Fedmobile is a new application that allows federal employees to manage their work schedule and leave requests from their mobile devices. The app was developed in response to the increased demands on government agencies and the need for more flexibility among employees. Fedmobile offers a number of benefits, including the ability to submit time cards and travel reimbursement requests, as well as view pay stubs and other personnel information. The app is available for download on both Android and iOS devices. For more information or to download the app, visit https://www.fedmobile.gov/.

| Question | Answer |

|---|---|

| Form Name | Fedmobile Application Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | federal referral code, referral code for federal bank, referral code in federal bank, referral code of federal bank |

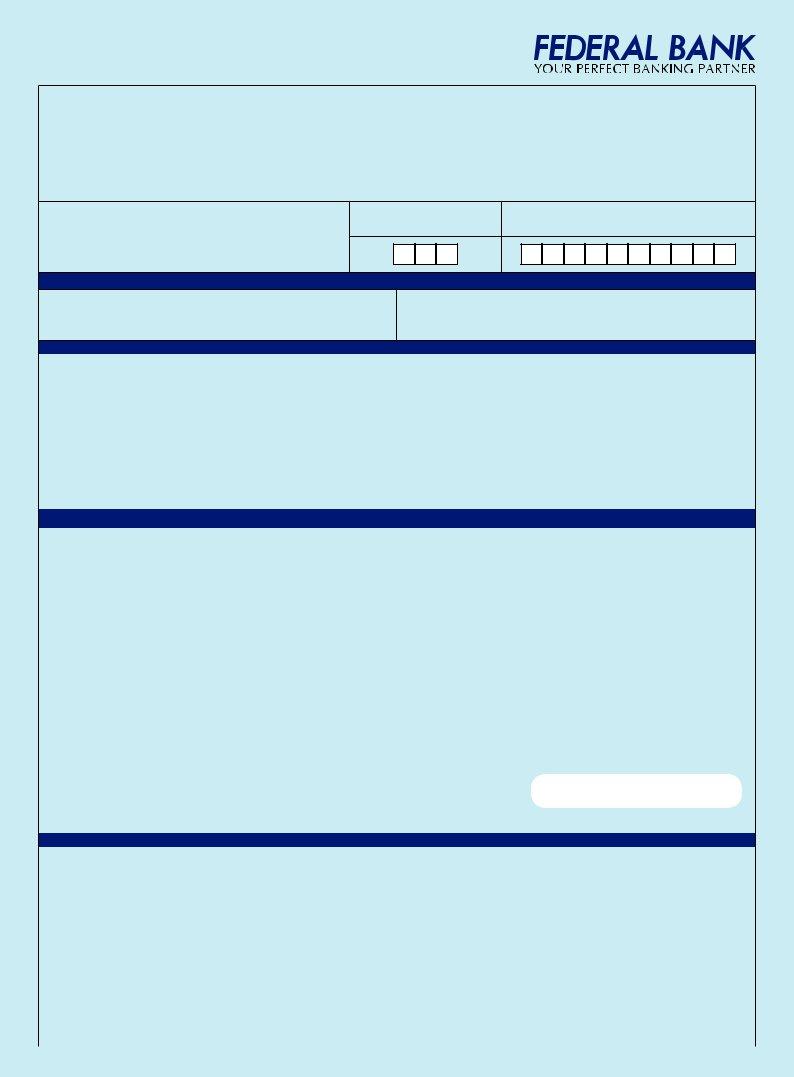

FEDMOBILE APPLICATION FORM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSONAL DETAILS |

|

|

|

|

|

Name (of primary A/c Holder): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender: Male: |

|

Female: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mother's Maiden Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Please ensure correctness of country code and mobile

number. |

Country code |

Mobile Number: |

|

|

For 2 digit Country Codes, please leave the first column blank and fill in the country code and mobile number continuously.

Fill in block letters

Permanent Address with pin code:

Communication Address with pin code:

Constitution (Please tick)

A) Individual: |

|

|

B) Joint / E or S: |

|

|

C) HUF: |

|

|

|

|

D) Sole Proprietorship: |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

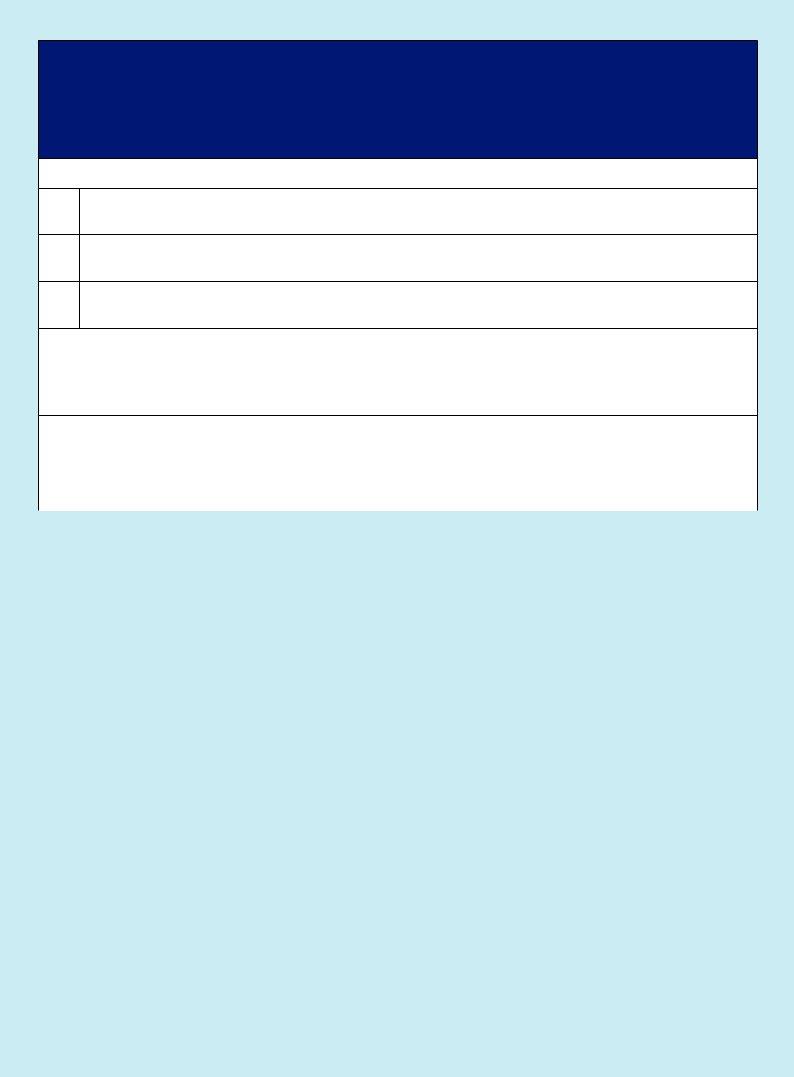

Accounts to be registered (All accounts in same Customer ID can only |

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

be linked. If customer has accounts in different Customer IDs, the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Customer IDs have to be merged) |

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alerts required: (Please indicate the items for which the customer requires alert. Please specify the limits for alerts)

|

Deposit amount greater than |

|

|

|

Withdrawal amount greater than |

|

|

|

|

|

A/c balance exceeds |

|

|

|

A/c balance falls below |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rs. |

|

|

Rs. |

|

|

Rs. |

|

|

Rs. |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Term deposit due date |

|

|

|

|

Loan installments due date |

|

|

|

|

Chequebook issue alert |

|

|

Deposited cheque bounced |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

No. of days |

|

|

|

|

|

No. of days |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

before due date |

|

|

|

|

before due date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issued cheque bounced |

|

|

|

Day end balance alert |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Declaration by the applicant:

1)I hereby declare that the above details are correct

2)I wish to link all accounts listed above in the Mobile Service

3)I confirm that in all these accounts, I am the sole signatory or authorised to act alone where accounts are in joint names. For joint accounts, I am submitting herewith mandate from joint account holders

4)I have read and agree to abide by the terms and conditions governing Mobile Banking services / Utility bill payments /

5)I hereby authorize the Bank to change my communications address in the system (CBS) with the latest address provided.

|

|

|

|

|

|

|

Signature of the Account holder (USER) |

|

|

|

|

|

|

|

|

|

For BRANCH use |

|

|

|

For HO use |

||

Branch Name: |

|

|

|

|

|

|

USER ID allotted: |

|

|

|

|

|

|

|

|

Customer ID (of primary A/c holder): |

|

|

|

User Data recorded on: |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

User Data enabled on: |

|

|

|

|

|

|

|

|

A/c number: |

|

|

|

|

|

|

Application Number: |

Mandate obtained: |

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MANDATE - INDIvIDuALS

Name of Joint Account holders (other than User):

1

2

3

We authorise ....................................................................................... ("USER") to avail of the Mobile Banking service in respect of all accounts

linked to his/her

Signature of Joint Account holders (other than user)

1 |

2 |

3 |

|

|

|

Definitions:

In this document the following words and phrases have the meaning set below unless the context indicates otherwise:

"Account(s)" shall mean bank account and /or any other type of account so maintained by the Customer with The Federal Bank Ltd or any of its Affiliate for which the Facility is being offered or may be offered in future (each an "Account" and collectively "Accounts").

"Customer" shall mean a customer of the Bank or any person who has applied for any product/service of the Bank.

The "Bank " shall mean The Federal Bank Ltd, a Banking company constituted under Banking Regulation Act, 1949 having its registered office at Federal Towers, Aluva, Kerala.

"FedMobile" shall mean mobile banking facility (which provides the Customers, services such as information relating to Account(s), details about transactions and such other services as may be provided on the Mobile Phone Number by the Bank from time to time.

"Mobile Phone Number" shall mean the mobile number used by the Customer to register for the Facility.

"Personal Information" shall mean the information about the Customer obtained in connection with the Facility. "Website" refers to www.federalbank.co.in, https://mobile.federalbank.co.in or any other website as may be notified by The Bank from time to time.

MPIN shall mean the Personal Identification Number (Password) for the Mobile Banking Service.

"Alert(s)" means the customised messages sent to the Customer over his mobile phone as short messaging service ("SMS") in response to the Triggers sent by the Customer. "Alert/Push Facility" shall mean the service provided by The Bank wherein a Customer can obtain specific information pertaining to his Account on his Mobile Phone number.

"Request/Pull Facility" shall mean facility through which Customers will be able to make requests about their Accounts by sending "key words" through SMS/ Encrypted SMS, GPRS, USSD, etc. to Mobile Phone Number provided by The Bank for the purpose.

"Triggers" means the customised triggers that are required to be set by the Customer with The Bank which shall enable The Bank to send the Alerts relating to his Account.

"Mobile Banking Menu" shall mean the mobile banking application which can be installed on the mobile phone handset to access information pertaining to the Account(s), by keying in digits representing the relevant menu options.

"GPRS" shall mean the General Packet Radio Service.

"M Commerce facility" Facility for payment for purchases on internet/ Utility payment through Fed Mobile facility. In this document all reference to Customer in masculine gender shall be deemed to include the feminine gender.

Applicability of Terms and Conditions:

These terms and conditions together with the application made by the Customer and as accepted by The Bank shall form the contract between the Customer and The Bank, and shall be further subject to such terms as The Bank may agree with the other service providers . These terms and conditions shall be in addition to and not in derogation of the terms and conditions governing the Telebanking facility, Fednet, ATM/ Debit Card Facility and those relating to any Account of the Customer and /or any other product/services provided by The Bank and its Affiliates.

Application:

The Customer shall apply to The Bank for use of the Facility (and/or for any changes to the options available under the Facility) in the specified application form and/ or by any other method as provided by The Bank from time to time for use of the Facility. Application for the Facility shall be accepted only after authentication of the Customer through any mode of verification as may be decided at the discretion of The Bank.

Eligible Customer:

1)All customers having satisfactory running Savings/ Current account can avail of this service.

2)The Customer desirous of using the Facility should be either a sole Account holder or authorised to act independently.

3)The facility will be available in case of joint accounts, only if the mode of operation is indicated as ‘either or survivor’ or ‘anyone or survivor’. For these joint accounts, only one account holder of the joint account holders will be allowed to avail the facility. The other joint account holder(s) shall expressly agree with this arrangement and give their consent on the application form to authorize the customer to avail the services. In case of any of the joint account holder(s) gives stop payment instructions or such other instructions in respect of operations through the use of the facility in writing, with a view to curtail, regulate, restrict, suspend or stop the operations by the other account holders through the use of facility on any of the accounts held jointly by them, the facility would be discontinued and restoration of the facility would be considered at the sole discretion of the Bank, only on the joint request of all account holders. All or any transactions arising from the use of the Facility in the joint account shall be binding on all the joint account holders, jointly and severally.

4)An Account in the name of the minor, in which a minor is a joint account holder or any account where the mode of operation is joint, is not eligible for the Facility.

Applicability:

1.The last updated mobile number in the records of The Bank would be the registered Mobile number for the facility. The Customer agrees to use the facility on a Mobile Phone properly and validly registered in his/ her name only with the Mobile Service provider and undertakes to use the Facility only through Mobile number which has been used to register for the Facility

2.Currently, Mobile Banking Facility is not offered for two Mobile numbers for the same account.

3.All accounts linked to a same Customer ID can be registered for the Facility, but the primary Saving / Current account of the customer will be the Primary account of the Facility.

4.The Bank reserves the right to reject a customer’s application for the Facility without assigning any reasons.

5.Entering the wrong MPIN thrice will block the Facility to the account for the day and three such consecutive blockages will deactivate the customer and the customer should

6.The Customer is responsible for intimating to The Bank any change in his Mobile Phone Number or email address or Account details and The Bank will not be liable for sending Alerts or other information over the Customer's mobile phone number/email address /fax number recorded with The Bank.

Availability & Disclosure:

The Bank shall endeavor to provide to the Customer through the Facility, such services as The Bank may decide from time to time.

The Bank reserves the right to decide what services may be offered to a Customer on each Account and such offers may differ from Customer to Customer. The Bank may also make additions / deletions to the services offered through the Facility at its sole discretion.

The Facility is made available to the Customer at his request, at the sole discretion of The Bank and may be discontinued by The Bank at any time, without notice. The Bank shall have the discretion to offer the Facility to Non Resident Indians subject to applicable laws.

The instructions of the Customer shall be effected only after authentication of the Customer by means of verification of the Mobile Phone Number and/or through verification of MPIN/ password allotted by The Bank to the Customer or through any other mode of verification as may be stipulated at the discretion of The Bank.

Instructions:

All instructions for availing the services under the Facility shall be provided through the Mobile Phone Number in the manner indicated by The Bank.

Where The Bank considers the instructions to be inconsistent or contradictory it may seek clarification from the Customer before acting on any instruction of the Customer or act upon any such instruction as it may deem fit.

The Customer and The Bank shall have the right to suspend the services under the Facility if The Bank has reason to believe that the Customer's instructions may lead to direct or indirect loss or may require an indemnity from the Customer before continuing to operate the Facility.

The Customer accepts that all information /instructions will be transmitted to and /or stored at various locations and be accessed by personnel of The Bank (and it’s Affiliates).

The Bank is authorised to provide any information or details relating to the Customer or to third party to facilitate the providing of the Facility and so far as is necessary to give effect to any instructions.

The Customer accepts that each Alert may contain certain Account information relating to the Customer. The Customer authorises the Bank to send Account related information, though not specifically requested, if The Bank deems that the same is relevant. The Bank shall not be held responsible for the confidentiality, secrecy and security of the Personal or Account information being sent through the Facility.

Fund Transfer Facility:

The Bank shall specify from time to time the upper limit that may be transferred by the Customer for the above mentioned Facility through the Bank’s website.

If the above mentioned Facility is made available to the Customer, it may be used for transfer of funds from Account/s to other accounts belonging to third parties maintained at The Bank and/or at any other Bank which falls under the network of Reserve Bank of India's Electronic Fund Transfer or National Electronic Fund Transfer system or Real Time Gross Settlement. In such an event, the terms applicable to such facilities, in addition to this facility, shall be applicable.

The liability of The Bank shall only commence subsequent to the debit in the Customer’s account.

The Bank may introduce Bill payment facility/

The Customer undertakes to provide accurate information wherever required and shall be responsible for the correctness of information provided by him to The Bank at all times including for the purposes of availing of the Facility. The Bank shall not be liable for consequences arising out of erroneous information supplied by the Customer. If the Customer suspects that there is an error in the information supplied by Bank to him, he shall advise The Bank as soon as possible. The Bank will endeavor to correct the error wherever possible on a best effort basis. While The Bank will take all reasonable steps to ensure the accuracy of the information supplied to the Customer, The Bank shall not be liable for any inadvertent error, which results in the providing of inaccurate information. The Customer shall hold The Bank harmless against any loss, damages etc. that may be incurred / suffered by the Customer if the information supplied to the Customer turns out be inaccurate / incorrect. The Customer agrees that the access to the Facility shall be only through the Mobile Phone Number and any transaction which originates from the same, whether initiated by the Customer or not, shall be deemed to have originated from the Customer.

Authority to The Bank:

The Customer irrevocably and unconditionally authorises The Bank to access all his Accounts for effective banking or other transactions of the Customer through the Facility. The Customer further authorizes The Bank to share the Account information with Third Party for the purpose of accepting/ executing request of the Customers.

The Customer agrees that The Bank and / or its Affiliates may hold and process his personal information concerning his Accounts on computer or otherwise in connection with the Facility as well as for analysis, credit scoring and marketing. The Customer also agrees The Bank may disclose, in strict confidence, to other institutions, such information as may be reasonably necessary for reasons inclusive of but not limited to the participation in any telecommunication or electronic clearing network, in compliance with legal directive, for credit rating by recognized credit scoring agencies, and for fraud prevention.

The Customer authorises Bank and its agents to send any message or make calls to his mobile phone to inform him about any promotional offers including information regarding banks' new products either now available or which the Bank may come up with in the future, greetings or any other message that the Bank may consider appropriate to the user.

The user irrevocably and unconditionally agrees that such calls or messages made by the Bank and or its agents shall not be construed as a breach of the privacy of the user and shall not be proceeded against accordingly.

Signature

Fees:

The Bank shall have the discretion to charge fees as it may deem fit from time to time and may at its sole discretion, revise the fees for use of any or all of the Facility, by notice to the Customer. The Customer may at any time discontinue or unsubscribe to the said Facility. The Customer shall be liable for payment of such airtime or other charges which may be levied by any cellular service provider in connection with availing of the Facility and The Bank is in no way concerned with the same. The charges payable by the Customer is exclusive of the amount payable to any cellular service provider and would be debited from the account of the Customer on a monthly basis. The Customer shall be required to refer to the schedule of fees put up on the Website from time to time.

(i)The Bank and its group companies shall have the paramount right of

(ii)In addition to the above mentioned right or any other right which the Bank and its Affiliates may at any time be entitled whether by operation of law, contract or otherwise, the Bank is authorized / will be entitled: (a) to combine or consolidate at any time all or any of the Accounts and liabilities of the Customer with or to any branch of the Bank and/or its Affiliates; (b) to sell or otherwise dispose off any of the Customers’ securities or properties held by the Bank by way of public or private sale or otherwise without having to institute any judicial proceeding whatsoever and retain/appropriate from the proceeds derived there from the total amounts outstanding to the Bank and/or to the Affiliates from the Customer, including costs and expenses in connection with such sale or disposal; and

Modification:

The Bank has the absolute discretion to amend or supplement any of the terms and conditions at any time and will endeavour to give prior notice of one month by email or by displaying on the Website depending upon the discretion of The Bank, whichever feasible, and such amended terms and conditions will thereupon apply to and be binding on the Customer.

Termination:

The Customer may request for termination of the Facility any time by giving a written notice of at least 30 days to The Bank. The Customer will remain responsible for any transactions made through his Mobile Phone Number through the Facility prior to the time of such cancellation of Facility.

The Bank may, at its discretion, withdraw temporarily or terminate the Facility, either wholly or in part, at any time without giving prior notice to the Customer. The Bank may, without prior notice, suspend the Facility at any time during which any maintenance work or repair is required to be carried out or in case of any emergency or for security reasons, which require the suspension of the Facility. The Bank shall endeavour to give a reasonable notice for withdrawal or termination of the Facility.

The closure of all Accounts of the Customer will automatically terminate the Facility. The Bank may suspend or terminate Facility without prior notice if the Customer has breached these terms and conditions or The Bank learns of the death, bankruptcy or lack of legal capacity of the Customer.

Notices:

The Bank and the Customer may give notice under these terms and conditions electronically to the mailbox of the Customer (which will be regarded as being in writing) or in writing by delivering them by hand or by sending them by post to the last address given by the Customer and in case to The Bank at its office at The Federal Bank Ltd. Registered Office, Federal tower, Aluva, Ernakulum District, Kerala, 683101. In addition, The Bank shall also provide notice of general nature regarding the facility and terms and conditions, which are applicable to all customers of the Facility, on its Website and/ or also by means the customised messages sent to the Customer over his mobile phone as short messaging service ("SMS"). Such notice will be deemed to have been served individually to each Customer.

Records:

All records of The Bank generated by the transactions arising out of use of the Facility, including the time of the transaction recorded shall be conclusive proof of the genuineness and accuracy of the transactions. The authority to record the transaction details is hereby expressly granted by the Customer to The Bank.

Disclaimer of Liability:

The Bank shall not be responsible for any failure on the part of the Customer to utilise the Facility due to the Customer not being within the geographical range within which the Facility is offered; Under no circumstance, The Bank shall be held liable if the Facility is not available for reasons including but not limited to natural calamities, legal restraints, system error, faults in the telecommunication network or network failure, or any other reason beyond the control of The Bank.

If the Customer has reason to believe that his mobile phone number is / has been allotted to another person and / or there has been an unauthorised transaction in his account and / or his mobile phone is lost, he shall immediately inform The Bank under acknowledgment about the same.

The Customer agrees that The Bank shall not be liable if

1.the Customer has breached any of the terms and conditions herein or

2.the Customer has contributed to or the loss is a result of failure on part of the Customer to advise The Bank within a reasonable time about unauthorised access of or erroneous transactions in the Account;

3.as a result of failure on part of the Customer to advise The Bank of a change in or termination of the Customer's Mobile Phone numbers.

The Bank is in no way liable for any error or omission in the services provided by any cellular or any third party service provider (whether appointed by The Bank in that behalf or otherwise) to the Customer, which may affect the Facility.

The Bank, does not warrant the confidentiality or security of the messages whether personal or otherwise transmitted through the Facility.

The Bank makes no warranty or representation of any kind in relation to the system and the network or their function or performance or for any loss or damage whenever and howsoever suffered or incurred by the Customer or by any person resulting from or in connection with the Facility

Without limitation to the other provisions of this terms and conditions, The Bank, its employees, agent or contractors, shall not be liable for and in respect of any loss or damage whether direct, indirect or consequential, including but not limited to loss of revenue, profit, business, contracts, anticipated savings or goodwill, loss of use or value of any equipment including software, whether foreseeable or not, suffered by the Customer or any person howsoever arising from or relating to any delay, interruption, suspension, resolution or error of The Bank in receiving and processing the request and in formulating and returning responses or any failure, delay, interruption, suspension, restriction, or error in transmission of any information or message to and from the telecommunication equipment of the Customer and the network of any cellular service provider and The Bank's system or any breakdown, interruption, suspension or failure of the telecommunication equipment of the Customer, The Bank's system or the network of any cellular service provider and/or any third party who provides such services as is necessary to provide the Facility.

Notwithstanding anything in the contrary provided in this terms and conditions, The Bank shall not be involved in or in any way liable to the Customer for any dispute between the Customer and a cellular services provider or any third party service provider (whether appointed by The Bank in that behalf or otherwise).

The Customer shall not interfere with or misuse in any manner whatsoever the Facility and in the event of any damage due to improper or fraudulent use by the Customer, the Customer shall be liable for damages to The Bank.

The Customer is solely responsible for protecting his Mobile Banking Personal Identification Number (MPIN) mobile phone number and any password given by The Bank for the use of the Facility. The Bank will not be liable for:

(a)any unauthorised use of the Customer's MPIN, mobile phone or for any fraudulent, duplicate or erroneous instructions given by use of the Customer's MPIN or mobile phone number;

(b)acting in good faith on any instructions received by The Bank;

(c)error, default, delay or inability of The Bank to act on all or any of the instructions

(d)loss of any information/instructions in transmission;

(e)unauthorized access by any other person to any information /instructions given by the Customer or breach of confidentiality;

f)any unauthorized transaction in the Account as a result of any other issue/default/error/technological problem in the telecommunication instrument (such as the mobile handset) or duplication of mobile number / SIM of the Customer such as but not limited to SIM card cloning, virus in handset etc.

The Bank may provide any other services as a part of the Facility and The Bank shall not be liable for the oversight on part of the Customer to update himself with the addition of services which have been included in the Facility and specific services for each product as may be provided on the website of The Bank and as will be available with the authorized call centers of The Bank.

Indemnity:

In consideration of The Bank providing the Facility, the Customer agree to indemnify and keep safe, harmless and indemnified, The Bank from and against all actions, claims, demands, proceedings, loss, damages, costs, charges and expenses whatsoever The Bank may incur, sustain, suffer or be put to at any time as a consequence of acting on or omitting or refusing to act on any instructions given by use of the Facility.

The Customer holds The Bank/ its Affiliates, harmless against any loss incurred by the Customer due to failure to provide the services offered under the Facility or any delay in providing the services due to any failure or discrepancy in the network of the cellular service provider. The Customer agrees to indemnify and hold The Bank harmless for any losses occurring as a result of:

i.the Customer permitting any third parties to use the Facility.

ii.the Customer permitting any other person to have access to his mobile phone or as a consequence of leaving the mobile phone unattended or loss of mobile phone.

Governing Law:

These terms and conditions and/or the operations in the accounts of the Customer maintained by the BANK and/or the use of the services provided through the facility shall be governed by the laws of the Republic of India and no other nation • The BANK accepts no liability whatsoever, direct or indirect, for noncompliance with the laws of any country other than the Republic of India.

The mere fact that the Facility can be accessed by a Customer in a country other than India shall not be interpreted to imply that the laws of the said country govern these terms and conditions and/or the operations in the Facility accounts of the USER and/or the use of the facility.

Disclaimer:

The Bank may, at its sole discretion, utilize the services of external service provider/s or agent/s and on such terms as required or necessary, in relation to its products/services.

Signature