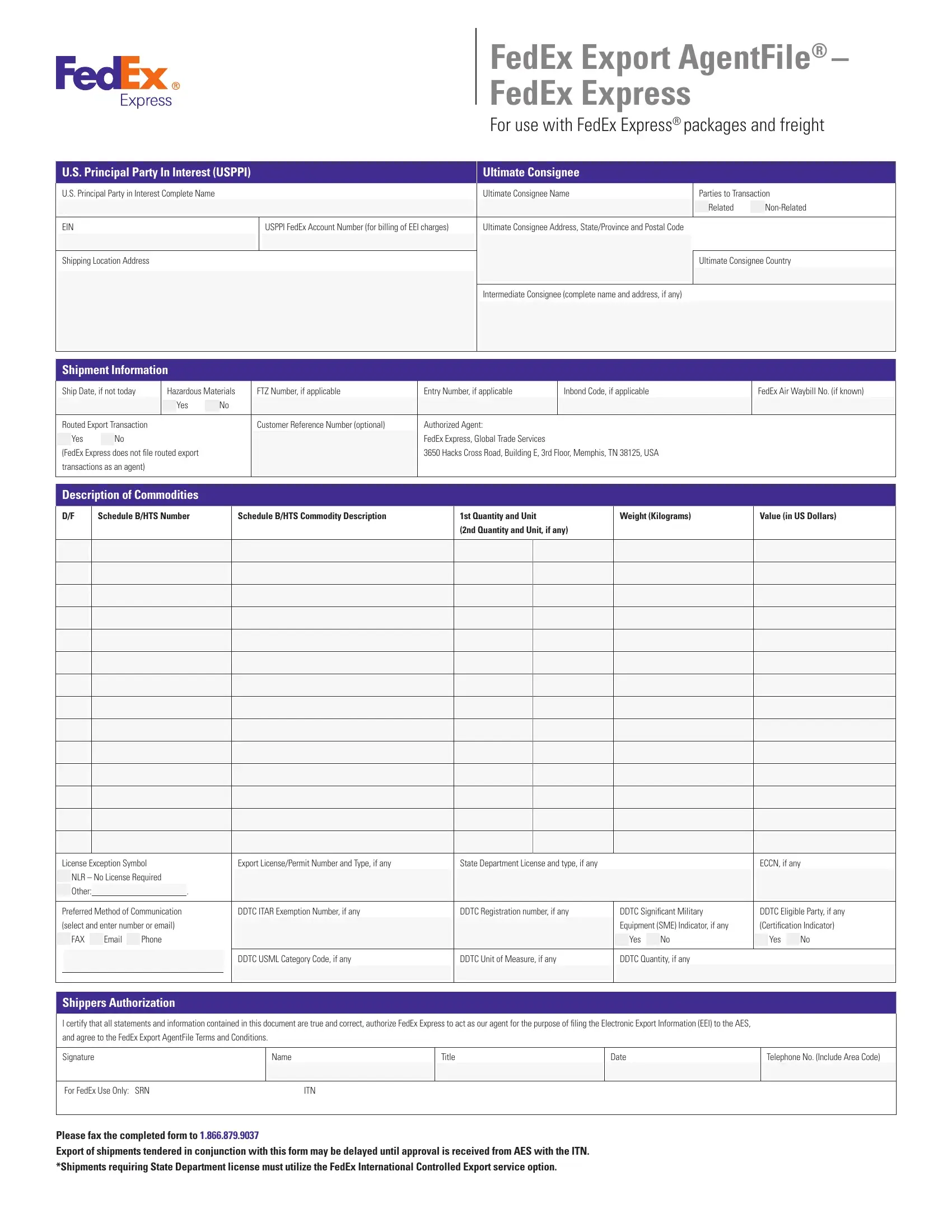

Explanation of Fields

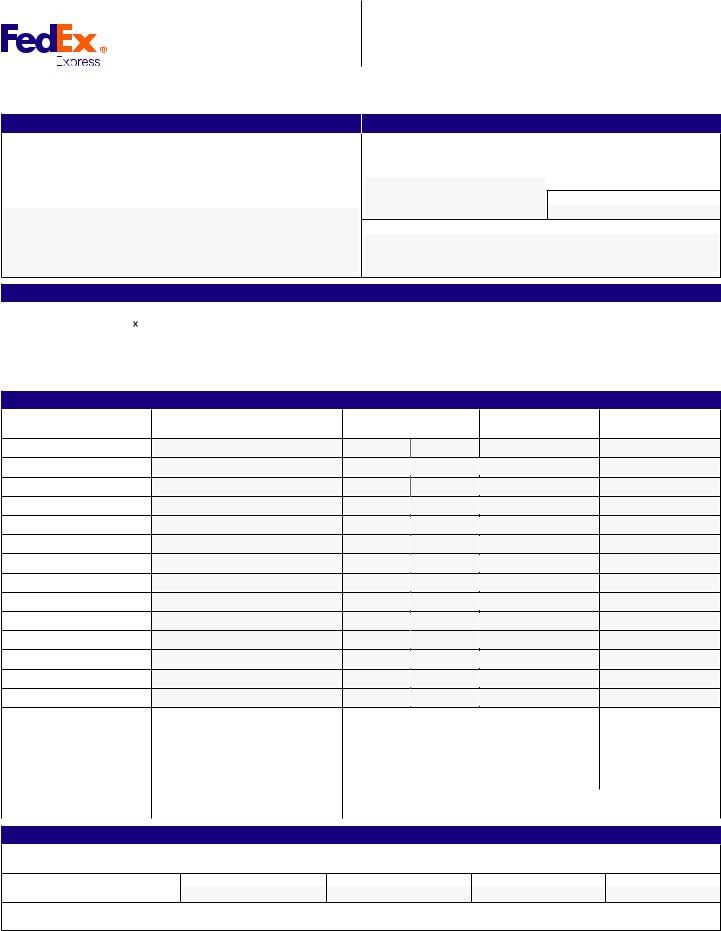

Please complete the form and fax it to FedEx. You will receive the AES approval number (ITN – internal transaction number), which you will need to enter on your air waybill or label prior to tendering the shipment to FedEx.

If you need additional assistance, please call Customer Service for FedEx Express® package shipments at 1.800.247.4747 or call Customer Service for FedEx Express freight shipments at 1.800.332.0807.

Charge for filing. The current charge for EEI filing is $10. This amount is subject to change without notice.

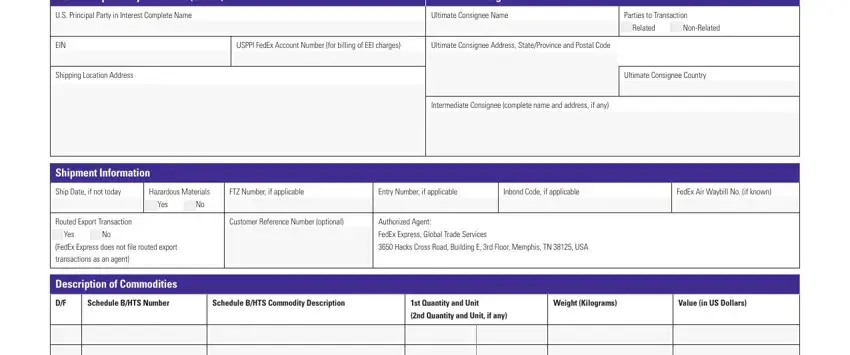

U.S. Principal Party In Interest (USPPI). Enter the name and address of the USPPI. The USPPI is the person in the U.S. that receives the primary benefit, monetary or otherwise, of the export transaction. Generally that person is the U.S. seller, manufacturer, order party or foreign entity. Provide the USPPI complete name.

EIN or SSN. Enter the nine-digit USPPI’s Internal Revenue Service Employer Identification Number (EIN) or Social Security Number (SSN) if no EIN has been assigned.

USPPI FedEx Account Number. For the express shipment, enter

your FedEx U.S.- based payor account number for billing of the EEI agent filing charges.

Shipping Location Address. The address is the location from which the merchandise actually starts its journey to be exported. If the USPPI does not have a facility (Processing plant, warehouse or distribution center, retail outlet, etc) at the location from which the goods began their export journey, report the USPPI address from which the export was directed.

Ultimate Consignee. Enter the name and address of the foreign party actually receiving the shipment for the designated end-user; or the party so designated on the export license. For shipments to Mexico, Puerto Rico or the U.S., include the state in the address. For shipment to Puerto Rico or the U.S. include the ZIP code in the address.

Parties To Transaction. Enter check mark in the appropriate Yes/No box to indicate if this is a related or non-related party transaction.

A related party transaction is a transaction between a USPPI and a foreign consignee, (e.g., parent company or sister company), where there is at least 10 percent ownership of each by the same U.S. or foreign person or business enterprise.

Intermediate Consignee. If one is involved in the transaction, enter the name and address of the party in a foreign country who makes the delivery of the merchandise to the ultimate consignee or the party so named on the export license.

Shipment Information

Ship Date. Enter the date the shipment will be tendered to FedEx.

Hazardous Materials. Check the appropriate “Yes” or “No” indicator that identifies the shipment as hazardous as defined by the Department of Transportation.

FTZ Number. If merchandise is withdrawn from a Foreign Trade Zone (FTZ), enter the unique five-character code assigned to the location by the Foreign Trade Zone Board.

Entry Number. Enter the Import Entry Number if the shipment is in bond; such as withdrawal from an FTZ or an inbond warehouse.

Inbond Code. If the shipment is in bond enter one of the following codes:

36 = Warehouse withdrawal for IE

37 = Warehouse withdrawal for T & E

67 = IE from a Foreign Trade Zone

68 = T & E from a Foreign Trade Zone

FedEx Air Waybill No. If available on express, enter the FedEx International Air Waybill Number. Required if shipped on an air cargo (023 IATA) air waybill.

Routed Export Transaction. FedEx cannot file Routed Export Transactions as an authorized agent. A routed export transaction occurs when the foreign principal party in interest authorizes a U.S. forwarder or other agent to export the merchandise out of the U.S. If your export is a routed export transaction, you need to check the “Yes” box and file your own EEI. NOTE: FedEx will not file Routed Export Transactions as an authorized agent.

Customer Reference Number. Enter your own reference number for the shipment.

Authorized Agent. Identifies FedEx Express as the authorized agent.

Description of Commodities

D/F. Enter D (domestic) for merchandise that is grown, produced, or manufactured in the U.S (including merchandise that has been enhanced in value or changed from the form in which imported by further manufacture or processing in the U.S.) or enter F (foreign) for merchandise that has entered the U.S. and is being re-exported in the same condition as when imported.

Schedule B/HTS Number and Commodity Description. Enter the 10-digit commodity classification number as provided in Schedule B, “Statistical Classification of Domestic and Foreign Commodities Exported from the United States” (Schedule B) or the Harmonized Tariff Schedule (HTS) and the full commercial description of the commodity.

1st Quantity and Unit. Enter the total number of units (whole numbers only) that corresponds to the SCHEDULE B or HTS commodity number for the 1st unit of measure. Enter the primary unit of measure

as prescribed under the schedule B or HTS commodity number or as specified on the export license if the units differ.

2nd Quantity and Unit. If the Schedule B requires two units of quantity to be reported, enter the second quantity (whole numbers only) that corresponds to the Schedule B or HTS commodity number for the 2nd unit of measure. Also, if the Schedule B requires two units of measure to be reported, enter second unit of measure as prescribed under the Schedule B or HTS commodity number.

Weight (Kilograms). Enter the gross shipping weight for each Schedule B/HTS number, including the weight of containers. To determine kilograms, please multiply the weight in pounds by 0.4536.

Value (in U.S. Dollars). Enter the selling price or cost if not sold, including inland freight, insurance, and other charges to the U.S. port of export, but excluding unconditional discounts and commissions. The value to be reported on the EEI is the USPPI’s price or cost if not sold, to the foreign principal party in interest. Enter one value for each Schedule B/HTS number in U.S. dollars using whole numbers only (omit cents).

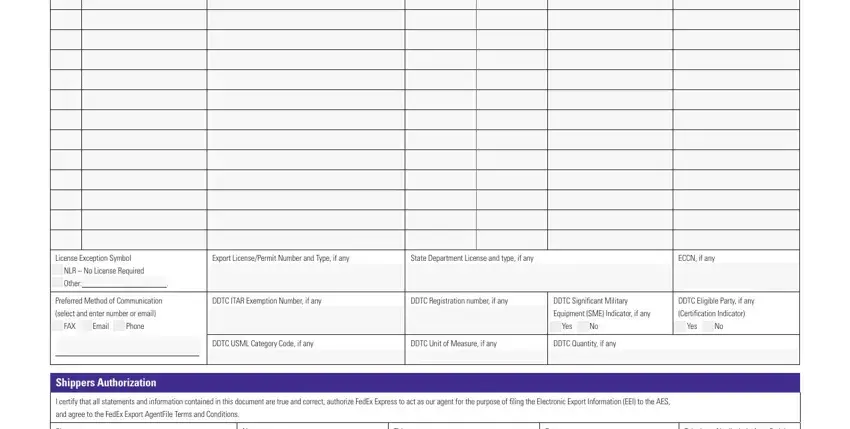

License Exception Symbol: NLR or Other. If not exporting under an export license enter the correct License Exception Symbol (e.g.

LVS, GBS, CIV etc.) or enter “NLR” (No License Required) if items that are being exported are subject to the EAR but not listed on the Commerce Control List (CCL) and if items being exported are listed on the CCL but do not require a license.

Export License Number/Permit Number and Type. If exporting under a license from the Bureau of Industry and Security (BIS), Department of the Treasury, or under a permit from the Department of Justice, enter the license type (e.g. BIS, DEA, OFAC) and number assigned by the licensing agency.

State Department License and type.

If exporting under a licence from the State Department enter the license type (e.g.. DSP5, DSP61 etc.) and license number. If shipped under a State Department License the following fields must also be completed. DDTC Registration Number

DDTC Significant Military Equipment Indicator DDTC USML Category Code

DDTC Unit of Measure DDTC Quantity

ECCN. Enter the Export Control Classification Number (ECCN) if exporting under a license or license exception; also enter an ECCN if exporting items under the NLR provisions of the EAR that are listed on the CCL and have a reason for control other than anti-terrorism. Enter EAR99 when exporting under the NLR provisions when items are subject to the EAR but not listed on the CCL. No ECCN is required for license exception symbol TMP and for items subject to International Traffic in Arms Regulations (ITAR).

DDTC. Directorate of Defense Trade Controls, formerly ODTC (Office of Defense Trade Controls).

DDTC ITAR Exemption Number. Enter the specific citation (exemption number) under the International Traffic in Arms Regulations (ITAR 22 CFR, parts 120-130) that exempts the shipment from requirements for a license or other written authorization from DDTC. If shipment is under an ITAR exemption the following DDTC fields must also be completed:

DDTC Registration Number

DDTC Significant Military Equipment Indicator DDTC Eligible Party Certification Indicator DDTC USML Category Code

DDTC Unit of Measure DDTC Quantity

DDTC Registration Number. Enter the number assigned by DDTC to the registered manufacturer or USPPI who has an authorization from DDTC (license or exemption) to export the article.

DDTC Significant Military Equipment (SME) Indicator. Enter “Yes” or “No” to indicate that the articles being exported do or do not warrant special export controls because of their capacity for substantial military utility or capability.

DDTC Eligible Party Certification Indicator. Check “Yes” or “No” to indicate that the USPPI is self certified for the exemption and is an eligible party to participate. This certification is required only when an exemption is claimed.

DDTC USML Category Code. Enter USML category code of the article being exported (e.g. 09 - Military Training Equipment, 11

– Military Electronics, etc.).

DDTC Unit of Measure. Enter unit of measure covering the article being shipped as described on the export authorization or declared under the ITAR exemption.

DDTC Quantity. Enter quantity for the article being shipped. The quantity is the total number of units that corresponds to the DDTC Unit of Measure.

Preferred Method of Communication. Check the Preferred Method of Communication that is to be used if we need to contact you if additional information is required, and enter the appropriate fax, phone or e-mail information.

Shipper’s Statement of Authorization. USPPI authorization appointing FedEx Express to act as an authorized agent for the purpose of filing the AES record.

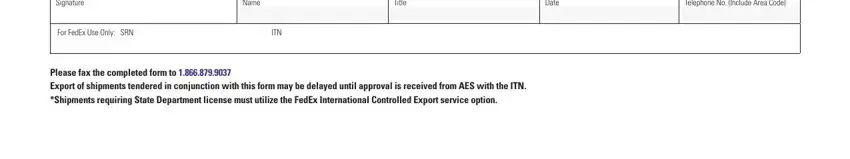

Signature. Signature of the USPPI authorizing the transaction.

Name and Title. Print/type signature name and enter title.

Date. Date signed.

Telephone Number. Telephone number of person signing the form.