We've used the efforts of our best computer programmers to design the PDF editor you are about to operate. Our software will help you fill in the export declaration example document easily and don’t waste time. All you need to do is keep up with the following quick instructions.

Step 1: Select the button "Get form here" to get into it.

Step 2: You can now manage your export declaration example. This multifunctional toolbar enables you to include, erase, change, and highlight content or undertake several other commands.

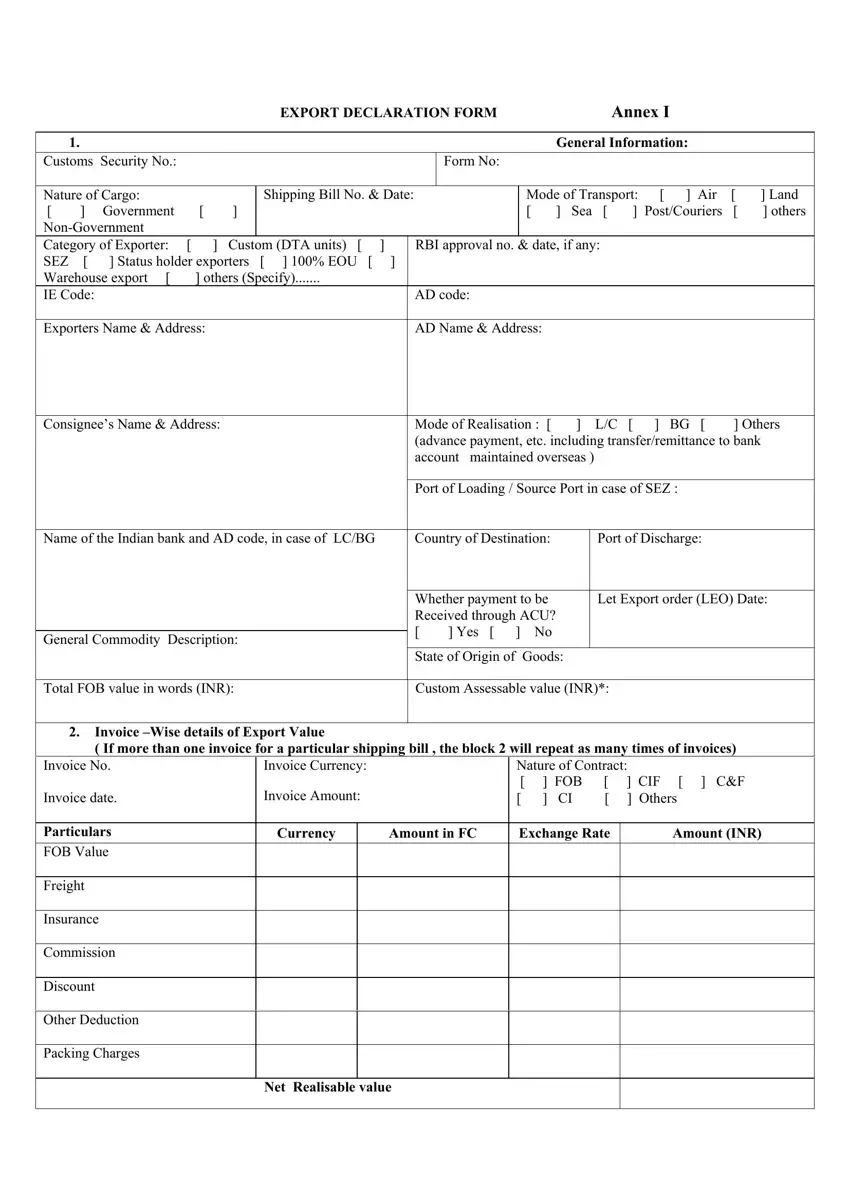

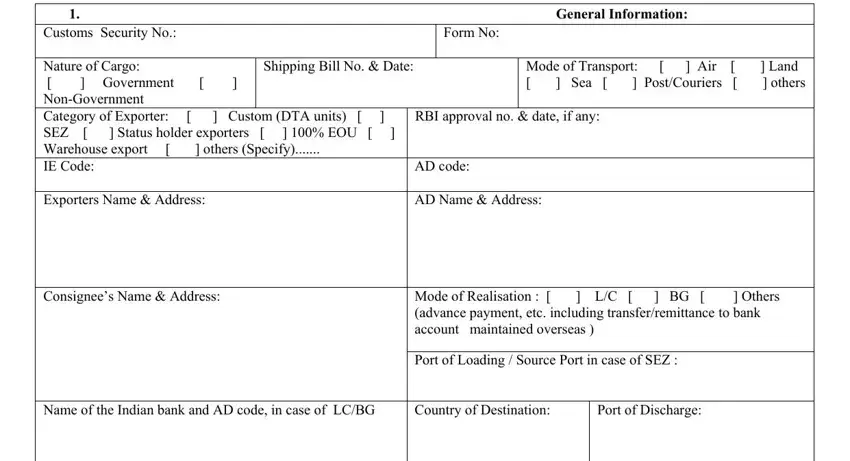

Prepare the next segments to fill out the template:

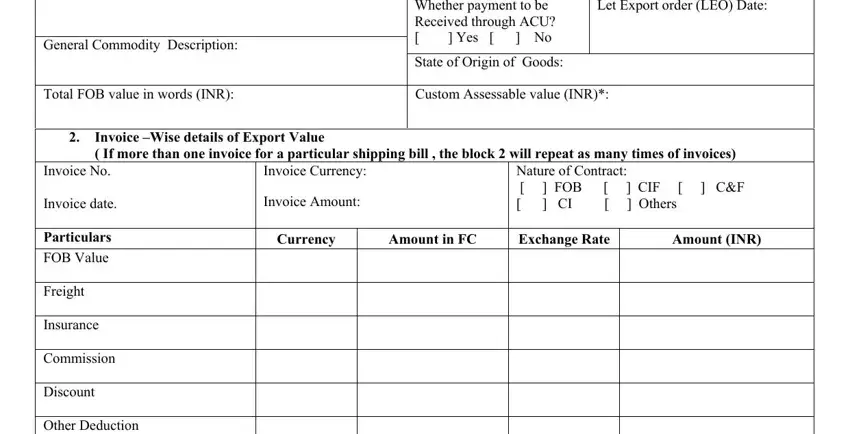

In the General Commodity Description, Whether payment to be Received, State of Origin of Goods, Let Export order LEO Date, Total FOB value in words INR, Custom Assessable value INR, Invoice Wise details of Export, If more than one invoice for a, Invoice No, Invoice date, Particulars FOB Value, Freight, Insurance, Commission, and Discount area, put in writing your data.

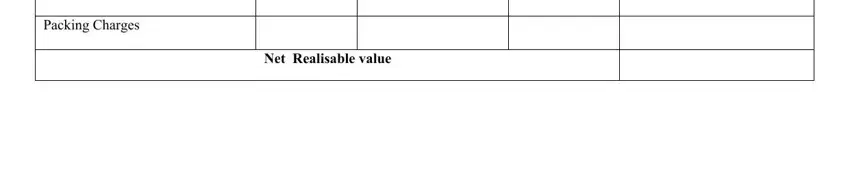

The program will require for additional info with a purpose to effortlessly fill out the part Packing Charges, and Net Realisable value.

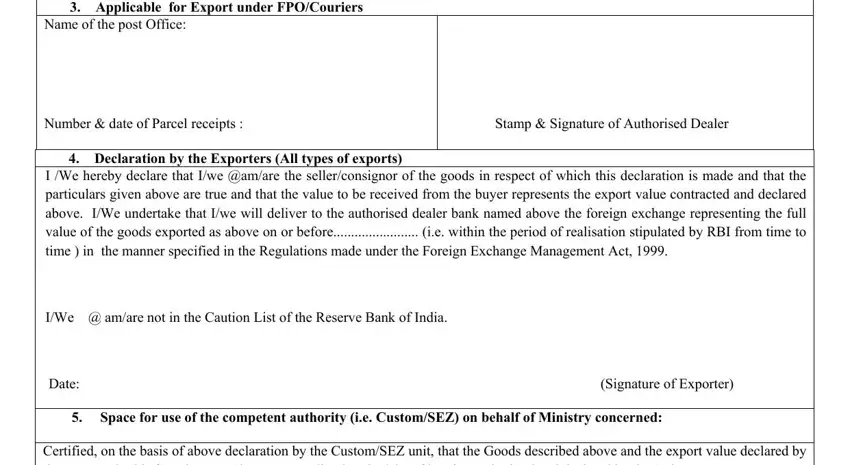

Within the field Applicable for Export under, Number date of Parcel receipts, Stamp Signature of Authorised, Declaration by the Exporters All, I We hereby declare that Iwe amare, IWe amare not in the Caution List, Date Signature of Exporter, Space for use of the competent, and Certified on the basis of above, list the rights and obligations of the parties.

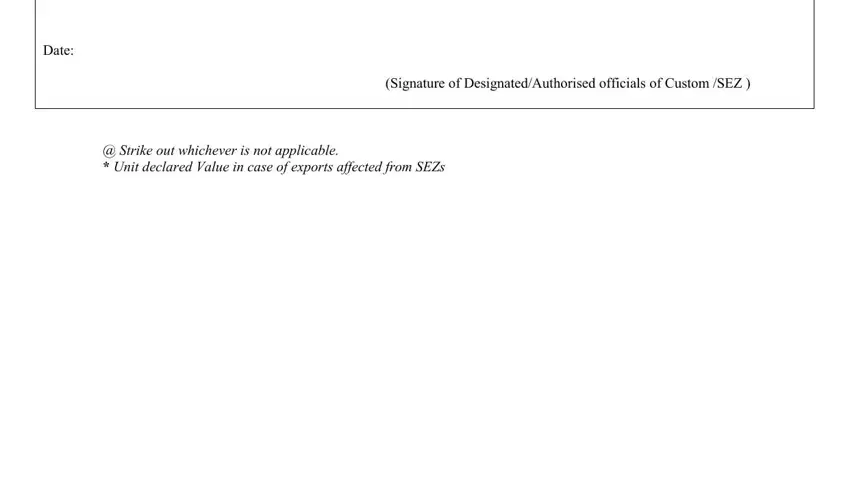

Review the sections Date, Signature of DesignatedAuthorised, and Strike out whichever is not and thereafter complete them.

Step 3: Once you click on the Done button, the finished document is readily transferable to all of your devices. Or, you can send it by using email.

Step 4: It's going to be safer to keep copies of the file. You can rest assured that we will not share or view your particulars.