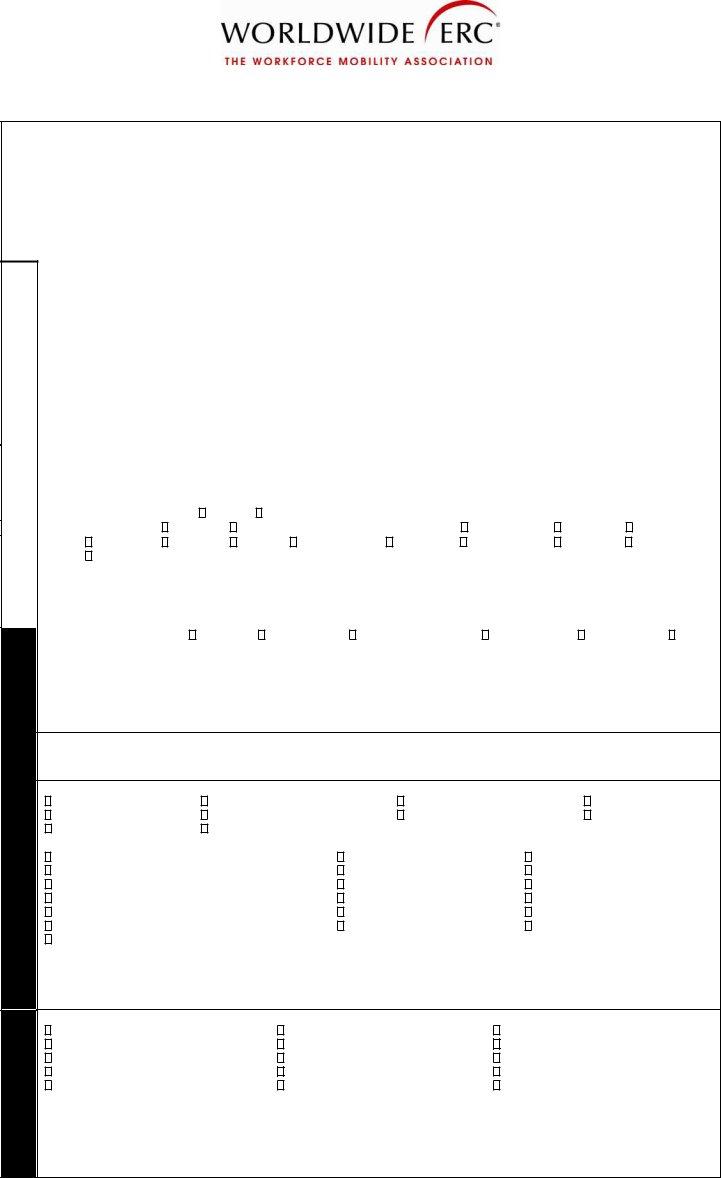

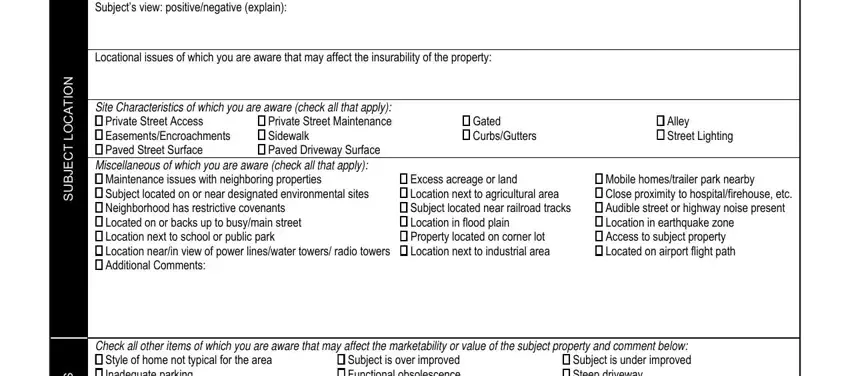

Provide the expected details in the Subjects, view, positive, negative, explain NOT, A, COLT, CE, J, BUS Gated, Curbs, Gutters Excess, acreage, or, land Location, in, earthquake, zone Alley, Street, Lighting and SUO, ENAL, LEC, SM section.

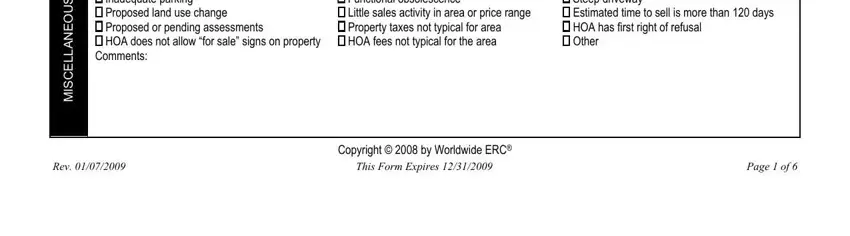

Indicate the main particulars in SUO, ENAL, LEC, SM Rev, This, Form, Expires, Page, of and Copyright, by, Worldwide, ER, C box.

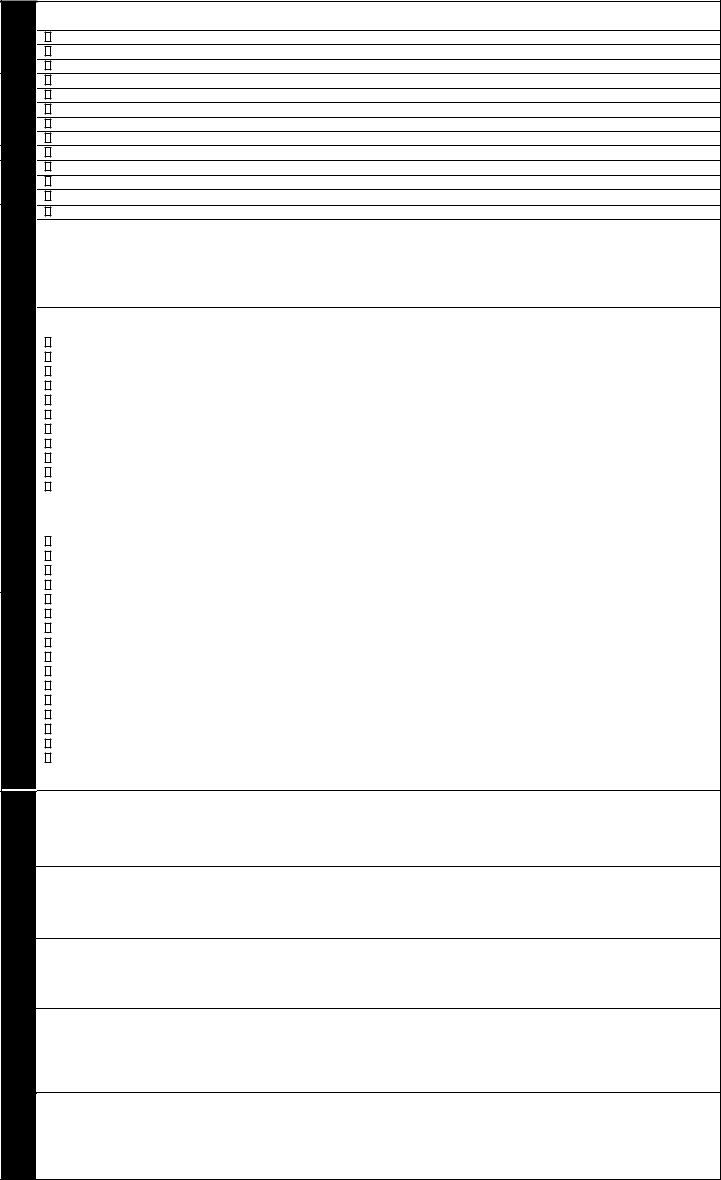

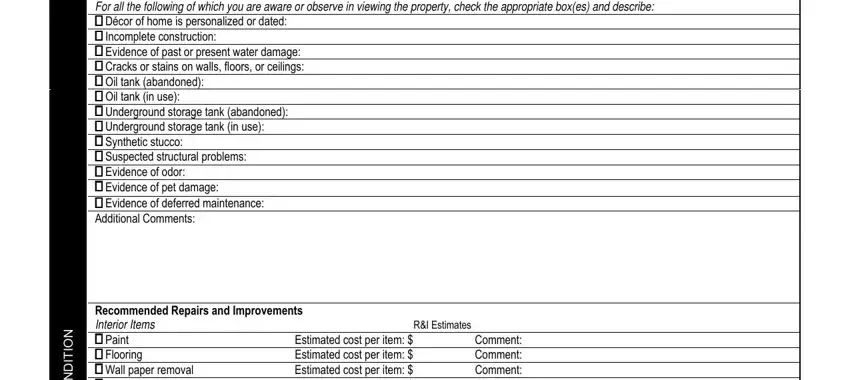

The NOT, DN, OCT, CE, J, BUS area will be your place to indicate the rights and obligations of each side.

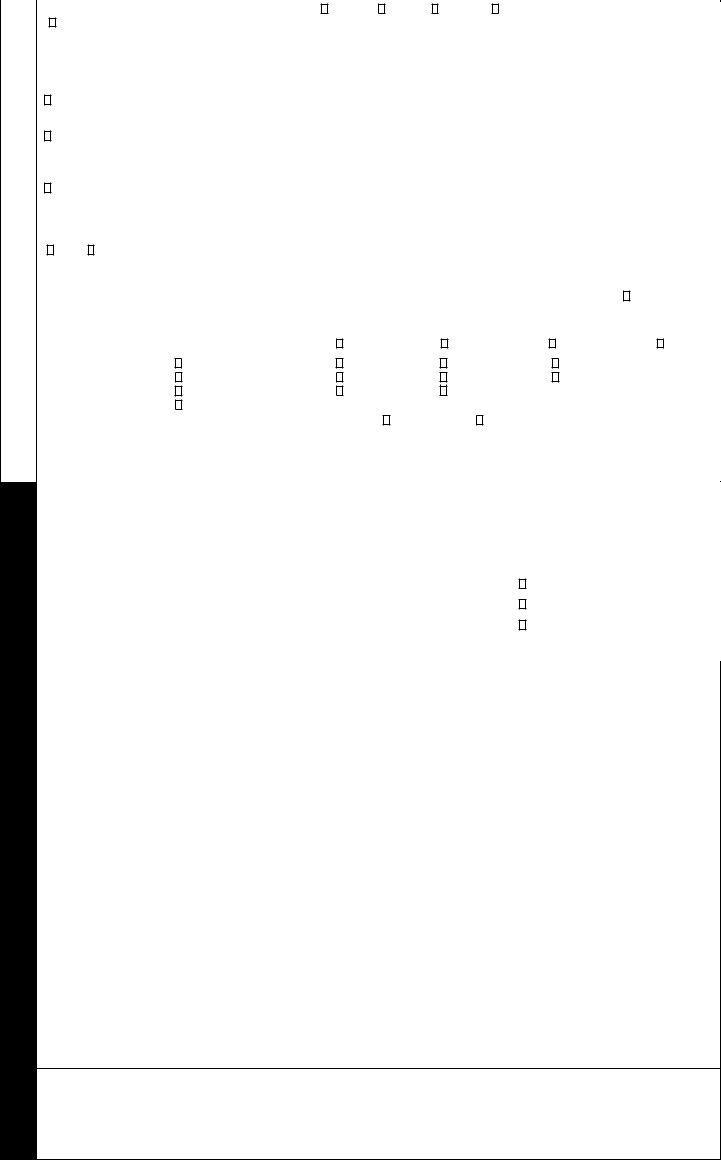

Finish by reading the following sections and filling them in accordingly: NOT, DN, OCT, CE, J, BUS

Step 3: At the time you click on the Done button, the finished document is readily transferable to any of your devices. Or, you can send it through mail.

Step 4: Prepare copies of your form. This can protect you from possible future concerns. We don't watch or disclose your information, therefore be assured it will be protected.