MT. SAN ANTONIO COLLEGE

FINANCIAL AID OFFICE

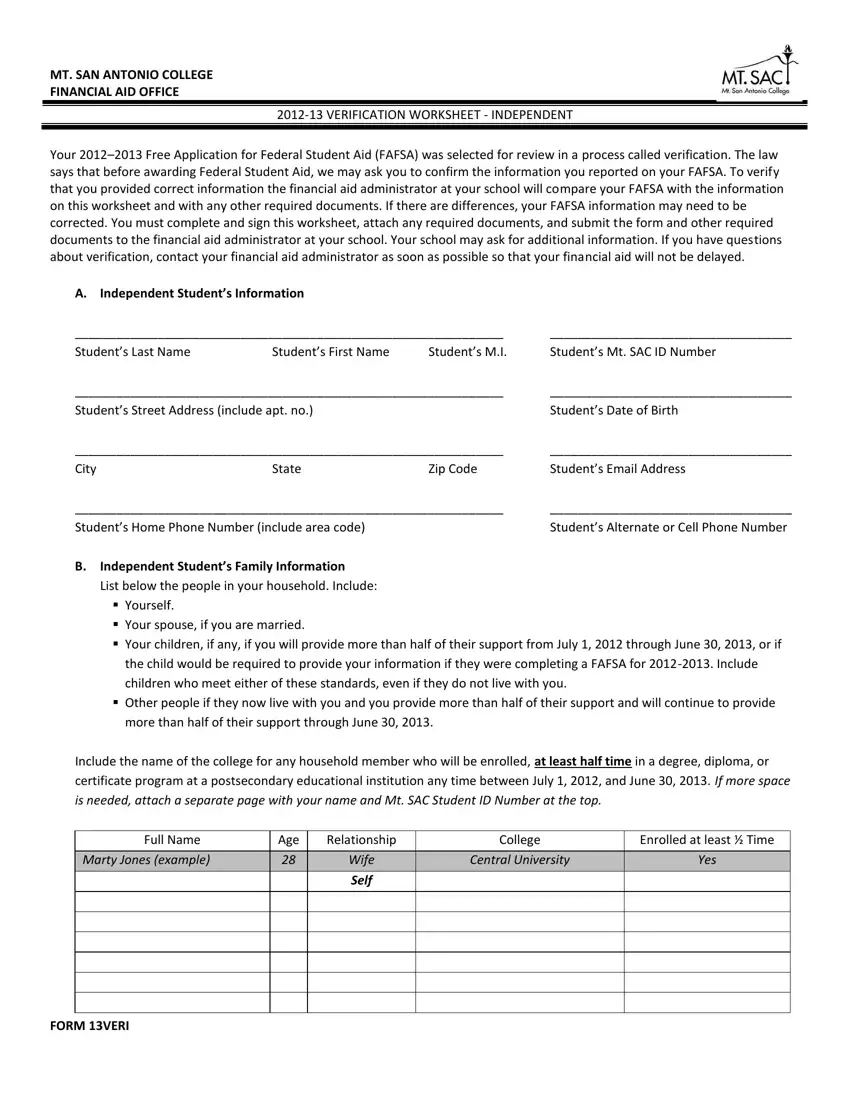

2012-13 VERIFICATION WORKSHEET - INDEPENDENT

Your 2012–2013 Free Application for Federal Student Aid (FAFSA) was selected for review in a process called verification. The law says that before awarding Federal Student Aid, we may ask you to confirm the information you reported on your FAFSA. To verify that you provided correct information the financial aid administrator at your school will compare your FAFSA with the information on this worksheet and with any other required documents. If there are differences, your FAFSA information may need to be corrected. You must complete and sign this worksheet, attach any required documents, and submit the form and other required documents to the financial aid administrator at your school. Your school may ask for additional information. If you have questions about verification, contact your financial aid administrator as soon as possible so that your financial aid will not be delayed.

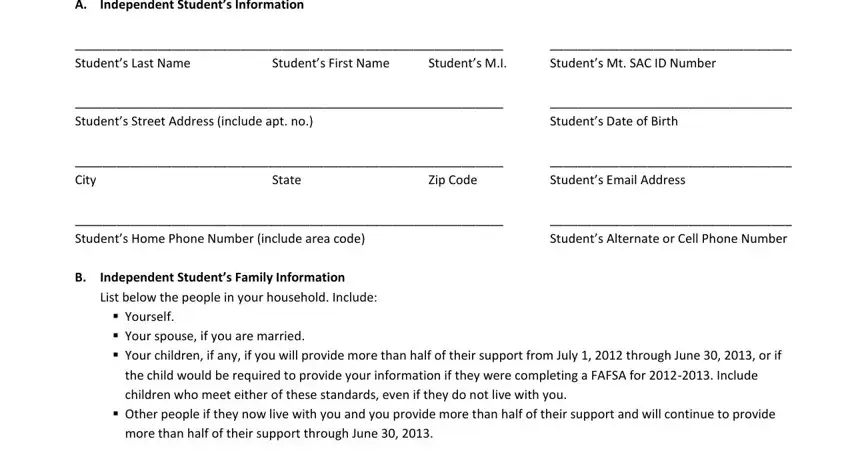

A.Indepe de t Stude t’s I for atio

______________________________________________________________ |

___________________________________ |

Stude |

t’s Last Na e |

Stude t’s First Na e |

Stude t’s M.I. |

Stude |

t’s Mt. SAC ID Number |

______________________________________________________________ |

___________________________________ |

Stude |

t’s Street Address i |

lude apt. o. |

|

Stude |

t’s Date of Birth |

______________________________________________________________ |

___________________________________ |

City |

|

State |

Zip Code |

Stude |

t’s E ail Address |

______________________________________________________________ |

___________________________________ |

Stude |

t’s Ho e Pho e Nu |

er i lude area ode |

|

Stude |

t’s Alter ate or Cell Pho e Nu er |

B.Indepe de t Stude t’s Fa il I for atio

List below the people in your household. Include:

Yourself.

Your spouse, if you are married.

Your children, if any, if you will provide more than half of their support from July 1, 2012 through June 30, 2013, or if the child would be required to provide your information if they were completing a FAFSA for 2012-2013. Include children who meet either of these standards, even if they do not live with you.

Other people if they now live with you and you provide more than half of their support and will continue to provide more than half of their support through June 30, 2013.

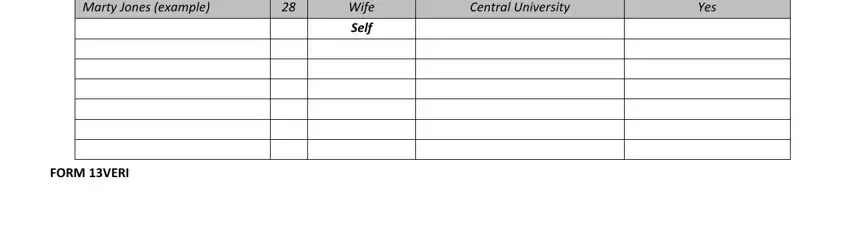

Include the name of the college for any household member who will be enrolled, at least half time in a degree, diploma, or certificate program at a postsecondary educational institution any time between July 1, 2012, and June 30, 2013. If more space is needed, attach a separate page with your name and Mt. SAC Student ID Number at the top.

|

Full Name |

Age |

Relationship |

|

College |

Enrolled at least ½ Time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marty Jones (example) |

|

|

28 |

|

|

Wife |

|

|

Central University |

|

|

Yes |

|

|

|

|

|

|

|

|

Self |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 13VERI

Stude t’s Na e: ______________________________________________ Mt. SAC ID #: __________________________

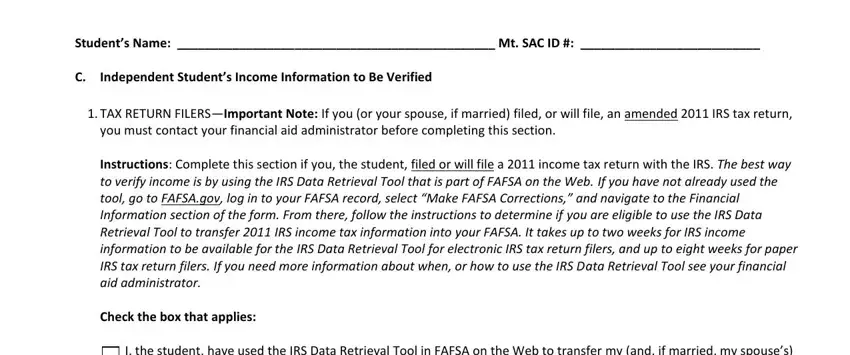

C. Indepe de t Stude t’s I co e I for atio to Be Verified

1.TAX RETURN FILERS—Important Note: If you (or your spouse, if married) filed, or will file, an amended 2011 IRS tax return, you must contact your financial aid administrator before completing this section.

Instructions: Complete this section if you, the student, filed or will file a 2011 income tax return with the IRS. The best way

to verify income is by using the IRS Data Retrieval Tool that is part of FAFSA on the Web. If you have not already used the tool, go to FAFSA.gov, log in to your FAF“A e o d, sele t Make FAF“A Co e tio s, a d a igate to the Fi a ial

Information section of the form. From there, follow the instructions to determine if you are eligible to use the IRS Data Retrieval Tool to transfer 2011 IRS income tax information into your FAFSA. It takes up to two weeks for IRS income information to be available for the IRS Data Retrieval Tool for electronic IRS tax return filers, and up to eight weeks for paper IRS tax return filers. If you need more information about when, or how to use the IRS Data Retrieval Tool see your financial aid administrator.

Check the box that applies:

I, the student, have used the IRS Data Retrieval Tool in FAFSA on the Web to transfer y a d, if arried, y spouse’s 2011 IRS income information into my FAFSA, either on the initial FAFSA or when making a correction to the FAFSA. Your school will use the IRS information that was transferred in the verification process.

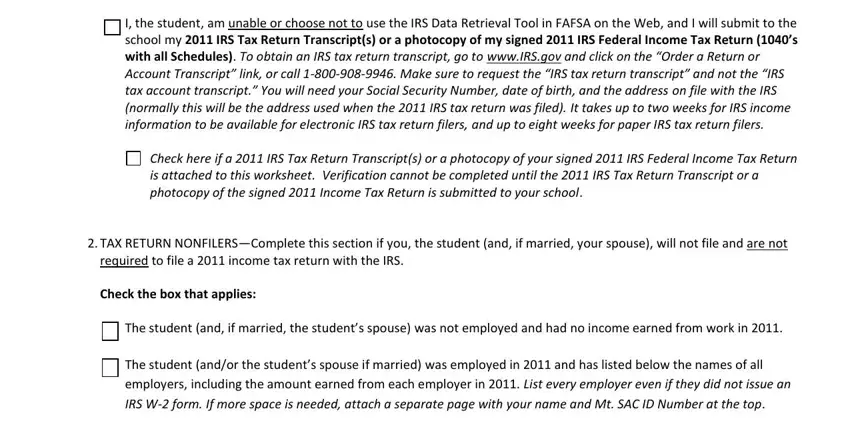

I, the student, am unable or choose not to use the IRS Data Retrieval Tool in FAFSA on the Web, and I will submit to the

school my 2011 IRS Tax Return Transcript(s) or a photocopy of |

sig ed |

IRS Federal I |

co |

e Ta Retur |

( |

4 ’s |

with all Schedules). To obtain an IRS tax return transcript, go to www.IRS.gov a d |

li k o |

the |

O de |

a Retu |

o |

|

A |

ou |

t T a s |

ipt |

li |

k, o |

all 1-800-908-9946. Make su e to |

e uest the |

IR“ ta |

etu |

t a |

s |

ipt |

a d ot the |

IR“ |

ta |

a |

ou t t a |

s |

ipt. |

You |

ill eed ou “o ial “e u it Nu |

e , date of |

i th, a |

d the add ess on file with the IRS |

(normally this will be the address used when the 2011 IRS tax return was filed). It takes up to two weeks for IRS income information to be available for electronic IRS tax return filers, and up to eight weeks for paper IRS tax return filers.

Check here if a 2011 IRS Tax Return Transcript(s) or a photocopy of your signed 2011 IRS Federal Income Tax Return is attached to this worksheet. Verification cannot be completed until the 2011 IRS Tax Return Transcript or a photocopy of the signed 2011 Income Tax Return is submitted to your school.

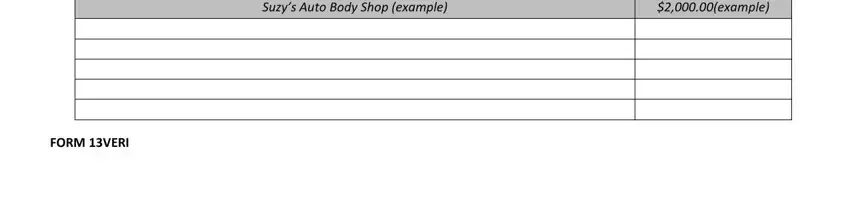

2.TAX RETURN NONFILERS—Complete this section if you, the student (and, if married, your spouse), will not file and are not required to file a 2011 income tax return with the IRS.

Check the box that applies:

The student |

a |

d, if arried, the stude t’s spouse was not employed and had no income earned from work in 2011. |

The student |

a |

d/or the stude t’s spouse if arried was employed in 2011 and has listed below the names of all |

employers, including the amount earned from each employer in 2011. List every employer even if they did not issue an

IRS W-2 form. If more space is needed, attach a separate page with your name and Mt. SAC ID Number at the top.

|

E ployer’s Na |

e |

2011 Amount Earned |

|

“uz ’s Auto Bod “hop |

e a ple |

$2,000.00(example) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 13VERI

Stude |

t’s Na e: ______________________________________________ Mt. SAC ID #: __________________________ |

D. I depe de t Stude |

t’s Other I |

for |

atio to Be Verified |

1. Co |

plete this se tio |

if so eo |

e i |

the stude t’s household listed i Se tio B re ei ed e efits fro the Supple e tal |

Nutrition Assistance Program or SNAP (formerly known as food stamps) any time during the 2010 or 2011 calendar years.

One of the persons listed in Section B of this worksheet received SNAP benefits in 2010 or 2011. If asked by my school, I will provide documentation of the receipt of SNAP benefits during 2010 and/or 2011.

2. Complete this section if you or your spouse, if married, paid child support in 2011.

Either I, or if married, my spouse who is listed in Section B of this worksheet, paid child support in 2011. I have indicated below the name of the person who paid the child support, the name of the person to whom the child support was paid, the names of the children for whom child support was paid, and the total annual amount of child support that was paid in 2011 for each child. If asked by my school, I will provide documentation of the payment of child support. If you need more space, attach a separate page that includes your name and Mt. SAC ID Number at the top.

|

Name of Person Who Paid |

|

Name of Person to Whom Child |

Name of Child for Whom |

Amount of Child |

|

Child Support |

|

Support was Paid |

Support Was Paid |

Support Paid in 2011 |

|

|

|

|

|

|

|

Marty Jones (example) |

|

Chris Smith |

Terry Jones |

$6,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E.Certification and Signature

I certify that all information reported on this

worksheet is complete and correct. The student must

sig this orksheet. If arried, the spouse’s sig ature is optional

_________________________________________________

Stude t’s Sig ature

_________________________________________________

Spouse’s Sig ature

WARNING: If you purposely give false or misleading information on this worksheet, you may be fined, be sentenced to jail, or both.

RETURN TO:

Mt. San Antonio College

1100 N. Grand Avenue

Walnut, CA 91789

_________________________________

Date

_________________________________

Date

Do not mail this worksheet to the U.S. Department of Education.

Submit this worksheet to the financial aid administrator at your school.

You should make a copy of this worksheet for your records.

FORM 13VERI