The 1099 k completing course of action is hassle-free. Our software enables you to work with any PDF form.

Step 1: Find the button "Get Form Here" on the site and select it.

Step 2: Right now, you can begin editing your 1099 k. The multifunctional toolbar is readily available - insert, eliminate, transform, highlight, and perform other commands with the content in the document.

For each part, create the content requested by the program.

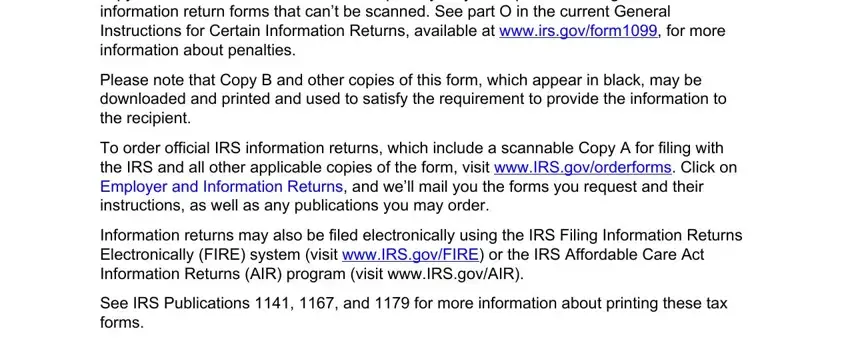

Type in the expected details in the VOID, CORRECTED, FILERS name street address city or, FILERS TIN, OMB No, Check to indicate if FILER is a an, Payment settlement entity PSE, PAYEES name, Check to indicate transactions, Payment card, Third party network, Street address including apt no, City or town state or province, PSES name and telephone number, and Account number see instructions segment.

Write down all information you are required inside the box State income tax withheld, Form K Rev Department of the, wwwirsgovFormK, and Cat No B.

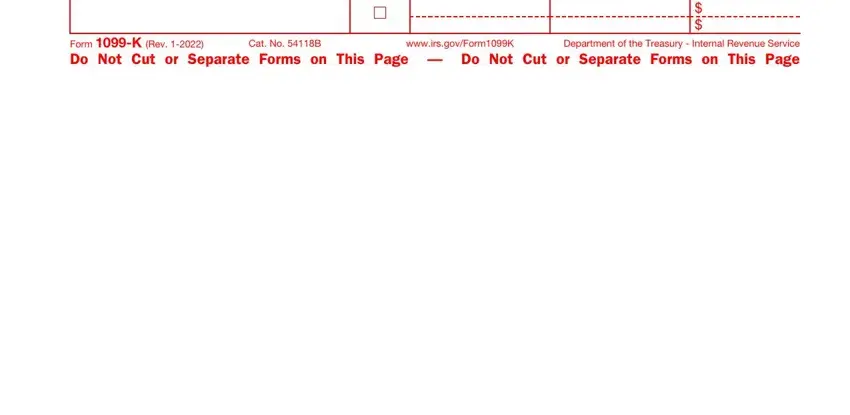

The FILERS name street address city or, FILERS TIN, OMB No, VOID, CORRECTED, Check to indicate if FILER is a an, Payment settlement entity PSE, PAYEES name, Check to indicate transactions, Payment card, Third party network, Street address including apt no, City or town state or province, PSES name and telephone number, and PAYEES TIN box will be the place to indicate the rights and obligations of all sides.

End by analyzing the following fields and completing them as required: Account number see instructions, a January c March e May g July, b February d April f June h, State income tax withheld, Form K Rev, wwwirsgovFormK, and Department of the Treasury.

Step 3: Choose "Done". Now you may export your PDF file.

Step 4: Get around several copies of the file to stay away from all of the potential future troubles.

CORRECTED (if checked)

CORRECTED (if checked)