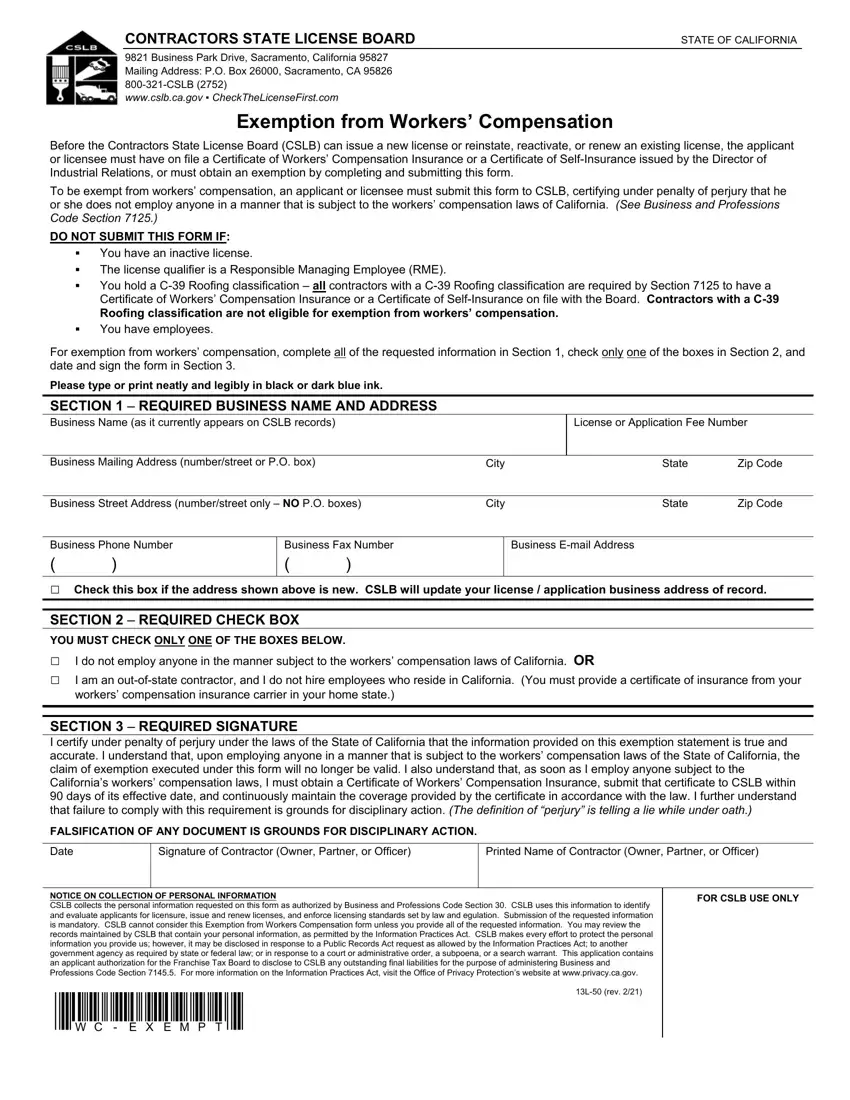

CONTRACTORS STATE LICENSE BOARD |

STATE OF CALIFORNIA |

9821 Business Park Drive, Sacramento, California 95827 |

|

Mailing Address: P.O. Box 26000, Sacramento, CA 95826 |

|

800-321-CSLB (2752) |

|

www.cslb.ca.gov ▪ CheckTheLicenseFirst.com |

|

Exemption from Workers’ Compensation

Before the Contractors State License Board (CSLB) can issue a new license or reinstate, reactivate, or renew an existing license, the applicant or licensee must have on file a Certificate of Workers’ Compensation Insurance or a Certificate of Self-Insurance issued by the Director of Industrial Relations, or must obtain an exemption by completing and submitting this form.

To be exempt from workers’ compensation, an applicant or licensee must submit this form to CSLB, certifying under penalty of perjury that he or she does not employ anyone in a manner that is subject to the workers’ compensation laws of California. (See Business and Professions Code Section 7125.)

DO NOT SUBMIT THIS FORM IF:

You have an inactive license.

The license qualifier is a Responsible Managing Employee (RME).

You hold a C-39 Roofing classification – all contractors with a C-39 Roofing classification are required by Section 7125 to have a Certificate of Workers’ Compensation Insurance or a Certificate of Self-Insurance on file with the Board. Contractors with a C-39

Roofing classification are not eligible for exemption from workers’ compensation.

You have employees.

For exemption from workers’ compensation, complete all of the requested information in Section 1, check only one of the boxes in Section 2, and date and sign the form in Section 3.

Please type or print neatly and legibly in black or dark blue ink.

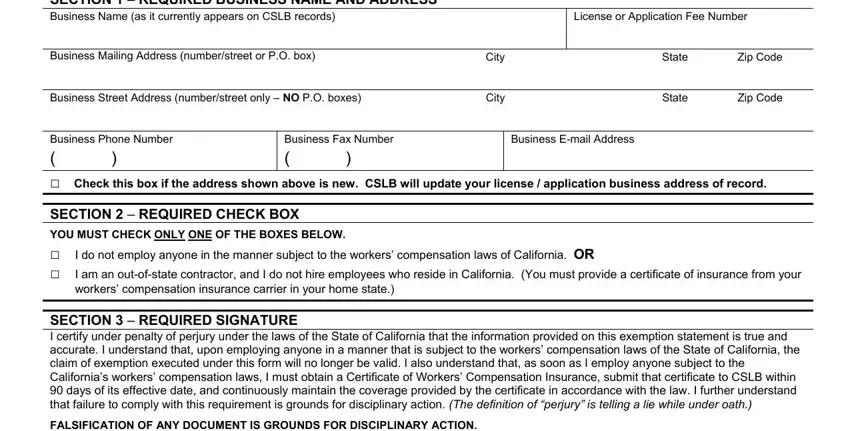

SECTION 1 – REQUIRED BUSINESS NAME AND ADDRESS

Business Name (as it currently appears on CSLB records) |

|

Business Mailing Address (number/street or P.O. box) |

City |

License or Application Fee Number

Business Street Address (number/street only – NO P.O. boxes) |

City |

State |

Zip Code |

|

|

|

|

|

|

Business Phone Number |

Business Fax Number |

|

|

Business E-mail Address |

|

( |

) |

( |

) |

|

|

|

|

□Check this box if the address shown above is new. CSLB will update your license / application business address of record.

SECTION 2 – REQUIRED CHECK BOX

YOU MUST CHECK ONLY ONE OF THE BOXES BELOW.

□I do not employ anyone in the manner subject to the workers’ compensation laws of California. OR

□I am an out-of-state contractor, and I do not hire employees who reside in California. (You must provide a certificate of insurance from your workers’ compensation insurance carrier in your home state.)

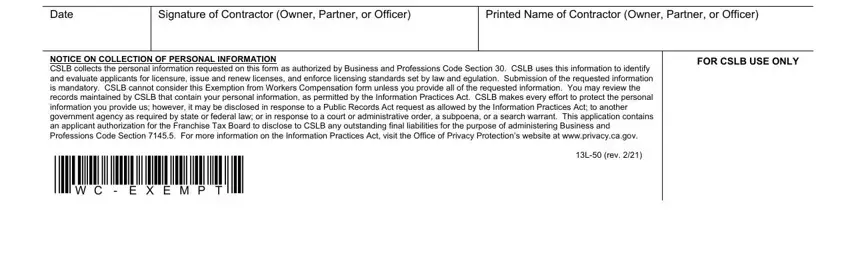

SECTION 3 – REQUIRED SIGNATURE

I certify under penalty of perjury under the laws of the State of California that the information provided on this exemption statement is true and accurate. I understand that, upon employing anyone in a manner that is subject to the workers’ compensation laws of the State of California, the claim of exemption executed under this form will no longer be valid. I also understand that, as soon as I employ anyone subject to the California’s workers’ compensation laws, I must obtain a Certificate of Workers’ Compensation Insurance, submit that certificate to CSLB within 90 days of its effective date, and continuously maintain the coverage provided by the certificate in accordance with the law. I further understand that failure to comply with this requirement is grounds for disciplinary action. (The definition of “perjury” is telling a lie while under oath.)

FALSIFICATION OF ANY DOCUMENT IS GROUNDS FOR DISCIPLINARY ACTION.

Signature of Contractor (Owner, Partner, or Officer)

Printed Name of Contractor (Owner, Partner, or Officer)

NOTICE ON COLLECTION OF PERSONAL INFORMATION

CSLB collects the personal information requested on this form as authorized by Business and Professions Code Section 30. CSLB uses this information to identify and evaluate applicants for licensure, issue and renew licenses, and enforce licensing standards set by law and egulation. Submission of the requested information is mandatory. CSLB cannot consider this Exemption from Workers Compensation form unless you provide all of the requested information. You may review the records maintained by CSLB that contain your personal information, as permitted by the Information Practices Act. CSLB makes every effort to protect the personal information you provide us; however, it may be disclosed in response to a Public Records Act request as allowed by the Information Practices Act; to another government agency as required by state or federal law; or in response to a court or administrative order, a subpoena, or a search warrant. This application contains an applicant authorization for the Franchise Tax Board to disclose to CSLB any outstanding final liabilities for the purpose of administering Business and Professions Code Section 7145.5. For more information on the Information Practices Act, visit the Office of Privacy Protection’s website at www.privacy.ca.gov.