Our main software engineers worked hard to build the PDF editor we are extremely pleased to deliver to you. This software will let you effortlessly complete florida new hire reporting form 2021 and will save you your time. You need to simply keep up with this specific procedure.

Step 1: Find the button "Get Form Here" on the website and hit it.

Step 2: The file editing page is right now open. Include text or change existing information.

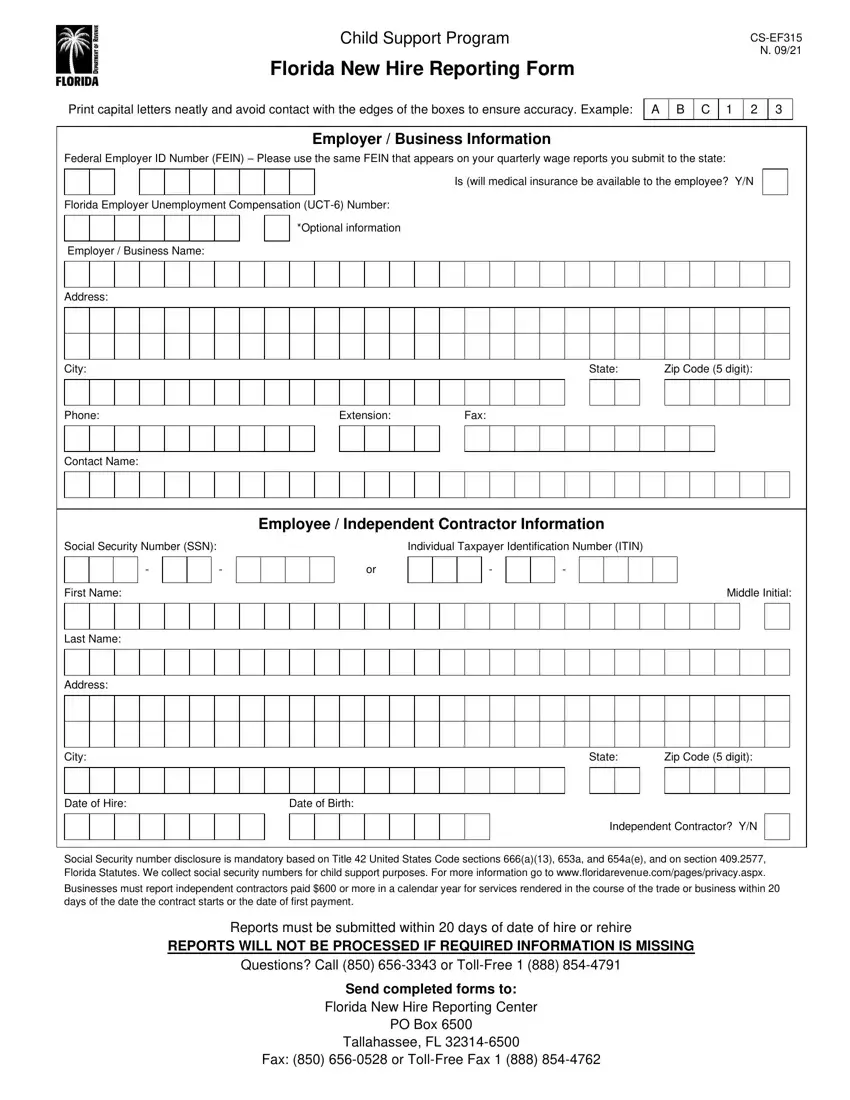

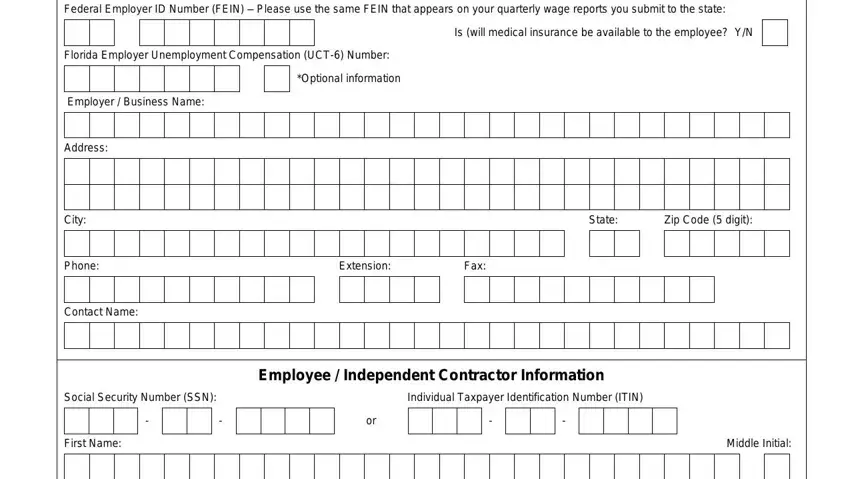

To fill out the florida new hire reporting form 2021 PDF, provide the details for all of the parts:

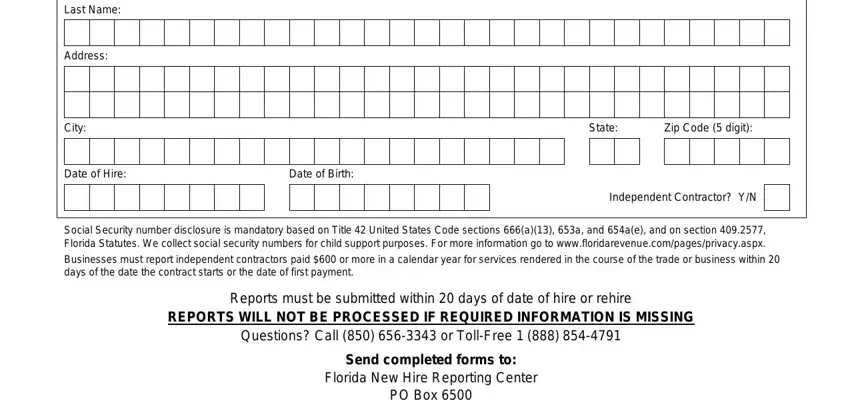

The system will need you to fill in the Last Name, Address, City, Date of Hire, Date of Birth, State, Zip Code digit, Independent Contractor YN, Social Security number disclosure, Businesses must report independent, Reports must be submitted within, and Send completed forms to Florida field.

Step 3: After you press the Done button, your finished document may be exported to each of your devices or to electronic mail given by you.

Step 4: It may be easier to maintain duplicates of the document. You can rest assured that we are not going to publish or read your details.