You are able to prepare form 1122 instructions without difficulty by using our online PDF tool. FormsPal expert team is always working to develop the editor and enable it to be even better for clients with its extensive functions. Enjoy an ever-evolving experience today! Here is what you'll need to do to get going:

Step 1: Press the "Get Form" button at the top of this webpage to access our editor.

Step 2: When you open the tool, you will see the document all set to be completed. In addition to filling in various blank fields, it's also possible to do various other things with the form, including writing your own text, modifying the initial text, inserting graphics, signing the document, and a lot more.

It is actually easy to finish the pdf with this detailed tutorial! Here is what you want to do:

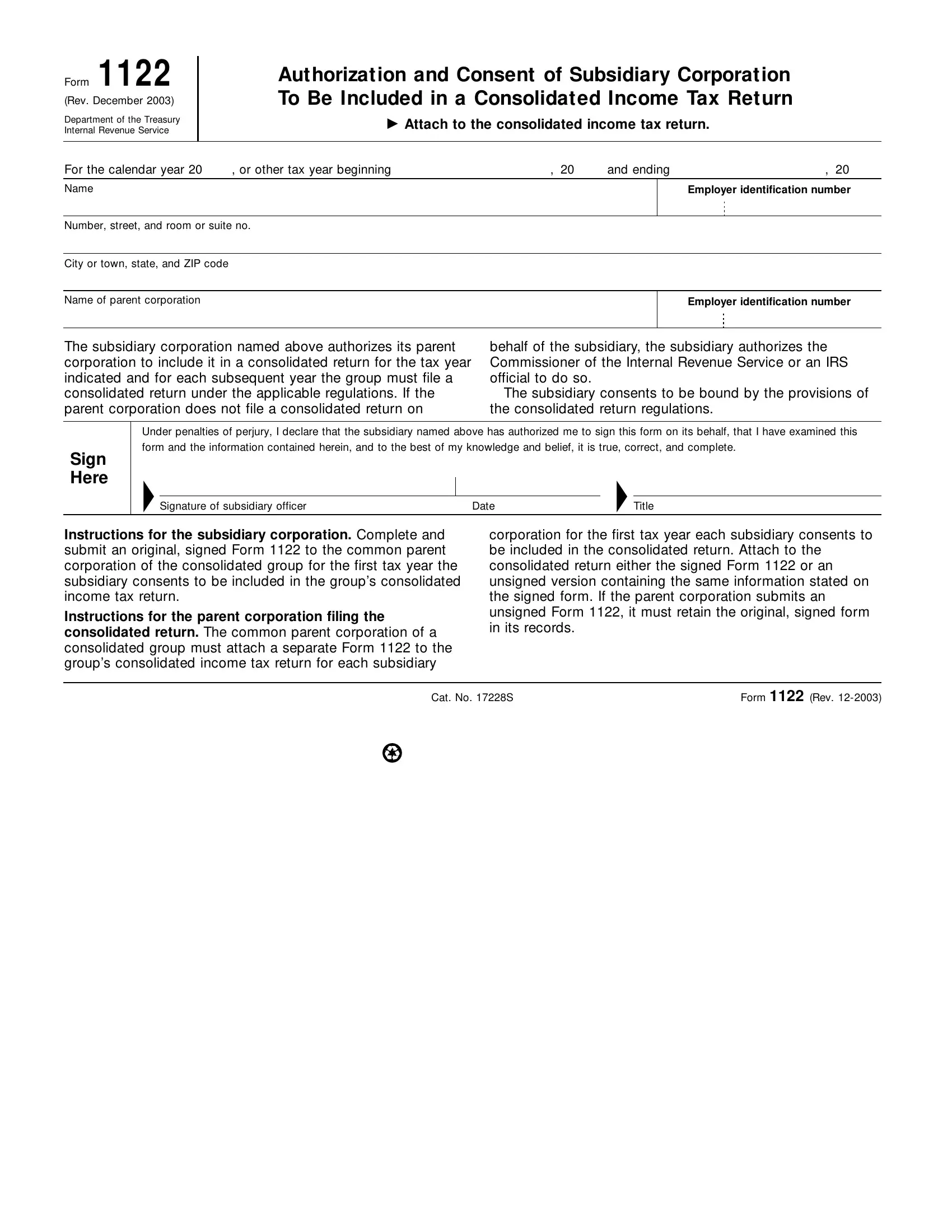

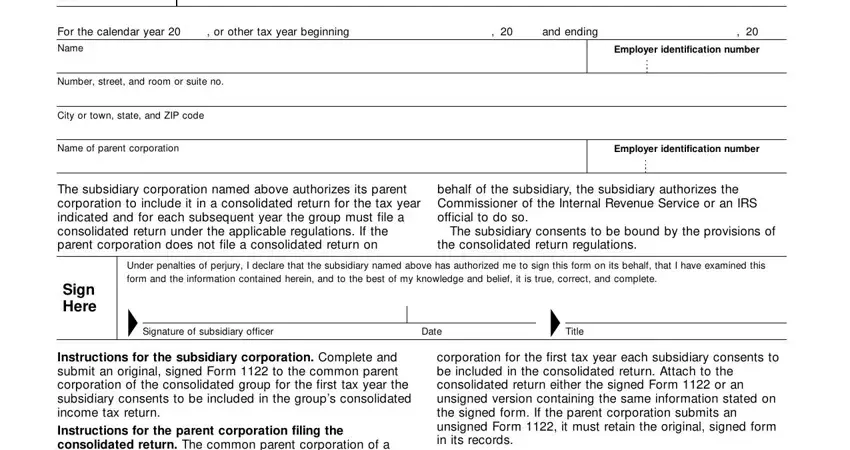

1. You need to fill out the form 1122 instructions accurately, thus be careful while working with the parts comprising all these blanks:

Step 3: Revise the information you have inserted in the blank fields and press the "Done" button. Go for a free trial subscription with us and get instant access to form 1122 instructions - which you may then begin to use as you wish in your personal account page. If you use FormsPal, you can fill out documents without the need to be concerned about information leaks or data entries being shared. Our protected software makes sure that your private data is stored safely.