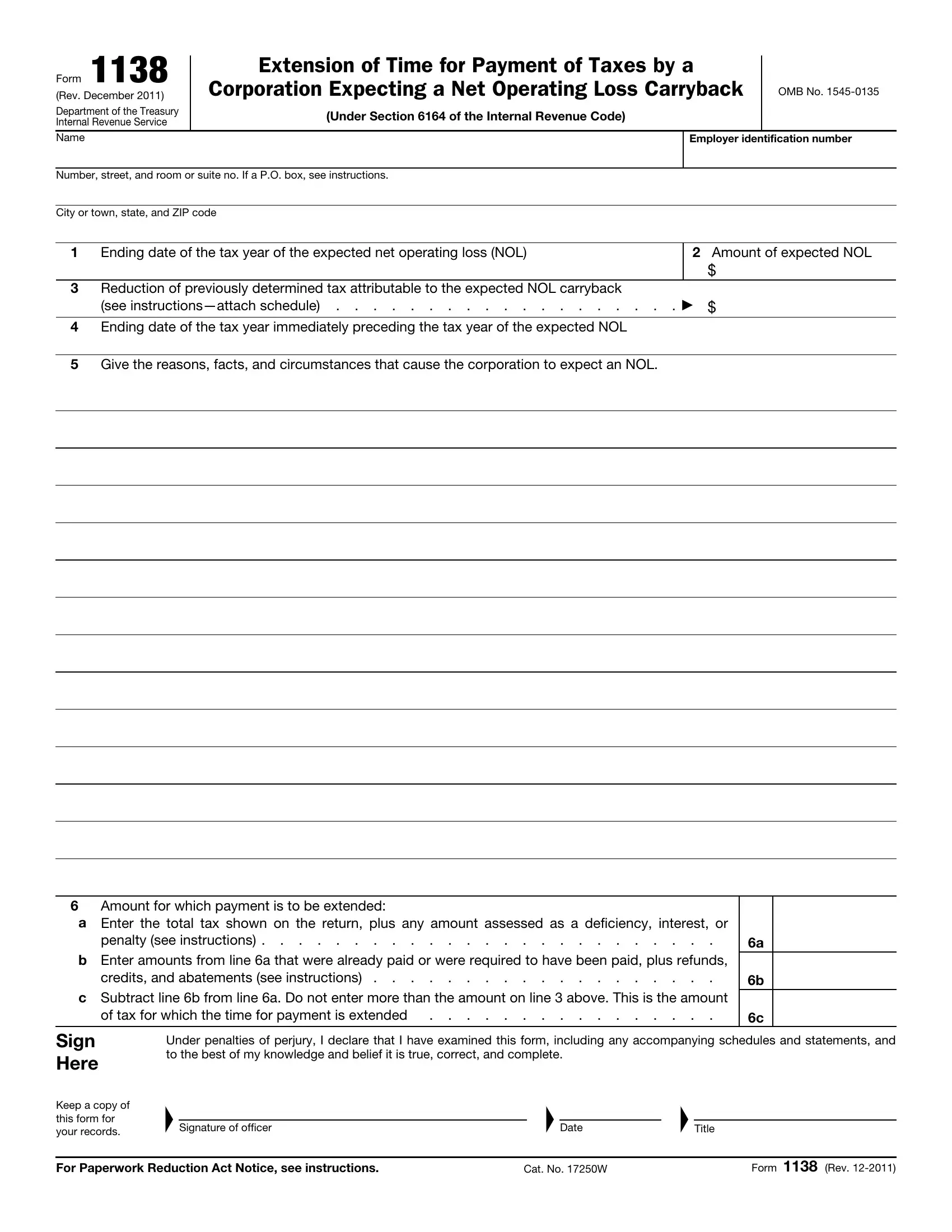

GENERAL INSTRUCTIONS

Section references are to the Internal Revenue Code unless otherwise noted.

Future developments. The IRS has created a page on IRS.gov for information about Form 1138 and its instructions at www.irs.gov/form1138. Information about any future developments affecting Form 1138 (such as legislation enacted after we release it) will be posted on that page.

Purpose of form. A corporation that expects a net operating loss (NOL) in the current tax year can file Form 1138 to extend the time for payment of tax for the immediately preceding tax year. This includes extending the time for payment of a tax deficiency. The payment of tax that can be postponed cannot exceed the expected overpayment from the carryback of the NOL.

Only payments of tax that are required to be paid after the filing of Form 1138 are eligible for extension. Do not file this form if all the required payments have been paid or were required to have been paid.

If the corporation previously filed Form 1138 and later finds information that will change the amount of the expected NOL, the corporation can file a revised Form 1138. If the amount of the NOL is increased based on the new information, the corporation can postpone the payment of a larger amount of tax as long as the larger amount has not yet been paid or is not yet required to be paid. If the amount of the NOL is reduced because of the new information, the corporation must pay the tax to the extent that the amount of tax postponed on the original filing exceeds the amount of tax postponed on the revised filing.

When and where to file. File Form 1138 after the start of the tax year of the expected NOL but before the tax of the preceding tax year is required to be paid. Generally, file Form 1138 with the Internal Revenue Service Center where the corporation files its income tax return.

A corporation can file Form 1138 separately or with Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns. If Form 1138 and Form 7004 are filed together, Form 1138 will reduce or eliminate the amount of tax to be deposited when Form 7004 is filed. If Form 1138 is filed with Form 7004, then file Form 1138 with the Internal Revenue Service Center at the applicable address where the corporation files Form 7004.

Period of extension. In general, the extension for paying the tax expires at the end of the month in which the return for the tax year of the expected NOL is required to be filed (including extensions).

The corporation can further extend the time for payment by filing Form 1139, Corporation Application for Tentative Refund, before the period of extension ends. See the instructions for Form 1139. The period will be further extended until the date the IRS informs the corporation that it has allowed or disallowed the application in whole or in part.

Termination of extension. The IRS can terminate the extension if it believes that any part of the form contains erroneous or unreasonable information. The IRS can also terminate the extension if it believes it may not be able to collect the tax.

Interest. Interest is charged on postponed amounts from the dates that the payments would normally be due. The interest is figured at the underpayment rate specified in section 6621.

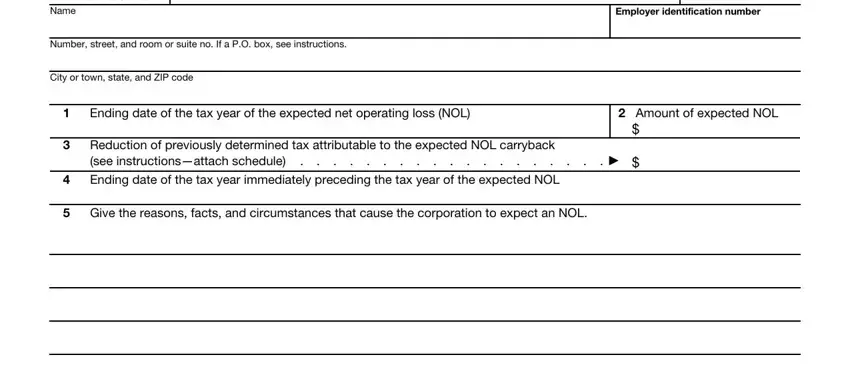

Specific Instructions

Address. Include the suite, room, or other unit number after the street address. If the post office does not deliver mail to the street address and the corporation has a P.O. box, show the box number instead.

If the corporation receives its mail in care of a third party (such as an accountant or attorney), enter on the street address line “C/O” followed by the third party’s name and street address or P.O. box.

If your address is outside the United States or its possessions or territories, fill in the line for “City or town, state, and ZIP code” in the following order: city, province or state, and country. Follow the foreign country’s practice for entering the postal code, if any. Do not abbreviate the country name.

Line 2. The amount of the expected NOL must be based on all of the facts relating to the operation of the corporation. Consider the following items when estimating the amount of the expected NOL:

1.The number and dollar amounts of the corporation’s Government contracts that have been canceled,

2.Profit and loss statements, and

3.Other factors peculiar to the corporation’s operations.

See section 172 and Pub. 542, Corporations, to help determine the amount of the expected NOL. Limitations apply to (a) the amount of taxable income of a new loss corporation for any tax year ending after an ownership change that may be offset by any pre- change NOLs and (b) the use of preacquisition losses of one corporation to offset recognized built-in gains of another corporation. For more information, see sections 382 and 384 and the related regulations.

Line 3. Enter the reduction of previously determined tax attributable to the carryback, for tax years before the tax year of the NOL. Previously determined tax is generally:

1.The amount shown on the return, plus any amounts assessed as deficiencies before Form 1138 is filed, minus

2.Any abatements, credits, or refunds allowed or made before Form 1138 is filed.

See section 1314(a).

Attach a schedule showing how the reduction was figured. See the instructions for the corporate income tax return for information on figuring the NOL deduction and recomputing the tax.

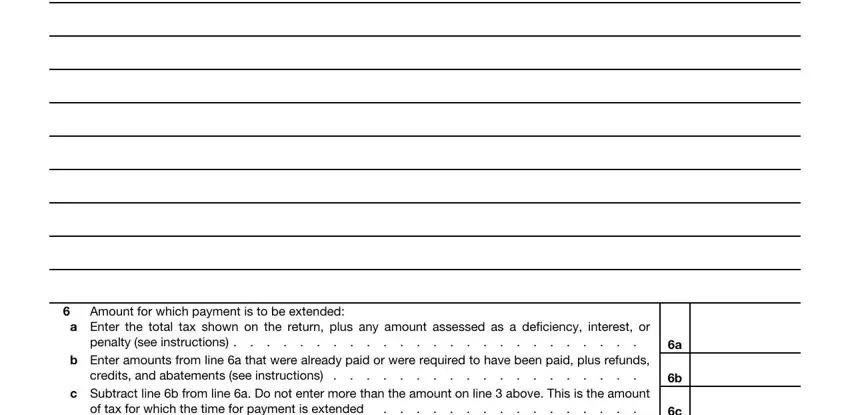

Line 6a. For the year shown on line 4, enter on line 6a the total of:

1.The total tax shown on the return, plus

2.Any amount assessed as a deficiency (or as interest or a penalty) prior to the filing of this Form 1138.

Line 6b. Enter the total of the following:

1.The amount of tax paid or required to be paid before the date this form is filed. This includes any amount assessed as a deficiency or as interest or a penalty if this form is filed more than 21 calendar days after notice and demand for payment was made (more than 10 business days if the amount for which the notice and demand for payment was made equals or exceeds $100,000). An amount of tax for which the corporation has received an extension of time to pay (under section 6161) is not considered required to be paid before the end of the extension, plus

2.The amount of refunds, credits, and abatements made before the date this form is filed.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

. 3 hr., 21 min. |

Learning about the law or the form . . . . |

. . |

42 min. |

Preparing and sending the form to the IRS . . |

. . |

47 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:M:S, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send Form 1138 to this office. Instead, see When and where to file, above.