It's very easy to fill out the taxforms blanks. Our editor makes it pretty much effortless to complete any type of form. Listed below are the primary four steps you'll want to consider:

Step 1: Choose the "Get Form Now" button to get started on.

Step 2: As soon as you access our taxforms editing page, you'll see each of the actions you can undertake regarding your file at the upper menu.

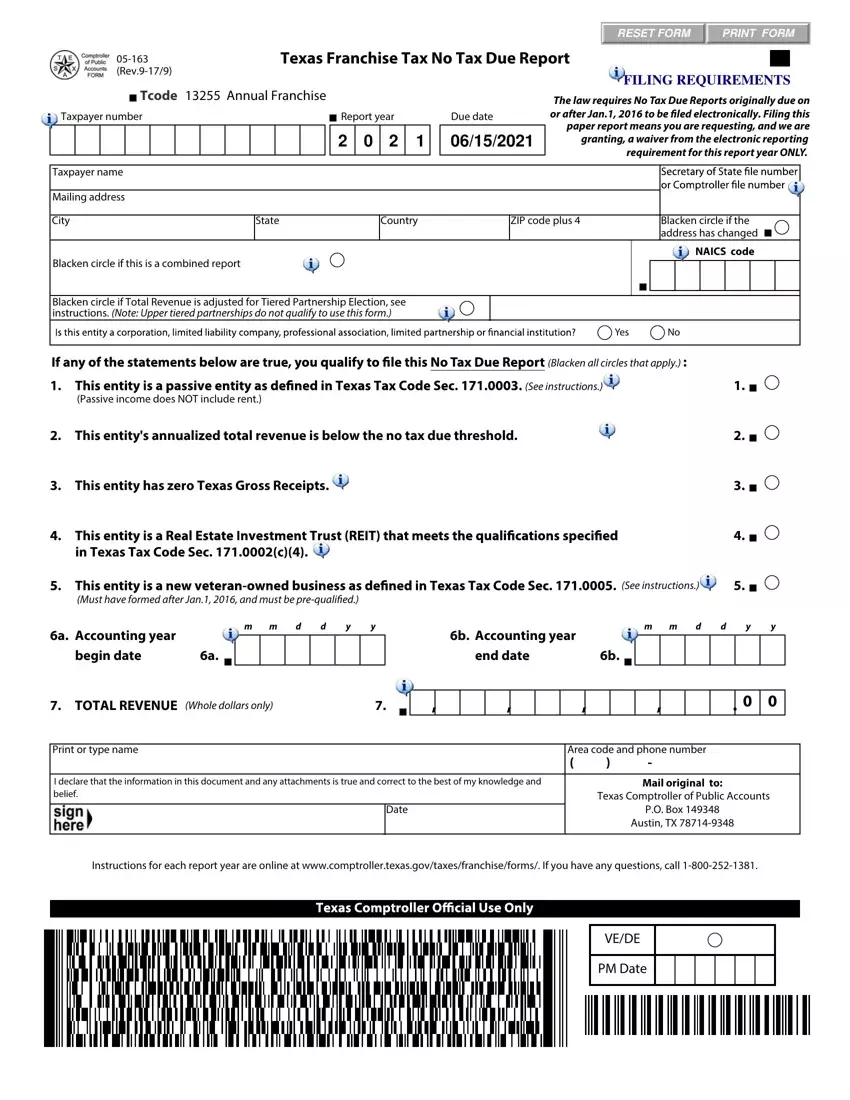

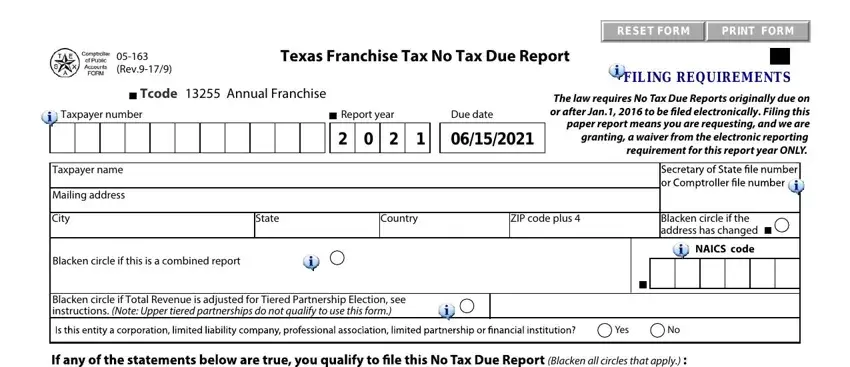

Enter the details demanded by the system to complete the file.

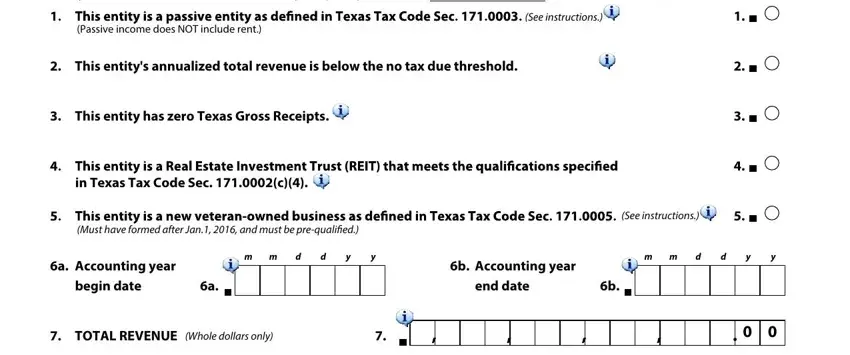

Write down the information in the Passive income does NOT include, This entitys annualized total, This entity has zero Texas Gross, in Texas Tax Code Sec c, Must have formed after Jan and, Blacken all circles that apply, See instructions, See instructions, a Accounting year begin date, m m, b Accounting year, end date, m m, and TOTAL REVENUE Whole dollars only field.

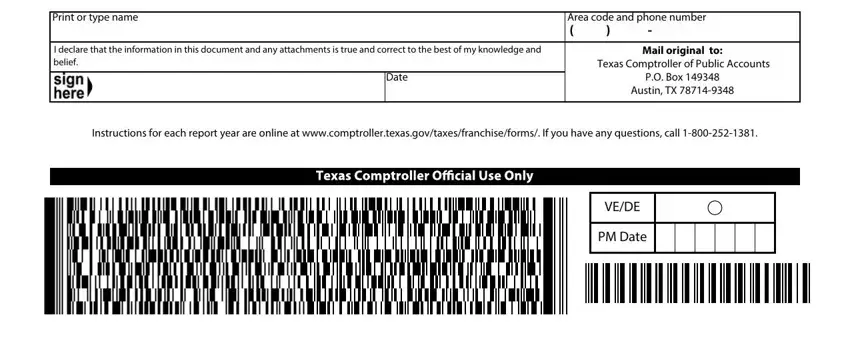

The program will ask for more information with a purpose to instantly fill in the area Print or type name, Area code and phone number, I declare that the information in, Date, Mail original to Texas Comptroller, Instructions for each report year, VEDE, and PM Date.

Step 3: If you're done, click the "Done" button to upload the PDF file.

Step 4: You may create copies of your form toremain away from any type of possible complications. Don't worry, we don't disclose or track your data.