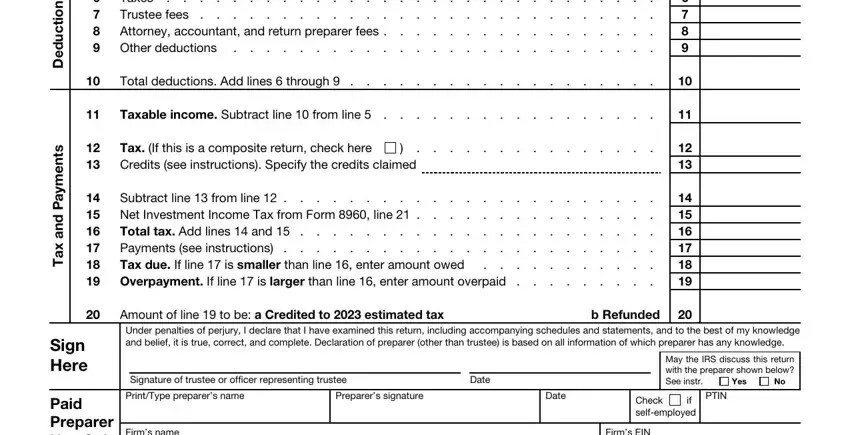

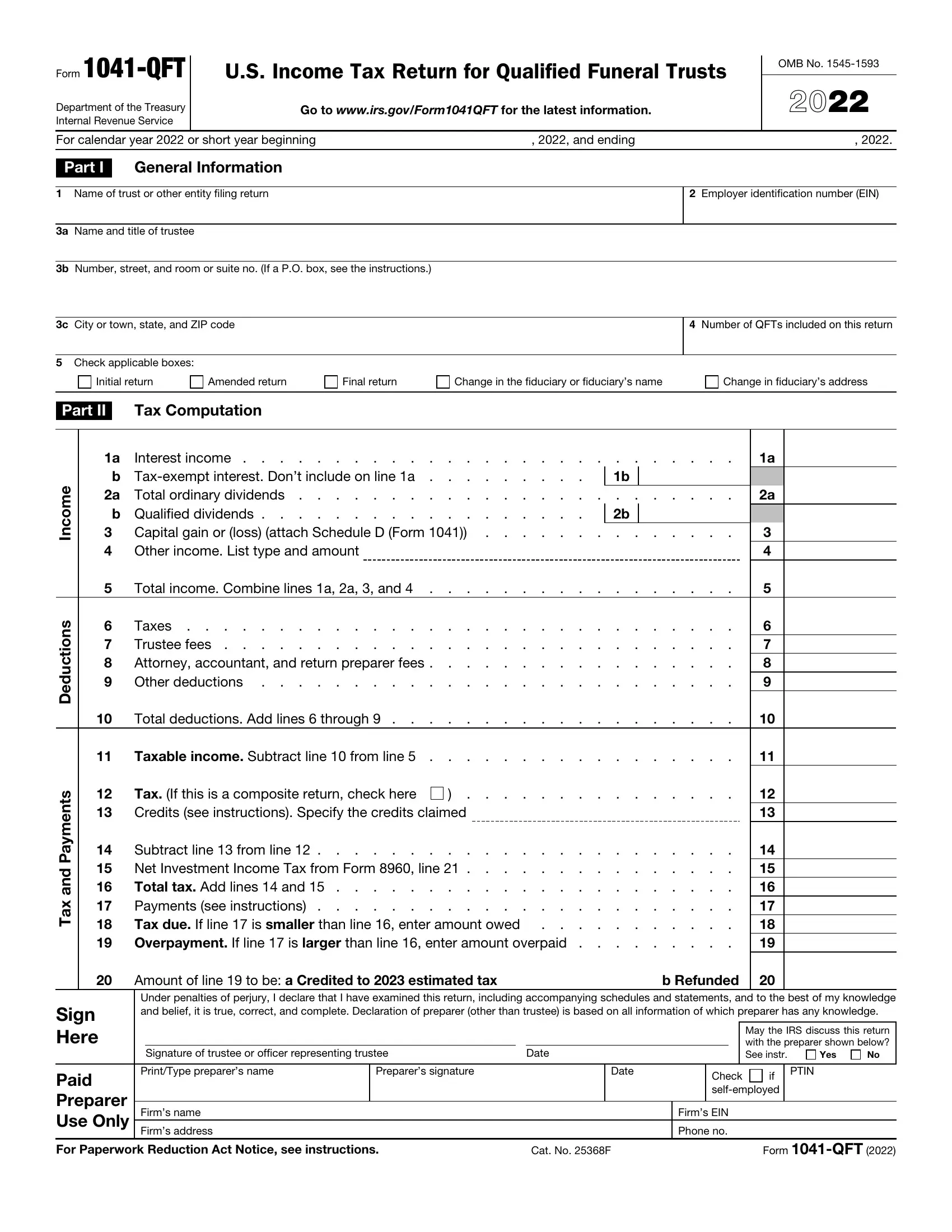

Paid Preparer Authorization

If the trustee wants to allow the IRS to discuss the QFT’s 2021 tax return with the paid preparer who signed it, check the “Yes” box in the signature area of the return. This authorization applies only to the individual whose signature appears in the Paid Preparer Use Only section of the QFT’s return. It doesn’t apply to the firm, if any, shown in that section.

If the “Yes” box is checked, the trustee is authorizing the IRS to call the paid preparer to answer any questions that may arise during the processing of the QFT’s return. The trustee is also authorizing the paid preparer to:

•Give the IRS any information that’s missing from the QFT’s return;

•Call the IRS for information about the processing of the QFT’s return or the status of its refund or payment(s); and

•Respond to certain IRS notices that the trustee has shared with the preparer about math errors, offsets, and return preparation.

The trustee isn’t authorizing the paid preparer to receive any refund check, bind the QFT to anything (including any additional tax liability), or otherwise represent the QFT before the IRS.

The authorization will automatically end no later than the due date (without regard to extensions) for filing the QFT’s 2022 tax return. If the trustee wants to expand the paid preparer’s authorization or revoke the authorization before it ends, see Pub. 947, Practice Before the IRS and Power of Attorney.

Accounting Methods

Figure taxable income using the method of accounting regularly used in keeping the QFT’s books and records. Generally, permissible methods include the cash method, the accrual method, or any other method authorized by the Internal Revenue Code. In all cases, the method used must clearly reflect income.

Generally, the QFT may change its accounting method (for income as a whole or for any material item) only by getting consent on Form 3115, Application for Change in Accounting Method. For more information, see Pub. 538, Accounting Periods and Methods.

Accounting Period

All QFTs must use a calendar year as their accounting period.

Rounding Off to Whole Dollars

You may round off cents to whole dollars on your return and statements. If you do round to whole dollars, you must round all amounts. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3. If you have to add two or more amounts to figure the amount to enter on a line, include cents when adding the amounts and round off only the total.

Estimated Tax

Generally, a QFT must pay estimated income tax for 2022 if it expects to owe, after subtracting withholding and credits, at least $1,000 in tax. Estimated tax liability is figured for the individual QFT, and not for a composite return taken as a whole. For details and exceptions, see Form 1041-ES, Estimated Income Tax for Estates and Trusts.

Interest and Penalties

Interest

Interest is charged on taxes not paid by the due date, even if an extension of time to file is granted. Interest is also charged on the failure-to-pay penalty, failure-to-file penalty, the accuracy-related penalty, and the fraud penalty. The interest charge is figured at a rate determined under section 6621.

Late Filing of Return

Section 6651 provides for penalties for late filing unless there is a reasonable cause for the delay. The law also provides for penalties for willful attempts to evade payment of tax. The penalty won't be imposed if you can show that the failure to file on time is due to reasonable cause and not due to willful neglect.

If you receive a notice about penalty and interest after you file this return, send us an explanation, and we will determine if you meet reasonable-cause criteria. Don’t attach an explanation when you file Form 1041-QFT. For more information about penalties for late filing, see Late Filing of Return Instructions for Form 1041.

Late Payment of Tax

Generally, the penalty for not paying the tax

when due is 1/2 of 1% of the unpaid amount for each month or part of a month that it remains unpaid. The maximum penalty is 25% of the unpaid amount. The penalty applies to any unpaid tax on the return. Any penalty is in addition to interest charges on late payments.

Underpaid Estimated Tax

If the trustee underpaid estimated tax, use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, to figure any penalty.

! |

If you include interest or any of |

these penalties with your payment, |

▲ |

identify and enter these amounts |

CAUTION |

in the bottom margin of Form |

1041-QFT. Don’t include the interest or penalty amount in the balance of tax due on line 17.

Other Penalties

Other penalties can be imposed for negligence, substantial understatement of tax, and fraud. See Pub. 17, Your Federal Income Tax, for details on these penalties.

Final Form 1041

If you have an existing EIN(s) that you previously used for filing Form 1041 and that you won’t use again (that is, for QFTs included in a composite return), you should file Form 1041 and check the final return box.

Specific Instructions

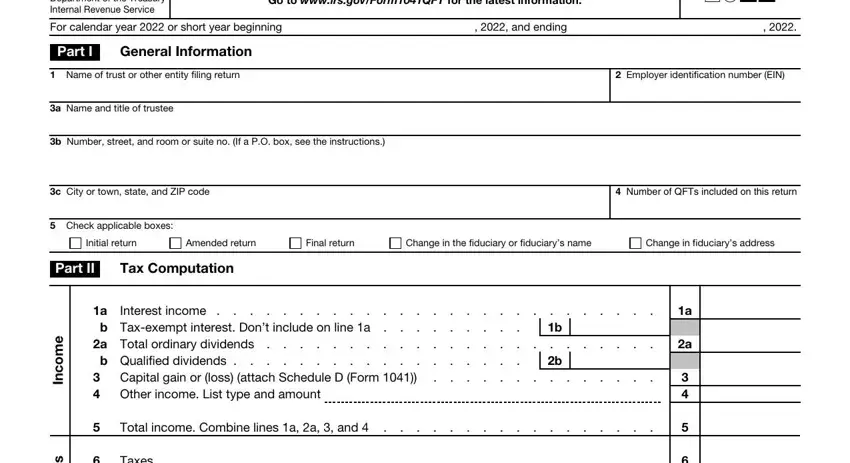

Part I—General Information

Line 1—Name of Trust

Copy the exact name from the Form SS-4, Application for Employer Identification Number, used to apply for the EIN you are using to file Form 1041-QFT.

Line 2—Employer Identification Number (EIN)

If the QFT isn’t filing as part of a composite return, use the EIN of the QFT. If the QFT doesn’t have an EIN, it must apply for one. Every trustee that elects to file a composite return must apply for an EIN to be used only for filing Form 1041-QFT. A trustee must use a separate EIN for every Form 1041-QFT it files.

A QFT without an EIN can apply for one.

•Online—A QFT can receive an EIN by Internet and use it immediately to file a return. Go to the IRS website at www.irs.gov/EIN and click on “Apply for an EIN Online.”

•By mail or fax—Send in a completed Form SS-4. Form SS-4 can be obtained online at www.irs.gov/OrderForms.

If the QFT hasn’t received its EIN by the time the return is due, write “Applied for” in the space for the EIN.

Line 3—Address

Include the suite, room, or other unit number after the street address. If the post office doesn’t deliver mail to the street address and you have a P.O. box, show the box number instead of the street address.

If you want a third party (such as an accountant or an attorney) to receive mail for the QFT, enter “C/O” on the street address line, followed by the third party’s name and street address or P.O. box.

If you change your address (including a new “in care of” name and address) after filing Form 1041-QFT, use Form 8822-B, Change of Address or Responsible Party — Business, to notify the IRS.

Line 4—Number of QFTs

If this is a composite return, enter the total number of QFTs (including separate interests treated as separate QFTs) included on the return.

Part II—Tax Computation

Composite Return

! |

If this is a composite return, |

enter in Part II the totals for all the |

▲CAUTION |

QFTs included on the return. |

Income

Line 2a—Total Ordinary Dividends

Report all ordinary dividends received during the tax year.

Report capital gain distributions on Schedule D (Form 1041), line 13.