Dealing with PDF files online is certainly super easy with this PDF editor. You can fill in sf 425 fillable here without trouble. Our development team is always working to enhance the editor and insure that it is much faster for users with its cutting-edge functions. Take your experience one step further with continually growing and interesting options we provide! Starting is simple! All you have to do is adhere to the next easy steps below:

Step 1: Just click the "Get Form Button" at the top of this page to launch our pdf editor. This way, you'll find everything that is necessary to fill out your document.

Step 2: The tool grants the capability to customize your PDF form in many different ways. Enhance it with any text, correct what is already in the PDF, and include a signature - all within a couple of mouse clicks!

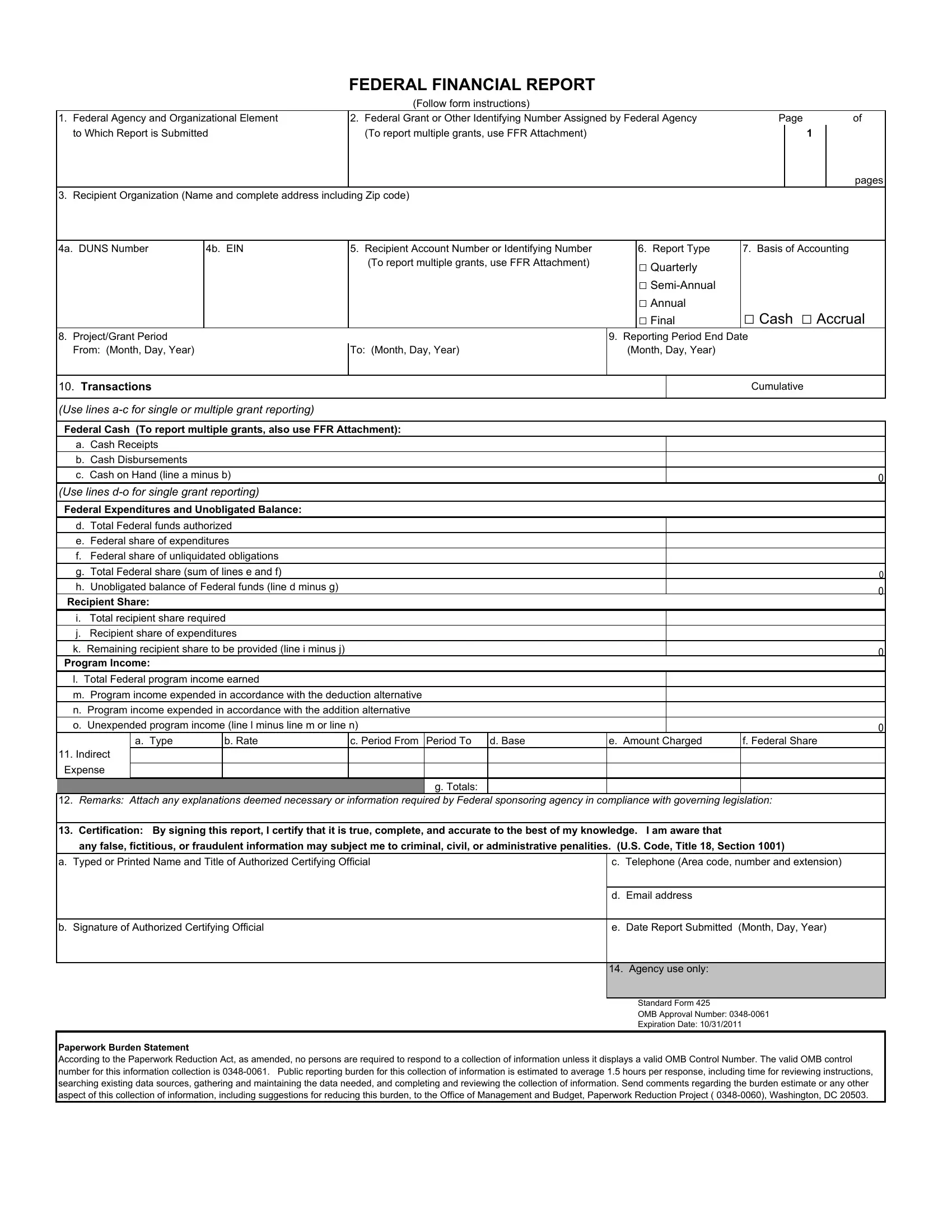

This PDF form will need specific information to be typed in, so you must take your time to fill in precisely what is requested:

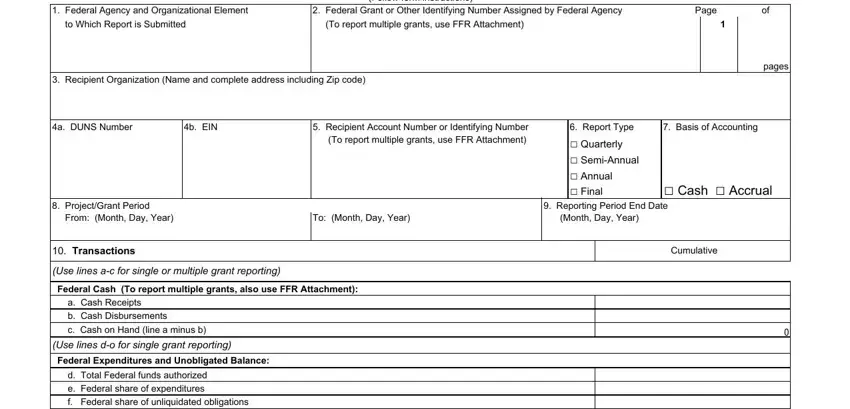

1. Whenever filling in the sf 425 fillable, be sure to incorporate all of the essential blank fields in their relevant area. It will help expedite the process, allowing your information to be handled quickly and accurately.

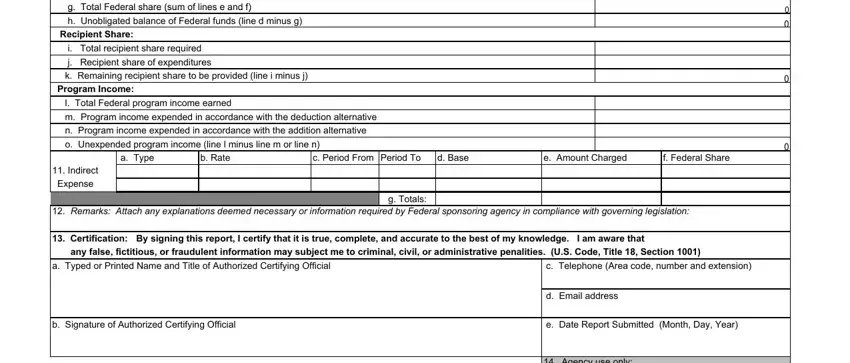

2. Now that the last segment is done, it is time to include the necessary specifics in g Total Federal share sum of lines, g Total Federal share sum, h Unobligated balance of Federal, Recipient Share, i Total recipient share required, j Recipient share of expenditures, k Remaining recipient share to be, l Total Federal program income, m Program income expended in, n Program income expended in, o Unexpended program income line l, a Type, b Rate, c Period From Period To, and d Base so you're able to move on further.

People who work with this PDF often get some points wrong when filling out i Total recipient share required in this section. Be sure to read twice everything you enter here.

Step 3: Revise the details you've entered into the blank fields and press the "Done" button. Sign up with us today and easily obtain sf 425 fillable, prepared for download. All modifications you make are preserved , allowing you to modify the form at a later point as required. Here at FormsPal, we do everything we can to guarantee that your details are maintained secure.