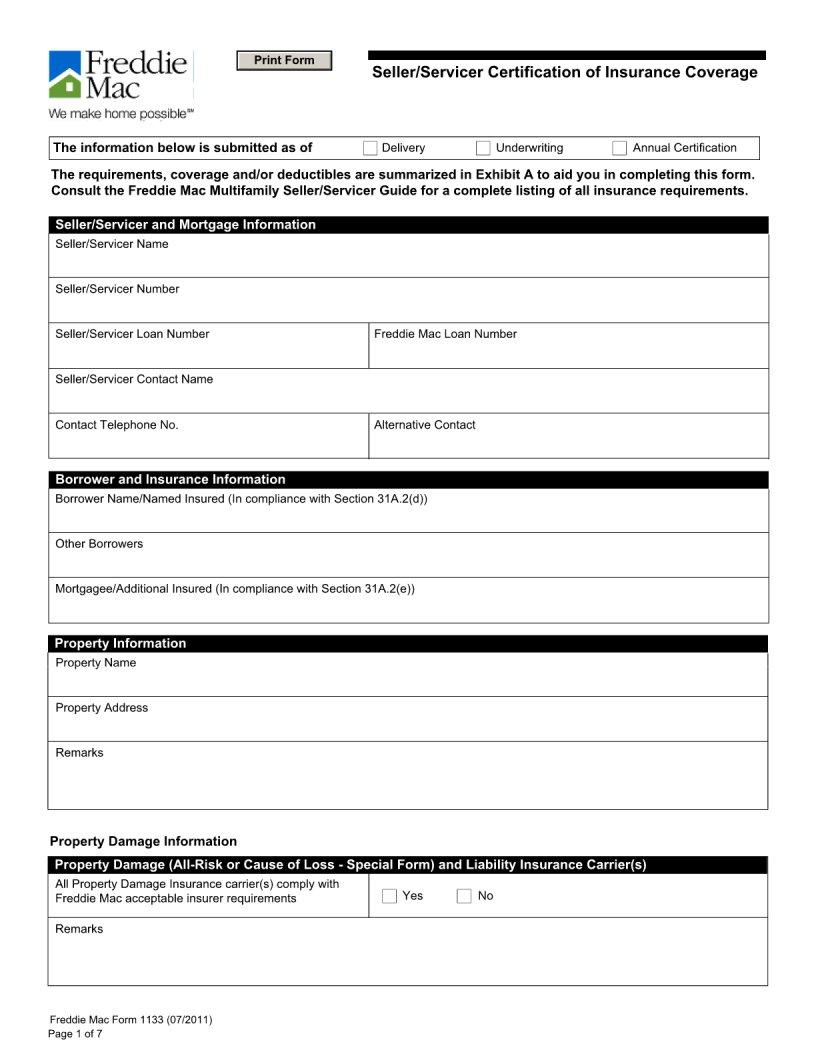

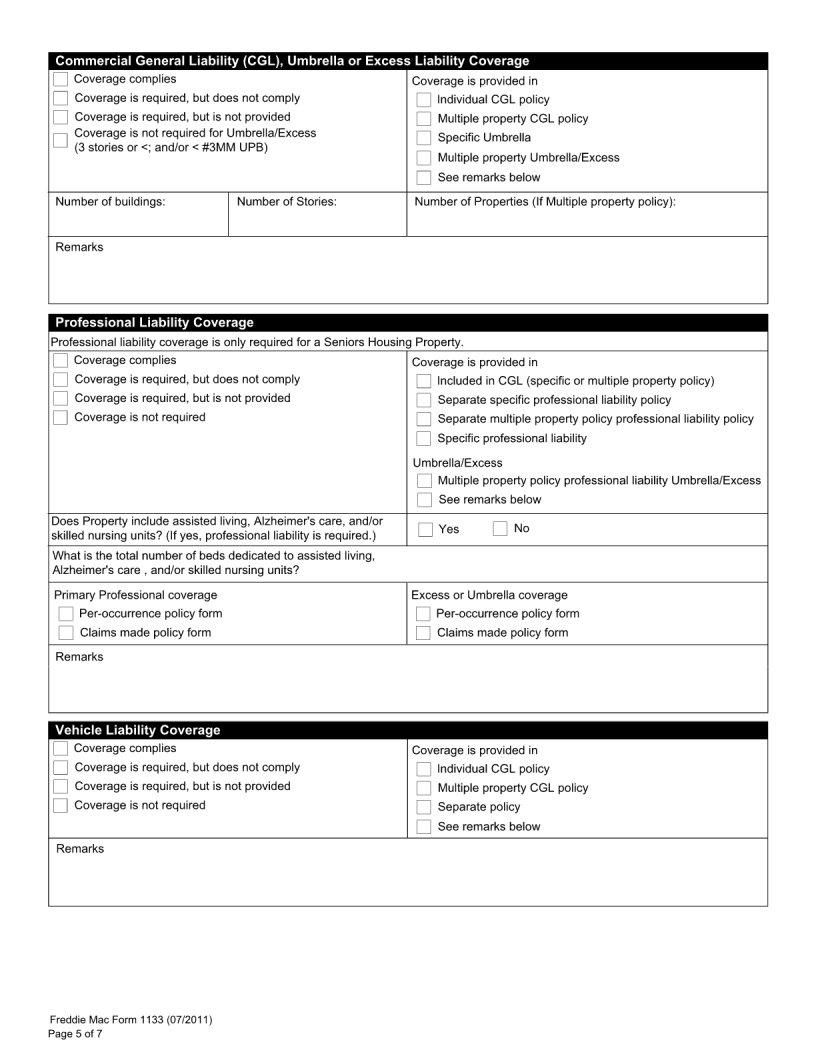

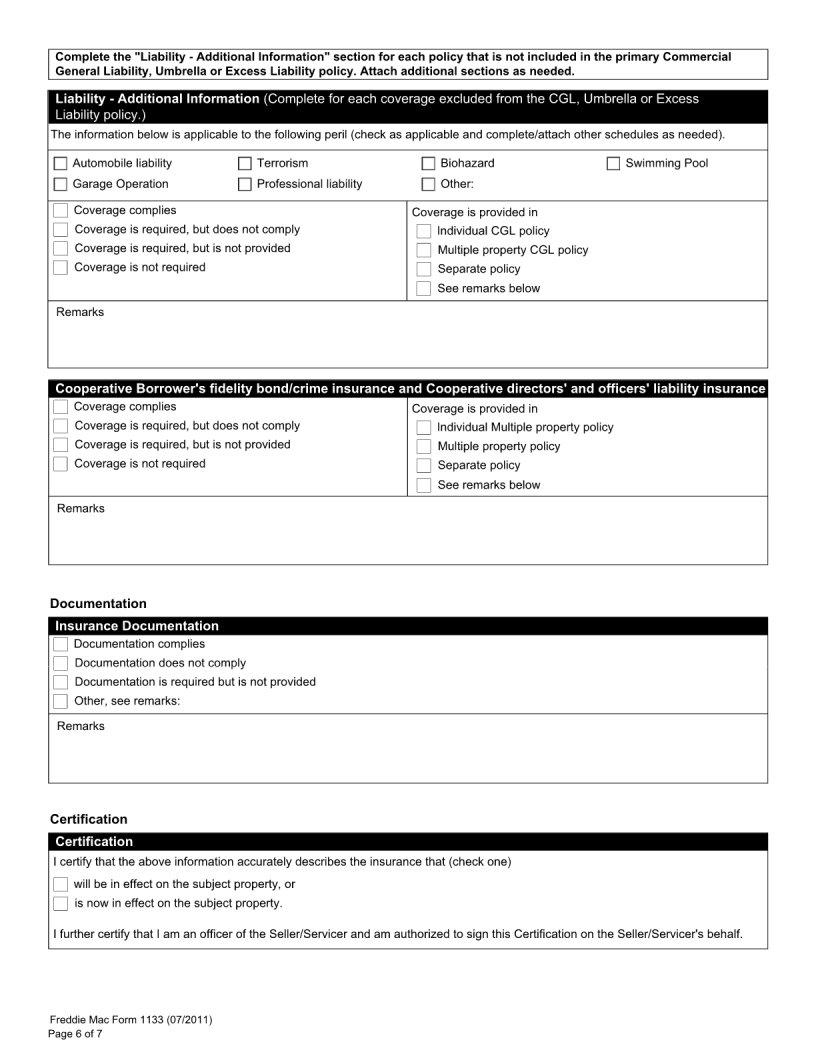

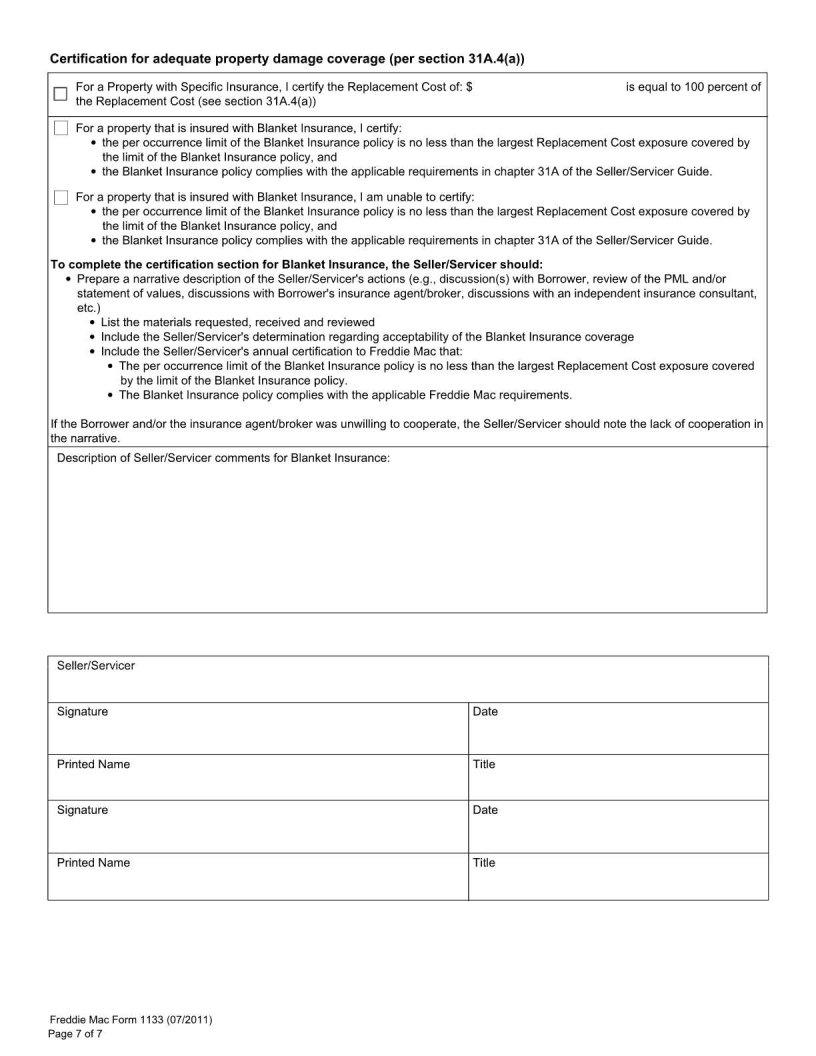

Navigating the landscape of legal documentation can often seem like a daunting task, especially for individuals who are encountering complex forms for the first time. Among these myriad forms, the 1133 form holds significant importance, serving a specialized role that impacts a variety of scenarios. It's essential to understand, even at a basic level, what this form entails, including the circumstances under which it's required, the type of information it solicits, and the implications of its proper or improper completion. The form is designed to gather specific data in a structured manner, ensuring that all necessary details are duly recorded for official purposes. While the specifics of what the 1133 form entails might not be commonly known, its significance cannot be underestimated, as it plays a crucial role in the administrative procedures it's associated with. Understanding the major aspects of this form is the first step toward demystifying what might initially appear to be just another piece of bureaucracy but is, in fact, a critical component in certain legal and administrative processes.

| Question | Answer |

|---|---|

| Form Name | Form 1133 |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | irs 1133 form, fs 1133 claim form, fs 1133, form 1133 |