GENERAL INFORMATION

This form is designed for use by dealers/dismantlers but may also be used by individuals or companies submitting multiple registration applications.

In computing any fees or penalties due whether on a proration or otherwise, disregard a fraction of a dollar unless it exceeds fifty cents ($0.49). In this case, round the fee up to the next dollar.

Example: (If fee and/or penalty is $5.50, submit $6.00.) (If fee and/or penalty is $5.49, submit $5.00.)

Please do not submit odd cents.

It is not necessary to enter .00 in the money columns to indicate cents.

Applications not submitted to the Department in a timely manner are subject to the following Administrative Service Fees (ASF)/ Investigative Service Fee (ISF).

Submitted after 20/30 days from date of sale (ASF) |

$5.00 |

Submitted after 40/50 days from date of sale |

$25.00 |

In addition, whichever is appropriate: |

|

Submitted after 20 days from date the |

|

department first returned the application (ASF) |

$25.00 |

Submitted after 5 days from acquiring the vehicle (ISF) |

$15.00 |

Sacramento Headquarters will bill for any ASF/ISF due. The dealer/ dismantler or lessor-retailer must submit the ASF/ISF invoice to make payment in full.

PREPARE AN ORIGINAL AND TWO (2) COPIES

Original: Retained by the Department.

Copy: Returned to submitter with documents due after the applications have been processed.

Copy: If ISF fees are due, this copy will be forwarded by the field office to:

ASF/ISF Unit

P.O. Box 932366, M/S L224

Sacramento, CA 94232-3660

An application for vehicle registration is considered to be received

by the Department only when it is accompanied by all necessary documents properly completed and the required fees. Penalties may accrue on applications submitted to the Department without fees.

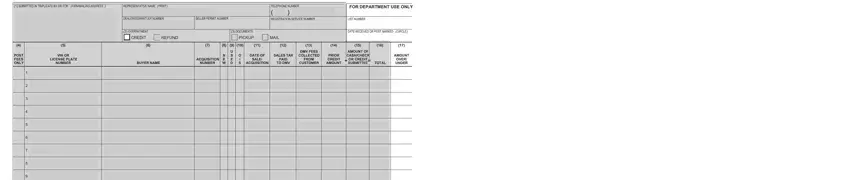

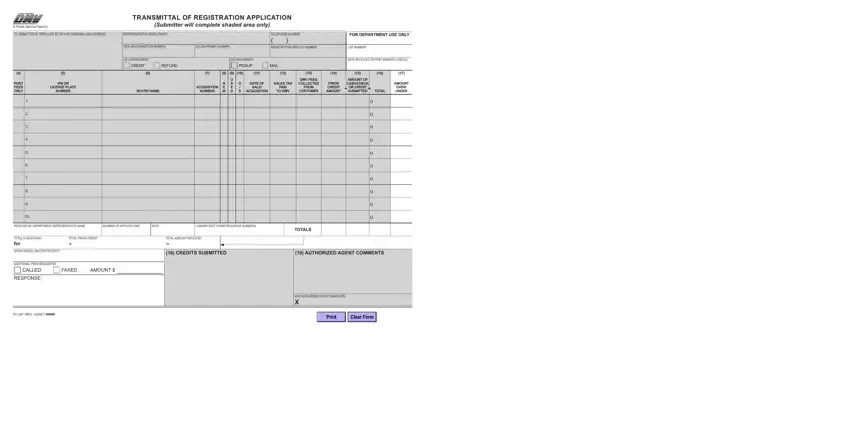

PROCEDURE TO COMPLETE THIS FORM

(Submitter will complete the shaded area only.)

1.As the submitter, enter your firm name, mailing address, dealer/dismantler number, Registration Service number, or Seller Permit Number, if applicable. Print the representative’s name and telephone number. Note: Seller’s Permit Number is a 9-digit number provided by the California Department of Tax and Fee Administration (CDTFA). For example: “012345678”.

2.Indicate choice of refund or credit media for overpayment.

3.Indicate choice of pickup or mail for documents.

4.Enter “X” if the item is for Posting Fees Only.

5.Enter the Vehicle Identification number (VIN) or the California license plate number presently on the vehicle. Note: When completing this form, group all “used” vehicle transactions together, all “new” vehicles together, and all “out of state (O/S)” vehicles together.

6.Enter the buyer’s name.

7.Enter the Acquisition Number for the transaction.

8.Enter “X” if transaction is for a new vehicle

9.Enter “X” if transaction is for a used vehicle.

10.Enter “X” if vehicle will be registered O/S.

11.Enter the date of sale/acquisition for each transaction.

12.Enter the amount of sales tax collected based on the actual selling price of the vehicle. Note: Sales tax collected on other charges related to the vehicle (including, but not limited to the document fees, smog certification fees, and mandatory warranties) must be reported directly to CDTFA on monthly sales and use tax returns.

13.Enter the amount of DMV fees collected from the customer.

14.Enter the prior credit amount, if any.

15.Enter the amount of cash/check or credit submitted.

16.Total for columns 14 plus 15.

17.To Completed by DMV personnel.

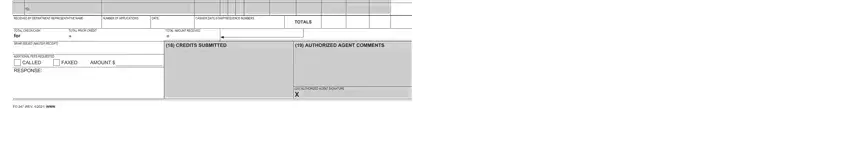

18.Indicate credits submitted; Bundle credit information, Z96, or write “none”.

19.Authorized agent’s comments.

20.Authorized agent’s signature.

NOTICE TO DEALERS

In the “Amount of Refund” column shown on the attached Bundle Listing sheet, the Department will indicate excess fees paid DMV. Refund of Excess Fees by Dealer (CVC §11713.4). If a purchaser of a vehicle pays the dealer an amount for the licensing or transfer of title of the vehicle, which amount is in excess of the actual fees due for such licensing or transfer, or which amount is in excess of the amount which has been paid, prior to the sale, by the dealer to the state in order to avoid penalties that would have accrued because of the late payment of such fees, the dealer shall return such excess amount to the purchaser, whether or not such purchaser requests the return of the excess amount.

FO 247 (REV. 4/2021) WWW