Handling PDF forms online is certainly easy with our PDF tool. Anyone can fill in Federal Financial Report Form 425 here and use several other functions we provide. FormsPal team is relentlessly working to improve the tool and help it become even better for users with its multiple functions. Uncover an endlessly innovative experience today - explore and find out new possibilities along the way! Here is what you'll want to do to get started:

Step 1: Click the "Get Form" button above. It will open up our tool so that you could start filling in your form.

Step 2: As you access the online editor, you will find the document prepared to be filled out. Apart from filling in different blanks, you can also perform several other things with the PDF, including putting on custom textual content, editing the initial text, adding illustrations or photos, affixing your signature to the form, and more.

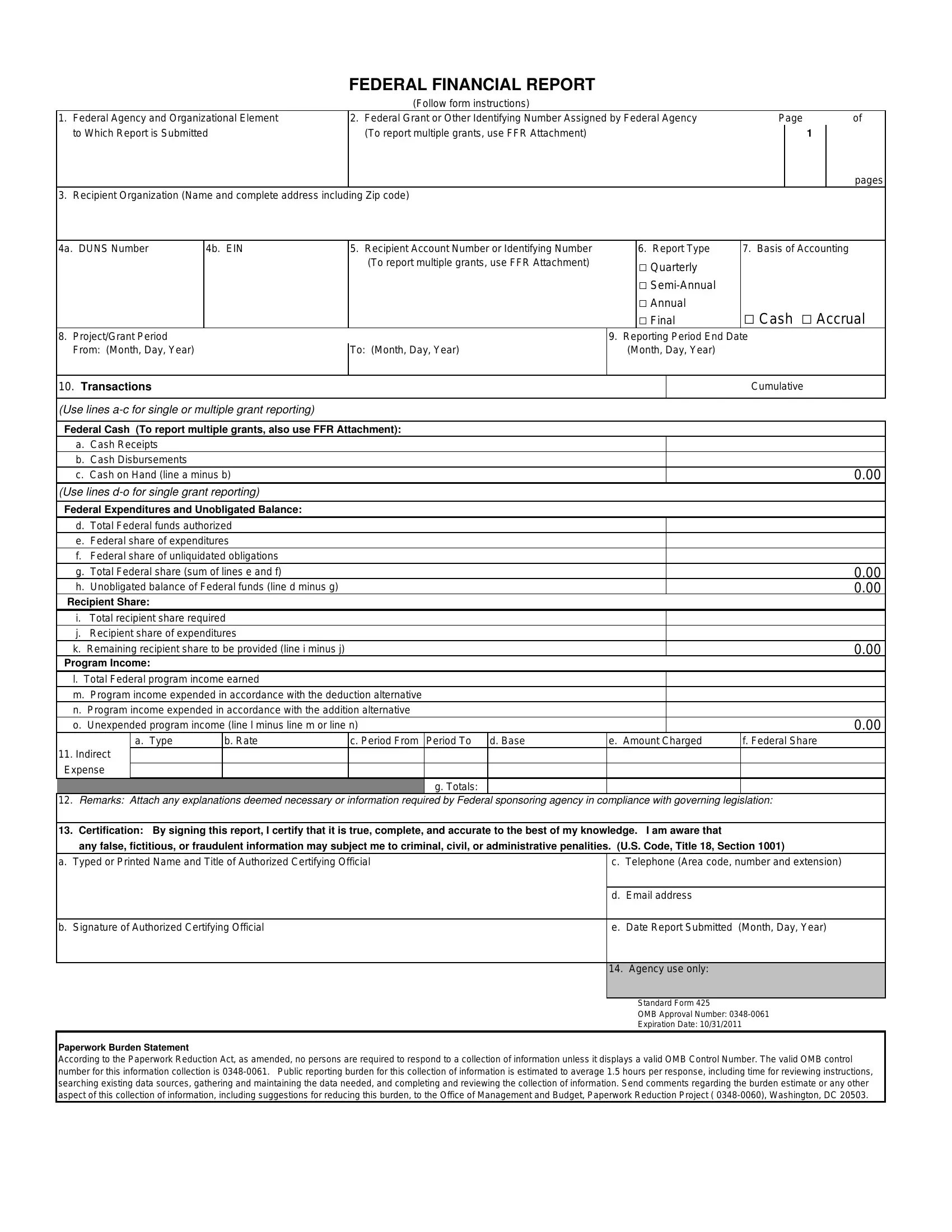

As for the fields of this particular PDF, this is what you want to do:

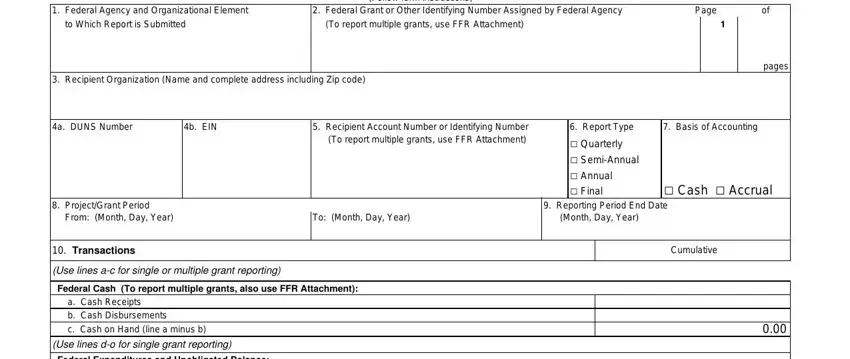

1. You need to fill out the Federal Financial Report Form 425 properly, thus be careful while filling out the segments containing these blank fields:

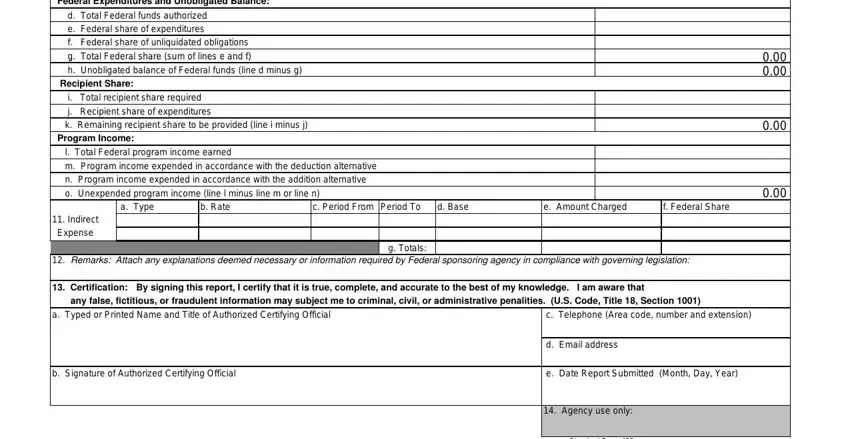

2. The third step would be to complete the next few blanks: g Total Federal share sum, Federal Expenditures and, a Type, b Rate, c Period From Period To, d Base, e Amount Charged, f Federal Share, Indirect Expense, Remarks Attach any explanations, g Totals, Certification By signing this, any false fictitious or fraudulent, c Telephone Area code number and, and b Signature of Authorized.

Be extremely attentive when filling in Certification By signing this and Indirect Expense, since this is where a lot of people make errors.

Step 3: Right after looking through the entries, click "Done" and you are all set! Create a free trial account at FormsPal and get direct access to Federal Financial Report Form 425 - which you may then make use of as you want from your FormsPal cabinet. FormsPal is dedicated to the privacy of our users; we always make sure that all personal data put into our system is secure.